Börsipäev 10. september

Kommentaari jätmiseks loo konto või logi sisse

-

Eilne oodatust parem esmaste töötuabiraha taotluste arv ning USA kaubandusdefitsiidi kiireim vähenemine viimase 17 kuu jooksul andsid päeva algusele lubava stardi (+1%), ent suuremate ostjate puuduses jäi turg endiselt suhteliselt õhukeseks (NYSE käive 3,5 miljardi aktsiat vs 4 miljardit keskmiselt augustis) ning indeksid lõpetasid +0,3% kuni +0,5% kõrgemal. Aasias liiguti pärast USA sessiooni erisuunaliselt: Hiina ja Hongkong kerges miinuses, Jaapanis aga rõõmustati oodatust parema majanduskasvu üle, kui teise kvartali annualiseeritud SKT kasv korrigeeriti 0,4% pealt 1,5%le. Nikkei 225 kauples 1,6% plussis. USA futuurid on viimase poole tunni jooksul jõudnud väikesest miinusest 0,05%-lisse plussi.

Olulist makrot täna oodata pole. Euroopas on teisejärguliseks infoks Prantsusmaa ja Itaalia tööstustoodangunumbrid ja Suubritannia tootjahinnaindeksid.

-

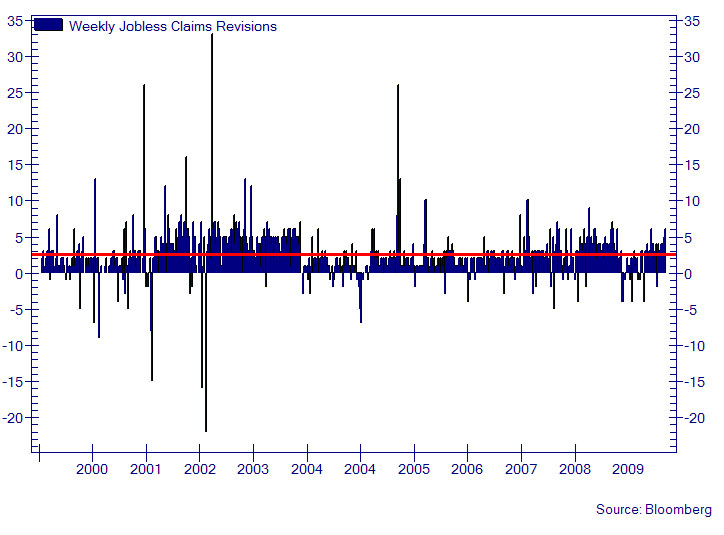

Tulles tagasi töötuabiraha taotluste juurde, siis nagu Joel eile nentis, pidi USA valitsus seekord prognoosima mitmete suuremate osariikide numbrid, mille viimased Labour Day tõttu avaldamata jätsid. Sealt ka nõnda suur ootuste ületamine, kuna sisuliselt vaadati välja sobiv number, mistõttu võib suure töenäosusega oletada, et järgmine nädal revideeritakse see ülespoole. Zerohedge on välja toonud graafiku Tööbüroo avaldatud statistikast, millelt on näha, et 90%l juhtudest on eelneva nädala andmeid kõrgemaks revideeritud, seega erilist usaldusväärsust sealt ei paljastu. Ent selleks ajaks kui saabub revideerimise aeg, keskendub turg juba värsketele numbritele.

-

USA ametnike sõnum rahvale neid numbreid prognoosides: Link

-

Credit Suisse näeb uue Equity Strategy raporti kohaselt MSCI Global indeksile aasta lõpuni 6% tõusu ning 2011. a. keskpaigaks 12% tõusu. Samas oodatakse 2011. aasta teisel poolaastal tugevat korrektsiooni.

-

Citi weeklyst nende lühiaja vaade aktsiaturgudele:

Our views on equities are unchanged: we still prefer to sell rallies than buy dips. We’re not yet tempted to fade the recent rally, however. Market sentiment seems pretty low at the moment, so from a contrarian perspective this advises caution in building any aggressive shorts at this juncture

-

Hiina väliskaubanduse ülejääk vähenes augustis 20 mld dollarini juulikuu 28.7 mld dollarilt: riigi augustikuu import kasvas oodatust rohkem, olles 35.2% (YoY) ning eksport jäi napilt ootusele alla, kasvades 34.4% (YoY). Võrdluseks, juulis kasvas import 22.7% ning eksport 38.1%.

-

Samut on Danske valmis saanud oma globaalse makro vaate. Saab lugeda nende enda koduleheküljelt:

http://danskeresearch.danskebank.com/link/GlobalScenarios09092010/$file/GlobalScenarios_09092010.pdf

-

Joel, see ametnike kommentaar on päris teravalt õeldud.

Legendid teavad kuidas asjad käivad. -

Qatari Doha Banki tegevdirektor ootab järgmise 6 kuu jooksul maailma langemist teistkordsesse majanduslangusesse (double-dip). Link Bloombergi videole siin.

-

Link viib Bloombergile, aga kus lugu leida võiks?

-

Link nüüd uuendatud ja töötab korrektselt.

-

Gapping down

In reaction to disappointing earnings/guidance: SWHC -7.1%, NSM -5.8%, QXM -3.2%, TXN -1.0%.Other news: LAQ -21.3% (trading ex dividend and post split), CNAM -6.8% (provides impact on Jiangsu Province Power Restrictions; expected to impact its revenue in 2010 by as much as $40 mln), CMO -2.4% (declares Q3 dividend of $0.26/share, down from $0.36/share), TRW -2.3% (announced the underwritten public offering of 7.5 mln shares of its common stock), EDMC -2.2% (urges Department of Education to reconsider gainful employment rule), ELN -2.1% (ticking lower on light volume on reports of potential director insider trading), BSX -1.9% (weakness attributed to tier 1 firm downgrade), RIMM -1.8% (coming under pressure over the past hour as headlines report that some firms are considering alternatives to RIMM's Blackberry), ADBE -1.3% (pulling back from yesterday's 3 point jump after AAPL news on relaxed restrictions on the development tools used to create iOS apps; also downgraded at tier 1 firm), BUD -1.2% (still checking).

Analyst comments: VE -1.7% (downgraded to Underperform from Outperform at Exane BNP Paribas), OMI -1.6% (downgraded to Neutral from Outperform at Credit Suisse), INTU -1.3% (downgraded to Neutral from Buy at UBS ), MTL -1.2% (downgraded to Neutral from Buy at Goldman).

Gapping up

In reaction to strong earnings/guidance: LULU +6.7%, CROX +2.3% (reaffirms guidance ahead of conference).Select financial related names showing strength: LYG +3.1%, RBS +1.6% (upgraded to Buy from Hold at Citigroup), HBC +1.0%, DB +0.9% (modestly rebounding from yesterday's intraday pullback following offering speculation; CNBC said could be as early as next week).

Select European drug names ticking higher: AZN +1.1%, SNY 0.7%.

Other news: NOK +5.5% (appoints Stephen Elop to President and CEO effective 9/21/10; upgraded to Buy from Hold at RBS), AEO +4.1% (Chairman/10% owner bought 500K shares at $13.50-13.58 ), JKS +3.3% (rebounding from yesterday's 2 point pullback; also passes California Energy Commission's module tests and becomes eligible for California's solar electric incentive programs in Senate Bill 1), JASO +2.6% (announces financial partnership agreement with China Development Bank for up to RMB 30 bln of financing and credit facility), RYAAY +2.0% (still checking for anything specific), SOLR +1.5% (announces the pricing of the secondary offering of 11 mln shares of its common stock at a price to the public of $7.39 per share), CCE +1.1% (strength attributed to tier 1 firm upgrade), MDCO +1.0% (provides PTO litigation update).

Analyst comments: CSC +3.0% (upgraded to Buy from Hold at Jefferies), LEN +1.0% (initiated with Buys at Keybanc).

-

USA turud alustamas kerges plussis: ES +0,25%, YN +0,15%, NQ +0,16%. Nafta kaupleb +1,58% @ 75,42 USD ja ja kuld -0,16% @1241,8 USD.

Euroopa turud:

Saksamaa DAX -0,23%

Pantsusmaa CAC 40 -0,02%

Suurbritannia FTSE100 +0,02%

Hispaania IBEX 35 -0,09%

Rootsi OMX 30 -0,07%

Venemaa MICEX -0,12%

Poola WIG -0,37%Aasia turud:

Jaapani Nikkei 225 +1,55%

Hong Kongi Hang Seng +0,43%

Hiina Shanghai A (kodumaine) +0,26%

Hiina Shanghai B (välismaine) +0,86%

Lõuna-Korea Kosdaq +0.54%

Tai Set 50 +0,46%

India Sensex 30 suletud -

Stay Flexible in a Rangebound Market

By Rev Shark

RealMoney.com Contributor

9/10/2010 8:56 AM EDT

Thus, flexibility, as displayed by water, is a sign of life. Rigidity, its opposite, is an indicator of death.

-- Anthony Lawlor

Although the indices were in positive territory on Thursday, most stocks finished off their highs as some mild profit-taking kicked in. We have had good gains five of the last six days as well as some very strong pockets of momentum which has resulted in overbought conditions in places. We were due for a little consolidation, and what we ended up with was healthy rather than worrisome.

Overall we are still a bit extended, but we are in a trading range, and that suggests we keep an open mind and be flexible. The S&P 500 is smack in the middle of the 50- and 200-day simple moving averages, and while the overhead at 1115 to 1125 looks formidable, the bulls have had the momentum lately and are doing a nice job of consolidating the move off the August lows.

We've gone from very negative sentiment to a much more upbeat atmosphere in just a week. Just a short while ago there was a tremendous amount of talk about the possibility of a double-dip recession. That has suddenly cooled off after some slightly-better-than-expected economic reports recently. The economic news hasn't been great, but sentiment and expectations were so negative that we ended up with a strong "buy the bad news" response.

Sentiment now feels quite sanguine once again, which could be a problem if we do have any negative economic news. The news agenda is very quiet right now, so that isn't a big concern at the moment.

Overall we are in trading-range market that is just slightly overbought but with upside momentum. There is no reason to be wildly bullish or bearish -- a setup that often makes for some great trading if you focus on individual stock-picking.

In an environment like this, I stick with my approach of making partial sells of positions into strength. It is very easy to suddenly believe that we should just adopt a buy-and-hold approach because many stocks are acting fairly well. That may work very well for some, but my approach is to make sure I take some gains into strength when we are in a trading range. New opportunities will occur as we jump around in the range, so it can pay off nicely to keep moving funds around as new stocks set up.

Let's stay flexible and be open-minded. We have a slight positive open on the way. Overseas markets were mixed, with Asia doing well on news of an unexpected jump in China imports, which bodes well for domestic strength there. -

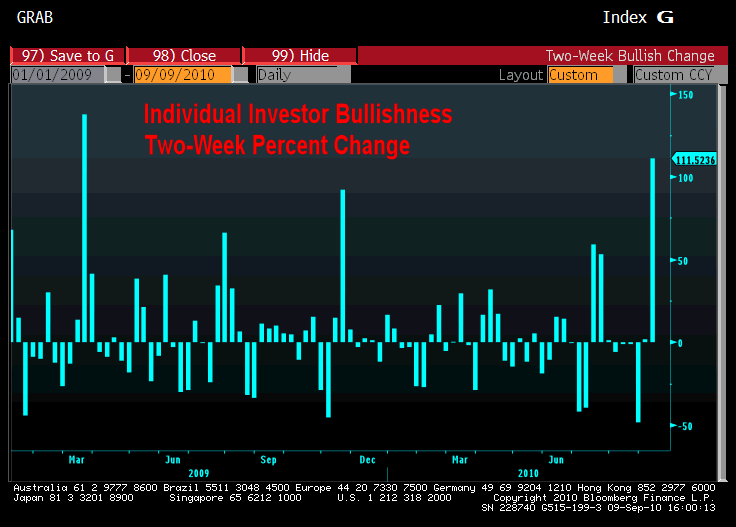

Alloleval graafikul on kujutatud erainvestorite sentimendi indeks, mis tegi täna suurima 2-nädalase tõusu möödunud aasta märtsikuust saati (2009. aasta märtsis tõusis S&P 500 indeks ca 5%). American Association of Individual Investors andmetel oli 43.9% küsitlusele vastanutest turgude suhtes positiivsel arvamusel (viimati oli kindlustunne samal tasemel 15. aprillil).

-

Eile õhtul toimus USAs California osariigis (San Franciscost mõne kilomeetri kaugusel) gaasitoru plahvatus, mis kuulus ettevõttele Pacific Gas & Electric Co. (PCG). Praeguseks on teada, et plahvatuses on surma saanud 4 inimest (arvatavasti hukkunute arv tõuseb). PCG kaupleb hetkel USA aktsiaturul ca 5.3% miinuses. All on PCG viimase 5 päeva graafik.

-

SEC approved new rules to expand a recently-adopted circuit breaker program to include all stocks in the Russell 1000 Index

SEC approved new rules submitted by the national securities exchanges and FINRA to expand a recently-adopted circuit breaker program to include all stocks in the Russell 1000 Index and certain exchange-traded funds. The SEC also approved new exchange and FINRA rules that clarify the process for breaking erroneous trades. SEC anticipates that the exchanges and FINRA will begin implementing the expanded circuit breaker program early next week. -

Tõotab tulla madalaima kauplemisaktiivsusega päev alates selle aasta aprillist.

-

Umbes 77% ameeriklastest usub, et USA majanduskasv aeglustub ning topeltpõhja stsenaarium realiseerub. BusinessInsider toob aga välja, et negatiivne sentiment peaks investoritele mõjuma häirekellana ning tegutseda tuleks vastupidiselt rahva arvamusele, sest ka eelnevate kriiside ajal on selline tegevusviis ennast õigustanud.