Börsipäev 25. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Aasia indeksid on oktoobri viimast nädalat alustanud positiivse noodiga eesotsas Hiinaga, kus sentimenti toetas Credit Suisse’i poolt mitmetele indeksitele seatud kõrgemad 12 kuu sihid. Shanghai rallis +2%, Hang Seng +0,9%. M&A uudised, Jaapani oodatust kiirem septembrikuu ekspordikasv (14.4% YoY vs prog 9,6%) ning dollari nõrkus aitasid tõsta indekseid ka mujal Aasia regioonis. USA futuurid on samuti korralikku plussi roninud, kaubeldes 0,6% kuni 0,7% kõrgemal võrreldes reedese sulgumisega.

Makrouudiseid täna kuigi palju pole. Euroopas jälgitakse eurotsooni augustikuu uusi tööstustoodangu tellimusi (kell 12.00) ning USA-s olemasolevate majade müüki (kell 17.00). Viimases ei tohiks foreclosure’i saaga veel kajastuda ning konsensus ootab hooajaliselt korrigeeritud ning annualiseeritud näiduks 4,25 miljonit maja vs 4,13 mln augustis. Kell 17.30 avalikustatakse Dallas Fedi töötleva tööstuse küsitlus (oktoober).

-

Ühtlasi jätkub aktiivne kolmanda kvartali tulemuste avalikustamine, kui siiani on 159 S&P 500 ettevõtet (45% turukapitalisatsioonist) juba oma numbrid teatanud. Sel nädalal oodatakse 179 S&P 500 ettevõtte raporteid (29 % turukapitalisatsioonist). Täna enne turgu on oma tulemused juba avalikustanud Changyou.com ning Sohu.com, kes mõlemad ületasid Q3 osas konsensuse ootusi ning tõstsid Q4 prognoose konsensusest kõrgemale. Pärast turgu on suuremad raporteerijad Amgen, Texas Instruments.

-

Saksamaa DAX indeks on tänahommikuse 0.6%lise tõusuga teinud uue kahe aasta tippu (kõrgeim tase alates 2008. aasta augustist).

-

Nädalavahetusel toimunud G20 tippkohtumise raames otseselt mingite meetmeteni ei jõutud, et hoida ära destabiliseerivaid "valuutasõdasid" ning dollari müümist jätkatakse sama innukalt edasi. G20 lõplikuks sõnumiks oli see, et liigutakse vaikselt turu nõudlusel ja pakkumisel põhinevate vahetuskurssideni, mis peaksid riikide majandust kõige paremini peegeldama ning loobutakse devalveerimise võidujooksust. Samas tõlgendas iga minister seda kokkulepet täpselt nii nagu ise soovis. Jaapani rahandusminister Yoshihiko Noda leiab, et nende möödunud kuu 24,6 miljardi dollari suurune valuutainterventsioon siia alla ei käi, rääkides pigem valvsusest üleliigse likviidsuse kontrollimisel. Samuti arvestatakse jätkuvalt sellega, et FED kavatseb järgmisel kuul hunniku uut raha juurde trükkida, mis peaks dollarit edasi nõrgestama.

USD/JPY vahetuskurss

-

British Banker’s Association teatas, et Suurbritannia uute hüpoteeklaenude arv septembris oli 31 104, mis märgib 18-kuu madalaimat taset, augustis oli vastav näitaja 31 781. Seega langes hüpoteeklaenude arv yoy 26%. Hüpoteeklaenude maht vähenes septembris £1.6 miljardini. Augustis oli see £2.5 miljardit ning eelneva kuue kuu keskmine maht oli £2.2 miljardit.

-

eurotsooni tööstustoodangu tellimuste kasv kujunes oodatust paremaks, kerkides juuliga võrreldes 5,3%, kui tegelik ootus oli 3%. Juuli numbrit revideeriti samuti positiivsemaks: -2% pealt -1,8% peale. Suuremaid liikumisi see EUR/USD vahetuskurssi ei toonud ning euro jätkab kauplemist 0,6% kõrgemal @1,4040. USA futuurid on hoidmas hommikust plussi, liikudes 0,6% kuni 0,7% kõrgemal.

-

Gapping down

In reaction to disappointing earnings/guidance: DSPG -8.1% (thinly traded), TDW -5.0%, RSH -3.0% (light volume), SVA -5.9%.

M&A news: KCP -4.7% (ticking lower after CNBC discussed that talks to sell the company have dissipated),.

Other news: WL -5.3% (pulling back from Friday's 8% jump), FTLK -2.2% (thinly traded; Funtalk China intends to offer ~7 mln ordinary shares in a public offering; proceeds to expand its retail network, including acquiring interests in other retail chains and establishment of new retail outlets).

Analyst comments: BKD -0.9% (downgraded to Neutral from Buy at Goldman), MSFT -0.4% (downgraded to Mkt Perform from Outperform at FBR Capital).

Gapping up

In reaction to strong earnings/guidance: ODP +12.3% (also announces that Steve Odland, Chairman and CEO, has resigned), YZC +6.7%, SOHU +4.8%, LO +0.9%.

M&A news: GIW 54.5% (Community Bank System will acquire The Wilber Corporation in Community Bank System stock and cash, or $9.50 per share), CTV +33.2% (confirms discussions with the Carlyle Group).

Select financial related names showing strength: C +2.9% (added to Conviction Buy List at Goldman), ING +2.1%, BAC +1.8%, UBS +1.5%, HIG +1.3%, AIG +1.1%, HBC +0.9%, JPM +0.8%, WFC +0.8%, DB +0.7%, GS +0.7%

Select metals/mining stocks trading higher: RIO +3.5%, GBG +3.2%, BBL +3.1%, BHP +2.8%, GOLD +2.2%, MT +2.2%, FCX +2.1%, SLV +1.9%, GG +1.8%, ABX +1.8%, EGO +1.8%, NEM +1.5%, GLD +1.1%, .

Select oil/gas related names showing strength: COP +1.4%, WLT +1.4%, SLB +1.3%, PBR +1.1%, BEXP +1.0%, RDS.A +0.9%, TOT +0.8%, BP +0.8% (discloses agreement to sell its recently-acquired interests in four mature producing deepwater oil and gas fields in the US Gulf of Mexico to Marubeni Oil and Gas for $650 mln), OXY +0.6%, RIG +0.6%, .

A few solar names lifting in premarket trade: LDK +6.6%, SOLF +2.9%, TSL +2.9%, JASO +2.3%, JKS +2.2%

Other news: CRDC +9.5% (thinly traded; announces peer-reviewed publication of positive results from five year clinical study of PAS-Port Proximal Anastomosis System), MOTR +8.7% (Cramer makes positive comments on MadMoney), APSG +5.3% (announces intention to explore strategic alternatives), AIXG +3.7% (still checking), PCX +2.2% and MEE +2.0% (ticking higher following YZC results), ASML +2.0% (still checking), RCL +1.5% and CCL +0.7% (early strength attributed to tier 1 firm upgrade), LVS +1.4% (trading higher following positive mention in finance/investor newspaper over the weekend), MNRO +1.1% (Cramer makes positive comments on MadMoney).

Analyst comments: NVTL +4.1% (upgraded to Outperform from Market Perform at BMO Capital), ENTR +3.2% (initiated with an Overweight at JP Morgan), JBLU +2.3% (ticking higher; upgraded to Overweight from Neutral at JP Morgan).

-

USA futuurid indikeerimas avanemist 0,4% kuni 0,5% kõrgemal.

Euroopa turud:

Saksamaa DAX +0,50%

Prantsusmaa CAC 40 +0,17%

Suurbritannia FTSE100 +0,43%

Hispaania IBEX 35 -0,55%

Rootsi OMX 30 -0,02%

Venemaa MICEX +0,83%

Poola WIG +0,34%Aasia turud:

Jaapani Nikkei 225 -0,27%

Hong Kongi Hang Seng +0,47%

Hiina Shanghai A (kodumaine) +2,57%

Hiina Shanghai B (välismaine) +2,47%

Lõuna-Korea Kosdaq +0,52%

Austraalia S&P/ASX 200 +1,33%

Tai Set 50 suletud

India Sensex 30 +0,68% -

Rev Shark: The Weak Dollar Propels Us Yet Higher

10/25/2010 7:41 AMA dollar saved is a quarter earned.

-- John CiardiMarket indications are higher this morning as the dollar weakens following the Group of 20 meeting this weekend. The G-20 announced that it is firmly against "competitive devaluation of currencies," but with the U.S. already taking the lead in devaluing its currency, this simple statement cemented the fact that we are leading and resulted in further dollar weakness.

In addition, Jan Hatzius, an economist at Goldman Sachs, has an email note out this morning opining that the Fed is almost certain to announce additional monetary easing next month. That isn't particularly surprising, but what is hurting the dollar is that Hatzius estimates that as much as $4 trillion of additional quantitative easing may be needed if the Fed hopes to hit its targets on inflation and unemployment.

The weak dollar and the open market activities of the Fed have been the primary driving forces behind the market uptrend since the first of September. It is a good old-fashioned example of the old adage about not fighting the Fed. It doesn't much matter what negatives are out there if the Fed continues to provided massive amounts of liquidity.

The bears constantly complain about this manipulation by the Fed, convinced that the troubled economy will eventual drive us down, but some very good earnings reports have been another hurdle for the pessimists. Market players just haven't been too worried about the negatives lately and we keep on chugging along.

Sooner or later the weak dollar and quantitative easing are likely to be fully discounted by this market, but we are showing few signs of that so far. The bears are hopeful that the actual implementation of "QE 2" may be a major "sell the news" event, but that is still at least a week or so in the future.

Although the overall tone of the market remains positive, we have had quite a bit of churning and limited upside over the past eight days or so. On Friday we had one of the narrowest trading ranges and the lightest volume in some time. This sort of action indicates some indecision, but there continues to be plenty of support from dip-buyers, and the bears just can't seem to build on any pullbacks.

Earnings are helping; we had some strong action in technology names on Friday following good reports. If you just looked at earnings reports, you'd never know we were dealing with such a difficult economy.

For a while now I've been writing that we need to respect the fact we are in an uptrend and try not to be overly anticipatory in looking for a top. It can be hard to do, especially when the main driving forces seem to be the dollar and the Fed, but this market continues to hold up well, and there is no indication yet that we are about to fall apart.

We have the typical Monday-morning gap up once again; it is going to be interesting to see if weakness in the dollar continues to drive us upward. We'll monitor that closely and be ready to adjust if that relationship changes.

-

September Existing Home Sales 4.53 mln vs 4.25 mln Briefing.com consensus, M/M change +10.0%

-

$10 bln 5-yr TIPS Reopening Results: -0.55% (expected -0.55%); Bid/Cover 2.84x; Indirect Bidders 39.4%

-

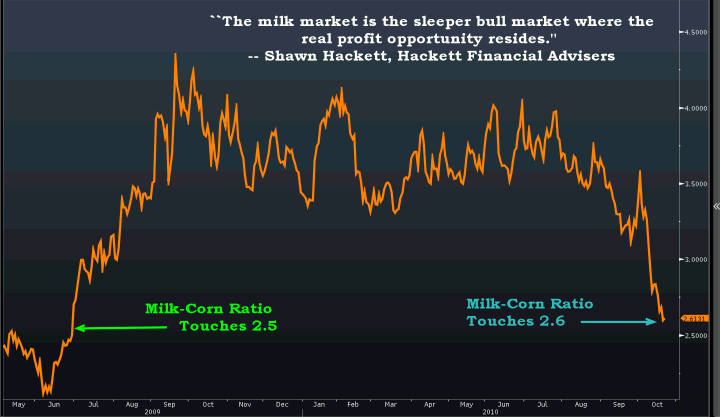

Hackett Financial Advisers kirjutab hiljuti avaldatud analüüsis, et piima futuurid pakuvad suurepärast investeerimisvõimalust, kuna piima hind on võrreldes maisi hinnaga viimase 15 kuu madalaimal tasemel (maisi kasutatakse söödana). Analüütikud kirjutavad, et piima hind kasvab seetõttu, et viimase 3 kuuga 46% kallinenud mais sunnib farmereid vähendama lehmade arvu, mis langetab aga piimatootmist. USA piimatootmine on 2 kuu jooksul langenud 5.6%.

-

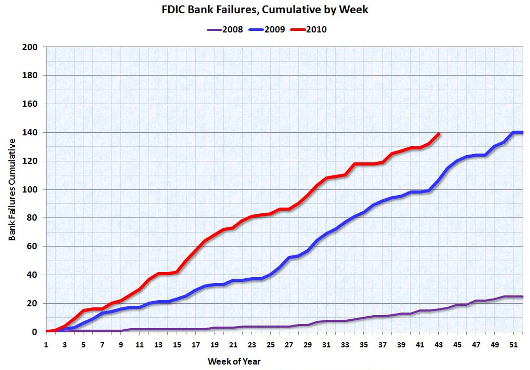

Käimasoleval aastal pakrotistuv rokem panku, kui 2009. aastal. Calculatedriskblog.com andmetel võib põhja läinud ettevõtete hulk kasvada tänavu 175le ehk ca 18 aasta tippu (1992. aastal pankrotistus USAs rekordiliselt 181 panka).

-

Bank of America on täna kauplemas viimase 17 kuu põhja tasemel.

-

BAC 17 kuu põhjadel. Ei tea kas finantssektoril endal ka piinlik on või?

Rääkige nüüd kuidas probleemid finantssektori ei ole finantssektori enda poolt tekitatud. Algselt subprime mortgage jm krediidi jama, nüüd foreclosure jama.

Minu illusioonid sellest kuidas finantssektoris elavad ja töötavad ainult ja ainult geeniused ja targad inimesed on purunenud.

;) -

Ma arvan ,et seda kakat on suurtes finants-

asutustes sees veel küllalt.

Eks ajapikku tilgub välja aga kui vaikselt pussutada siis on hais talutavam ja harjub ära:)) -

Opaa,

TZA tehti +400k 5 minuti spike, päris korralik käive TZA kohta. -

Fast market päeva lõpus - tehingute tegemisel limiithinnaga orderid mõistlikud.

-

Veeco Instruments (VECO) prelim $1.46 vs $1.26 Thomson Reuters consensus; revs $277.1 mln vs $275.23 mln Thomson Reuters consensus

-

Digital River (DRIV) prelim $0.20 vs $0.13 Thomson Reuters consensus; revs $85.0 mln vs $77.7 mln Thomson Reuters consensus

-

krt nii ei ole vist ikka viisakas teha.

OMAHA, Neb. (AP) -- Warren Buffett's company is defending its decision not to write down the value of its investments in Kraft Foods, US Bancorp and other stocks even though they were worth nearly $1.9 billion less at the end of 2009 than what Berkshire Hathaway Inc. paid for them.

On Monday, Berkshire disclosed several letters it exchanged with the Securities and Exchange Commission between April and September about its 2009 annual report.

The SEC asked why Berkshire hadn't adjusted the value of its stock holdings to reflect losses that had lasted more than 12 months.

Berkshire officials said they're confident Kraft and US Bancorp stock will rebound within a couple years, and Berkshire is willing to hold the stocks long enough for them to recover. -

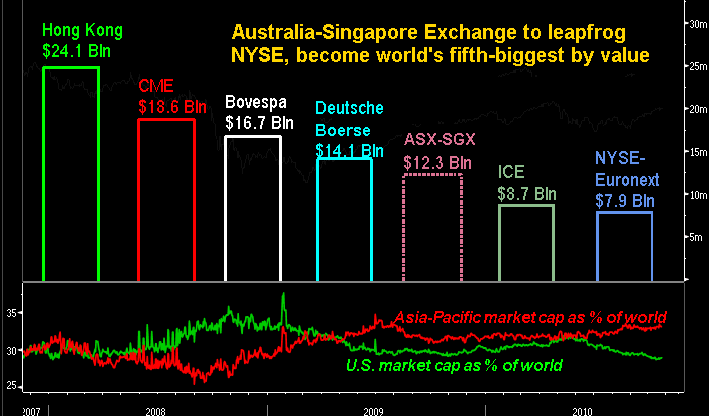

Kristiina mainis hommikuses turuülevaates ASX ja Singapore Exchange Ltd. ühinemist, mis tekitab turuväärtuselt suuruselt maailma viienda börsioperaatori. Allolev graafik näitab, et ASX-SGX oleks väärt ca $12.3 miljardit, mis ületab nii NYSE Euronexti kui ka IntercontinentalExchange turuväärtuseid.