Börsipäev 24 - 25. november

Kommentaari jätmiseks loo konto või logi sisse

-

Mõned teemad tänaseks päevaks:

- Euroopa turud on täna hommikul päris heas plussis ning dollar alustas mõne tunni eest tugevat rallit teiste valuutade vastu. Graafikul USD/EUR. See on andnud positiivse tooni ka USA futuuridele:

- Adams Harkness tõstab Brocade Communication Systems (BRCD)-i reitingu Strong Buy peale varasema Buy pealt. 12 kuu hinnasihiks $8.75. Nende arvates on reedene aktsiate 15% kukkumine veidi liiast.

- JP Morgan lisab OmniVision Tech (OVTI)-i oma Weekly Top 3 Ideas nimekirja 6-kuulise $75 hinnasihiga. Mis aga veelgi olulisem, Lexar Media (LEXR) on see firma, mis peab oma koha loovutama. See võib tuua kaasa müügisurve, kuna tõenäoliselt on mitmed JP Morgan kliendid neid aktsiad varem ostnud.

- Barrons kirjutab täna hommikul üpris neg. maiguga loo Four Seasons (FS)-i nimelisest hotelliketist. Oma luksusklikkuse poolest tuntud hotellioperaatori aktsiad kauplevad 91x selle aasta kasumit aktsia kohta, mis on mitu korda kõrgem näitaja võrreldes ülejäänud sektoriga.

"Kids with freckles are always going to have freckles. Four Seasons stock is always going to be expensive."

Selline on ühe ebaõnnestunult neid aktsiaid lühikeseks müünud fondijuhi kommentaar. Ka analüütikud nendivad, et selle firma aktsiad ostes tuleb prügikasti visata kõik klassikalised aktsiate hindamise vahendid.Kuuldavasti Britney Spears eelistab alati Fours Seasonsi hotelle..

- Barronsi iganädalases intervjuus pakub Hummingbird Fund-si juht Paul Sonkin investoritele huvitavaid ideesid pisikeste aktsiate seast:

Mity Enterprises (MITY) - toodab plastmassist laudu.

George Risk Ind (RISKA) - firma toodab basseinialarme, mis nüüd on Floridas seaduse järgi kohustuslikud. Aktsiad võivad praegustelt tasemetelt kahekordistuda.

Keith Cos (TKCI) - firma pakub inseneriteenuseid kinnisvarafirmadele.

Trailer Bridge (TRBR) - pakub logistikateenuseid USA ning Puerto Rico vahel.

- Lehman tõstab Fairchild Semi (FCS) reitingu Overweight peale varasema Equal Weight pealt. Samas mainitakse, et väiksem konkurent ON Semi (ONNN) võib olla huvitav pisike mäng. Hinnasiht tõstetakse $4.50 pealt $6.50 peale.

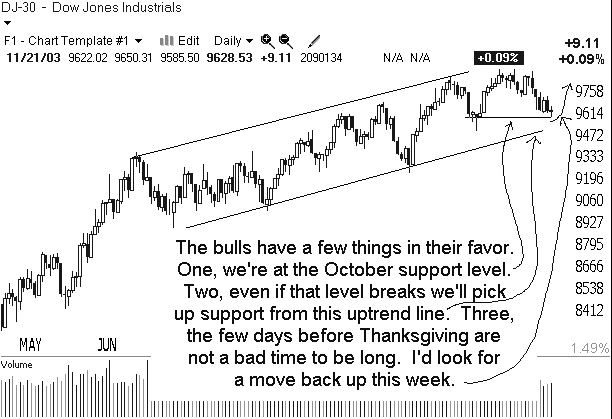

- Gary B. Smith:

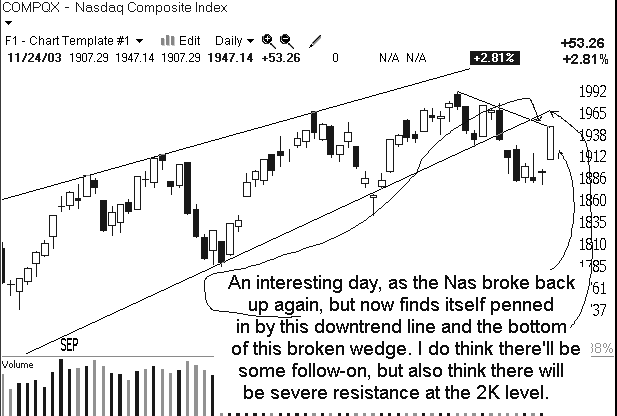

- ReVShark:

The facts are clear. Although the indices were hitting multiyear highs just a short time ago, the market has been struggling lately. The Nasdaq is at the same level it was seven weeks ago, solid economic news is failing to move the market, and the dip buyers have become more cautious. Mutual fund scandals, a weak dollar, valuation concerns and a big move since March have many folks ready to declare that it is time for the market to pull back significantly and take a rest.

Those are the facts that support the bearish viewpoint but our short-term direction is going to be determined by emotions. The most important determinate of where this market is heading is the attitude of market participants. Are the bulls ready to lock in profits, move to the sidelines and high five each other for the best performance since 1999? Or are they just resting before they make another run and try to improve their relative performance before we ring in a new year?

The next five weeks are all about attitude and sentiment. The good news for the bulls is that this tends to be the season of good cheer and positive feelings. Santa Claus has a habit of delivering rallies. The economy is clearly improving. Can the bulls run further or have they priced in a recovery already?

The bulls will tell you that the recent market weakness provides exactly the sort of worry and skepticism that will help support an end-of-the-year rally. The contrarian bears have been citing the very high level of bullish sentiment for months as a good reason to expect a pullback. That high level of optimism has diminished a bit lately and the contrarian bulls are saying that we are setting up a situation that will allow us to climb the proverbial wall of worry to conclude the year.

The bears warn that we shouldn't be too quick to conclude that a year-end rally is a certainty. We never really saw the substantial seasonal weakness that many expected this fall so why should we expect we see seasonality in the holiday season? Too many folks are looking for this scenario to play out and that means it's unlikely to happen. Furthermore, the technical picture is precarious at best. The major indices are all very close to significant technical breakdowns. The fact that this market can regain any steam despite good economic numbers should be sufficient warning that the upside is going to be tough.

Will positive attitudes drive us to new highs before the end of the year or will the weight of factual concerns be too great? We are kicking off Thanksgiving week with a positive tone. Asia is a bit mixed but Europe is up across the board. Gold is trading down a couple dollars, oil is down and the dollar is mixed.

The market is set up fairly well for a technical bounce. This is typically a good week for the bulls. Will they be able to run a bit or has the tone changed sufficiently that the bears will stomp on strength fairly quickly? We'll find out soon enough.

Futuurid: Naz0.62% Dow0.53%sB

-

Tänasest kehtib USAs numbri portatiivsus operaatorite vahel. Avalöögi tegi viiekordne poksi maailmameister Felix "Tito" Trinidad, kes teatas 00:01 ET, et soovib oma numbri üle viia Cingulari võrku.

Uurimuse järgi on 35% ameeriklastest rahulolematud oma operaatoriga, kuid numbrit kavatseb esimese kuu jooksul vahetada ainult 4%. -

tahaks pisut vaba raha paigutada ca 8..10-nädalase perspektiviiga (üle aastavahetuse) kesk- ja idaeuroopasse.

millist instrumenti soovitate? vana hea CEE?

või mõni euro-põhine fond? -

Trigoni Kesk-ja Ida Euroopa fond (KIE) on europõhine ja LHV vahendausel saadav.

-

Jajah, Rene, europõhine on veel ju ka JPMF EEE, mida samuti pakute.

Mõtlesin rohkem, kas kellelgi on mingit arvamust selle kohta mis antud horisondi jooksul taal teeb ja kas valitav instrument võiks sisaldada rohkem (EEE?) või keskmiselt (CEE?) või vähem (KIE?) venemaa osakaalu...

Endale tundub, et dollar alla 13 ei lähe ja venemaal kardetud/loodetud presidendivalimiste-eelseid pauke, mis liikumissuunad ootamatuks võiksid keerata, jaanuariks veel ei toimu? rozhdestvo jne? -

Kas ÜHISPANGA KASVUFONDI OSAK on ka LHV vahendusel saadav, müüdav!?

-

Mõned teemad tänaseks päevaks:

- Eastman Kodak (EK) on jällegi liikumas digitaalse ümbersünni poole. Täna hommikul teatatakse väikese Scitex (SCIX)-i ostmisest $250 mln eest. Firma tegeleb digitaalse printimistehnoloogia arendamisega. Alles mõne nädala eest osteti üks teine pisike tehnoloogiafirma.

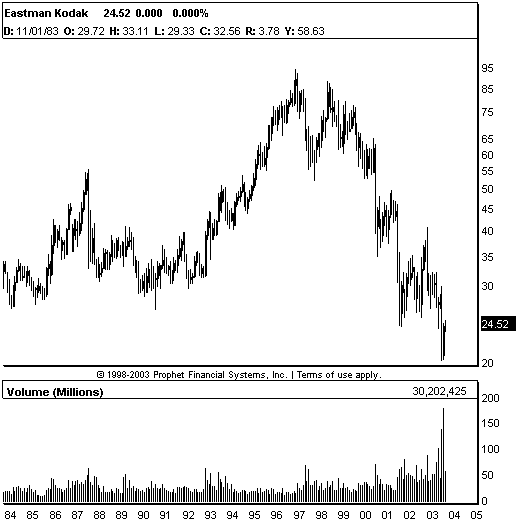

Vaadates Eastman Kodaki (EK) viimase 20 aasta graafikut, siis eriti ilus see pilt ei ole:

Hetkel kauplevad aktsiad siiski 11x järgmise aasta kasumit aktsia kohta (EPS $2.18). Legendaarne investor Carl Icahn on ostmas. Lisaks sellele vihjas mulle aktsiates pikk olev fondijuht, et EK-l on tugev meditsiinitehnika äri, mis hoiab suurel määral praegusi tulemusi üleval.

- Merrill Lynch tõstav täna hommikul Xeroxi (XRX) reitingu Neutraalse pealt Osta peale. Analüütikute arvates peaks 2005. aasta tooma tulemuse tõusu. Hinnashiks $14.

- Pisike Orchid Biosciences (ORCH) sai FBI käest lepingu, mille järgi firma hakkab arendama uusi vahendeid kahtlusaluste identifiseerimiseks. Seda läbi DNA-testide. Aktsia on selle uuduse peale eelturul 10% plussis.

- JP Morgan tõstab Lattice Semi (LSCC) reitingu Overweight peale varasema Neutraalse asemel. Nende arvates tuleb Q4 oodatust parem. LSCC aktsiad kauplevad 4x käivet, mis on ajaloolise vahemiku keskel (2-6x). Usun, et kui aktsiad on ka avanemisel $9.40-9.50 juures (+10%), tulevad karud oma osa saama.

- Novellus Systemsi (NVLS) kvartali vahearuanne läks eile õhtul oodatult hästi. Firma tõstis käibeprognoose järgmiseks kvartaliks. Juhtkonna sõnul on elavnemine klientide hulgas suhteliselt laiapõhjaline.

- Wall Street Journal kirjutab, et Visa USA Inc. ning MasterCard International Inc vaidlevad suurte jaemüüjatega, kes tahavad saada soodsamaid hindu kahe firma krediitkaartidega seotud tehingutelt. Usun, et see uudis võib veidi negatiivselt mõjutada ka American Expressi (AXP), mis on ainuke suurem noteeritud konkurent.

- GDP prelim 8.2% vs 7.6% consensus

Turgude esmane reaktsioon on positiivne.

- Gary B. Smith:

- RevShark:

One of the great things about trading is that if you are intellectually and emotionally prepared there is an endless supply of opportunities. If you miss a good chance to make money one day you can shrug it off and be confident that another one will come along shortly. As long as you have capital to work with, there is boundless potential.

The bulls had a great opportunity to make some money yesterday. Following a two-week struggle, the market gapped up and ran all day long. Breadth was solid, there was good leadership and volume picked up a bit over the prior day. There were plenty of sharp bounces to take advantage of throughout the day. But what about today? Will the opportunities lie in catching some follow-through?

As has been the history of this rally since March, the sharp bounce came after we had probed in the area of the 50-day moving average for several days. Each time we have bounced like this we have followed through solidly and made new highs. In August, September and October the Nasdaq bounced off its 50-day simple moving average and then hit a new annual high within about a week.

The big question for us to contemplate this morning is whether the market still has the capacity to regain upside momentum quickly like it has done so often in the past. The pace of gains has slowed recently and obviously we are at much higher levels than we were eight months ago. Are the same dynamics that have been working for so long still in place to take us higher, or are we running out of fuel?

It has been my contention for some time now that the reason we have had so many V-shaped bounces in this market is that the underinvested bulls tend to chase strength. The fear of being left out of yet another move to new highs drives the folks with cash to jump in following a day like yesterday so they don't miss out like they have so often in recent months.

At some point our supply of underinvested bulls will diminish but many of us who are tuned to the market on a daily basis fail to recognize how difficult it is for many retail investors to regain confidence in the stock market. They have not rushed to embrace it like they did back in the bubble days. Many have been burned and they are inching back in slowly. That is the dynamic that keeps this market running -- for now.

The bears will argue that this is just a seasonally induced respite from the inevitable downturn that is coming soon. Maybe, but anticipating a market correction has been a losing strategy for quite some time now. Sooner or later we'll have a substantial pullback but there is nothing in the technical picture at the moment indicating that we should be anticipating a major meltdown.

We have a full schedule of economic reports on the calendar for the next couple of days. This morning we third-quarter GDP, consumer confidence and existing-homes sales. Tomorrow we have unemployment, durable orders, new home sales, Chicago PMI, the Beige Book and several others.

These reports will set the tone. Expectations are upbeat and as long as they are reasonably in-line the market should react favorably.

Overseas markets were reassured by the strength of the U.S. indices and the dollar. We have strength across the board. The index of German business confidence helped boost the optimism when it hit its highest point in 33 months.

We have a positive open shaping up but watch for the economic data to affect the mood.

Futuurid: Naz0.46% SP0.10%

sB

-

eile vahetasid USAs operaatorit sajad tuhanded inimesed. vahetamise sujuvusest vastutava firma hinnangul oodati esimesel päval vahetama miljon inimest. aasta lõpuks peaks numbri portatiivsust kasutanud olema kuni 12M inimest.

Väidetavalt kasvatab numbri portatiivsus USAs telefonide müüki, kuna erinevate operaatorite vahel pole võimalik telefone vahetada (erinevad võrgud jne). -

loogiliselt v6ttes v6ib ju gdp (gnp igal juhul) kasvada ka siis kui valuts odavneb, kuna sama välisväärtuse jaoks tuleb rohkem pappi liigutada tugevalt importival riigil, nagu usa on..

v6i t6esti usa paneb nii karmilt, paremini kui arenev eesti (kes tarbib)??? -

Number portability should be positive for Lucent and Nortel

CIBC believes the impact of Local Number Portability should be positive for LU and NT, as they expect their lead CDMA customer, Verizon Wireless, will likely continue to invest aggressively in its network to consolidate its position as the quality leader in this mkt; VZ has already awarded a $1 bln contract to NT and is widely reported to be close to renewing its supply contract with LU, and while they are hesitant to suggest that VZ would raise its total capex, they believe LNP makes it more likely it will spend its full amount sooner rather than later. -

MOT kills launch of new camera phone in China

Reuters reports that Motorola killed the launch of a camera phone model for the Chinese market, underscoring the co's struggles in the hot-selling segment. "We killed the program," Motorola spokesman Alan Buddendeck told Reuters. "Any company, you make strategic decisions about how you're going to manage the products you bring to market."