Börsipäev 27. september

Kommentaari jätmiseks loo konto või logi sisse

-

Reedel kõnega esinenud Ben Bernanke toonitas oma jätkuvat rahulolematust, et riigi majanduslik taastumisprotsess pole olnud piisavalt tugev aitamaks vähendada kõrget tööpuudust. Ühtlasi jagas ta vihjeid, et keskpank võib oma järgmise kohtumise raames alandada USA majanduskasvu prognoose. Selliste kommentaaridega suureneb aga investorite usk, et FED kavatseb üha suurema tõenäosusega alustada uue kvantitatiivse lõdvendamise programmiga, aidates USA turgudel lõpetada reedese päeva üle 2%-lise ralliga. Aasia indeksid on täna järgi võtmas ning USA futuurid kauplemas 0,1% kõrgemal.

Kui nädala esimene pool on makro osas suhteliselt vaene, siis teises pooles avaldatav info kujuneb juba oluliselt kaalukamaks. Muuhulgas jäävad neljapäeva ja reede peale teise kvartali lõplik SKT, jobless claims, ISM Manufacturing, Michigani tarbijasentiment.

-

Nädalavahetusel sõlmisid $5 miljardilise investeerimismemorandumi Kreeka minister Harris Pamboukis ja Qatar Investment Authority esindaja Ahmed Al Sayyed. Eesmärgiks on investeerida turismisektorisse, kinnisvaraarendusse, infrastruktuuri, finants- ja energiasektorisse. Lähis-Ida on oma naftadollaritega üritamas eurotsooni problemaatilisi riike vaevatest raskustest pikaajaliselt kasu lõigata ning teisalt on läänemaailm pakutavat raha hea meelega vastu võtmas.

-

Moody's downgrades Anglo Irish's covered bonds to A2 from Aa2

-

Southwest Airlines (LUV) on teatanud AirTrani (AAi) ülevõtmisest, mis on 55% plussis.

Unilever (UN) võtab $3.7 miljardi eest üle Alberto-Culveri (ACV), mis on üle 18% plussis.

Wal-Mart pakub $4.25 miljardit Lõuna-Aafriks Massmarti eest.

Korralik ülevõtumaania käimas. -

Momentum turgudel on eelturul igaljuhul jätkumas ning näiteks Apple'i (AAPL) eelturu hind indikeerib kuuendat järjestikust kauplemispäeva, mil tehakse uus ajaloo tipp.

-

Gapping up

In reaction to strong earnings/guidance: CALM +1.6% (ticking higher).

M&A news: AAI +54.5% (Southwest Air to acquire AirTran; transaction values AAI common stock at $7.69/share), ACV +18.3% and UN +1.8% (Alberto-Culver to be acquired by Unilever for $37/share).

Select airline related names getting boost following AAI/LUV news: JBLU +9.5% (also positive mention in finance newspaper over the weekend), LCC +3.4%, AMR +3.4%, SKYW +2.2%, DAL +1.2%.

Other news: YRCW +48.1% (announces tentative agreement with Teamsters), CVBK +24.0% (ticking higher; postpones capital raise), HNR +10.3% (announces retention of financial advisor to explore strategic alternatives; could include a sale of assets or a sale or merger of the Company), SGEN +10.2% (Seattle Genetics and Millennium Announce positive top-line Brentuximab Vedotin data from pivotal trial in relapsed and refractory hodgkin lymphoma), GFRE +7.5% (announces $10 million share repurchase program), TTT +5.7% (light volume; announces agreement to acquire Mass Financial; valuing the transaction at approx $225 mln), ATPG +4.0% (formed ATP Titan LLC to monetize its investment in the ATP Titan, DRYS +2.9% (early strength attributed to tier 1 firm upgrade), BBY +2.3% (positive mention in finance newspaper over the weekend), LDK +1.7% (enters strategic financing agreement with china development bank for up to RMB60 bln), HOLX +0.7% (receives favorable votes from FDA advisory for panel Selenia Dimensions Digital Mammography Tomosynthesis).

Analyst comments: RINO +3.2% (initiated with Buy at Global Hunter), S +2.7% (Mgmt has also suggested that a complete takeover of ClearWire is unlikely in S's near-term future - Auriga), BDX +1.6% (upgraded to Neutral from Sell at Goldman).

Gapping down

In reaction to disappointing earnings/guidance: PTN -11.1% (will reduce workforce by ~50%), ZLC -6.0%.

Other news: MTB -2.7% and STD -2.1% (early weakness being attributed to reports out over the weekend related to breakdown of merger talks), CHU -2.1% (traded lower overseas; co reported iPhone shortages over the weekend following launch in China).

Analyst comments: INFN -6.5% (downgraded to Sell from Neutral at Goldman), RDWR -3.5% (downgraded to Perform at Oppenheimer), VCLK -3.0% (downgraded to Neutral at Merriman), ISRG -2.0% (initiated with Sell at Goldman), ESRX -1.9% (downgraded to Neutral from Buy at Goldman), NOK -1.6% (downgraded to Underperform from Market Perform at Bernstein), NKE -0.7% (downgraded to Hold from Buy at Argus).

-

Lisaks Apple'it peibutavale ümmargusele 300sele numbrile on ümmargune number käeulatuses ka Baidu.com'il (BIDU), millel on $100ni jõudmiseks vaja reedesest sulgumishinnast tõusta 2.22% ning eelturul kaubeldakse juba üle $99. QQQQ'l on selle aasta tipu tegemisest puudu veel vaid 1.99%.

-

USA futuurid hetkel kauplemas 0,2% kõrgemal võrreldes reedese sulgumisega.

Euroopa turud:

Saksamaa DAX +0,06%

Pantsusmaa CAC 40 -0,01%

Suurbritannia FTSE100 -0,08%

Hispaania IBEX 35 -0,73%

Rootsi OMX 30 -0,12%

Venemaa MICEX -0,34%

Poola WIG -0,09%Aasia turud:

Jaapani Nikkei 225 +1,39%

Hong Kongi Hang Seng +1,00%

Hiina Shanghai A (kodumaine) +1,40%

Hiina Shanghai B (välismaine) +1,89%

Lõuna-Korea Kosdaq +0,23%

Tai Set 50 +1,33%

India Sensex 30 +0,36% -

Rev Shark: Respect the Upside Momentum

09/27/2010 8:16 AM"Where would we be if we had I.O.U.'s ... floating all around the country?" Instead he decided to "issue currency against the sound assets of the banks. The Federal Reserve Act lets us print all we'll need. And it won't frighten the people. It won't look like stage money. It'll be money that looks like real money."

-- Treasury Secretary William H. Woodin (from "Closed for the Holiday: The Bank Holiday of 1933," Federal Reserve Bank of Boston, March 7, 1933)

The action on Friday caught many market players by surprise. After three weak days in a row, we were due for a bounce, but the strength of the move reflected some panic-buying and performance-anxiety. Volume could have been a bit heavier, but breadth and leadership made up for it.

What triggered the action were some OK economic reports, but mostly it was a hedge fund manager who earned over $4 billion and was the highest paid hedge fund manager in 2009 that fanned the flames. David Tepper on CNBC simply set forth a common sense theory that either we have a bad economy and the Fed drives the market up with more money printing or we have a better economy and that drives the market. No one seemed particularly inclined to argue with him, and that is what really spiked the action on Friday.

The possibility of QEII has been driving the market all month. At the end of August, there was much worry that we were headed for a double-dip recession, but Ben Bernanke and the Fed have made a number of not-so-subtle hints that they are prepared to run the printing presses as needed should they need to do so. That has kept a bid under the market and has sent us straight up for nearly a month now.

Since the bottom in March of 2009 the primary driving force in this market has been excessive liquidity and cheap money. There just aren't many places for cash to go so it ends up flowing into the market and gives us these straight-up, light-volume moves.

This phenomenon has caused many people to struggle with the market. First, it just isn't easy to reconcile with the state of the overall economy. The stock market hardly reflects any economic problems at all while most individuals have a dramatically different perception of real estate, jobs and economic growth. If you have tried to use the health of the economy to determine your level of stock market bullishness, you have likely had a tremendously difficult time.

The second difficulty that this excessive liquidity causes is that stocks tend to act in an unusual fashion. First, they are much more highly correlated because when the money flows into the market, it isn't selective. Big baskets of securities are purchased, and everything goes up together. Individual stock picking has mattered much.

Lately, there is a preference for some of the big liquid momentum names such as Apple (AAPL - commentary - Trade Now), Google (GOOG - commentary - Trade Now), Netflix (NFLX - commentary - Trade Now), Chipotle Mexican Grill (CMG - commentary - Trade Now) and the like, but I suspect that has to do with fund managers trying to make up some relative performance. It is still liquidity-driven action, but managers have been unable to outperform by just buying indices, so they are focusing a bit more on certain names.

The most important thing we can do as individual investors is to simply be aware of what is driving the market. Fighting a flood of liquidity just doesn't work very well, even when we are technically extended and/or have a lousy economy. If the Fed is still printing money, it is going to drive the market, no matter what else is going on.

I try to deal with this by not being overly anticipatory. I want to respect the upside momentum until I see some clear evidence that it is slowing. I thought the slowing last week was an indication that we were due for some consolidation, but it's hard not to be impressed by how quickly we heated up again on Friday.

At this point, there are some tremendously extended charts, and if we see further upside, you better be ready to do some chasing if you want to play. That is not easy to do if you are prudent about entry points, but straight-up V-shaped moves are a pattern that this market has embraced and will continue to embrace.

We have a quiet morning so far and aren't repeating the big gap opens we saw to start the last two weeks of action. We'll see how quick the dip-buyers are to jump in after the open, but even some of the bulls wouldn't be unhappy to see a rest at this point.

-

CNBC reports that the FDIC staff delayed its vote on bank liquidation power

-

Yields across the curve falling to session lows...10-yr sees 2.511%

-

Turul käive täna taaskord väga madal, ei imestaks kui õhtul veidi intensiivsemat kasumivõttu näha oleks.

-

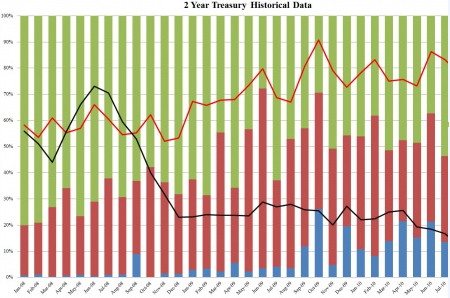

Treasury Auction: The $36 bln 2-yrs draw 0.441% with a 3.78 cover and indirect bidder take out of 39%. Highest cover since August 2007.

-

Õhukesel turul kiirelt anomaaliad tulema. PGN hinnas korralikud liikumised ja ka uutele reeglitele kohaselt halt. Nüüd hind juba tagasi $44.40 tasemel.

-

Alari poolt mainitud 2-aastase võlakirja oksjonist annab hea ülevaate allolev zerohedge graafik. Oksjoni Bid to Cover suhtarvuks saadi täna 3.78 – viimati nägime sellist nõudlust 2007. aasta augustikuus. Punane joon tähistab Bid to Cover suhtarvu ning must joon tähistab võlakirja tulususe määra.

-

GN Store Nord tegi Otix Globalile ülevõtupakkumise ~$58 miljonit. OTIX peale halti kauplemas 14.44% kõrgemal $9.65 tasemel.

William Demant Holding AS (WDH) on teinud varasema ülevõtupakkumise $8.60 aktsia kohta.

NB! Tegemist ebalikviidse aktsiaga. -

Möödunud nädalal kirjutati Bloomberg’is, et USA ettevõtete “insider selling” ja “insider buying” suhtarv oli 17. septembriga lõppenud nädalal vaid 290/1. Nimetatud perioodil ostsid tippjuhid kokku ca $1.4 miljoni väärtuses aktsiaid koguni 7 ettevõttes. Tegu oli hea uudisega, mis aktsiatele ka tuge pakkus. Täna avaldati aga uus raport. Viimaste andmete kohaselt on “insider selling” ja “insider buying” suhtarv 1411/1. USA ettevõtete tippjuhtidel pole järelikult erilist usku, et Fed’i plaanid majandust turgutavad.

-

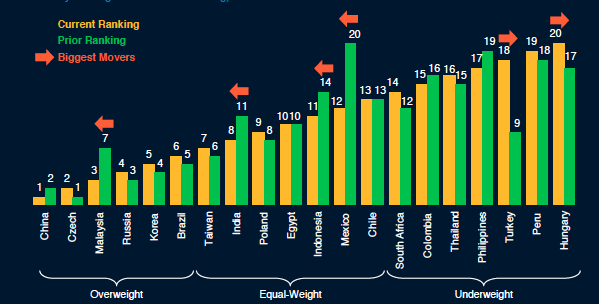

Morgan Stanley presentatsiooni vaadates hakkas silma nende reitingud erinevate riikide aktsiaturgudele. MS on eraldi välja toonud Venemaa, Hiina ja Korea.

-

Kristjani poolt viidatud Insider selling/insider buying toob mulle taas meelde ühe videolingi, mille postitasin 15. septembril ka börsipäeva foorumisse. Link sellele uuesti : )

-

Paistab, et PGN puhul circuit breaker ei toiminud ja tehingud lasti läbi Nasdaq-il, mitte Nyse-l. Circuit breaker poolt tuli halt alles hinna taastumisel.

-

U.S. Corporate Bond issuance hits September record of $125 bln

-

Ken Shevre'i kommentaar kvartalilõpu liikumise kohta on RealMoney all päris hea: "I suspect GMCR -- and several other high-beta names -- will benefit from "window dressing" in coming days where mutual fund managers buy strong performers just before the end of the quarter to make their portfolio look good."

-

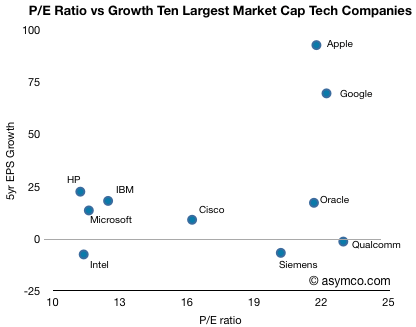

Päris huvitav fakt Nasdaq 100 indeksist, mille võib sisuliselt Apple indeksiks ristida. Ettevõtte aktsia moodustab nimelt 20% Nasdaq 100 indeksist, mida on ca 4x enam, kui ühegi teise aktsia puhul (Qualcomm 4.7%, Google 4.3% ja Microsoft 4%). Allolev graafik näitab Apple aktsia osatähtsust indeksis alates 2003. aastast. Mulle isiklikult on meeltmööda nimi Appsdaq.

-

Bob Prechter CNBC-s väga negatiivselt sõna võtmas. Tema väite kohaselt käib DOW 6 aasta jooksul alla 1000 punkti, päris raju. 2011 on tema sõnul languse algus.

-

Apple aktsia rekordtasemete murdmisest rääkides, toob Asymco välja huvitava graafiku. Nagu näha, siis Apple P/E on sarnane konkurentidele (horisontaalne telg), kuid viimase viie aasta aktsiapõhise kasumi kasv (vertikaalne telg) on teistest üle, täpsemalt 95.2%. Kuigi praeguse ostja jaoks on tähtis tulevik, näitab viimase viie aasta kasumikasv, milleks Apple võimeline on.

-

Kui 6 aasta pärast käib Dow alla 1000 punkti, siis aastaks 2025 peaks indeks jõudma 38 820 punktini väidab „Stock Trader’s Almanac“ autor Jeffrey Hirsch. Kusjuures tema sõnul algab suurem tõus 2017. aastal. (link)

-

Virtual Radiologic to pay $170M for NightHawk Radiology shares.

Levi & Korsinsky, LLP Launches an Investigation into the Possible Breaches of Fiduciary Duty by the Board of NightHawk Radiology Holdings, Inc. in Connection with the Sale of the Company to Virtual Radiologic For $6.50 in cash Per Share.