Börsipäev 17. märts

Kommentaari jätmiseks loo konto või logi sisse

-

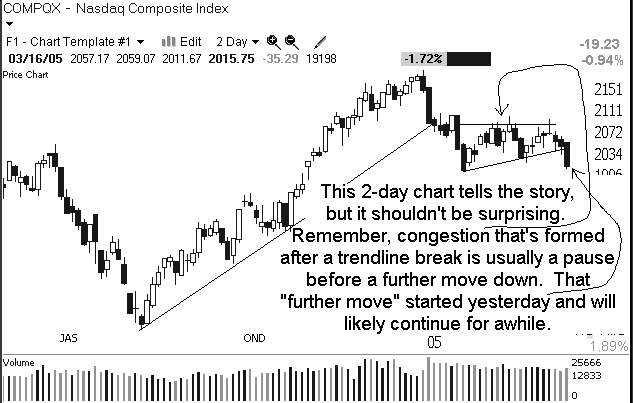

Tänase USA börsipäeva eel 3 graafikut: alumine joon on pikk tõusutrend 2003. aasta lõpu või 2004. aasta alguse põhjade juurest tõmmatuna, ülemine joon märgib eelmist põhja.

Küsimus: Kas täna põrkame eelmiste põhjade juurest?

-

Rev Shark:

Don't Succumb to Siren Call of the Bottom

3/17/05 8:41 AM ET"One of the worst things that can happen in life is to win a bet on a horse at an early age."

-- Danny McGoorty Irish Pool Player

The good new is that it is St. Patrick's Day, the NCAA Basketball Tournament begins and the rain in Florida has stopped. The bad news is that this market stinks. There is nothing pretty about what happened yesterday and anyone trying to spin it in a positive way is deluding himself.

One thing that we must keep in mind is that the market will always and forever undergo cycles of positive and negative action. It is as inevitable as the sun rising, and rather than fight it we need to embrace that fact. One of the worst things that can happen to an investor is to start investing in a bull market and then have to learn that they don't last forever.

It is important to keep in mind that the only reason the market is so rewarding is because it is so frustrating and difficult at other times. If it were an easy job to determine what the market is going to do, we couldn't make good money trading and investing.

Oil is up again sharply this morning and we obviously can't ignore that. All of the major indices have broken support and have been undergoing distribution lately. (Distribution simply means that selling has come on increased volume and is indicative of large institutions liquidating long positions.)

An awful lot of folks are tempted to try to catch the bottom when a market has broken down, as this one has. And just like the folks trying to call a top they are almost always early -- they will assume a turn is coming well before it actually occurs and will suffer some losses because of that impatience.

Your No. 1 job in a weak market is to protect your capital. The opportunities to make money will come again sooner or later but if you let your capital erode you will be greatly handicapped when that time comes again. Bargain hunting in downtrending markets is a good way to learn about the irrationality of the market. The market seldom is good at valuing companies; tt always goes too far both ways and the impatient trader soon learns that lesson.

Stay defensive for now, and don't be fooled by a knee-jerk bounce. It is very likely that we see some recovery from yesterday's pounding but it would be foolish to expect it to last.

Weekly unemployment claims are roughly in line and oil is up sharply. Proceed with caution.

Gary B. Smith:

-

Uut ja huvitavat vähiravis...

http://story.news.yahoo.com/news?tmpl=story&cid=97&ncid=97&e=1&u=/hsn/20050314/hl_hsn/drugstopscancerinitstracks -

Gapping Up

VIA +4% (confirms it is exploring division of its business into separate companies; Legg Mason upgrade; up in sympathy: VIA.B +5.6%, TWX +2.2%), DRIV +12% (guides higher), AMLN +12% (announces FDA approval of Symlin), NFI +10% (reports Q4), GEPT +8.6% (receives new contracts), GEOI +6.4% (oil momentum name), OATS +6% (Pru upgrade), DISH +5.2% (reports Q4; 10-K lessens accounting scandal fears -- Janney), RETK +5.5% (board recommends shareholders accept SAP new offer), AFFX +4.3% (Thomas Weisel upgrade), FRO +3.4%, GT +3.3% (reports Q4), TOY +2.5% (KKR Group to buy all of Toys 'R' Us for $5.7 bln - WSJ), ATYT +2.2% (Wells Fargo upgrade).

Gapping Down

Gapping down on disappointing earnings/guidance: LEXR -18%, INSU -16%, HOTT -4%, FDX -1.7%.... Other News: LGND -14% (delays 10-K filing), IPIX -6.6% (delays 10-K filing), EGY -4.7%, ARBA -3.4% (RBC downgrade), MICU -2.9% (competitor receives drug approval), CNCT -2.5% (convertible offering)... Under $3: AAII -40% (delays 10-K), MCLD -38% (reports Q4), GTCB -27% (updates European Regulatory Review of ATryn), HOFF -25% (to delay 10-K), CRAY -13% (Piper downgrade), TGEN -12% (Phase 2 trial data). -

NB! homme optsioonireede, see lisab teatava annuse volatiilsust turule.

-

Jätkuvalt on nafta hinnal ja indeksite liikumisel väga tugev negatiivne korrelatsioon. Nafta on tegemas päeva põhjasid, indeksid päeva tippe.

-

Usk Ameerika autotööstusesse on väga tugevalt kõikuma löönud, General Motors on tänagi pea 3% miinuses. Infoks, et General Motorsi turuväärtus on sulanud 16 miljardile dollarile, millega ollakse kõige väiksem Dow komponent.

-

Millal saab GM Dow indeksist kinga? Ma pakuks, et siis kui võlareiting junk'i peale langetatakse. Ilmselt 2005.

-

FRX on kõvasti pihta saanud, paistab hea ostukoht olevat. Languse taga ilmselt allpool olev tekst. Mis arvad Oliver, kui tõsiselt seda peaks võtma, Morgan Stanley annab aastatargetiks ikka 63 USD-i.

NEW YORK, March 16, 2005 (PRIMEZONE) -- Murray, Frank & Sailer LLP has filed a

class action lawsuit on behalf of shareholders who purchased or otherwise

acquired the securities of Forest Laboratories, Inc. ("Forest Labs" or the

"Company") (NYSE:FRX) between August 15, 2002 and September 1, 2004, inclusive

(the "Class Period").

The complaint charges Forest Labs and certain of its officers and directors with

violations of the Securities Exchange Act of 1934. Forest Labs develops,

manufactures and sells prescription drug products, as well as non-prescription

pharmaceutical products.

According to the complaint, during the Class Period, defendants caused Forest

Labs' stock price to be overstated by concealing deficiencies with its

Celexa/Lexapro drugs in treating adolescent depression. When Forest Labs

ultimately disclosed an agreement with the New York State Attorney General to

make available summaries of previously undisclosed studies on the drugs to the

public, the price of Forest Labs stock dropped to as low as $36 per share.

Murray, Frank & Sailer LLP and its predecessor firms have devoted its practice

to shareholder class actions and complex commercial litigation for more than

thirty years and have recovered hundreds of millions of dollars for shareholders

in class actions throughout the United States.

If you purchased or otherwise acquired Forest Labs securities on any world

exchange between August 15, 2002 and September 1, 2004, and sustained damages,

you may, no later than May 10, 2005, move the Court to serve as lead plaintiff.

Shareholders outside the United States may also join the action, regardless of

which exchange was used to purchase the securities. To serve as lead plaintiff,

however, you must meet certain legal requirements. You can join this class

action as lead plaintiff online at

http://www.murrayfrank.com/CM/NewCases/NewCases.asp. If you would like to

discuss this action, this announcement, or your rights and interests, please

contact plaintiff's counsel Eric J. Belfi or Aaron D. Patton of Murray, Frank &

Sailer LLP. -

Ma pole küll Oliver, aga näen selliseid class action law suite iga päev kümnete viisi. Pole veel märganud, et keegi selle peale viitsiks aktsiaid müüa.

-

Forest Labs on see firma, mille juhi põhitegevus oli mõni aeg tagasi firma aktsiate müümine suurtes kogustes. Kui ma õigesti mäletan.

-

Tarmo, vaata näiteks YAHOO-st mõnda suvalist aktsiat, mis hiljuti lühikese ajaga väga tugevasti pihta saanud. Pea kindlalt on nii mõnigi hinnalangusega seotud kohtuasja kuulutav pressiteade seal ka olemas. Analoogseid kohtuasju algatatakse kiirete kukkumiste puhul (vähemalt näib, et) reeglina alati.

-

Oleme FRX jälginud pikka aega ning firmast tuli juttu ka seminaril. Arvame endiselt, et tegu on pikaajaliselt hea investeeringuga. Lühiajaliselt võib ettevõtte väärtus veelgi kahaneda, kuna Lexapro kohtuasi Ivaxiga on lähiajal tulemas ning enne seda ei taheta eriti positsioone võtta. Oleme ise valmis pikka positsiooni kaitsma optsioonidega. Hea indikatsiooni võib anda ka Ivaxi kohtuasi Eli Lillyga, mille otsus võib tulla lähiajal.

Tarmo, need kohtuasjad, mida sina mainisid, on suhteliselt non-event, raske on hetkel leida langeva aktsiaga firmat, kellel ei oleks sama jama kaelas.

Hetkel on turg ära unustanud Forest Labsi pipeline ning juhtkonna. Kogu tähelepanu on koondunud Lexapro ümber. Lisaks tasub ära märkida, et Forest on varem või hiljem toonud turule kõik ravimid, millega neil tegemist on olnud. -

GM kohta üks küsimus:

Yahoo fiannce näitab GM total cash per share 63,74 USD, aga aktsia kaupleb alla 30 USD, millest nii suur vahe? -

Cashi on GM -il 36 miljardit, võlga 300 miljardit. Cashi hulgas on veel lisaks töötajate pensionifondid, mis vähendavad reaalselt kasutatavat cashi hulka.

-

probleem selles, et võlga on neil ikka märksa rohkem

-

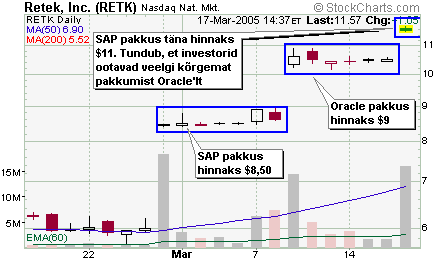

Tarkvaratootja Retek (RETK) lugu on päris huvitavaks kiskunud. Mäletatavasti tegi veebruari lõpus firmale ülevõtupakkumise SAP (SAP) ning sellele järgnes pisut rohkem kui nädala pärast Oracle (ORCL) konkureeriv suurema preemiaga hinnapakkumine. Täna naasis võitlusse taas SAP ning kergitas ülevõtuhinna $11 tasemele. Aktsia on suurte tarkvaratootjate sõja toel igatahes ligi 100% poole kuuga plussis. Kas Oracle pakub üle?

-

Tänud, Arko

-

PLMO halted.

-

reteki puhul on näha et enne oracle pakkumist käive tõusis

-

Oracle ostis 10% Reteki aktsiad kokku enne pakkumise avalikustamist, kergitas käivet jah.

-

Suure tõenäosusega kärbib GM dividende ( momendil 2 USD aastas )

-

loen igasugu artikleid, et dinosaurused surevad ka välja (GM), aga mina siiski ei usu sellesse pikas perspektiivis. nõustun küll sellega, et väga palju gm toodangust on crap, aga leidub ka head, mis lihtsalt ei saa välja surra. a la hummer (pole küll minu maitse, aga müüb), corvette jm. cadillac kusjuures minu arust eriti strong ei ole, kuid ikka päris palju on ka profitit tootavaid autosid. kogu poliitika tuleb lihtsalt üle vaadata ja siis saab GM-st taas asja. ma küll ei tea mis hinnaga ise siseneksin. 10-15?

-

kas keegi on kunagi sellist pakkumist vastuvõtnud ka nagu praegu reteki aktsionäridele tehakse

kas see toimub kuidagi lhv abil/kaudu või tuleb ise nendega suhelda? -

ma myyks pigem turul kõrgema hinna eest.