Börsipäev 27. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Gapping Up

Gapping up on strong earnings/guidance: MPAC +21%, ITRI +13% (also JP Morgan upgrade), NVTL +7.6%, LCAV +7.1%, NTES +4.3%, XMSR +3.4%, ATML +4.8%, WBSN +3.3% (also Wm Blair upgrade), ESI +3.3%, GLW +2.9%, BHI +2.6%, ESRX +2.5%, WLP +2.2%... Other News: WLS +10% (CEO proposes buyout), AX +2.6% (announces new market making program), CSCD +12% (JP Morgan upgrade), USEG +3.4%.

Gapping Down

Gapping down on disappointing earnings/guidance: INSP -20% (also multiple downgrades), AMZN -6%, INTL -16%, CNCT -15% (also Jefferies downgrade), BWLD -12% (also BB&T downgrade), COCO -11%, DFIB -9.5%, PLUG -4.8%, NEM -4.2%, GRMN -2.4%, SEE -2.2%, BA -2.1%.... Other News: PKTR -15%, GILD -4.5% (Truveda update), POZN -4.4% (profit taking after 100% move over last 4 sessions), NVDA -2.2% (started with an Underweight and $20 tgt at Lehman), CRXL -5.9%, CNR -8%. -

Lisaks on tugevalt alustamas ka LHV Pro valik, Select Comfort (SCSS) +7%, pärast tugevaid majandustulemusi.

-

Rev Shark:

Good Rallies Aren't Just One-Day Affairs

4/27/05 8:44 AM ET"Patience is waiting. Not passively waiting; that is laziness. But to keep going when the going is hard and slow -- that is patience."

-- Unknown

We have been in a market environment for a while that takes a great emotional, not to mention financial, toll on most market participants. The see-saw action, lack of follow-through, low-volume patterns, and lack of trading opportunities sap us of energy and optimism. The worst part of this market is that we want to do something productive and are inclined to jump in simply to escape the tedious waiting.

What we need to keep in mind is that the grinding, difficult action is the market's way of testing us. The market will always look for ways to disappoint as many people as possible. Sometimes it is through rallies or downtrends that last longer than seems reasonable; other times it is through quick moves and wild volatility that leave us leaning the wrong way. We are experiencing some increased volatility now but the real frustration of this market is that it is so difficult to do anything substantial.

One of my favorite sayings about the market is that it doesn't scare you out, it wears you out. That pretty much sums up the environment. Sentiment continues to erode as the serial bottom callers are frustrated. The overanxious bulls have been punished for trying to put their money to work, but they are getting so tired of waiting that they justify doing it again by proclaiming that negativity is at an extreme.

Trying to call in a bottom in this market by measuring the level of negative sentiment is an extremely difficult task. Sentiment is a slippery thing and even if you can accurately measure the feelings of market participants you still have to figure out if those feelings have caused them to take action.

My sermon remains the same. There is no reason to be highly anticipatory in this market. When a solid turn comes there will be plenty of time to join the rally. Good rallies last weeks or months, not a day or two.

Economic reports are hitting. Durable goods is very poor and the prior month is revised down also. It is interesting that we have this report after the strong housing number yesterday. Stagflation is going to be something we will hear more about if housing prices are going up and demand for durable goods is weak. This is a very tricky economic environment and that is why the stock market is such a mess as well.

We have a weak open on the way.

Gary B. Smith:

-

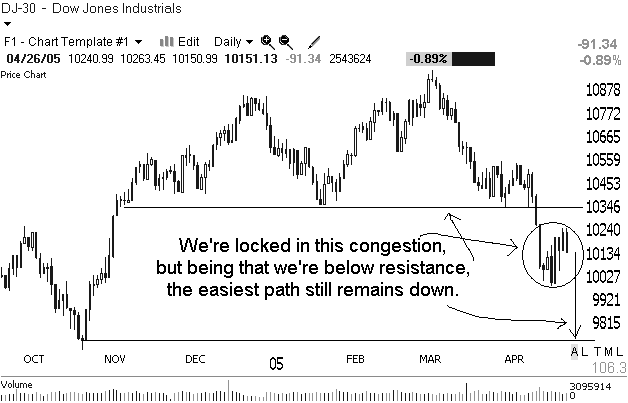

Avaldatud USA kütusevarude info kukutas naftahinda praegu -1.5%, aktsiatele veidi tuge. Kuid miinuses oleme siiski endiselt. Avalöögis näidatud 10 päeva graafikul oleme uue põhja teinud ja see negatiivne märk.

-

Nafta tuleb veelgi allapoole ja turg juba plusspoolele jõudnud. Väga oluline see kuidas päev lõpetatakse.

-

Turg päeva viimasesse tundi läheb üsna tugevana, üheks põhjuseks short-covering enne neljapäevast USA GDP-d.

-

Nafta hind samuti toeks, päevaga langes barreli hind üle 4%.