Börsipäev 26. august

Kommentaari jätmiseks loo konto või logi sisse

-

4 päeva järjest kukkunud USA aktsiaturud suutsid eile hommikustest jubedatest makronumbritest ja üle indeksite päeva alguse 1%lisest miinusest hoolimata päeva lõpuks tõusta plussi. Pullidele võib seda kindlasti vähemalt lühiajaliseks võiduks pidada, kuna halbade numbrite peale turu rallimine on alati hea märk. Võimsat liikumist näitas eile kinnisvarasektor, kus XHB tõusis üle 3%.

USA makronumbritest on täna kell 15.30 oodata esmaste töötuabiraha taotlejate arvu (ootus ca 485 000) ja kestvate töötuabiraha taotlejate arvu (ootus ca 4.515 mln).

Euroopa indeksid on päeva alustanud ca 0.5%lise tõusuga ning USA indeksite futuurid hetkel ca +0.2%. -

Toll Brothersist (TOL) rääkides - nende eile õhtul Eesti aja järgi kell 21.00 peetud konverentsikõnet saab kuulata siit (link).

Analüüsimajad on aktsia osas tulemustejärgselt oma varasemaid seisukohti üldiselt kinnitamas. Citi kinnitab oma ostusoovitust, kuid langetab aktsiale antava hinnasihi $24 pealt $22le. Wells Fargo, Soleil ($25) ja Barclay ($21) kinnitavad oma ostusoovitusi. JMP, Raymond James ja Stifel Nicolaus kinnitavad oma neutraalset hoiakut.

-

Šveitsi tõõhõive andmed: II kvartalis lisandus töökohti oodatud 0,8% asemel 0,6% (YoY). Töökohti oli kokku 3,968 miljonit, kuigi oodatav näit oli 3,975 miljonit.

Eurotsooni juulikuu rahapakkumine M3 avaldati samuti: juuli muutus 0,1% ning aastases lõikes 0,2% kasv vs oodatud 0,3%. -

Esmaste töötuabiraha taotlejate number on 473 000 vs oodatdu 490 000.

Kestvate töötuabiraha taotlejate number on 4.456 mln vs oodatud 4.495 mln.

Turg reageerib oodatust paremate numbrite peale tõusuga. Hetkel S&P500 indeksi futuur +0.50%. -

USA indeksite futuurid alustavad päeva ca 0.4%lise tõusuga.

Euroopa turud:

Saksamaa DAX +0.68%

Pantsusmaa CAC 40 +1.04%

Suurbritannia FTSE100 +0.95%

Hispaania IBEX 35 +1.42%

Rootsi OMX 30 +1.09%

Venemaa MICEX +1.43%

Poola WIG +0.57%Aasia turud:

Jaapani Nikkei 225 +0.69%

Hong Kongi Hang Seng -0.11%

Hiina Shanghai A (kodumaine) +0.26%

Hiina Shanghai B (välismaine) +0.87%

Lõuna-Korea Kosdaq -0.70%

Tai Set 50 +0.20%

India Sensex 30 +0.26% -

Economic News Stays in the Spotlight

By Rev Shark

RealMoney.com Contributor

8/26/2010 8:17 AM EDT

For those who believe, no proof is necessary. For those who don't believe, no proof is possible.

-- Stuart Chase

Despite a weak durable goods report and a poor housing number, the market managed to digest the bad news and bounce a little on Wednesday. The hope is that the market is fully pricing in the steady stream of negative economic news we have had lately and is ready to turn up. After all, when the market goes up on bad news, we obviously have already anticipated the worst.

The problem with that argument is that we were already technically oversold and ripe for a bounce. We had gone straight down so far and so fast that we were likely to bounce back reflexively on any mildly bad news.

In addition the weak existing-home sales number on Tuesday probably prepared us for the bad new-home sales number on Wednesday. The durable goods number was a surprise, but the market has pretty low expectations lately so it didn't cause any undue panic.

This morning we have the weekly unemployment claims, which will give us another test to see what has already been priced into this market. Last week claims hit 500,000, which caused a lot of consternation. We are supposed to be under that today, but if we see another number with a "5" in front of it, there is going to be some unhappiness.

Weekly claims tend to be forgotten pretty quickly, but most market players will be looking forward to the revised GDP tomorrow. Goldman has already taken its number down to 1.2% from over 2% due to the weak economic reports, and if the second quarter is being cut that much, you have to wonder how bad the third quarter is going to be.

To add to the negatives, we have increased worry that we are heading for a double-dip recession and that the Fed has run out of ammo to combat it. Those are the main themes in the media this morning.

So the big question for traders to consider is whether this market has fully discounted the bad news already. I'd love to say it has, but the one rather weak bounce yesterday just isn't very convincing. Technically the charts look quite poor. They are struggling to hold on to some support levels, but that July low is beckoning. We are clearly in a downtrend, and with the low volume and negative seasonality working against us, it will not be easy to shrug off a continued flow of negative news.

I don't want to sound overly negative, as there are some trades to be found if you are staying short term and very flexible. The "buy the bad news" bounce after the housing number yesterday worked well, especially late in the day, and we do have some residual momentum that may keep us going a while longer if the weekly unemployment claims aren't a complete disaster.

Nonetheless the big picture does not look very healthy and we need to respect that. This is not the time to start building up big longer-term positions. The market needs to find a low and show that it is serious at trying to end the downtrend. The bulls have the burden of proof, and we shouldn't assume that they are going to meet it.

We have some slightly positive action this morning. Overseas markets were mostly up. Unemployment will set the tone, but it should be a very slow day of trading once again.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: JAS +5.4%

Select Irish bank stocks showing strength after an Irish debt auction saw strong investor demand: IRE +3.6%, AIB +3.0%.

Other news: MNTA +8.4% (U.S. District Court denies sanofi-aventis (SNY) request for preliminary injunction for generic Lovenox), CHTP +5.1% (FDA approves its CH-4051 Phase II Protocol in rheumatoid arthritis), PPO +4.7% (positive Cramer mention), NEWN +4.5% (announced plans to launch MeePower brand of advanced battery backup systems and related accessories for smartphones, laptop computers and other portable electronic devices), GTE +4.3% (confirms additional oil pay at Moqueta-2 well), POT +2.0% (Board believes that the continued operation of the Rights Plan is in the best interests of the co and its shareholders and other stakeholders), SOMX (continued momentum following yesterday's deal with PG), ALXA +2.5% (licensed its Staccato nicotine technology to Cypress Bioscience; Cypress to pay Alexza an upfront payment of $5 mln to acquire the worldwide license).

Analyst comments: BW +2.2% (upgraded to Buy from Hold at KeyBanc).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: GES -10.3%, GIGM -8.9%, LFC -3.2%, JDSU -2.8%, CWTR -2.3%.

Other news: SCON -11.3% (prices 4 mln shares of common stock offering at $1.50 per share; net proceeds of approx $5.3 mln), SNY -1.1% (U.S. District Court denies sanofi's request for preliminary injunction for generic Lovenox).

Analyst comments: WBMD -1.0% (downgraded to Market Perform from Outperform at Raymond James). -

Kell 17:30 Eesti aja järgi avaldas EIA oma iganädalase maagaasi raporti, mille peale langes maagaasi septembrikuu futuur alla $3.80.

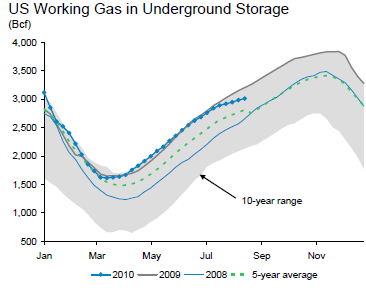

Varud kasvasid 20. augustiga lõppenud nädalal 40 miljardit kuupjalga ehk 3,052 miljardile kuupjalale. Alloleval graafikul on näha maagaasi varude viimase 10 aasta trendi.

Moody’s väljastas täna raporti, milles räägitakse pikemalt maagaasi perspektiividest. Analüütikute sõnul ootavad nad 2H 2010 keskmiseks maagaasi hinnaks ca $5. Seda muidugi juhul, kui USA majandus teisel poolaastal kokku ei kuku.

-

Bloombergi sõnul on Intel (INTC) ja Infineon Technologies saavutamas kokkulepet. Väidetavalt läheb Intelile Infineon Technologies nii-öelda „wireless“ üksuse ostmine maksma ca 1.5 miljardit eurot ($1.91 miljardit). Selgelt on tegemist Inteli poolse plaaniga haarata nutitelefonides kasutatavate kiipide turgu. Kuigi ca 80% maailma arvutitest jooksevad Inteli kiipide peal, siis telefonides Inteli kiipe veel ei kasutata. Deutsche Bank katab Intelit hinnasihiga $27. Kõrgeima hinnasihi $34 on Intelile määranud Piper Jaffray. JMP poolne hinnasiht on $30.

INTC kaupleb hetkel veidi alla 1 protsent miinuses.

-

Paar mõtet Bloombergi vahendusel:

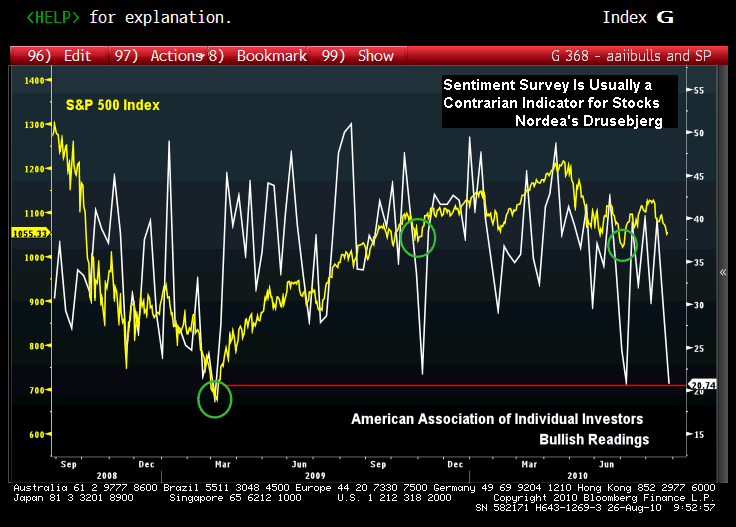

USA turgudel on investorite sentiment langenud ca viimase 18 kuu madalamale tasemele, kuid turuosaliste sõnul võib see olla hoopiski hea märk. Viimati oli turusentiment nii madal 2009. aasta märtsis, pärast mida S&P 500 indeks tõusis 56%.

All on graafik S&P 500 indeksist ja American Association of Industrial Investors indeksist. Hirmud seoses nii-öelda topeltpõhjaga on suurenenud, mis kajastub ka AAII indeksis. Samas võib öelda, et indeks on S&P 500 indeksi suhtes negatiivse korrelatsiooniga – kui indeks langeb, siis turud tõusevad. Graafiku on koostanud Nordea Investment Management.

-

Today after the close look for the following companies to report: ARUN, BEBE, DLLR, IRF, JCG, MCRS, NZ, NOVL, OVTI, and SLH. Tomorrow before the open look for the following companies to report: FRO and TIF.