Börsipäev 21. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

USA turud taastusid eile teisipäevasest müügist tänu dollarile, mis enne FED-i Beige Booki’i taas nõrgenema hakkas. Viimase kohaselt jätkus septembris ja oktboobri alguses riigi majanduse aeglane kasv ja kuigi kohati olid küsitluse tulemused varasemast veidi optimistlikumad, siis üleüldine foon tõstis turuosaliste silmis tõenäosust, et keskpank kavatseb tulevikus raha trükkimist jätkata.

Aasia indeksid on hommikul liikunud kerges miinuses eesotsas Hiinaga, kus kolmanda kvartali majanduskasv aeglustus kõrgema baasi tõttu 9,6% peale vs 10,3% teises kvartalis, lüües sellegipoolest analüütikute 9,5%-list ootust. Septembrikuu inflatsioon kiirenes 3,6% peale, olles augustis 3,5%. Shanghai Composite kauples -0,7% madalamal.USA futuurid on aga praegu 0,1% miinuspoolel.

Euroopas avaldatakse täna mitmel pool oktoobrikuu esialgsed PMI-d kulmineerudes kell 11.00 kogu eurotsooni töötleva tööstuse ja teenindussektori PMI-ga. Kell 11.30 avalikustatakse Suurbitannia septembri jaemüügi muutus. USA-s langeb fookus iganädalasele esmase töötuabiraha taotluste arvule (konsensus ootab langust 462K pealt 455K peale ning jooksvate taotluste puhul kasvu 4399K pealt 4400K peale). Kell 17.00 avalikustatakse septembri juhtivate indikaatorite indeks ning Philadelphia Fedi kohalikku ärikliimat kajastav küsitlus.

Majandustulemused teevad enne turge teatavaks muuhulgas Caterpillar, Eli Lilly, Nokia, McDonald’s, UPS. Pärast turgu aga Amazon, Baidu, SanDisk.

-

Saksmaa PMI tootmisindeks tuli oodatud 54,6 asemel 56,1 punkti. Teenustesektori indeks tuli oodatud 54,9 asemel 56,6 punkti. Euro on kergelt tuge saamas, kaubeldes dollari vastu 0,1% kõrgemal $1,3975 juures.

-

Eurotsooni PMI tootmisindeks 53,4 vs oodatud 53,7 punkti. Teenustesektori PMI 53,2 vs oodatud 53,7 punkti. EURUSD läbis uuesti $1,4000 taseme.

-

Oppenheimer tõstab Netflixi (NFLX) eilsete tulemuste järel aktsia soovitust underperform pealt outperform peale. Hinnasiht tõstetakse $110 pealt $200 peale.

-

Initial Claims 452K vs 455K Briefing.com consensus, prior revised to 475K from 462K

Continuing Claims falls to 4.441 mln from 4.450 mln -

Gapping down

In reaction to disappointing earnings/guidance: GRNB -45.9% (also downgraded to Sell at Wunderlich), CRUS -12.1%, PLCE -11.5%, UTSI -9.1%, CYS -5.5% (also downgraded to Neutral from Buy at Sterne Agee), ADS -4.9%, MLNX -4.5%, TEX -4.3%, RS -3.7%, FNF -3.3%, CY -3.2%, CS -2.8%, K -2.7%, NTRS -2.4%, HSY -2.2%, GSK -2.2%, XLNX -1.6% (also downgraded to Neutral from Buy at UBS), UNP -1.7%, PM -1.5%, ESI -1.2%, STX -0.5% (also downgraded to Neutral from Outperform at Robert W. Baird, downgraded to Neutral from Buy at UBS).Select rare earth metal related names pulling back: SHZ -14.0%, REE -1.8%.

Other news: CRME -26.2% (announces suspension of enrollment in ACT 5 Trial), VOD -3.1% (checking for anything specific), SDRL -2.0% (announced that it intends to issue up to $650 million in principal amount of convertible bonds with a seven-year tenor), ALTR -1.3% (trading lower with XLNX), GIS -1.2% (modest weakness following K guidance).

Analyst comments: JCG -1.4% (downgraded to Neutral from Overweight at Piper Jaffray), CRI -0.7% (downgraded to Neutral from Buy at Sterne Agee).

Gapping up

In reaction to strong earnings/guidance: NFLX +13.9% (also upgraded to Buy from Neutral at Merriman, upgraded to Neutral from Sell at Janney Montgomery Scott), WSTL +12.0%, NOK +8.8%, EBAY +7.2%, SCSS +6.3% (also upgraded to Overweight from Neutral at Piper Jaffray), COHU +6.0%, ALXN +5.8%, LUV +4.9%, EGHT +4.6% (also authorized $10 mln share repurchase plan), BANR +4.1% (light volume), STI +4.0%, FCX +3.5% (increases annual dividend to $2.00 from $1.20), HBAN +2.9%, GGG +2.2% (ticking lower), MCD +1.8%, CAT +1.2%, MKSI +1.0% (also awarded $20 mln order for solar application).M&A news: PTEC +5.2% (discloses higher $4.05 per share cash offer to acquire co),.

Select metals/mining stocks trading higher: MT +1.8%, RIO +1.8%, BBL +1.3%, AAUKY +1.1%, HL +1.0%, X +1.0%.

Other news: NLST +11.1% (to demonstrate 100 virtual machines on a single standard server using HyperCloud Memory at Interop), CHGS +8.7% (continued strength), MNTA +6.7% (will present at the Newsmakers in the Biotech Industry Conference on October 22 ), BT +5.1% (trading higher following court ruling related to Crown Guarantee), NYT +4.8% (reports out after the close that investment group wants to buy the Globe from The New York Times), DEO +4.6% (early strength attributed to peer French Spirits Groups' earnings results), IL +2.6% (Cramer makes positive comments on MadMoney), SAP +2.2% (traded higher overseas), RYAAY +2.1% (still checking), AMZN +2.1% (trading higher in sympathy with EBAY; strength also being attributed to upgrade at tier 1 firm), CSTR +1.8% (ticking higher in sympathy with NFLX), SI +1.5% (still checking), RIG +1.3% (still checking), NVO +1.1% (rebounding from 2 day drop), DE +1.0% (ticking higher in sympathy with CAT).

Analyst comments: AVII +4.0% (initiated with Buy at ThinkEquity), AGU +0.8% (upgraded to Buy from Hold at Stifel Nicolaus).

-

Rev Shark: Live in the Now

10/21/2010 7:46 AM"You may be deceived if you trust too much, but you will live in torment if you do not trust enough." -- Frank Crane

Good earnings reports from eBay (EBAY - commentary - Trade Now), Caterpillar (CAT - commentary - Trade Now) and Netflix (NFLX - commentary - Trade Now) moderated, but strong growth in China of 9.6% and pressure on the dollar are enticing buyers this morning. After the stumble we had on Tuesday, many are not positioned well for further upside, and that is causing some chasing, as underinvested bulls look to add long exposure and bears are stopped out of shorts.

I often advise market players to trade what is in front of them rather than fight it. Trust the existing trend to continue. It may sound like simple and obvious advice, but it is tough to follow. The natural inclination of many people is to be skeptical of what is happening in the financial markets rather than to embrace it and trust it to last. Trusting this market to continue to run up has been especially difficult, since so many have a view of the broad economy that is at odds with the action in the major indices.

Generally, if we simply stuck with the prevailing trend in the market and didn't try to constantly pick turning points, we'd be better far off. There are always serial turn callers who attract great attention. They will eventually be right and make a big splash, but everyone always forgets how much they lost while waiting for their predictions to come true.

One of the basic tenets of my trading is that trends will almost always last longer and go further than most people think they will. That has certainly been the case since the low in March 2009. Even the most bullish market players back then would never have predicted that this market would go back up in a straight line so quickly and easily. It has been a source of great consternation for many as they try to reconcile a euphoric Wall Street with a dour Main Street.

Once again, this morning we have a good example of what makes this market so tricky. After stumbling on Tuesday due to a weaker dollar, an interest rate hike in China and too high of expectations for Apple (AAPL - commentary - Trade Now) earnings, we have completely shrugged off those concerns, and not only do we recover but we keep on going straight up. If you didn't rush in and buy weakness on Tuesday, you are out of position this morning and going to have a tough time finding easy entries.

After Tuesday, there was good reason to have some increased caution, although I noted that the trend was still intact and there was no reason to be overly negative. Even after the bounce yesterday, which wasn't all that vigorous, there was still good reason to tighten up defenses and not let gains disappear. We now have the market celebrating good earnings and a weaker dollar this morning, however, and that caution doesn't look like a very good idea at all.

The mood has shifted from Tuesday, and rather than fight it, we need to respect it and try to find trades that will profit from it. There will be lots of bears growling about why this market can't keep going up, but most of them have been saying the same thing for quite a while and that isn't making anyone any money.

We need to stay focused on the action in front of us, and right now it is upbeat. Respecting the market action doesn't mean that you are undisciplined and force buys; it means that you don't fight the trend, even though it may seem very illogical to you.

-

October Philadelphia Fed 1.0 vs 1.4 Briefing.com consensus, September -0.7

September Leading Indicators +0.3% vs +0.3% Briefing.com consensus, prior revised to +0.1% from +0.3% -

Saks (SKS): Diego Della Valle discloses 19.05% stake in amended 13D filing; up from 11.12% previously reported on 10/19

Osalus aina suureneb! -

Täna suurendab veel, et nii rallis :

9:48AM Saks showing relative strength, up 5% on no apparent news (SKS) 10.67 +0.55 : SKS is trading up 5% this morning, on no apparent news. There was an SEC filing out overnight disclosing the purchase of 1 mln shares by 11% owner Diego Della Valle, but this purchase was previously disclosed, along with other recent purchases, in a filing out on Tuesday (10/19). Today's strength is a continuation of recent momentum, and takes the stock to new two year highs -

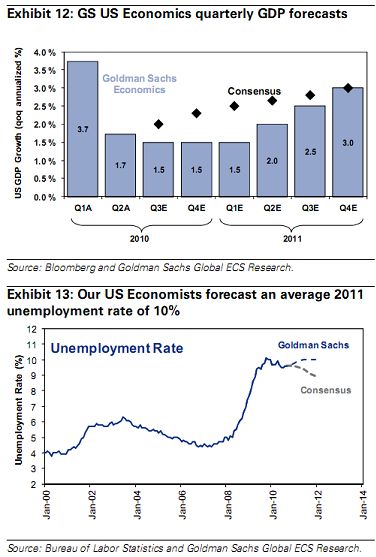

Eilses börsipäeva foorumis tõin välja Goldman Sachi prognoosid seoses varude kasvu aeglustumise ning fiskaalstiimulite vähenemisega, mis tulevates kvartalites hakkavad tugevalt piirama USA majanduskasvu. Kui aga vaadata analüüsimaja SKP kasvuprognoose, siis konsensuse ootustest on need oluliselt madalamad. GS hinnangul kasvab USA majandus 2011. aasta esimeses pooles ca 1.5% kuni 2% ning töötus kasvab ca 10%le.

-

Lisan siia briefing.com vahendusel ning kerge hilinemisega Nokia majandustulemused:

Nokia reported Q3 EPS of EUR 0.14 vs. the EUR 0.09 consensus; net sales of EUR 10.3 billion, up 5% year-on-year and 3% sequentially (down 2% and up 1% at constant currency), vs. the EUR 9.4 bln consensus Nokia's preliminary estimated mobile device market share was 30% in the third quarter 2010, down from an estimated 34% in the third quarter 2009 and an estimated 33% in the second quarter 2010 (based on Nokia's revised definition of the industry mobile device market share applicable beginning in 2010 and applied retrospectively to 2009 for comparative purposes only). An overall improved demand environment primarily contributed to Nokia's 2% year- on-year increase in global mobile device volumes during the third quarter 2010. However, this was largely offset by the impact of industry-wide shortages of certain components, particularly in the low end of the market where Nokia's position is strong, during the third quarter 2010. On a sequential basis, Nokia's 1% decrease in global mobile device volumes was primarily due to these industry-wide component shortages.

-

Seni on Nokia prognoose tõstnud BMO Capital, mis tõstis ettevõtte hinnasihi $9 pealt $10 peale ning RBC Capital, mis tõstis Nokia hinnasihi $14 pealt $16 peale. Nokia aktsia on USAs 4.71% plussis.

-

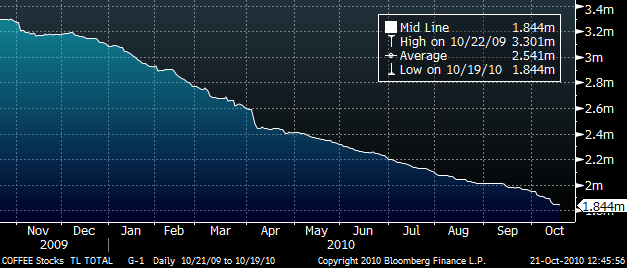

Arabica kohvi hind moodustas täna New Yorkis uue viimase 13 aasta tipu. Hinnatõusu taga on suuresti Aasias ning Kesk-Ameerikas möllavad tormid, mis on oma jälje jätnud ka pakkumisele. Erakordselt märjad olud on näiteks Aasias sundinud edasi lükkama saagi koristamist ning kohviubade töötlemist. Kesk-Ameerika vihmad on muutnud olukorra aga veelgi kriitilisemaks. Näiteks Kolumbia, mis on Arabica kohvi üks maailma suurimaid tootjaid teatas, et märja ilma tõttu kasvab taimedel torik, mis võib tublisti piirata tuleva aasta tootmist.Allolev graafik näitab Arabica kohvi hindu viimase aasta lõikes.

Ilma mõjusid kohvile kajastab hästi New York Board of Trade poolt 19. oktoobril avaldatud raport, mille kohaselt on kohviubade varud käimasoleva aasta algusest saati langenud 40%.

.

-

kurat ikka õudus on see UNG, kas on tõesti päris põhja minemas või on ikka lootust ka taastumiseks? vale ta on, aga kuidagi ei taha kahjumit kanda veel

R -

Fed's Bullard says no decisions made yet on QE2; says Fed not 'here to ratify what the market thinks' - CNBC

-

Amazon.com prelim $0.51 vs $0.48 Thomson Reuters consensus; revs $7.56 bln vs $7.36 bln Thomson Reuters consensus

Amazon.com sees Q4 operating income of $360-560 vs $615.36 mln consensus (29% y/y growth consensus); revs $12-13.3 vs $12.30 bln Thomson Reuters consensus

Amazon.com pops on earnings up to 172 and quickly slips back to its 165 regular hour close -

Miks aktsiad täna kukkusid rängalt?Seda tahaks teada,mitte Amazon.com jne.

-

Helve , äkki sellepärast: Fannie and Freddie may need another $215 billion

-

rainerb:

UNG/maagaasi hinda mõjutavad hetkel mõned huvitavad asjaolud.

Nimelt oodati ja avaldati eile kaks olulist raportit, mis viis gaasi hinna -4.8% allapoole, viimase 13 kuu madalamale tasemele.

Kõigepealt varude raport EIA-lt, mille kohaselt varud suurenesid rohkem kui oodati ja ületavad hetkel 8.4% viimase 5 aasta keskmist. Avatud gaasimaardlate arv tõusis 966-ni, mis on 34% rohkem kui aasta tagasi, gaasi tootmise maht päevas on suurim alates 1973 aastast. Link raportile: http://ir.eia.gov/ngs/ngs.html

Kuna gaas pole sarnaselt naftale, kullale või näiteks teraviljale globaalse tähtsusega siis odavnev USD hinnale tuge ei paku.

Teine oluline raport tuli USA ilmateenistuselt (NOAA), kes teatas, et eesolev talv võib tulle 3-4 kraadi soojem kui tavaliselt. Selles saab süüdistada kiiresti arenevat ilmastikunähtust Al Nina. Viide ühele graafikale: http://www.noaanews.noaa.gov/stories2010/images/winteroutlooktemp_2_20102.jpg