Börsipäev 3. november

Kommentaari jätmiseks loo konto või logi sisse

-

Täna õhtul peaks kulmineeruma ootus, mis on turgudel viimaste kuude jooksul päev-päevalt kasvanud. Kui järjekordse kvantitatiivse lõdvendamise programmi väljakuulutamise osas julgetakse juba mürki võtta siis siiani ei ole kellelgi täpset aimu, kuidas ning milliseses mahus kavatseb USA keskpank raha majandusse süstida. Üha rohkem on hakatud arvestama stsenaariumiga, et FED määrab QE2 programmile mingi potentsiaalse suuruse, mida siis järk-järgult vastavalt makronäitajatele ning vajadusele kukutama hakatakse. FED avalikustab kahe päeva kohtumise otsuse Eesti aja järgi kell 20.15.

EUR/USD on hetkel hoidmas eilset taset ning kauplemas 1.4020 juures. Euroopa indeksite futuurid indikeerivad positiivset päeva algust (ca +0,2%), USA futuurid liiguvad nulli lähedal.

-

Lisaks FOMC kohtumisele avalikustatakse täna USA sessiooni eel veel ADP Employment raport (kell 14.15), mis annab hinnangulise ülevaate muutustest erasektori tööturul oktoobris (konsensus ootab 23 000 uue töökoha loomist) ning regulaarkauplemise ajal kell 16.00 teatatakse ISM teenusteindeks (oktoober) ja tehastetellimuste muutus (september). Peale selle avaldavad autotootjad päeva jooksul oma möödunud kuu müüginumbrid.

-

Suurbritannias avaldati PMI teenustesektori indeks: 53,6 vs oodatud 52,6 punkti. Naelsterling on saanud hea hoo sisse: GBPUSD +0,56% ja kaupleb 1,6131 taseme juures.

-

Täna saabub tõehetk ka PotashCorp (POT)-i jaoks. Kanada valitsus peab täna andma vastuse, kas annab oma nõusoleku tehinguga edasi liikumiseks. Teatavasti tegi BHP Billiton (BHP), mis on Austraalia päritolu kaevandaja, augustis $39 miljardi suuruse ülevõtupakkumise maailma suurimale Kanada väetisetootjale Potashile.

Tänane Financial Times kirjutab, et Kanada peaministril Stephan Harperil läheb otsuse tegemine väga keeruliseks, sest vastuolulisi arvamusi tehingu osas on palju. Ühest küljest kardetakse, et tehingu keelamine mõjutaks välisinvesteeringute voolu Kanadasse ja teisest küljest ei peeta õigeks, et valitsus annab firma, mis katab kolmandiku kogu maailma väetisevajadusest, välismaiste omanike meelevalda.

FT kirjutab ka, et isegi kui tehing peaks rohelise tule saama, on ees ootamas veel hulgaliselt probleeme. Näiteks hakkab USA kohus varsti arutama Potashi hagi, mis nõuab tehingu blokeerimist, kuna firma väitel eksitas BHP Billiton oma 17. augusti pakkumisega POT- aktsionäre, jättes selle üsna selgusetuks ja ei täpsustanud pakkumise sisu ning edaspidiseid plaane.

-

UBS on tehnilises analüüsis järeldamas, et set-up märkimisväärseks korrektsiooniks on loodud, ent kuna turuosalised on oma positsioone hakanud järjest rohkem hedgima, siis see on pisut ebatavaline sentiment enne suuremaid korrektsioone. Sestap tõdetakse, et pärast FOMC kohtumist võivad turud liikuda edasi ülespoole, enne kui korrektsioon novembri teises pooles lõpuks aset leiab. Või ei pruugi potentsiaalne taandumine kujuneda nii suureks nagu oodatakse.

UBS on tehnilises analüüsis järeldamas, et set-up märkimisväärseks korrektsiooniks on loodud, ent kuna turuosalised on oma positsioone hakanud järjest rohkem hedgima, siis see on pisut ebatavaline sentiment enne suuremaid korrektsioone. Sestap tõdetakse, et pärast FOMC kohtumist võivad turud liikuda edasi ülespoole, enne kui korrektsioon novembri teises pooles lõpuks aset leiab. Või ei pruugi potentsiaalne taandumine kujuneda nii suureks nagu oodatakse.Keskpikas perspektiivis aga jäädakse bullish teesi juurde:

Apart form any short-term correction scenarios, in line with our October 12 strategy update we are sticking to our medium-term bullish view and see a potential tactical set-back into November as a buying

opportunity on the way up into H1 2011. -

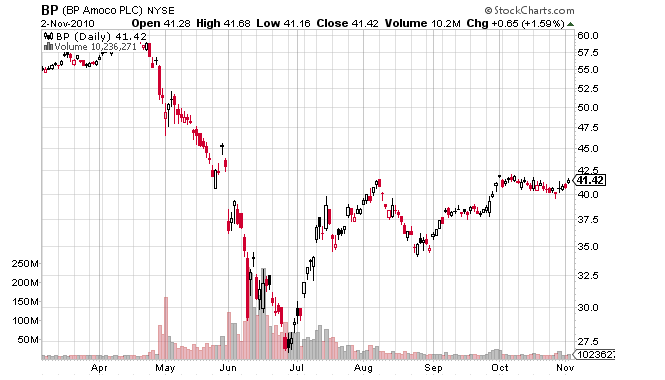

Täna on üsna paeluva reitingumuutusega välja tulnud Goldman Sachsi analüütikud. Nimelt leiavad nad, et BP p.l.c. (BP) on antud hinnatasemel väga atraktiivne ning soovitavad aktsiat osta koos $52 hinnasihiga.

Ilmselt on firma BP ( varasem nimi British Petroleum) tuttav kõigile, sest just see firma on alates aprillist üks tihedamalt figureerivaid nimesid ajalehtede esikaantel. Kuid ettevõtte kahjuks ei saanud seda ootamatut populaarsust kuidagi positiivsena tõlgendada, kuna BP on peasüüdlane ühes suurimas ökokatastroofis, mis leidis aset tänavu aprillis Mehhiko lahes ( tuntud ka kui Macondo intsident). Põhjalikumalt kirjutasin sellest siin ja siin.Kuid nüüdseks on kõige suurem torm siiski vaibunud, naftaleke peatatud ja natuke ka tagajärgi juba silutud ning aktsia oma suvistest põhjadest ka oluliselt kosunud.

Eile teatas firma ka oma kolmanda kvartali tulemused, mis olid Goldman Sacshi analüütikute arvates üllatavalt tugevad.

Analüütikud põhjendavad oma „osta“ soovitust järgnevalt:

We upgrade the stock from Neutral to Buy for three key reasons: (1) valuation is extremely attractive, with BP now trading at a 2011E 14% EV/DACF discount after the cash outflow associated with the GoM spill; (2) the company has achieved US$14 bn of disposals so far this year and is targeting another US$10-15 bn in the next 12 months that are likely to be accretive in this seller market, in our view; (3) we believe that the dividend reinstatement with 4Q results is likely to bring back the income investor base that had to divest the stock when the dividend was reduced to zero. We expect the dividend to be reinstated at $8 cents per quarter with the 4Q results ($14 cents previously) and grow to $11 cents in two years.

Peale selle, et analüütikud peavad aktsiat hetkel väga soodsaks, eeldatakse ka, et dividendimaksete taastamine toob investori aktsiasse tagasi.

Aktsia on eelturul juba 3,65% plussis ning kaupleb $42,90 tasemel. Isiklikult ei usu, et sellelt tasemelt aktsia oluliselt kõrgemale enam liigub, aga selle kõrvale võiks jälgida Transocean (RIG)-i aktsiat, mis alates õnnetusest on BP-ga ühes paadis olnud. Väga võimalik, et Goldman Sachsi reitingumuutus annab tuge ka RIG-le. RIG kaupleb hetkel $64,2 tasemel ning on 1,29% plussis.

-

Gapping down

In reaction to disappointing earnings/guidance: HPY -18.0% (ticking lower), GIGA -12.0% (thinly traded), QUIK -11.2%, ZSTN -9.4%, GRMN -8.0%, EOG -7.9%, IPHS -7.6%, UDRL -7.0%, SONS -6.3%, CQB -5.6%, LEAP -5.4%, STO -5.3%, PWR -4.7%, NANO -4.4%, JRCC -3.7%, LNC -3.4%, DISCA -3.3% (also downgraded to Mkt Perform at Barrington Research), WYNN -3.2% (also declares $8 cash dividend; downgraded to Neutral from Buy at Sterne Agee), ERTS -2.7%, NOA -2.6%, DGI -2.0%, MAKO -2.0%, SIGA -1.5%.M&A news: CASY -5.3% (Casey's General rejects 7-Eleven's $43.00 per share offer and no longer in talks; signs asset purchase agreement to acquire 44 Kabredlo's stores).

Other news: TGB -29.0% (confirmed last night that Federal Minister of Environment announced the Prosperity mine project, 'as proposed', cannot be granted federal authorizations to proceed; downgraded to Hold from Speculative Buy at Canaccord, downgraded to Underperform from Neutral at Credit Suisse), HCP -3.4% (to offer 10 mln Shares), BUD -2.4% (ABV reported), CIM -2.0% (intends to make a public offering of 125 mln shares of its common stock), NMM -1.5% (files for a $500 mln mixed shelf offering), ARMH -1.0% (still checking).

Analyst comments: OAS -1.3% (downgraded to Market Perform from Outperform at Morgan Keegan , ALTR -0.4% (downgraded to Neutral from Buy at Ticonderoga).

Gapping up

In reaction to strong earnings/guidance: WWWW +18.3%, OPEN +17.3%, STEC +11.4% (also upgraded to Buy from Hold at Needham), RLD +8.3% (light volume), SNCR +6.2% (light volume), ICLK +6.1% (also announced President and Founder Michael Katz will become Chief Executive Officer), TRW +6.0% (ticking higher), SBGI +5.7% (light volume), HIG +5.4%, SCGLY +5.1%, RADS +3.6%, Q +3.4%, MGIC +3.4%, KEYW +2.3% (light volume).M&A news: FSIN +24.2% (receives 'going private' proposal at $11.50 per share).

Select financial related names showing strength: LYG +3.3%, HBC +1.9%, BAC +1.0%, BCS +1.0%.

Select metals/mining names trading higher: TORM +4.6%, MT +2.5%, NG +1.9%, SLW +1.5%, AU +1.1%, AAUKY +0.8%, BHP +0.8%, GOLD +0.8%, AUY +0.7%, GBG +0.7%, HL +0.7%.

Select oil/gas related names showing strength: BP +3.8% (upgraded to Buy from Neutral at Goldman), HERO +3.3%, PTR +1.7%, RIG +1.3%, TOT +1.2%, CVX +0.7%, E +0.6%, PBR +0.6% (trading ex dividend).

Other news: HAWK +18.7% (announces initiated a process to explore and consider possible strategic alternatives), UPI +12.0% (announced CMS published anticipated Category I CPT code for Posterior Tibial Nerve Stimulation), PDE +11.5% (Hearing attributed to takeover speculation), SPPI +5.7% (ticking higher; awarded grants totaling $977,900 under the Qualifying Therapeutic Discovery Project Program), CRH +5.6% (still checking), CRNT +3.4% (announces a multi-million dollar contract with Mobile Cellular), TC +2.6% (still checking), VOD +2.2% (still checking), FFIV +0.8%and HON +0.4% (Cramer makes positive comments on MadMoney).

-

Täna on kaks analüüsimaja Barclays Capital ja J.P. Morgani analüütikud väljas positiivsete kommentaaridega AMR Corporation (AMR) kohta.

Koos oma mitmete tütarettevõtetega on ARM üks suurimaid lennufirmasid USA-s. Möödunud aasta seisuga on firmal 900 lennukit ning sihtkohtadeks on linnad nii USA-s, Ladina-Ameerikas, Euroopas kui ka Aasias.

J.P. Morgani analüütikud usuvad, et ettevõtte olukord on paranemas ning vastutuul on muutumas pärituuleks.

We expect AMR to turn a significant margin corner in 2011, as alliance immunity, rising industry labor costs, and a shifting Latin/Pacific supply dynamic reverse its multiyear relative margin decline. Based on our theoretical analysis, if AMR relative margins can perform in line with the industry from here, upside equity potential is expected to exceed that of all other U.S. names we cover. If relative margins can narrow their gap to the industry, potential equity upside is still great. Thus, AMR emerges as our top equity pick among U.S. airlines.

Analüütikud usuvad, et järgmisel aastal pöörab firma viimasel ajal tugevasti kannatada saanud marginaalid uuesti tõusule. Kui AMR suudaks kogu sektoriga samale tasemele jõuda, siis analüütikute arvates oleks aktsia potentsiaal suurim võrreldes kõigi teiste sektori nimedega, mida J.P.Morgani analüütikud katavad. Isegi, kui suudetakse sektori marginaalidega vahet natuke vähendada, ka see oleks juba analüütikute sõnul positiivne ning tekitaks aktsiale tõusuruumi.

And of course, we gravitate toward the underdog – AMR has the highest percentage of Sell & Hold broker ratings of any U.S. legacy. Its year-to-date equity performance has been woefully weak (+2% vs. +46% XAL & +7% S&P). Investors tend to identify labor as an overhang, despite greater risk of cost escalation elsewhere. While the lack of company aggression in pursuing alternative strategies has been disappointing, in our view, that doesn’t stop us from identifying where potential equity upside is greatest. We think we’ve found it.

Analüütikud juhivad tähelepanu ka sellele, et AMR aktsia suhtes on sentiment äärmiselt negatiivne. Protsentuaalselt omab ARM aktsia kõige enam „müü“ ja „osta“ analüütikute reitinguid ja teatavasti on sellise aktsia kasvupotentsiaal kõige kõrgem, millele ootused väga madalad on. J.P. Morgani analüütikud kinnitavad oma „osta“ soovitust koos $13,50 hinnasihiga.

Nagu öeldud usuvad ka Barclays analüütikud olukorra paranemisse ning kommenteerivad oma veendumust nii:

We believe concern about the possibility of a pension expense headwind, among other things, is creating apprehension among investors about performance in AMR shares. Our focus for AMR is on relative margin expansion across the cycle and cash generation during 2011 that we believe will encourage investors to re-think current valuation. As year-end approaches, with a relatively benign current Outlook on pension expense for 2011, we see opportunity in AMR and believe the shares could rally into year-end as investors anticipate better things to come in 2011.

AMR aktsiat on rõhunud ka kõrged personalikulud ja võrreldes konkurentidega on pensionikulude osakaal käibest just kõige suurem AMR-l. Barclays analüütikud on veendunud, et investorid siiski liigselt alahindavad aktsiat ning usuvad, et turuosalised avastavad AMR aktsia enda jaoks juba enne aasta lõppu. Barclays analüütikud kinnitavad oma „osta“ soovitust koos $18 hinnasihiga.

Hetkel kaupleb AMR eelturul 2% plussis $8 tasemel.

-

USA indeksite futuurid indikeerimas avanemist nulli lähedal

Euroopa turud:

Saksamaa DAX +0,28%

Prantsusmaa CAC 40 +0,58%

Suurbritannia FTSE100 +0,23%

Hispaania IBEX 35 -0,17%

Rootsi OMX 30 -0,24%

Venemaa MICEX +0,53%

Poola WIG +0,08%%Aasia turud:

Jaapani Nikkei 225 suletud

Hong Kongi Hang Seng +2,0%

Hiina Shanghai A (kodumaine) -0,47%

Hiina Shanghai B (välismaine) -0,55%

Lõuna-Korea Kosdaq +0,37%

Austraalia S&P/ASX 200 +0,45%

Tai Set 50 +1,02%

India Sensex 30 +0,59% -

Panen siia tagantjärgi makrot ka aga see kujunes suhteliselt non-evendiks

October ADP Employment Change 43K vs 23K Briefing.com consensus

September ADP revised to -2K from -39K -

Rev Shark: Selling the News May Not Be So Easy

11/03/2010 7:34 AMElections are won by men and women chiefly because most people vote against somebody rather than for somebody.

-- Franklin Pierce Adams

The election results came in pretty close to expectations. The Republicans gained around 60 seats and took control of the House of Representatives, but the Democrats were able to hold on to the Senate despite some losses. There were few surprises, but it clearly was certainly a good night for the Republicans.

The market has been anticipating gridlock in Washington for a while, so now the question is whether we can continue to rally now that we have it. There is probably a good chance that the Bush tax cuts will be extended for everyone as the Democrats show some willingness to be flexible. That is a market positive, but the biggest positive, as far as I'm concerned, is that with Nancy Pelosi out the door, any discussion of a tax on trading is likely to be dead and buried.

So the big question now is whether we have a sell-the-news reaction now. What greatly complicates things is that we still have to wait for very important news from the Federal Open-Market Committee this afternoon. The decision on further quantitative easing is likely to have as much impact as the election on the market. Market players are going to hesitate to make big moves until we see that announcement today at 2:15 pm EDT.

For quite some time the bears have been looking forward to a sell-the-news reaction to today's news but the market seldom makes it that easy. With the Fed news still to come, it is even more difficult than it would normally be. I believe the bears still run a very high risk of being squeezed before they see the downside they are anticipating. In fact, we already have some early strength building on yesterday's strong close.

The bulls definitely need to be careful here and watch for signs that selling is going to accelerate, but I suspect that the dip buyers are going to be very active on the first few pullbacks and will not let the market slip too much.

Overall, the election results are a positive for the market. We should have a better business environment and, hopefully, a greater level of certainty as the parties have no choice but to work together if they want to pass anything new. Voters sent a clear message that they are unhappy with the way Washington has been functioning, and it is going to be very interesting to hear what President Obama has to say when he speaks later today. When Bill Clinton found himself in a very similar situation, he shifted his priorities and we ended up with one of the best economic environments we have ever had. Many are afraid that President Obama is too much of an ideologue to make a similar shift, but we shall find out soon enough, especially with the fight over the Bush tax cuts looming.

We have a positive open, and market players are anxiously awaiting the Fed decision this afternoon. Don't be too quick to count on a sell-the-news reaction, as it is over-anticipated and there are still too many bulls out there looking to jump in on weakness.

The good news is that the traders' tax issue is now completely dead. That may not have been a big worry, so it won't be a driving force today, but it sure makes the long-term market picture look a lot better.

-

Kopeerin siia John Kempi (Reuters) päris hea QEII tõlgendamise juhise:

The place to start is the benchmark number of $500 billion over 6 months of mostly or exclusively medium-term Treasury securities.

Less than this figure or spread over a long time scale would risk disappointing the markets and might indicate the Fed is worried about the side-effects a bigger programme would have on the markets. Definite climb down.

More than $500 billion would indicate an aggressive attempt at shock and awe. Short term bullish. But would also raise after-reaction concerns about how bad the outlook is if it needs this much stimulus. So a big package must be “sold” carefully to ensure that it adds to confidence rather than underscores the dire state of the economy.

What the Fed is buying is important. It is supposed to be trying to bring down medium term (roughly 5-10 year) borrowing rates. If the Fed has to buy shorter term paper (2-4 year notes) it would indicate the central bank is running into operational problems, so bearish.

Interesting question is whether the Fed will stick to buying Treasuries (which is reassuringly orthodox from a central banking perspective, or at least as orthodox as QE can be) or decides to buy other paper as well. Agency and mortgage bond purchases would be a modest extension. Could be presented as targeting assistance more directly on the housing market. Corporate bonds would be very aggressive and innovative. Presented as helping the real economy recover. But anything other than Treasuries will raise questions about the operational constraints on a Treasury-only strategy, so bearish, and will be seen as highly innovative/unorthodox.

What is the exit/extension condition? If the Fed announces a numerical condition it might boost market confidence. But it also means the Fed is giving up control over its future balance sheet expansion. The balance sheet and QE2 becomes driven by forces the Fed does not control. Very very risky. Some weaker more judgmental and qualitative condition is safer but might leave investors wondering if Bernanke has the stomach and the votes on the FOMC to extend the programme beyond the initial round? Qualitative conditionality would suggest caution and perhaps indicate the committee would not back a further extension, which would be bearish for the markets.

Finally, the real trillion dollar question is what diplomats call “the atmospherics”. Can Bernanke limit dissents to just Hoenig? Another dissent (which given the current FOMC line up would have to come from the Board of Governors) would be highly destabilising and indicate the chairman’s grip on the Fed is slipping. It is very unlikely. And can the Committee come up with a form of words that indicates responsiveness to concerns about inflation etc, but starts talking up rather than talking down the economic recovery?

-

ISM ja tehaste tellimused samuti prognoositust paremad

October ISM Services 54.3 vs 53.4 Briefing.com consensus, September 53.2S

eptember Factory Orders +2.1% vs +1.7% Briefing.com consensus. prior revised to 0.0% from -0.5%

-

ComScore reports September 2010 U.S. mobile subscriber market share

Total smartphone subscribers: RIMM 37.3% (of total) -2.8% MoM; AAPL 24.3% flat MoM; GOOG 21.4% +6.5% MoM; MSFT 10% -2.8% MoM. -

BusinessInsider kirjutab, et septembri isiklike tulude vähenemine oli alles algus ning asjad muutuvad järjest hullemaks, sest aprilliks lõppeb töötu abiraha maksmine 4 miljoni ameeriklase jaoks. Optimistid ütlevad seepeale, et selle tõttu on töötud sunnitud olema vähem valivad töökohtade suhtes ning peavad vastu võtma selle, mis neile pakutakse ja see omakorda vähendaks tööpuudust. Skeptikud aga vaidlevad vastu, et töötud ei ole juba praegu valivad ning majanduses ei ole lihtsalt töökohti, isegi mitte madalapalgalisi töökohti. (link)

-

Union Pacific (UNP) target raised to $102 at Deutsche Bank

Deutsche Bank raises their UNP tgt to $102 from $92 saying they believe strong EPS growth is likely in 2011-12E. The firm expects UNP to highlight productivity benefits from railroad technology, operational improvements, and above-rail inflation pricing at its upcoming Security Analyst Meetings this week. They continue to see solid upside in UNP shares. -

S&P 500 langes enne FOMC otsust alla 1188 punkti

-

Fed leaves fed funds target at 0.00-0.25%, announces it will expand asset purchases by $600 bln.

-

Fast market - kõik tehingud soovituslikult limiithindadega praegu...

-

Joeli poolt öeldu täiendamiseks, et võlakirju ostetakse $600 miljardi väärtuses kuni juuli alguseni ($75 miljardit kuus). Intressimäära kohta kirjutatakse raportis, et "The central bank kept its pledge to keep interest rates low for an 'extended period'"

-

Alloleval graafikul on kujutatud USA 30-aastase võlakirja päevasisene tulususe määr, mis on hetkel 3.945% tasemel.

-

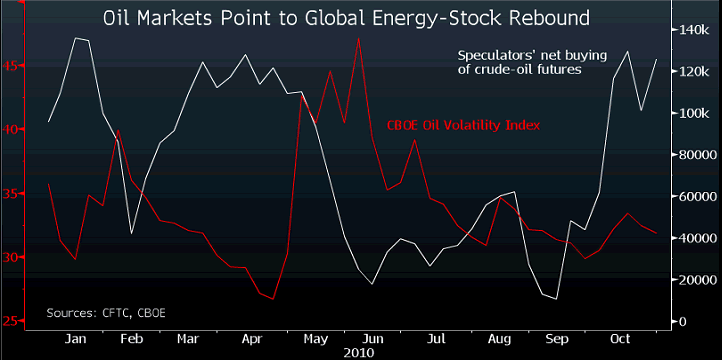

Brockhouse & Cooper avaldab arvamust, et praegu on õige hetk investeerida energiaettevõtetesse. MSCI World Energy indeks (naftat ja gaasi tootvad ettevõtted) on käesoleval aastal tõusnud ca 0.4% ning MSCI World indeks on sama ajal kerkinud ca 5.6%. Allolev graafikul näitab valge joon spekuleerijate poolt kaubeldavaid naftafutuure (andmed põhinevad Commodity Futures Trading Commission’i andmetel) ning punane joon on CBOE nafta hinnavolatiilsuse indeks (Chicago Board Options Exchange). Spekuleerijate lühikesed positsioonid ületasid lühikesi positsioone 26. oktoobriga lõppenud nädalal 125,271 kordselt – viimase 7 nädala jooksul on number kasvanud 12 kordselt. Samas on aga nafta volatiilsuse indeks langenud ca 33 punktile.

-

Dollar kukub nagu kivi. EUR/USD Last Trade: 1.4116 Change: 0.60%

-

Tulemustesadu jatkub:

Today after the close of the many companies scheduled to report, some of the bigger names include: DOX, CELL, CRL, CHK, FRPT, ROCK, GDP, IPI, JCOM, LBTYA, KGC, PRU, THQI, RIG, WFMI, and AUY. Tomorrow before the open, of the many companies to report, some of the bigger names include: APA, BDX, CVC, DTV, FTO, LAMR, PCS, MFA, ZEUS, PDE, SMG, SIRI, TDC, TWC, USM, WCG, and WNR. -

Täna pakkus AMR hea võimaluse. Avanemisel oli võimalik positsioon soetada $8 kandis ja kes volatiilset turgu ei peljanud ja päeva lõpuni hoidis, ei pea ilmselt pettuma.

Mis puudutab BP-d , siis nagu hommikul juba ka mainisin, aktsia eelturu tasemetelt enam kõrgemale ei roninud ning vajus päeva jooksul üsna ära. Eks samal põhjusel ei saanud ka RIG piisava huvi osaliseks. -

Qualcomm prelim $0.68 vs $0.59 Thomson Reuters consensus; revs $2.95 bln vs $2.85 bln Thomson Reuters consensus

Qualcomm sees Q1 $0.70-0.74 vs $0.64 Thomson Reuters consensus; sees revs $3.05-3.35 bln vs $2.99 bln Thomson Reuters consensus

Qualcomm sees FY11 $2.63-2.77 vs $2.59 Thomson Reuters consensus; sees revs $12.4-13.0 bln vs $12.10 bln Thomson Reuters consensus -

Chesapeake Energy prelim $0.70 vs $0.64 Thomson Reuters consensus; revs $2.58 bln vs $2.31 bln Thomson Reuters consensus

-

Kus on hea ülevaade Skandinaavia ja kogu Euroopa börsifirmade tulemustest ning finantskalendrist?

USA börse on suht puust ja punaseks tehtud Google ja Yahoo finance's. Kas kuskil on sarnaselt Euroopa kohta infot? -

AMR-i toetab homme ilmselt see:

http://finance.yahoo.com/news/American-Eagle-Airlines-prnews-3283091926.html?x=0&.v=1 -

CHK küll punane hetkel ,ju siis ei sobinud sellised numbrid.