Börsipäev 17. august

Kommentaari jätmiseks loo konto või logi sisse

-

Rev Shark:

That Cheap Stock Might Be Cheap for a Reason

8/17/2005 8:05 AM EDT"Temptations, unlike opportunities, will always give you many second chances."

-- Orlando A. Battista

Bargain stock prices are always so tempting. When the market struggles, like it did yesterday, and some of our favorite stocks pull back sharply, it can be very difficult to resist what seems to be a great opportunity to buy cheap. But the stock market has a tendency to make today's bargain prices look grossly inflated as a downtrend deepens.

One of the easiest mistakes to make in the market is to assume that because a stock is down substantially it can't go much lower. It is surprising how often what looks like a terribly mispriced situation is simply the market knowing something that is not on the news wires and that you don't know about.

If you are going to be a bargain hunter in a downtrending market the key is to be patient in your accumulation, and leave plenty of room to average in further should the target of your affection continue to languish. In many cases the best strategy is to wait until a stock starts going up and average your basis up rather than down.

If you are thinking of giving in to the temptation of bargain hunting keep in mind that this is a very poor market environment now and the likelihood is that we are not ready to bottom and turn back up. We may well see an oversold bounce, especially following generally good earnings reports from Hewlett-Packard (HPQ:NYSE) and Applied Materials (AMAT:Nasdaq) but this market is damaged technically and can't be trusted to produce lasting upside momentum.

The ability of the market to build on good earnings from HPQ and AMAT will tell us something about how sick this market might be. If the opening strength reverses quickly, that does not bode well. One other tip-off about the health of this market will be retailers, which have had a slew of bad news. The latest is the poor report from high flyer ANF, which is down sharply and joins the ranks of other retail disappointments such as FD, DKS, BEBE, KSS and even the behemoth WMT.

We have a slightly positive start shaping up. Asian markets were mixed overnight while Europe was mostly negative. Oil is down just a tad and gold is pulling back.

No positions in stocks mentioned

Gary B. Smith:

-

The U.S. housing boom may be set for a stumble, because first-time buyers are finding it increasingly difficult to get in. In the U.K., home prices leveled off about 6-9 months after first-time home buyers had dropped out of the market (top panel). We do not have data on first-time home buying activity in the United States, but anecdotal evidence suggests that these buyers have been shut out in some regional markets. Housing affordability has slumped and the recent dip in the U.S. rental vacancy rate may be an indication that potential first-time buyers are increasingly opting to rent instead. These could be early warning signs that the housing boom is in late innings .

BCA Research, august 17, 2005

-

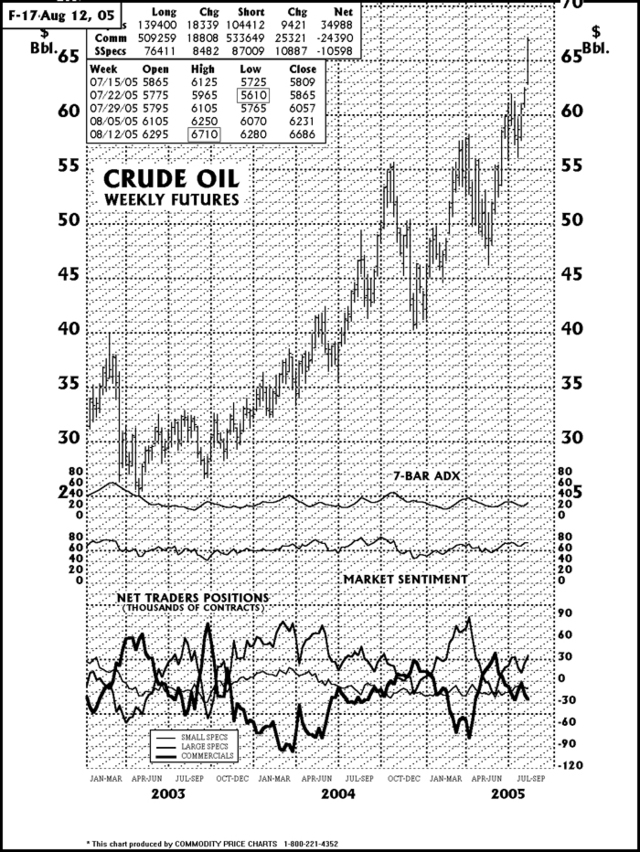

Commercialid pigem pöördumas karuseks. Suured spekkajad vastupidi.

-

RGEN Repligen may have a hidden catalyst ahead

RGEN has been strong lately, partly because of improving performance of its core marketed products. But there may be another catalyst on the horizon as Bristol Myers (BMY) is expected to receive news from the FDA regarding Orencia (abatacept, CTLA4-Ig) novel infusion agent for the treatment of rheumatoid arthritis (RA). Orencia is indicated for patients that have failed therapy with anti-tumor necrosis factor (TNF) drugs like Enbrel, Remicade, and Humira. The FDA recently announced that an Arthritis Drugs Advisory Committee meeting is being held on Sept 6 to review Orencia. The rolling NDA was completed in March, and the drug has been given priority review status at FDA. The PDUFA date is scheduled for Sept 16. Analysts are generally positive, with approval nod expected from the Committee on Sept 6... Where does RGEN come in? Repligen claims it owns the exclusive rights to an issued U.S. patent that covers the use of CTLA4-Ig for the treatment of various autoimmune diseases, including rheumatoid arthritis and multiple sclerosis. The co faced BMY in court over the patent but received an unfavorable ruling in 2003, which was then appealed. The final decision is likely due some time this year. In case of a favorable ruling, RGEN could be in for some royalties on BMY's product. With RGEN's market cap at $94 mln and Orencia's peak sales at over $1 bln, the shares could have hefty upside potential if the aforementioned appeal is decided in its favor. -

Kes on HEXil maakler OPS?

-

Optiva pank ?

tegelikult kohalik soome oma Opstock Pankkiiriliike Oy -

http://www.hex.com/eng/brokers/

Opstock Ltd (OPS) http://www.opstock.fi

-

allrighty, õnn on tulnud minu õuele....

Redskins Owner Snyder Launches Battle to Control Six Flags

The brash young owner of the most valuable team in pro football is teaming up with the brash young programming chief of the most dominant network in sports television.

Their goal: creating a new entertainment power, with theme-park company Six Flags Inc. as its first target.

Daniel Snyder, the 40-year-old principal owner of the National Football League's Washington Redskins, yesterday initiated a shareholder proxy contest to gain control of Oklahoma City-based Six Flags. He has hired Mark Shapiro, 35, the executive vice president of programming and production at Walt Disney Co.'s ESPN, as chief executive of a private investment company, Red Zone LLC, that will pursue Six Flags and other entertainment properties.

Mr. Snyder is seeking to control three of seven seats on the board of Six Flags, oust the company's top management and increase his ownership stake to 34.9% from its current 11.7%. To reach that level, Mr. Snyder is making a tender offer of $6.50 a share for 22 million Six Flags shares, for a total cost of roughly $140 million. People familiar with the effort said the takeover attempt is limited to less than half of the board and shares to prevent the company from triggering defensive "poison pill" provisions embedded in both its stock and debt designed to thwart a takeover.

Six Flags, in a statement, said it would "communicate with Six Flags' stockholders in due course."

Six Flags bills itself as the world's largest regional theme-park company. It owns or operates 28 parks in the U.S., one in Mexico and one in Canada. Attendance at Six Flags parks totaled 33.5 million in 2004, second only to Disney's, and revenue totaled $1.04 billion. The company has a market capitalization of $511 million and $2.6 billion in debt and preferred stock. But Six Flags has lost money for six straight years and its share price has plunged since topping $40 in 1999. Yesterday in 4 p.m. New York Stock Exchange composite trading, Six Flags closed at $5.49, up 47.5% from a 52-week low of $3.72 in May.

While much of the theme-park industry has struggled with rising travel costs and the lingering effects of Sept. 11, Messrs. Snyder and Shapiro in interviews criticized Six Flags as poorly run and out of touch with popular culture. They said they had visited Six Flags parks and found long lines, inadequate parking and poor customer service.

Messrs. Snyder and Shapiro say they want to integrate celebrities from mainstream and extreme sports, popular music and film into the theme parks. They envision more tie-ins with cartoon characters, children's toys and electronic-game makers. "I look at Six Flags as a tired, damaged brand...with illustrious assets that can be transformed into a family-entertainment company," Mr. Shapiro says. They didn't rule out investments in television, film and other entertainment media. "Who knows what it can be?" Mr. Shapiro says.

The two men, who got to know each other through dealings between the NFL and ESPN, have displayed ambitions beyond running a theme park. When Mr. Snyder was in his 20s he built a marketing and advertising company with 12,000 employees that he took public in 1996 and sold in 2000 for more than $2 billion. When he acquired the Redskins, he was -- and remains -- the youngest team owner in the NFL.

Mr. Snyder has been one of the most aggressive marketers in the NFL, blanketing brand names in every nook of the team's home FedEx Field. He has vastly increased the Redskins' sponsorship and advertising base, and moved the team to the top of the league with about $250 million in annual revenue. A waiting list for season tickets stands at 140,000, with each eligible for multiple tickets.

At the same time, Mr. Snyder has cycled through expensive, marquee-name coaches and players who haven't panned out, alienating some fellow owners and fans. The Redskins haven't made the NFL playoffs since the 1999 season. Similarly, Mr. Shapiro, who joined ESPN as a production assistant in 1993 and rose rapidly, has a reputation as an innovative programmer whose cockiness can rub people the wrong way.

With sports-rights fees rising, Mr. Shapiro pushed ESPN's entry into entertainment programming. His first attempt at a drama, the football series "Playmakers," was a ratings success but was canceled after one season amid criticism from the NFL. His decision to hire Rush Limbaugh for ESPN's NFL pregame program backfired after comments by Mr. Limbaugh that were perceived as racist.

Mr. Shapiro also was active in negotiations with major sports properties, including ESPN's decision earlier this year to pay $1.1 billion annually to retain the NFL. Mr. Shapiro, who about a year and a half ago turned down an opportunity to run ABC's entertainment division, also recently was approached for a top job at NBC News. He had one year left on his ESPN contract but is being released early by Disney. Mr. Shapiro says he will stay at ESPN until Oct. 1.

The hiring of Mr. Shapiro isn't contingent on acquiring Six Flags, Mr. Snyder says. Red Zone intends to explore acquiring other entertainment properties, but the initial focus is Six Flags, he says. Drawing a parallel to the former longtime head of Disney, Michael Eisner, Mr. Shapiro says, "when he arrived at Disney, it was primarily theme parks with a historic past of great characters and animated films."

Mr. Snyder began acquiring Six Flags stock a year ago. At the time, he said he hoped to "influence management" to boost the company's value. In a meeting with Six Flags executives last year, Mr. Snyder says he requested a board seat and suggested replacing the company's management, but was rebuffed.

He then went on the offensive. He wrote a letter to an independent director saying the board was protecting "underperforming management." Six Flags, he wrote, relied on a "misplaced capital expenditure plan, an overly expensive advertising campaign and a flawed guest-service enhancement program." In recent weeks, Mr. Snyder and Red Zone acquired about 1.5 million Six Flags shares and began planning a takeover. "I grew frustrated with them," Mr. Snyder says.

His plan is no sure thing. To unseat the board members, he first must win the consent of more than half of Six Flags' outstanding shares, whose major holders also include Microsoft Corp.'s Bill Gates and the hedge fund SAC Capital Advisors. Even if that proves successful, he would control only three of seven board seats. A majority would be needed to install himself as chairman and Mr. Shapiro as chief executive.

Six Flags shareholders must decide whether the 18% premium offered by Mr. Snyder is enough to essentially cede control of the company. Even if they endorse Messrs. Snyder and Shapiro, they may object to the fact that Mr. Snyder is purchasing a minority stake rather than the entire company.

Mr. Snyder is hoping to replace on the Six Flags board the company's chief executive, Kieran Burke, its chief financial officer, James Dannhauser, and Stanley Shuman, from the investment bank Allen & Co. Mr. Snyder says he hopes shareholder support would encourage a fourth director to come around to his vision for Six Flags. "I'm not a corporate raider. I'm an operator," he says.

PKS järelturul juba $6.20. -

Google uus emissioon tulekul

In today's S-3 filing, GOOG registers 14,159,265 shares of Class A common stock. Co plans to use the proceeds for general corporate purposes, including working capital and capital expenditures. In addition, co may use proceeds for acquisitions of complementary businesses, technologies or other assets. Co has no current agreements or commitments with respect to any material acquisitions. The offering is being managed by Morgan Stanley, CSFB, and Allen & Co.

-

GOOG -12 punkti.

-

head uudised PKS-i fännidele

-

veel paremad PKS-i investoritele! :)