Börsipäev 29. september

Kommentaari jätmiseks loo konto või logi sisse

-

Lootus, et FED päästab päeva, aitas eile mööda vaadata tarbijausalduse langusest, vedades indeksid 0,4% kuni 0,5% kõrgemale. Võimaliku stiimulprogrammiga kaasnev inflatsioonihirm nõrgestas aga dollarit ning saatis kulla untsi eile 1306 dollarini ning pannud täna hommikul veel võimsamalt särama (1312 USD).

Aasias on sentimenti toetamas Hiina PMI indeks, mis kerkis teist kuud järjest, viidates töötleva tööstuse kasvu kiirenemisele. Jaapani Tankani raport sisaldas seevastu nii positiivset kui negatiivset sõnumit – ühest küljest peegeldus selles suuremate töötlejate oodatust kõrgem usaldus, teisest küljest osutus tuleviku väljavaade arvatust nõrgemaks. Sarnaselt USA-le loodetakse, et Jaapani keskpank kavatseb oktoobri kohtumisel avalikustada järgmise stiimulpaketi, mille peale Nikkei ka täna 0,67% kõrgemal kaupleb.

Makroraportitest on täna kell 12.00 oodata eurotsooni tarbijausalduse näitu, USA-s aga jääb laud selles osas jätkuvalt hõredaks ning tähelepanu keskpunktis võiksid olla erinevate FEDi liikmete esinemised.

-

Eile õhtul jäi silma selline uudis.

(US) FINRA has warned recent jump in high yield purchases has stoked some yield chasing fears - FT

- For retail trades, defined by FINRA (Financial Industry Regulatory Authority) as transactions of $100,000 or less, this buy-sell trade ratio jumped to over 1.2 in the third quarter, more than double the level it was at in the second quarter. While that same ratio for institutional investors fell in the third quarter near zero.

Sept 19th: FT comments on strong demand in junk bond markets, taking prices to levels not seen since June 2007; According to a BNP analyst, funds coming into the sector are searching for higher yield and see few prospects in stocks. -

Äsja avaldati eurotsooni indeksid, mis tulid oodatust paremad: ärikliima indeks 0,77 vs oodatud 0,58; majanduse usaldusindeks 103,2 vs oodatud 101,3 (eelmise kuu näit korrigeeriti üles 102,3 punktini); tarbijausalduse indeks vastas ootustele -11; tööstususalduse indeks -2 vs oodatud -5 (ja eelmise kuu näit korrigeeriti üles -3 peale); teenustesektori indeks 8 vs oodatud 7.

Euro tänaseks tipuks on $1,3637. Hetkel kaupleb $1,3604 juures. -

Global Debt Comparison - The Economist'i interaktiivne kaart riikide võlataseme muutuse kohta alates 1999. aastast.

-

Gapping up

In reaction to strong earnings/guidance: FDO +6.9%, CADC +4.6% (ticking higher), HPQ +1.4%.

M&A news: GENZ +0.7% (light volume; higher following reports out overnight that Sanofi is considering increasing its offer for the company).

Select stem cells trading higher: ASTM +5.3%, GERN +4.1%, STEM +3.9%.

Other news: LRAD +23.1% (announces $17.6 million LRAD Systems and maintenance order from a foreign government), YRCW +3.4% (CEO announces he will retire), CRUS +1.4% (Cramer makes positive comments on MadMoney), BA +1.1% (being awarded a $5.297 bln modification to convert the previously awarded advance acquisition contract to a fixed-price-incentive-fee multi-year contract - DoD).

Analyst comments: ISPH +2.1% (initiated with Buy at Jefferies), JBL +1.9% (upgraded to Strong Buy from Buy at Needham), MGM +1.4% (initiated with Market Performs at Wells Fargo), SGEN +1.3% (initiated with Buy at Jefferies), CCL +1.3% (upgraded to Buy from Neutral at Goldman), PLCE +1.3% (initiated with Buy at Goldman), LVS +1.2% (initiated with Market Performs at Wells Fargo), FTE +1.0% (upgraded to Neutral from Underperform at Exane BNP Paribas).

Gapping down

In reaction to disappointing earnings/guidance: MLNK -12.0%, ZZ -11.9%, SMSC -7.7%, MTRX -6.0% (ticking lower).

Select financial related names showing weakness: DB -2.1%, RBS -1.9%, BCS -1.3%, HBC -1.2%, IBN -1.2%, UBS -1.1%, STD -0.7%.

Select metals/mining stocks trading lower: NXG -4.1% (to launch of $135 mln public offering of convertible notes), SLT -3.3%, MT -1.5%, BBL -1.2%, BHP -1.1%, GOLD -1.1%, AU -1.0%, HMY -1.0%, RTP -0.7%.

Other news: GMCR -13.7% (discloses SEC inquiry and overstatement of pretax income), THM -7.3% (announces up to CAD 105,375,000 in equity financings), CHTP -5.2% (announces public offering of common stock), SYT -2.9% (traded lower overseas), ARMH -1.5% (still checking), MFN -0.7% (reports that remediation work on the phase 1 leach pad at the Co's Dolores Mine continues).

Analyst comments: AZN -1.1% (downgraded to Hold from Buy at RBS), FLR -0.7% (with an Underperform at BMO Capital).

-

S&P 500 futuur on järjepidevalt nulli lähedal liikunud, hetkel -0,15% punases

Euroopa turud:

Saksamaa DAX -0,3%

Pantsusmaa CAC 40 -0,27%

Suurbritannia FTSE100 -0,26%

Hispaania IBEX 35 -1,05%

Rootsi OMX 30 -0,64%

Venemaa MICEX +0,63%

Poola WIG +0,19%Aasia turud:

Jaapani Nikkei 225 +0,67%

Hong Kongi Hang Seng +1,22%

Hiina Shanghai A (kodumaine) -0,03%

Hiina Shanghai B (välismaine) +0,43%

Lõuna-Korea Kosdaq +0,38%

Tai Set 50 +1,29%

India Sensex 30 -0,74% -

GS tõmbas MS-i EPS prognoosi $0.60 pealt $0.15 peale. Päris rajud kärped.

-

Rev Shark: Not Much to Hate, Not Much to Like

09/29/2010 7:57 AMThe optimist proclaims that we live in the best of all possible worlds, and the pessimist fears this is true.

-- James Branch CabellOver the last 18 months, many market players have found it difficult to stay bullish as we go up without a pause. Not only have we tended to go straight up on light volume and become very technically extended, but we also always seem to have plenty of good fundamental reasons to believe a correction is right around the corner.

It has been extremely easy to be prematurely bearish as we deal with a lousy economy, and we face that situation once again. As I've mentioned numerous times lately, there is nothing technically wrong with the major indices. They are a little overbought, but we have taken out the June and August highs and have been churning for a week or so as we build a base for a move through 1150 of the S&P 500. It isn't a bad technical setup at all, and there is no compelling reason to be bearish based on the charts of the indices.

Under the surface, though, the picture is not as clear. We have a group of big-cap, high-beta names like Priceline (PCLN - commentary - Trade Now), Apple (AAPL - commentary - Trade Now) and Amazon (AMZN - commentary - Trade Now) that have been on fire, but they are quite extended and do not offer good entry unless you are extremely aggressive and want to chase momentum. On the other hand, small-cap stocks have not performed nearly as well. The Russell 2000 did pop up above the July high yesterday at the close, but there is a major disconnect between the Nasdaq 100 and the Russell 2000.

Ultimately my view of the market is primarily determined by the trade opportunities that I see, and that has me a little troubled right now. While the indices look OK, my list of setups and potential buys is very short. Either things are extremely extended (like the Nasdaq 100) or they look dead (like the Russell 2000).

I have to admit I don't have a very positive view of the economy and I'm surprised that we were able to shrug off the poor consumer confidence numbers so easily yesterday, but I try to set aside that bias and focus just on the charts. There just aren't many there even if I take a very optimistic view of big picture.

One thing about trading that many people struggle with is that opportunities don't come at a steady pace. There will be times when you just can't move fast enough as new setups keep popping up. We saw a bit of that in the last few weeks when we had some good momentum that hadn't become extended. At other times, though, there just isn't much there, and you have to stay patient and simply accept that fact. You might feel frustrated and left out, but if you start reaching for those reasons, it's very easy to make some mistakes.

My point this morning is that there is nothing wrong with this market right now from a technical standpoint. I'm sure there are many fundamental bears who can find all sorts of problems, but if you are just looking at the price action, there isn't any reason to be overly negative. On the other hand, it is not an easy market to buy right now. We are extended, need some consolidation and are lacking in individual setups.

The action looks very slow this morning. The indices are flat, and there is no major economic news on the agenda. Overseas markets have some minor gains and Green Mountain Coffee Roasters' (GMCR - commentary - Trade Now) pullback is probably the most interesting action. This dull action has been favoring the bulls, though, so don't be overly negative.

-

Small Business Administration avaldas uuringu, mille kohaselt lähevad USA riiklikud regulatsioonid ja järelvalve ameeriklastele aastas maksma ca $1,75 triljonit (pdf). 2005. aasta uuringu järgi oli vastav summa $1,1 triljonit. Kogusumma on kasvanud $445 miljardi võrra tänu majanduslikele regulatsioonidele. Käesoleva aasta tervishoiu- ja finantsregulatsioonid kasvatavad seda summat ilmselt veel märkimisväärselt.

Siin on Heritage Foundation'i pikem artikkel USA regulatsioonidest, nende maksumusest ja trendist.

-

Kuulduste kohaselt hakkavad Skype ja Facebook koostööd tegema:

Facebook and Skype to announce partnership, All Things Digital reports

(flyonthewall) Facebook and Skype are set to announce a partnership, reports All Things Digital's BoomTown. The partnership would include integration of SMS, voice chat, and Facebook Connect. According to unnamed sources, Facebook wants to integrate communications with its community at a higher level.

-

Fed's Plosser says asset purchases at this time could hurt Fed's credibility; asset purchases can do little to speed up return to full employment - CNBC

-

$29 bln 7-year Auction Results: Yield: 1.890% (expected 1.889%); Bid/Cover: 3.04x (Prior 2.98x, 12-auction avg 2.82x); Indirect Bidders: 50.2% (Prior 56.7%, 12-auction avg 51.8%)

-

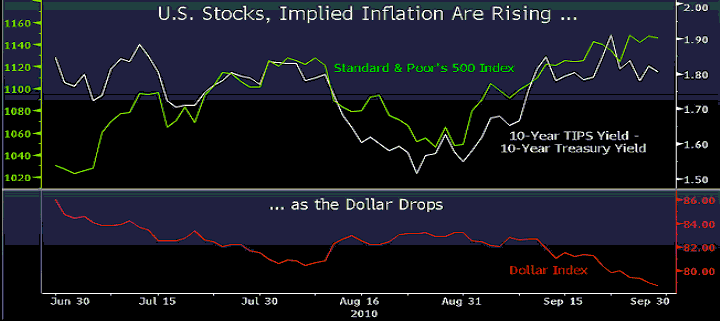

RBC Capital Markets analüütikute sõnul on aktsiaturgudel parima oktoobrikuu (1939. aastast saati) taga Föderaalreserv. Eile kirjutasin sellest, et Fed on võlakirjade lühikeseks müüjad nii-öelda hirmutanud aktsiaturgudele ning nüüd on aeg rääkida inflatsiooniootustest. Allolev graafik võrdleb S&P 500 indeksit TIPS spread’i (10-aastase riikliku võlakirja tulususe määra ja TIPS tulususe määra vahe) ning dollari indeksit. Oktoobris on S&P 500 tõusnud ca 9% ning tulususe määrade vahe kasvanud 0.27 protsendipunkti, kuid dollari indeks langenud 5%. RBC sõnul ootab ees turge tugev langus, kui novembrikuus Fed uut kvantitatiivse lõdvendamise programmi ei tutvusta.

-

Mis nad novembri kohta arvavad?

-

IPO'de turgu iseloomustab hästi täna "USA valitsuse" ettevõttega Liberty Mutual Agency'iga. Nimelt lükati ettevõte IPO edasi, kuna nõudlus ettevõtte aktsia vastu ei olnud piisavalt suur. Liberty Mutual plaanis tõsta ca $1.29 miljardit kapitali. IPO läbiviijateks on Citigroup ja Bank of America ML.

-

ymeramees, RBC strateeg prognoosib, et Fed'il pole suurt valikut ehk programmiga jätkatakse.

-

Eilses börsipäeva foorumis öeldule annab kinnitust hiljuti Birinyi Associates poolt avaldatud analüüs, kus kirjutatakse, et USA aktsiaturgude tõusu taga ei ole lühikeste positsioonide likvideerimine. Nimelt moodustavad lühikesed positsioonid hetkel 3.8% kõikidest USA turul kaubeldavatest aktsiatest – tegu on käimasoleva aasta kõrgeima numbriga. Huvitav fakt on veel see, et septembrikuus USA aktsiaturgudel parimat kasvu näidanud 10 aktsia „short interest“ on kasvanud samuti rekordiliselt. Ehk aktsiate hinnatõus käib käsikäes „short interest“ suhtarvu kasvuga – aktsiahindu ei tõsta lühikeste positsioonide likvideerimine.

-

No ja kui tõus jätkub, siis hakkab alles õige pigistamine ja marginid lendavad.

-

RBC Capital Markets analüütikute sõnul on aktsiaturgudel parima oktoobrikuu...

Ma nagu vihjasin selle peale :)