Börsipäev 22. märts

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

Traders Hang on Fed's 'Measured' Response

3/22/05 8:10 AM ET"There is no greater impediment to the advancement of knowledge than the ambiguity of words."

-- Thomas Reid

Much of today's stock market action will be influenced by a single word. If the FOMC drops the word "measured" from its policy statement this afternoon there are likely to be some major market repercussions.

The FOMC has been slowly and methodically raising interest rates a quarter-point at a time for a while. Today it is widely expected to do so again for the seventh time. The Fed has taken some of the sting out of the move by commenting in its policy statement as follows: "With underlying inflation expected to be relatively low, the Committee believes that policy accommodation can be removed at a pace that is likely to be measured."

The assurance that the inflation threat is low and that interest rates can be raised at a measured pace has kept the market reaction to interest rates fairly sanguine. In recent months the market reaction to the FOMC announcements has been muted because they have been widely expected and fairly benign.

In recent weeks, as oil and other commodities run higher and raise concerns about inflation, there has been increased speculation the FOMC may begin to signal that they will be more aggressive in raising rates and fighting inflation. The FOMC will make it clear that it is adopting that course of action by the single word "measured." If that word disappears from the policy statement it is very likely that inflation fears will send a shiver through this market.

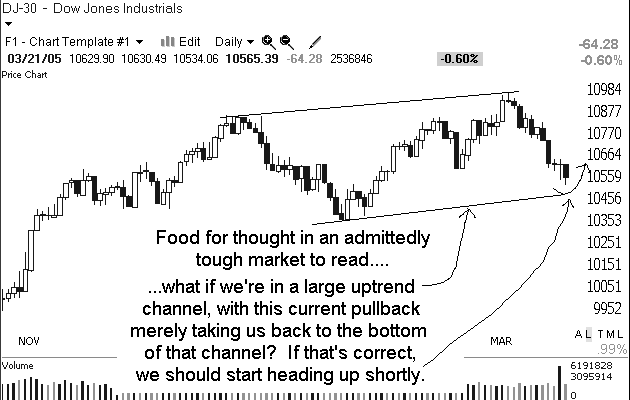

The interest rate decision at 2:15 p.m. EST comes at a time when the market is quite technically vulnerable. The major indices have all recently cracked support and have been acting very poorly in recent days. Breadth has been very negative and the bounce attempts have been lifeless. A surprise move by the FOMC in an already weak market environment could produce some real drama for traders.

So how likely is it that the FOMC will adopt a more hawkish posture toward inflation? Probably fairly low but it isn't such a wild idea that the market is ignoring the possibility. There clearly is some commodity inflation in this economy but whether that signals a more pervasive problem is debatable.

We have to consider the other side of the coin as well. If the FOMC does not drop the "measured pace" language will that calm interest rate and inflation worries and boost the market? Maybe, but the condition of this market is so weak at the moment that nonaction by the FOMC is unlikely to be the cause for a lasting reversal.

Once again we have to stay very focused on defense. Until we see something to indicate otherwise the trend is down, we need to respect that. The FOMC is unlikely to do anything to help out the bulls.

We have a shaky start this morning. Overseas markets were weak, oil steady and the dollar pulling back.

Be careful out there.

Gary B. Smith:

-

Gapping Up

WYE +2.9% (guides Q1 EPS above consensus), OVTI +7% (key design win from handset maker), TASR +7% (introduces new air cartridge), CTIC +5.4% (initiates Phase 3 trial for Xyotax), CY +5.4% (UBS upgrade), WGAT +4.4% (reports Q4), STTX +4.3% (guides higher), AGIX +4.2% (Needham upgrade), SDS +3.6% (extension of 25% move yesterday on takeover talk), LEN +3.5% (reports FebQ), NTGR +3.3% (started with a Buy at Smith Barney; tgt $20), BOOM +2.5% (extension of 23% move yesterday), UNP +2.4% (guides higher).... Stem cell stocks higher on CNN.com story: ASTM +10.4%, STEM +10.3%, VIAC +4.9%, GERN +4.6%..... Under $3: UHCP +49% (Heritage Food Group spin-off), ELTK +30% (reports Q4), EIDSY +21% (to be acquired -- WSJ).

Gapping Down

ERTS -13.4% (guides lower; down in sympathy: ATVI -5.5%, THQI -5.2%, TTWO -5.1%, ELBO -3.9%), GDYS -10.6% (guides lower), NRG -2.4%, RETK -2.4% (to be acquired by Oracle; ends bidding war with SAP; apparently market not happy with the price), GM -2% (mentioned in WSJ).... Small cap momentum energy names seeing some profit taking: USEG -4.7%, FUEL -2.9%, ABLE -2.8%, GEOI -2.1%. -

Oodatult tõstis Fed intressimäära 0,25% võrra. Ja paistab tõstmist samas tempos jätkavat.