Börsipäev 29. sept

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

- JP Morgan on täna hommikul välja positiivsete kommentaaridega pooljuhtide sektori teemal. Nende arvates on pooljuhtide tootmiseks vajaminevate seadmete tootjate (semi eq.) aktsiaid ülemüüdud ning seda rohkem kui mingil muul ajal pärast 03/2003. Mured neljanda kvartali prognooside teemal on analüütikute arvates ülepaisutatud ning kasvu peaks antud sektori tulema 5-10%.

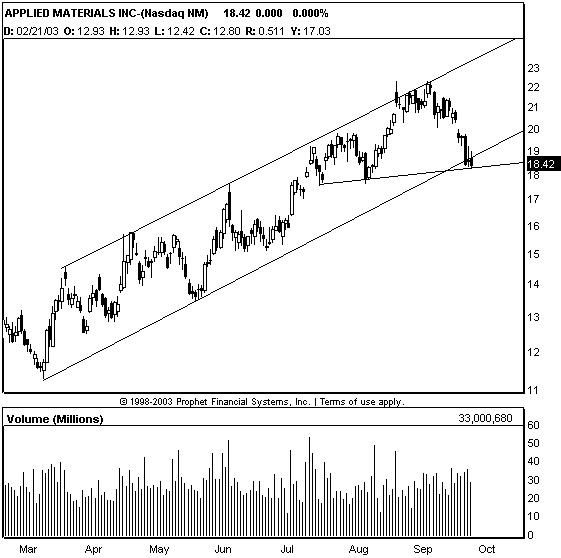

Vaadates näiteks semi eq. ühe suurima tegija Applied Materialsi (AMAT) aktsiate graafikut, siis näeme tõesti, et langus viimase paari nädala jooksul on olnud järsk. Põhimõtteliselt murti reedel tõusujoones olnud trendikanal, mis on vägagi karune märk. Tänane analüütikute toetus võib tekitada põrke, mis uhub mõned ennast juba lühikeseks müünud karud välja, kuid veidi pikemas perspektiivis (päev-kaks) peaks langus jätkuma.

- JP Morgan lisab ka kaitsetöötsuse hiiu Northrop Grummani (NOC) oma fookusnimekirja $120 hinnasihiga järgmise 12 kuu jookul. Reedel sulgusid aktsiad $86 juures.

- Barrons kirjutab täna positiivse kaaneloo Nokia (NOK) teemal. Soomes olid Nokia aktsiad juba 3-4% üleval.

- Merrill Lynch alandab NVIDIA (NVDA) reitingu MÜÜ peale varasema Neutraalse pealt. Põhjuseks võimlik turuosa kaotamine konkurendile ATI Tech (ATYT).

- Lehman Brothersi legendaarne PC analüütik Dan Niles tõstab Apple Computeri (AAPL) reitingu Overweight peale varasema Equal Weight pealt. Põhjuseks back-to-school nõudlus, G5 upgreidi-tsükkel ning muusikaga seotud käive. Hinnasihiks $24, mis sobib suurepäraselt ka minu LHV Pro alla mainitud plaanidega.

- SoundView jagab pos kommentaare SWKS, RFMD ning ONNN-i teemal pärast reedel õhtul tulnud Motorola (MOT) käibeprognoose. Kõik firmad omavad Motorolat kui 8-15% osakaaluga klienti.

- Gary b. Smith

- Revshark:

The market suffered its worst loss in over a year this past week. Leading stocks sold off broadly and dramatically, volume was high, and plenty of technical damage was done. The dip-buyers, who have been jumping on the most minor of pullbacks, suddenly disappeared and left many of the stocks with the best recent relative strength twisting in the wind. The momentum traders ran for cover, and stocks had nowhere to go but down.The bears have been predicting this sort of carnage for some time and were bound to get what they asked for if they waited long enough. The problem is that too many of them have been predicting this action for many months and need substantially further weakness before they are close to even.

We have a number of interesting crosscurrents to consider this week. Foremost is the end of the quarter, which is the end of the fiscal year for many large funds. Even after last week's selling, it has been a generally good quarter for the markets, and funds will want to do what they can to paint a positive picture. Quite often we see end-of-the-month window-dressing on the day before the end of the month so it doesn't look quite so blatant. Keep that in mind as you watch the market today.

Another issue to keep in mind is that seasonal weakness is finally kicking in. Many folks were looking for it to start back in August, but the market did its best to frustrate and kept chugging along much further than many thought possible. There are many reasons why September and October tend to be tough months for the market, and it's important to respect that tendency even if the bullish arguments seem compelling.

After three days of heavy pressure, we are seeing a Monday morning bounce. Semiconductor stocks have some positive comments from analysts, and the Semiconductor Industry Association trade group has released comments about "broad-based strength" and increasing end-market demand.

Chip stocks remain one of the most interesting battlegrounds in this market. It's the group that bears point to as a classic example of overvaluation, while the bulls insist that the skeptics simply fail to understand how the cycle is playing out as the economy improves. Regardless of your opinion, it is clear that this group is a leading indicator of which way the broader market is heading.

The big question this morning is, do the bulls deliver something more than just a knee-jerk bounce after three days of heavy selling? Will this market shake off last week's correction and resume the upward trend that started back in March?

After the damage done last week, we have to stay skeptical when we see a quick bounce. Now that the upside momentum has been broken, the inclination to do some selling into strength will be increased. The bears aren't going to be quite so worried about being squeezed higher after finally tasting some success. Last week's action changed the character of the market, and we have to respect that for now.

Regardless of you market posture, the main thing to keep in mind for the next couple days is window dressing. The market bottomed last October and has been rallying since then. If a fund has a fiscal year ending Sept. 30, it should have some very good performance. Fund managers will want to make sure they finish on a high note and have some performance statistics that they can brag about in the months ahead.

Futuurid: Naz 0.80% SP 0.40%

sB

-

Kas USAs juhtus midagi või on mitte pääsemine Nasdaqi lehele meie võrkude probleem!?

-

Microlink on täna päev läbi olnud tõsises hädas oma välisühendusega, lülitasime juba keskpäeval nende pealt ümber.

-

ODP on võimalik osta alla 14 $

-

Millal oleks loota, et hinnad sisse hakkavad jõudma?

-

Mõned teemad tänaseks päevaks:

- JP Morgan alustab Qualcommi (QCOM) katmist negatiivse Underweight reitinguga. Aktsia on eelturul ühe punkti kukkunud. Põhjused? CDMA kasv hakkab vaikselt aeglustuma ning WCDMA on alles paari aasta kasugusel. QCOM langetas oma (chipi)prognoose juba tegelikult paari nädala eest, kuid üldise positiivsuse foonil ronis aktsia edasi. Ma usun, et nädala-paari pärast on QCOM praegustest tasemetest madalamal.

- Eilne tõus toimus suhteliselt lahja käibe juures. Siiski on kvartali lõpp piisavalt lähedal, et veidi toetust pakkuda. Tänane päev võib olla karude jaoks soodsaks võimaluseks lühikeste positsioonide ehitamisel.

- Thomas Weisel tõstab Peoplesofti (PSFT) reitingu Outperform peale varasema Peer Perform pealt. Nende sõnul läheb äri suhteliselt hästi ning firma kliendidki usuvad, et Oracle (ORCL) ostupakkumine kaob peatselt.

- IBM (IBM) teatas, et on leiutanud transistori, mis kulutab praegustest 80% vähem energiat ning omab 5x suuremat jõudlust.

- Lehman kommenteetrib elektroonikamüüja Best Buy (BBY) 10% kukkumist viimase paari nödala jooksul kui suurepärast ostuvõimalust. P/E järgi kaupleb BBY 20% allpool teiste suurte jaemüüjate valuatsioone.

- Gary B. Smith:

- RevShark

Good morning. After three days of heavy selling, the indices produced a rather unsurprising low-volume bounce fueled, at least in part, by end-of-the-quarter window dressing. As I mentioned yesterday, the heaviest window-dressing action often occurs the day before the end of the quarter in order to avoid being too blatant and obvious.

As window-dressing pressure fades and the earning warnings season commences, the big question is whether yesterday's bounce has any further to run. The action yesterday was a classic dead-cat bounce that should give us little confidence that this market is likely to reverse straight back up and proceed on its merry way. The key warning sign was that volume was light. That indicates that the action was dominated by smaller traders looking for quick profits who will sell quickly, rather than big institutions taking advantage of lower prices to build longer-term positions.

It is very important to not overlook the technical damage that was done last week. The big, broad selloff changed the character of the market. The dip-buyers found out that they can suffer losses and that maybe it was prudent to wait for lower prices rather than buy slight weakness. The bears finally had some success after being badly abused. They are likely to gain some confidence now and press a bit harder when opportunities arise. The fear of being squeezed had rendered them powerless for some time.

The bottom line is that it is a good time to proceed with caution. Even if you are bullish about the prospects of the market, the prudent approach is to let last week's breakdown play out and not read too much into low-volume bounces like yesterday's. Seasonality is kicking in, Sun Micro (SUNW:Nasdaq) has kicked off the earnings warnings season, and we have technical damage in all the major indices.

A lot of folks cost themselves big money by over-anticipating the top in this market. For months they were warning of the impending rollover. Even after the recent pullback, many if not most of the bears who warned about a top are still far from even.

Now that the market has rolled over a bit, we need to flip-flop our thinking and not be overly anxious to anticipate an end to the downtrend. Let the market prove itself rather than trying to outguess it. When the technical picture strengthens, there will be plenty of time to put capital to work.

We have a shaky start this morning. It's the last day of the fiscal year for many big funds, and that may produce some odd action. Proceed with caution, be patient, and keep some cash ready for opportunities.

Futuurid: Naz -0.60% SP -0.35%

-

Täna LHV Pro teemaline seminar, kus räägin nii olnust kui ka tulevikuplaanidest.

See toimub kell 18.00, LHV kontoris Pärnu mnt. 25 ja osalemine on tasuta.

Kõik huvilised oodatud kuulama. -

peale eilset puhkepäeva näitab turg jälle valmisolekut ülejäänud nädala allapoole vajuda :)

-

yahoo finance

Stocks opened lower after Sun Microsystems announced a large write-off and said that business remains difficult in the current quarter...many analysts have come out and said that is probably company specific, and Briefing.com agrees...problems at Sun don't necessarily mean problems across the tech sector as Sun continues to lose market share...the fact that this announcement hurt the entire tech sector suggests traders are nervous and perhaps looking for an excuse to sell...then two early reads on September economic conditions were weak...