Börsipäev 26. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

Jury's Still Out on This Market

4/26/05 8:36 AM ET"The more unpredictable the world is the more we rely on predictions."

-- Steve Rivkin

The stock market is always difficult to predict but the recent increase in volatility and the very light volume has set up the likelihood that a big surprise lurks in our future. In an uncertain market like we have now the inclination to make predictions rises steadily. Although there is little directional information in the market there seems to be more strong opinions about where we are headed than usual.

It is human nature to seek out certainty. We want to create order out of confusion and not sit by idly as we wait for clarity. So the longer the market continues to act randomly and without any real character the more inclined we are to start staking out a position on where things are headed.

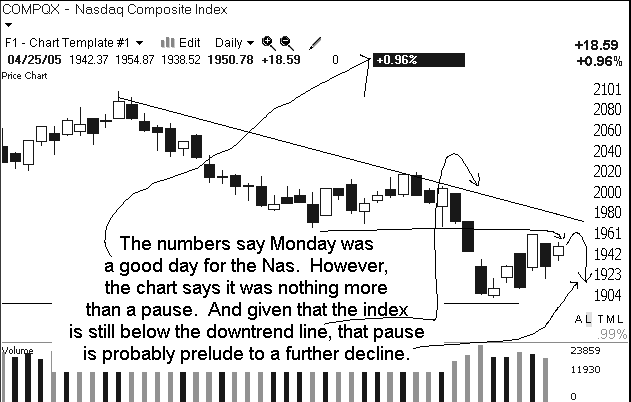

Despite the strong desire to have an opinion about this market we need to continue to be open-minded. There is little hard evidence that a tradable move is upon us. The market has acted better the last few days but only grudgingly so, and buyers are not embracing this market. They are sticking a toe in to test the temperature, but they continue to harbor substantial doubts.

Until we start seeing a higher level of confidence in the form of better volume, the chances of quick reversals and substantial volatility are very high. Low-volume rallies like we had yesterday are the perfect setup for a quick pullback.

Although there is probably a strong desire to adopt a more firm opinion about where the market is headed in the near term, there isn't enough evidence to do so. If the market really is ready to make a turn there will be plenty of time to hop on board the express train to Nasdaq 5000.

We have a shaky start this morning. Overnight earnings reports were not particularly upbeat with several technology stocks issuing less-than-glowing reports. Overseas markets were down slightly. Crude oil slipped slightly lower again and gold was making an upward move.

Gary B. Smith:

-

Gapping Up

Gapping up on strong earnings/guidance: LIFC +10%, BMHC +8.3%, DASTY +6.1%, COGT +5.1%, BYD +4.9%, PVN +4.7%, CFC +4.5%, IFLO +4.2%, ISSI +4.2%, X +3.4%, ALTR +2.3% (also UBS upgrade), IMCL +1.8%.... Other News: DNA +8.4% (positive Phase III Herceptin data, up in sympathy: PDLI +3.2%), PECS +35% (to be acquired by Nortel), INCX +7.8%, SIMG +7% (co's CFO becomes a director), POZN +6.3% (extends recent rally), MSTR +5% (2 upgrades).... Under $3: RDCM +14% (reports Q1), SMRA +11% (reports Q1), VVUS +9% (Announces Promising Results of Avanafil Nitrate Interaction Study), OSCI +8%.

Gapping Down

Gapping down on disappointing earnings/guidance: INTX -39% (also Smith Barney and Deutsche downgrades), ZOLL -18%, ATHR -15%, FBR -13%, SLAB -12%, LXK -10% (down in sympathy: HPQ -3.5%), HYDL -10.5%, MVK -9%, NTY -7%, INFS -6.6%, TARO -6.4%.