Börsipäev 3. -4. juuni - Intel ja tööjõuraport

Kommentaari jätmiseks loo konto või logi sisse

-

OPEC naftaministrid on täna nõu pidamas Beirutis ja Euroopa turg on üsna tasane tootmiskvootide suurendamise otsuse ootuses

Samal ajal on Euroopa Keskpanga nõupidamine istumas koos Frankfurdis, arutlusel muuhulgas ka intressimäärade küsimus

Enamik turuosalisi ootab 11% naftatootmise kvootide tõusu OPECilt ja intressimäärade muutmata jätmist ECB poolt

Samas on kuulda arvamusi, et ECB ei taha intressimäärade küsimuses võta vastu otsust enne OPECi tootmismahtude tõstmise osas selguse saamist ja on sellest tulenevalt valmis ka üllatusotsuseks ... -

OPEC naftaministrid otsustasid oma tänasel Beiruti kohtumisel tõsta tootmismahtu 2 miljoni barreli võrra päevas ja vajadusel lisada augustis veel 500 000 barrelit - tegu siis kompromissiga 2 ettepaneku vahel: 1,5M ja 2,5M. Naftahind NYMEXil ei ole hetkel veel langenud ja paljude analüütikute arvates ei muutugi oluliselt kuna otsus vastas keskmistele ootustele.

Euroopa Keskpank jättis samuti vastavalt ootustele intressimäärad muutmata.

USA töötu abiraha esmataotlejate arv vähenes eelmise nädala 345 000 juurest 339 000 tasemele, samas kui oodati numbrit 337 000. Üksikasjalikum raport tööjõuturu olukorrast mais avaldatakse homme.

Täpsustatud andmetel kasvas tööviljakus USAs I kvartalis 3,8%, esialgsed andmed andsid kasvuks 3,5% ja konsensus ootas revisjonijärgselt 3,7%.

G. B. Smith:

Cody Willard täna RevShark asemel:

Oil and bonds, and bonds and oil. Little else seems to matter to this market right now.

The press is endlessly discussing the surge in oil and its many ramifications: a tax on the consumer; a break for the Fed, which needs to tighten, as it will undercut the improving economy; a trap for the Fed, which needs to tighten, as it will spark yet higher inflation; a boon for the producers in the Middle East, Russia and elsewhere; practically meaningless to the valuations and prospects of U.S. oil companies; and so on and so forth. This is what's making newspaper headlines, and CNBC can't seem to venture from the topic of oil for more than a few segments in a row.

Frankly, all that makes me think that -- even if oil doesn't crack and fall back into the $30s in the coming months, quarters and years -- the market has already done everything it can to price in the reality of a $40-plus barrel of oil.

The bigger, but less focused-on issue confronting this economy and market right now is the Treasury and corporate-bond action. The volatility in the yield on the 10-year indicates that a lot of tension has built up. The hedge-fund and money-management communities are practically unanimous in their higher yield expectations. The much bigger and more powerful bond and mortgage investors are in the difficult position of trying to game how much and how fast those 10-year yields will move.

That brings us to tomorrow's payroll number and to the logic that a "disappointing number" would probably be a bullish development for the market. If the number is much higher than the consensus (which, by the way, is quietly climbing before the number's release), the bonds are likely to sell off quickly, sending yields higher. That could begin a self-fulfilling cycle of more bond-selling and even higher yields.

A disappointing number can take yields lower and -- if done slowly and steadily -- even spark a new round of refinancing. If corporate spreads improve along with those lower yields -- indicating better access to capital -- we'll have a very bullish setup into the summer.

I always note two things when I discuss these topics, though. First, this "consensus" number is arrived at by sheer guesswork from a bunch of economists with horrid track records. (Some even admit to simply "going with their gut.")

Second, note the reflexivity of the whole shebang. As George Soros explains, "Reflexivity is, in effect, a two-way feedback mechanism in which reality helps shape the participants' thinking and the participants' thinking helps shape reality in an unending process in which thinking and reality may come to approach each other but can never become identical." If the market perceives Friday's payroll number as a little bit disappointing to the consensus, stocks might do better because there will be fewer market forces working against growth.

We've got a red open shaping up, as the people who buy and sell futures in the premarket have decided that oil, interest-rate concerns (where have we heard about those things before?) and who knows what else might make the markets fall today.

-

Naftahind allapoole OPECi sõnumi peale ei tulnud, kuid aktsiaindeksid on päeva alguse miinusest veidi kosunud.

Jällegi - LHV Traderis saate naftafutuure jälgida reaalajas sümboli QM all. -

muutsin pisut foorumi pealkirja nüüd: "mida ütleb OPEC?" asemel "mida ütleb Intel?" - seda saame küll teada alles peale börsipäeva lõppu ...

-

Need, kes jälgivad aktiivselt LHV Pro soovituse Six Flags (PKS) käekäiku, leidub siin üks huvitav analüüs: Independent Research Group (IRG) usub, et aktsiad on väärt $11. Hetkel PKS veel $6-7 kandis.

sB -

9:29AM Six Flags: I.R.G. initiates with a Buy; tgt $11 (PKS) 6.92: Independent Research Group (I.R.G.) is initiating Six Flags (PKS) with a Buy rating and tgt of $11. Firm views 2004 as a rebuilding year as co closed the sale of Six Flags World of Adventure in Ohio for $144 mln and its European division for $200 mln, bringing down their debt by $170.5 mln. Firm states that growth drivers for co include new rides and attractions, ticket strategies, enhanced food and merchandise outlets to increase in-park spending, and special events. In-park corporate sponsorship and co-marketing agreements are additional revenue opportunities for PKS. Firm believes that Y04 operating cash flow is on the rebound for PKS, noting that 2003 season was a tough environment that included economic weakness, the Iraq war, terrorist threats and historically high rainfall.

On tunduvalt paremaid aktsiaid :) -

No lase aga tulla! All ears.

Ma usun, et siin leidub teisigi, kes oleksid nõus iga kell Su tarkusest osa saama :)

sB -

No see ricki kommentaar on umbes sarnane kui keegi tuleb oma tütarlapsega seltskonda ja tere asemel öeldakse "On tunduvalt paremaid naisi".

Ei ole olemas sellist asja nagu paremad naised või paremad aktsiad, kõik on kinni isiklikest maitse-eelistusest (või investeerimise puhul horisondist ja veel tuhandest muust asjast).

Rick, sa pole PKSi ideed LHV Pro all lugenud, seega on sellised kommentaarid minu meelest üsna mõttetud. -

ärge nüüd nii plokki ka minge, tahtsin vaid öelda oma isikliku arvamuse selle pks kohta ja ca pool aastat mis see idee seal pros on olnud pole ta just suuremat kasu kellegile toonud

-

Vot täpselt selles ongi asi - kui LHV Pro all on toodud investeerimishorisondiks 2.a., siis ei peagi aktsia poole aastaga kellegile midagi tegema. VÕIB teha, aga ei pea. Fundamentaalsete nägemuste teostumiseks peab kannatust olema.

-

Täitsa nõus Kristjaniga. On palju aktsiaid, mis on turul pikka aega alahinnatud tasemel ja põhjuseid selleks võib olla mitmeid. Sageli ei leia ka analüütikud koheselt head aktsiat ülesse, seega kannatust peab olema ja kindlameelsust oma investeerimisstrateegia järgimisel.

-

Kristjani võrdlus on küll hea, otse kümnesse;)

-

Dow plussis. Aga nagu Avalöögi all öeldud - olulisem tänasest reaktsioonist on see kuidas homme uudiseid vastu võetakse (Intel + makro).

-

Intel INTC sees Q2 sales $8.0-$8.2 bln, consensus $8.0 bln, aktsia kenasti üles

-

+2% järelturul, ehk sai tänane miinus tasa tehtud. Esimesel pilgul paistab nende sõnum tõesti korralik, enamus ootas turul hullemat.

Kuid siiski põhiline suund turule homsest tööjõutururaportist. -

tänamatu töö see aktsiate soovitamine...

-

WSJ kirjutab OPECi eilse otsuse kohta suurendada nafta tootmiskvoote:

"The increase was largely symbolic and won't result in extra volume of oil because the cartel already is producing more than the new ceiling. Yesterday's decision merely legitimizes some of that output."

....

"by raising the production limits, OPEC hopes to calm jittery oil markets"

....

"ministers insist that the world market is well-supplied with oil and that no customers are being turned away, regardless of official production quotas."

kuid peamine probleem pole tootmiskvootides vaid pingetes Lähis-Idas. oodatult nafta hind ei kuku. -

Tööjõutururaport - 248K uut töökohta (oodati 230K), seega parasjagu kergelt üle ootuste, FED väga kiiresti intresse tõstma ei pea, kuid majandus endiselt tugev. Ma usun, et aktsiaturu jaoks väga hea number, futuurid plussi suurendanud.

-

-Turule täna mõju avaldamas Inteli hea vaheraport ning oodatust kergelt parem tööjõuturu raport, mis positiivne. Tänase turu liikumise põhjal peaks olema selge lähemate nädalate siht. Nasdaqi futuurid on 15 punkti plussis, S&P 500 on 8,5 punkti plussis.

-Mais loodi 248 000 uut töökohta, mis viitab tööjõuturu jõulisele taastumisele. Ka aprilli vastav näitaja vaadati üle ning kergitati 346 000 uuele töökohale. Märtsis oli vastav number 353 000. Kolme kuuga seega pea miljon uut töökohta, mis on juba mõjuv põhjus intressimäära tõstmiseks.

-Nafta hind on taas alla 39 dollari ehk turu tõusuks on vaid häid märke.

Rev Shark:

When forecasting what will happen in the stock market, the most important information to have is a clear understanding of the prevailing mindset and mood. The stronger the level of prevailing emotions and/or expectations, the more likely the market is to make decisive moves. When we understand what the market is thinking and feeling, we are able to trade with more conviction and certainty. Random events have far less impact when mood and sentiment are at extreme levels.

This is not one of those times when market sentiment and mood are clear. For over a week now we have been drifting around rather randomly on lighter-than-average volume. Market participants have looked uncertain, and many of them are standing aside while they wait for greater clarity. Today's jobs report at 8:30 a.m. EDT may help solidify the mood.

One of the major questions in the market right now is to what degree have we priced in the possibility of interest rate hikes. Has the market fully discounted the possibility of several 0.25% cuts? The market seems to be struggling with that issue, and the rising price of crude oil is making things even more difficult. High oil prices counteract the need for higher interest rates to some extent, but we really don't know what the FOMC's perception is of the impact of oil prices.

Another issue to grapple with is whether a very strong jobs report will cause speculation that the Fed may make an initial interest rate hike of 0.5% rather than 0.25%. Recent economic data continue to be solid but have cooled somewhat from earlier levels. If the data pick up again, the market may be fearful that things are overheated.

The best hope for the jobs report is that it not be too hot or too cold. A "Goldilocks" report that is just right is the best scenario for the market right now. If the numbers are close to expectations, we should see a favorable response.

The midquarter update from Intel (INTC:Nasdaq) is helping matters this morning. The report was positive, and there are some bullish analyst comments this morning. Semiconductors are going to be the key group to watch today. If they hold on to early gains, that bodes well for the market.

The market has had a tendency to whipsaw quickly on days when the jobs data are released. The chances that the first move after the numbers hit will reverse are very high. I expect many traders know that and will "fade" the action, which tends to make reversals self-fulfilling.

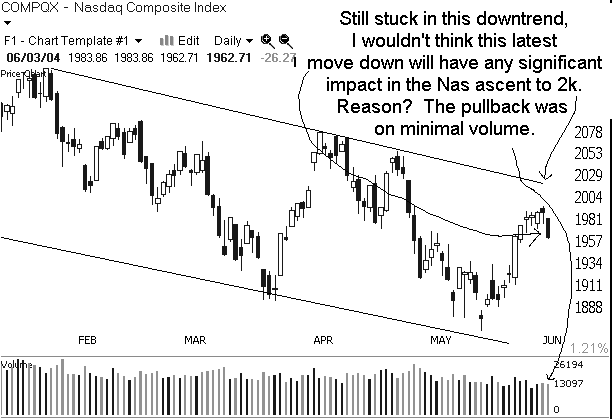

Technically, the weak action yesterday was a positive in that it helped to diminish the overbought condition of the Nasdaq. As I've conveyed numerous times over the past week, I did not like the technical condition of the market because we did not have a good base. We had rallied on low volume into substantial overhead, and it was going to be very hard to work higher without pulling back first. The pullback of the Nasdaq to the 200-day simple moving average is a good start. We now need to hold and build up the energy for an attack on the downtrend line that connects the January and April tops.

Look for choppy action today that will eventually lead to greater market clarity. We are setting up for a trend move of some sort, and today should help us determine which way things are headed.

The early action is bullish primarily due to Intel, but the jobs data will shake things up at 8:30 a.m.

Thanks to Cody for an excellent job in my stead. I appreciate the efforts.

Gary B. Smith: