Börsipäev 26. jaanuar

Log in or create an account to leave a comment

-

Rev Shark:

A Glimmer of Hope. Just a Glimmer

1/26/05 8:13 AM ET"It is hard to fail, but it is worse never to have tried to succeed. In this life we get nothing save by effort."

-- Theodore Roosevelt

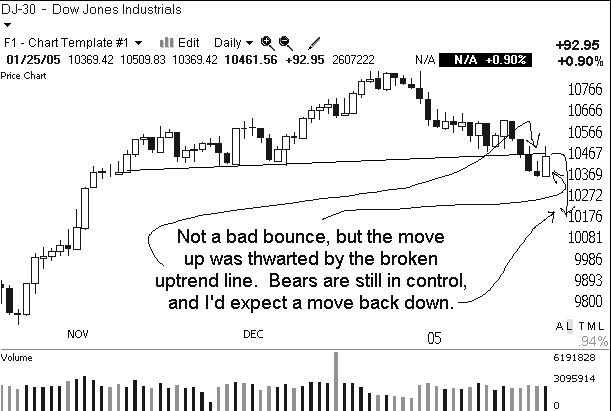

The bulls finally decided it was time to put forth some effort but it was a mixed effort at best. The DJIA was the clear leader yesterday with a big move on increased volume and a close in the upper range of the day. The one negative was that breadth was close to flat. However, the price and volume movement is the type of action that signals there is a chance of further upside.

The problem for the market is that the effort in the DJIA was undermined by the much less impressive action in the Nasdaq, S&P 500 and Russell 2000. Volume was poor, the close weak and there was little vigor to the buying. The bulls didn't appear to be particularly anxious to rush in and buy.

Although we didn't see the sort of aggressive buying that would give us comfort that a decent bounce was on the way, it certainly was an improvement over the action we have been seeing this year. It was a decent start -- the downtrend was halted and buyers did step up to some degree.

The key now is that we see some follow-through. The S&P 500, Nasdaq and Russell 2000 can redeem themselves from their poor effort yesterday with good breadth and a jump in volume, but we can't be too quick to trust it given the lame effort they put forth yesterday. It is almost as if they were trying to fool us by just going through the motions rather than making any real effort.

The action yesterday was a signal to increase long exposure to some extent but it wasn't good enough to justify a high level of aggressiveness. We need to stay defensive and keep stops tight but the downtrend we have experienced over the past three weeks has been substantial, and the action yesterday does indicate that there is some attempt to bounce. We don't want to leap to the conclusion that it is full steam ahead but there is a slight glimmer of hope that we see a respite to the selling.

Early indications are solid. Asian markets were solid overnight but Europe was a bit mixed. Oil is giving back some of yesterday's gains, which is helping matters. Merrill Lynch is bullish on Yahoo (YHOO:Nasdaq) and

Texas Instruments (TXN:NYSE) and that is helping a bit. There were some solid earnings reports as well from the likes of Sigmatel (SGTL:Nasdaq) and InfoSpace (INSP:Nasdaq), and that is prompting some sympathy buying.

We have the possibility of some upside trading opportunities but proceed with caution. The market is still struggling to shake off the downtrend and the action yesterday, although good, was not persuasive.

Thanks to Cody for filling in yesterday and doing his usual fine work.

Long SGTL

Gary B. Smith:

-

Gapping Up

Trading higher on strong earnings/guidance: INSP +21% (up in sympathy: ASKJ +4.9%, MAMA +3.1%, YHOO +1.9%, GOOG +1.4%), CPWR +21%, SGTL +15% (also IRG upgrade), FLEX +7% (up in sympathy: SANM +2.8%), CNCT +5.8% (also Jefferies upgrade), ENTU +5.7%, CYMI +5.7%, IMCL +5.5% (also signs license agreements with Genentech and Centocor), ERTS +3.1%, EK +3%, TXN +2.8% (also upgraded at Merrill and Deutsche Bank), ORCL +1.8%.... Other News: MSHL +25% (FDA grants Fast Track Designation for Phenoxodiol in oral dosage form), RMBS +5.2% (files patent infringement suit), NVEC +4.5% (awarded DoD contract), VIAC +4.4% (extends 32% move yesterday as momentum crowd continues fascination with stem cell stocks), FDRY +4.2% (RBC upgrade), RIMM +2.9% (WSJ discusses takeover speculation).

Gapping Down

Down on earnings/guidance: LEXR -31% (also JP Morgan downgrade; Down in sympathy: SNDK -7.2% which CIBC downgraded, FLSH -5.5%), PCLE -15% (also JP Morgan downgrade), RFMD -6%, SIRI -5.8% (down in sympathy: XMSR -2.1%), VTSS -5.4%, ET -5.3%, ICOS -3.6%, GLW -2.6%, SGI -9.5%..... Other News: ASTM -4.7% (profit taking after recent move), CRXL -3.4% (continues recent sell-off), NFLX -2.9%.