Börsipäev 11. mai - YHOO, NAPS ja AAPL

Kommentaari jätmiseks loo konto või logi sisse

-

GOOG tehniliselt päris ilus, $225 jäi eile püsima ja täna taas tippude juures.

-

Eile päris oluline uudis Yahoo!-lt (YHOO), Yahoo! Music Unlimited teenus pakub 5-7 USDi eest kuus piiramatult muusikat laadida. Napster (NAPS) ja Apple (AAPL) küsivad iga loo eest ligemale dollari ja NAPS igakuine tasu on $15 juures. Mõlemad viimatinimetatud täna ka miinuses (vastavalt -31% ja -3.3%).

Miinuseks näiteks see, et Yahoo süsteem toetab kõiki teisi MP3 mängijaid peale iPodi, ilmselt Apple lihtsalt ei luba. iPod turuliider ja seega Yahoo süsteemi korralik miinus. Siiski on konkurentidele Yahoo odav teenus löögiks, marginaalid ilmselt vähenevad. Kahtlemata huvitavad ajad digitaalse muusika turul. -

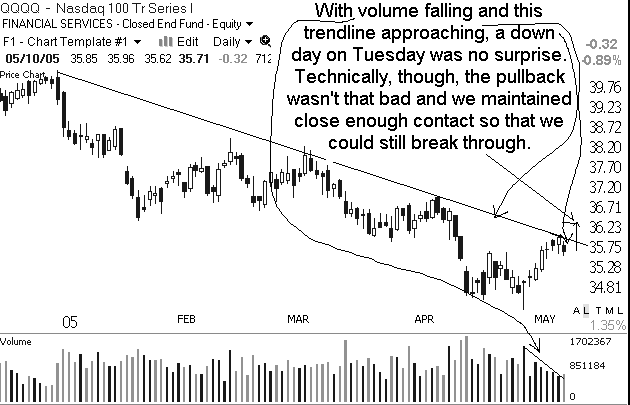

Rev Shark:

The Advantage for Now Is to the Bulls

5/11/05 8:14 AM ET"Courage brother, do not stumble, though thy path be dark as night: There is a star to guide the humble, Trust in God, and do the right."

-- Norman Macleod

The market has put together a fairly good rally since bottoming April 29 but stumbled badly yesterday. It was the first day of distribution since this move started and was accompanied by poor breadth. Although it was a poor day it wasn't bad enough to kill the rally the market has been working on for the past 10 days or so. In fact, some would say a pullback that traps overanxious bears and shakes out weak bulls is necessary before the market can move higher.

The primary excuse given by the media for the pullback was large losses at big hedge funds. As is so often the case the news hit at the same time that the market was somewhat extended and technically vulnerable. The market was ready for a correction so it went looking for a reason, and speculation about hedge fund problems related to investments in General Motors (GM:NYSE) was the obvious choice.

That doesn't mean the problems aren't real but it is a good illustration how the market tends to regard "news" as the technical situation evolves. News is often a product of the market environment rather than inherently bad or good.

The question we confront now is whether yesterday was just a healthy pullback within an emerging uptrend or the first crack in yet another failed rally. My tendency is to give the benefit of the doubt to the bulls for a few reasons.

First are the technical reasons cited above. Uptrends are allowed an occasion day of distribution. This "uptrend" hardly deserves the name because it is in such an early stage, but there has been some genuine improvement in the way stocks have acted recently. The pullback yesterday did not kill this trend.

Second, market sentiment continues to be extremely negative, which is a bit surprising given that we have rallied for a bit. With a good amount of money on the sidelines I feel the conditions are ripe for the market to climb that wall of worry.

Third, the big worry fundamentally is talk of "stagflation." The market seems to have resolved itself to the fact that the Fed is going to continue with its interest rate hikes for a while. Any indication that the Fed may become less hawkish will be a big boost to the market. I don't expect that to happen for quite a while but some weakness in oil or economic stats may help matters.

The bulls definitely have their work cut out for them: They have seasonality working against them and a lot of fundamental issues. If nothing else it should be a good battle.

We have a positive open shaping up as talk about China floating its currency makes the rounds. Oil is dipping and overseas markets were mostly weak.

No position in stock mentioned

Gary B. Smith:

-

RNWK samuti ca -20% YHOO uudise peale.

-

Paistab, et drugstore.com (DSCM) ostusurve on läbi ning nüüd istub suur müügiorder $3 juures. Täna ei ole sealt hind alla läinud. Tasub $3 tasemel silma peal hoida - eile murti ka korraks, kuid hiljem kosus kiirelt.

-

Aaple (AAPL) juba -8% miinuses.

-

Apple-ga koos saavad pihta ka PLAY (-4,6%) ja ADBL(-4,6%)

-

Reuters: WHITE HOUSE is being evacuated

-

12:07 White House and Capitol building being evacuated - DJ

-

räägitakse mingist lennukist piirkonnas, turg väga volatiilne.

-

REUTERS U.S. HOMELAND SECURITY OFFICIAL SAYS FIGHTER JETS SCRAMBLED, AIRPLANE WITHIN 3 MILES OF CAPITOL

sB -

12:16 CNN reports that jets fired two warning flares at plane; CNN also reporting site of single-engine plane

Praeguseks kinnitatakse juba, et peaks kontrolli alla olema, turg selle uudise kukkumise juba tasa teinud. -

Graafik, mitu minutit siis Reuters'i meestel eelist oli? Briefingus tuli uudis 12.07

-

Apple (AAPL) kohta - UBS arvas hommikul, et Yahoo! uudisele on ülereaktsioon ja tegemist on väga hea ostuhetkega, kuulda on, et Goldman Sachs on praegu arvamust avaldanud, et nemad Apple't praegu ei ostaks.

-

Ram, 12.05 oleks uudise ilmselt kätte saanud.

-

2 kuud tagasi härrad analüütikud leidsid, et langemine 40 kanti on hea ostukoht ;)

-

12:36 BBI Blockbuster: CNBC reports Carl Icahn and 2 dissidents elected to Blockbuster Board in prelim. vote (10.14 +0.31)

Netflix (NFLX) hüppas uudise peale terve punkti. Idee hüppe taga on see, et tõenäoliselt Carl Icahn ei luba BBI-l nii suurelt NFLX-ga konkureerivasse internetiärisse panustada, vaid püüab pigem raha väljavoolu takistada. Vesi NFLX'i veskile.

Üldiselt näevad ka analüütikud vist Ichani valimist positiivses valguses. Lehman Bros oli peale uudist väljas kauplemiscalliga, pakkudes, et BBI hüppab lähiajal üle $11 tasemete. Saab näha.

sB