Börsipäev 23. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

-Usa turud on avanemas väikeses miinuses, tugevas tõusus on tubakatööstuse ja telekomisektori aktsiad.

-Prantsuse Alcatel (ALA) on kerkinud Pariisis üle 4%, SBC Communications teatas, et kavatseb kulutada üle 6 miljardi dollari digitaaltelevisiooni seadmete peale. Vähemalt digitelevisiooni vastuvõtjaid toodab ka Nokia (NOK).

-Pakkide vedaja FedEx (FDX) teatas, et ootab kvartali kasumiks aktsia kohta 90 senti kuni dollar ning aastakasumiks peaks kujunema 4,2 kuni 4,4 dollarit aktsia kohta, mis ületab varasemaid analüütikute prognoose.

Rev Shark:

The primary problem with the market in recent weeks is that neither the bulls nor the bears have been tough enough to take advantage when they have had a slight edge. Yesterday the bears had the market on the ropes as the Nasdaq took out key support at the 200-day simple moving average. However, they weren't tough enough or strong enough to press their advantage. The bulls hung on, and managed to battle back and close the market nicely higher on decent volume.

Now it is the bulls' turn to show us if they have what it takes. After the reversal yesterday, the Nasdaq is on the verge of breaking the downtrend line that has been in place since January. A move through 2010 or so on above-average volume is what the bulls need to deliver in order to put themselves in control. A follow-through on above-average volume has been a very rare thing in recent weeks as both bulls and bears have squandered their chances.

One of the big positives yesterday was the strength in the semiconductor stocks. That is a sector the Nasdaq tends to look to for leadership. The reversal yesterday and the ability to hold recent lows is a good sign, but the technical picture of the group is still very shaky. The chips need to recover the June highs and make a run at the 200-day simple moving average if the Nasdaq is gong to have a chance to really run.

The biotechnology group is another key sector within the Nasdaq, and it also looks quite shaky. The group managed to avoid a breakdown yesterday, but it is hanging on by its fingertips and needs to find its footing quickly if it is going to aid the Nasdaq in an upside run.

Despite the weak conditions of two key sectors, the technical setup of the Nasdaq is promising. Yesterday it managed to bounce off support at the 200-day simple moving average for the third time this month. The ability to hold that level is encouraging, but it can only handle so many tests before one eventually fails.

The Nasdaq is now set up to make a run at the downtrend line that connects the January and April tops. The ball is in their court, and like the bears yesterday they have the advantage. Do they have the toughness and fortitude to make a run? We shall see.

We are setting up for a slightly soft open to start the day. Overseas markets were generally positive on strength in technology stocks. There isn't much news this morning and we don't have any economic news on the agenda.

Gary B. Smith:

-

OraSure Tech (OSUR) on täna +25%, kuna sai oma oral HIV2 kiirtestile FDA peanoogutuse. Siiski HIV2 on viirus, mida on täheldatud Ameerika Ühendriikide ajaloo jooksul umbes 100 korda. Mitte just väga suur turg.

sB -

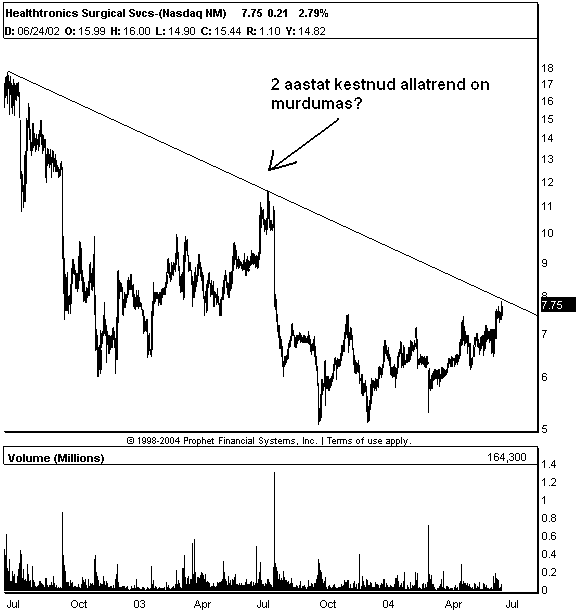

Tundub, et Schering-Plough (SGP) ei ole täna ainuke täht. Ka LHV Pro soovitus HealthTronics (HTRN) on kompamas 2 aastat kestnud allatrendi. Firmast saab peale ühinemist Prime Medicaliga (PMSI) märksa kogukam tegija, mis nii kergelt enam analüütikute radarite alt läbi ei lenda:

PS: LHV Pro all on SGP fännidele pakkuda üks põhjalik võõrkeelne analüüs.

sB