Börsipäev 6- 7. november

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

- Cisco tulemused tulid paremad isegi üpris optimistlike analüütikute ootustest. Firma juhi John Chambersi sõnul tunnevad kliendid ennast märksa paremini kui veel 3 kuu eest. August oli olnud väga tugev kuu, september veidi nõrgem ning oktoober jällegi väga hea. Cisco ostis selle kvartali jooksul tagasi $2 mld eest oma aktsiaid keskmise hinnaga $19.55. Siiani on üldse kokku ostetud $9.8 mld eest aktsiaid keskmise hinnaga $15.11. Hetkel on veel plaanis osta $10.2 mld eest lisa.

Analüütikute arvates võiks see $160 mld turuväärtusega ettevõte järgmisel (2005) aastal genereerida $23-24 mld käivet ning seda ülikõrgete marginaalide juures.

Täna hommikul teatas Piper Jaffray, et tõstab CSCO reitingu Mkt Perfrom peale Outperform peale. Hinnasihiks $28 varasema $22 asemel.

Tulemus järelturul:

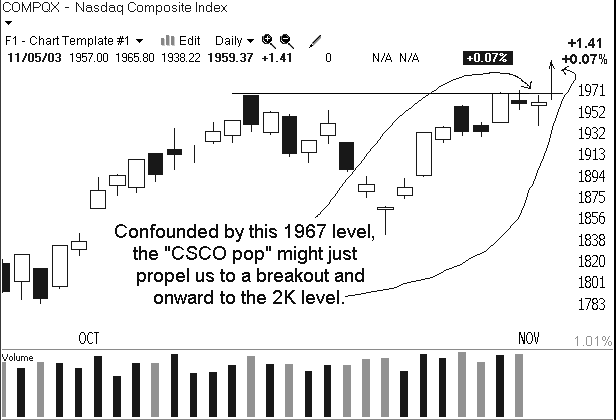

Mis saab edasi? Tõenäoliselt liigub turg CSCO toel nüüd veidi veel üles ning siis tuleb korrektsioon. Mäletate veel Intelit (INTC)?

- VeriSign (VRSN)-i graafikut olete vaadanud?- ATI Tech (ATYT) ning Korea tehnoloogiahiid Samsung teatasid, et viimane hakkab oma uue generatsiooni televiisorites kasutama ATI tehnoloogiat.

- Legg Mason tõstab täna hommikul Priceline (PCLN) reitingu Hoia pealt Osta peale. Priceline avaldas teisipäeva õhtul tulemused, mille järel aktsia kukkus kolmapäeval 26%. Legg Masoni arvates kauplevad PCLN-i aktsiad 20% madalama valuatsiooni juures võrrelde konkurendi IACI-ga. Samas aga peaksid valuatsioonid analüütikute arvates olema võrdsed, kuna PCLN on kasumit suutnud konkurendist kiiremini kasvatada.

- Barrons toob välja, et oktoobris müüsid insaiderid iga aktsiate ostmiseks kulutatud dollari kohta $59 väärtuses aktsiad. Tegemist on viimase 10 aasta kõrgeima numbriga. Müüginumber on viimased 6 kuud järjest olnud 20x kõrgem ostunumbrist. Tegemist on väga karuse indikaatoriga.

Siiski on ka üksikuid kindlameelseid ostjaid. Seda eelkõige just nö. vana majanduse hulgas. Teras, kemikaalid, toiduained ning energia. Selliste firmade nagu CAG, PNR ja SBP juhtkonnad on olnud oma aktsiaid ostmas. Tasub ilmselt lähemat uurimist.

- Initial Claims 348k vs 380k consensus; Productivity 8.1% vs 8.5% consensus

Üllatavalt head tööturu numbrid tekitasid hetkeks elevuse ning siis keeras turg sunna alla.

- Gary B. Smith:

- ReVsharkIn my early days of trading one of my biggest mistakes was constantly being worried about a 1987-type crash. Fear that I would be caught in a sudden meltdown of giant proportions with no chance of escape was always in the back of my mind. At certain times when feeling particularly paranoid I would dump good positions just to protect myself from the crash I was dreaming about at night.

One day, while on the verge of dumping positions again based on fuzzy fears of a crash, I spent some time studying what had happened in the past when I let my fears dominate my thinking. It became quite clear that I had lost far more money worrying about the big one-day crash than I ever would have lost in an actual crash. Giving in to my thoughtless caution and taking myself out of good positions was hurting my trading substantially.

When I went back and studied some of the big crashes, particular the 1987 meltdown, it was fairly clear that there generally were some pretty good technical warning signs before we saw an epic meltdown. I was prone to exercise my fits of caution at times when the market had been particularly strong, which turned out not to be the time when crashes tended to occur. Historically, crashes didn't occur when the market was close to a top and very strong. They came after a period of struggle and some poor technical action. If I simply heeded the technical signs, it was very unlikely I would ever be caught in a crash unless it was caused by some outside event like 9/11.

Of course, you don't need a giant crash to hurt your performance; even a mild pullback can inflict a hefty dose of pain. However, selling because of niggling fears about a one-day crash is very likely to be a major mistake. Be cautious, but make sure your fears are based on facts and not some murky concerns about crashes.

Despite the strong earnings report from Cisco (CSCO:Nasdaq) last night, the buyers are exhibiting a fair amount of caution so far this morning. Japan took a hit overnight and the Bank of England raised interest rates a quarter point, which helped keep European markets mixed. Interestingly housing stocks in the U.S. continued to move up strongly despite clear signs that interest rates were likely to rise internationally. It will be interesting to watch that sector today on the BOE interest rate news.

An interest rate increase is a mixed bag for the market. On the one hand it signals that the economy is improving and earnings are likely to improve. It also makes bonds less desirable as their prices start to fall, and folks become more interested in equities. On the other hand, increased interest rates hurt businesses and consumers who borrow. Consumers can't continue to refinance their homes to extract cash and business have to pay more to carry their debt.

The monthly unemployment and payroll reports that are due tomorrow morning are attracting a lot of attention and are likely to be major market movers. We have the weekly unemployment data today as well as productivity numbers. Those reports should help set the early tone.

The bulls did a nice job of battling back from weakness yesterday. Will they find strength again as the day wears on? Technically we are sitting at a juncture where we could see some pretty good volatility without having any particular impact on the bigger picture.

The key to this market continues to be the dip buyers. When their tenacity starts to wane, that is when we have to start worrying.

Good luck and go get 'em.

sB

-

kas NOK on lõpuks endale suuna leidnud ?

-

Ollila kobises midagi positiivset (loe soome ylevaadet), loodame, et investoritele on kohale jõudnud, et Nokia näol on tegemist hea firmaga :)

-

Mõned teemad tänaseks päevaks:

- Mõlemad graafikaprotsessorite tootjad, NVIDIA (NVDA) ning ATI Tech (ATYT) tulid eile õhtul välja Q3 tulemustega, mis ületasid analüütikute ootusi. Täna hommikul on NVDA eelturul üle 15% plussis ning ATYT nullis.

- Wall Street Journal kirjutab, et legendaarne investor Carl Icahn kohtub esmaspäeval Eastman Kodaki (EK) juhatuse esimehega. Väidetavalt on Icahn saanud valitsuselt loa osta kuni $500 mln EK aktsiaid. Investoritele ei tundu EK uus digitaalne suund meeldivat, kuid Icahn arvab vist teisiti.

- Washingtonis oli suletud 11 postkontorit, kuna seal kahtlustatakse antraksi saastet. Siiski oli määr 100 korda allpool nakkuslikku taset. Reeglina lähevad momentum-kauplejad selliste uudiste peale SureBeami (SURE) aktsiaid ostma, mis toodab seadmeid, millega postkontorid pakke kontrollivad.

- Flash-mäludel põhinevate seadmete tootja SanDisk (SNDK) liidetakse Nasdaq 100-ga. Indeksifondid peavad nüüd SNDK aktsiaid oma portfellidesse ostma, mis tekitab veidi ostusurvet.

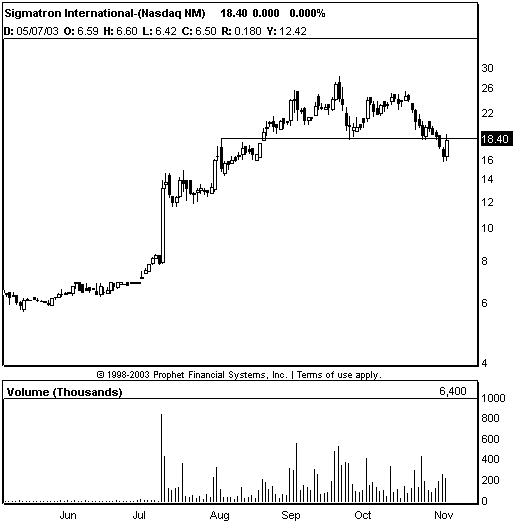

- Keegi Sigmatroni (SGMA) graafikut on vaadanud. Aktsiad püüdsid eile päeva sees 18.50 taseme vastupanu murda, kuid tulutult. See võib meelitada ligi karusid.

- BusinessWeeki aktsiad on seekord KROL, HHS ning ADP. Tegemist on päris suurte aktsiatega, mida BW artikkel tõenäoliselt liigutada ei jaksa. Siiski lähemalt juba esmaspäeval.

- Merrill Lynch lisas Altria (MO, endine Philip Morris) oma Fookusnimekirja. Hinnasihiks $63 aktsia kohta, mis jätab praegustelt tasemetelt päris tubli tõusuruumi. Tubakatoodete tootjatel on praegu palju kohtuhagisid kaelas, kuid Merrilli arvates ei ole asi nii hull kui esmapilgul paistab.

- Nonfarm Payrolls 126k vs 65k consensus; Unemployment rate 6.0% vs 6.1% consensus

Turu esimene reaktsioon kergelt positiivne. Usun, et leidub turuosalisi, kes ootasid selliste numbrite peale oluliselt suuremat reaktsiooni.

- Lasin/lasen täna hommikul mööda mitmed hea lühikeseks müümise võimalused. Miks? Ma kardan seda, mida turg võib nende numbrite peale päeval teha. Usun, et minusuguseid on veelgi. Ma ei tea, kas see näitab midagi, kuid..äkki siiski näitab.

- RevShark

It happens to everyone. Despite your compelling logic, insightful arguments and downright brilliance, you wake up and find yourself positioned on the wrong side of the market. For some reason the rest of the world has decided to ignore what is so painfully obvious to you.

You are sitting on a pile of cash -- or even worse, with lots of shorts -- and the market takes off with you in the rearview mirror. Your stops are triggered, you take your punishment, mutter some profane words and then what do you do? If you are like me you probably grumble and complain a bit more and then have a very difficult time embracing the action that you so clearly were wrong about.

That generally isn't the most productive approach so perhaps you should try something different. Stop thinking about how idiotic all those folks on the other side of the market are and force yourself to act. Dip a toe in and do something. Action will take you off the bench and put you back in the game. Once you knock out a decent trade or two you start to forget yesterday's ill-advised posture. Your confidence builds and before you know it you have made up your losses and are ready to attack whatever Mr. Market decides to dish out.

"Analysis paralysis" is what it's sometimes called and it is the result of thinking too much and acting too little. You can ponder, contemplate and cogitate all you want but nothing will have more effect on your thinking than a little action and a taste of success.

The ability to change your mind rapidly is of great value in the stock market. We all have to do it at times but it can be very difficult when you are not only financially but emotionally invested in a certain scenario. It's very easy to dig in your heels, sit there and convince yourself that you are right and everyone else is a fool. However, if you start to take some minor action and have a little success it becomes increasingly easier to adjust your thought process. When in doubt, don't just sit there -- do something.

Yesterday the bulls pulled off another late-day recovery. For most of the day the bears were hopeful that the lack of a big response to good earnings from Cisco (CSCO:Nasdaq) and the weekly unemployment report were signs that a top was near. But the dip buyers were not to be denied. There was hardly a dip to buy but they decided to buy anyway. Many of these underinvested bulls are simply disgusted with sitting on the sidelines with too much cash on hand.

In the early going we have a positive bias. Overseas markets were generally strong. Europe is near an 11-month high and Japan bounced back a bit after a tough day yesterday. However, it is the employment number that is out at 8:30 a.m. EST that is going to determine how this market opens. This report has always been important but today it takes on special significance as a test of whether the "jobless" recovery may not be so jobless.

The numbers to keep in mind are nonfarm payroll increases of 65,000 and an unemployment rate of 6.2%. Those are the expectations but the better-than-expected weekly unemployment report yesterday has probably nudged those numbers a bit so an in-line report will likely be a disappointment.

If we see good numbers, is this market going to fly? The indices certainly don't have much in the way of overhead resistance with which to contend. The Nasdaq is at its highest point since January 2002 and the S&P 500 and DJIA are within spitting distance of new highs. However, this market has not had much of a rest for a while and we are somewhat extended. For that reason I'd expect that a big gap open would probably invite some profit-taking.

We have another interesting day on tap. I'm going to have another cup of coffee, a little cinnamon oatmeal and glance through the papers before I mount the turret and prepare to do battle.

Futuurid: Naz 0.48% SP 0.28%sB

-

njaa

üks algaja investor ostis nädalakese tagasi ntes calli, kui veel aktsia 46.7 maksis, lootes kergelt raha teenida

täitsa masendav kuidas aktsia liigub -

NOKIA MULLS PSION MOBILE SOFTWARE TAKEOVER

NOKIA SAID MULL PSION BUY TO THWART MICROSOFT ON MOBILE

NOKIA PSION OFFER SEEN LIKELY UK 400 MLN -

Rene ,mida see NOK hinnale teeb ?Langeb ?

Ja igasugu väiksemad tech 'd tõusevad ? -

Kuulujutt sellest, et Nokia ostab softifirma on turul juba pikemat aega levinud.

Ma arvan, et uudis Nokia aktsiale ei mõju, kuid mõned teised mobiilisofti firmad võivad liikuda, kuigi minu arust pole selleks põhjust, sest ei usu, et Nokia oleks rohkemat kokku ostmas ... praegu. -

Ka see uudis on kuulujutt. Briti ajalehest Business, viidatakse nimetule allikale. Ametlikest kõnelustest veel ei ole teadet. Psioni turuväärtus on £312M, kuid hinnaks koos preemiaga hinnatakse £400M (ca €600M).

Psion omab Symbianist 31% ja Nokia 32%.

Psioni ost oleks loogiline samm, kuna ettevõtte juht on vihjanud Symbiani börsil noteerimisele ja siis peaks Nokia ilmselt selle eest palju rohkem maksma. Symbianit kasutavad ka teised mobiilitootjad, nt Samsung ja SonyEricsson. Symbian on praegu kahjumis, kuid analüütikute hinnangul jõutakse kasumisse 2005.a. ja siis saaks Nokester sealt kena litsentsitasu. Ja Nokis siiski kardab MSFT konkurentsi smartphonede vallas (kuigi Ollila selle väite sellel nädalal ümber lükkas). -

ja nii tulebki 6nn meie 6uele ja saame sonyericsson p911,

mis jookseb wince.net'il ja mida on actually v6imalik progeda,

mitte nagu symbiani osi kasutades, nutta ja halada, kui n6medalt keeruliseks v6ib progeja elu teha..

ja siis muutub symbian sama suletuks kui wince.

huvitav, kui noksteril on symbian ja ericssonil bluetooth,

kuidas yldse tulevikus eri mopsifirmad omavahel hakkama saavad,

kui tehnoloogiaid ristkasutavad?