Börsipäev 30. november

Kommentaari jätmiseks loo konto või logi sisse

-

WMT Wal-Mart Nov same store sales decrease 0.1%, in-line with company preannouncement (46.89 )

"Of our five key focus areas -- electronics, home, apparel, food and pharmacy -- we are posting strong results in electronics, food and pharmacy. Comparable store sales in food were in the mid-single digits," said Eduardo Castro-Wright, president and ceo, Wal-Mart Stores Division U.S. "As I discussed at our October analysts' meeting [October 23, 2006], the home and apparel business is challenging and this will continue throughout the fourth quarter. While we were disappointed in these areas, we did see strong results in our home and apparel basics." Co sees December same store sales of 0-1%.

Võrreldavate poodide müüginumbrid 4-nädalisel perioodil seisuga 24. november 2006

Wal-Mart Stores -0.5%

Sam's Club 2.0%

Total U.S. -0.1% -

SCSS on suurepärane näide täna sellest, kuidas housing sektor mõjutab jaemüüjaid, tarbijat ning tööturgu.

Realmoney.com: Considering that the real estate industry has been responsible for 40% of the job growth since 2001, the rise in home prices has provided for 70% of the increase in household net worth since 200... -

Kelle portfelli kuuluvad YHOO, GOOG või EBAY, siis soovitan lugeda järgmist artiklit.

-

Detsembri suhtes andis WMT SSS-numbrite sihiks 0% kuni +1.0%.

Wal-Mart said it sees U.S. same-store sales flat to up 1 percent for the five-week December period. If the retailer hits the midpoint of that range, it will mark Wal-Mart's worst December same-store sales performance since the retailer posted growth of only 0.3 percent in December of 2000, according to Thomson Financial. -

Shark pakub välja ühe stsenaariumina, et raha on liikumas energia ja metaalide aktsiate poole, kuna need pole võrreldes tehnoloogiaga kaugeltki niivõrd üleostetud. Madalaid P/E suhteid energias olen varemgi rõhutanud ning sedapuhku toob ka Shark selle välja kui ühe põhjuse, miks suuremad fondid võiksid neist sektoritest huvitatud olla.

A Shift Out of Extended Tech?

By Rev Shark

RealMoney.com Contributor

11/30/2006 8:40 AM EST

Click here for more stories by Rev Shark

"It is easier to perceive error than to find truth, for the former lies on the surface and is easily seen, while the latter lies in the depth, where few are willing to search for it."

-- Johann Wolfgang von Goethe

Although yesterday's action looked like a continuation of our four-month rally, there were some changes that demand our attention. The point move in the indices was big and breadth very strong but many of the leading technology stocks showed relative weakness while the hot money chased oils, metals and heavy cyclical stocks.

It is possible that this was just a one-day aberration and that we will soon revert to chasing parabolic moves in stocks that everyone -- and I do mean everyone -- love such as Apple (AAPL - commentary - Cramer's Take - Rating) and RIM (RIMM - commentary - Cramer's Take - Rating). On the other hand we would be remiss if we didn't at least examine the possibility that the market is ready to undergo some sort of change in character.

The great likelihood isn't that the indices -- which have been so strong for so long -- are suddenly going to collapse. The more likely course of events is that shifts into new leadership will slowly take place under the surface while the most extended stocks consolidate and look for support. We often have these sort of "rotational" corrections in the market and if you can catch them at their early stages they can be quite profitable. They have a tendency to play out longer than you might think and in a choppy fashion so don't be too quick to dismiss the idea if it isn't smooth.

As I discussed a bit yesterday, I believe there is a likelihood that fund managers looking for performance may be more interested in less extended oils, metals and industrial stocks, which have low PE ratios, good valuations and are far less extended than many of the technology leaders. I believe we could see money come out of technology, semiconductors, retailers and flow into those low-PE stocks as managers look for way to have long side exposure without the risk of owning a tech stock that is up 20% in recent months.

We have a positive start this morning as exporters in Asia gain ground and the dollar weakens once again. Oil is holding steady after a big jump yesterday and gold is trading up sharply. -

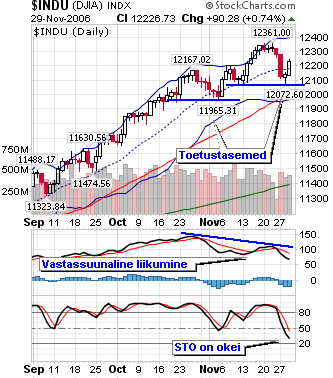

Tehniline analüüs ei ole kõikvõimas, kuid nagu ma eile ütlesin, pole statistikal emotsioonidega midagi pistmist, siis vaatame, mida turg meile eilse kauplemispäeva järel uut on toonud. Eile lõpetasid indeksid oma päeva tippude juures ning taas peame tõdema, et pullidel on pidupäev ning makro on neid kenasti toetamas. Nõus, ma pole ei loomariigi esindaja - ei pull ega karu, kuid tehnilisel pildil kavatsen edasi tuhnida küll, ise visalt uskudes, et aegridadel on mälu.

Tehniline analüüs ei ole kõikvõimas, kuid nagu ma eile ütlesin, pole statistikal emotsioonidega midagi pistmist, siis vaatame, mida turg meile eilse kauplemispäeva järel uut on toonud. Eile lõpetasid indeksid oma päeva tippude juures ning taas peame tõdema, et pullidel on pidupäev ning makro on neid kenasti toetamas. Nõus, ma pole ei loomariigi esindaja - ei pull ega karu, kuid tehnilisel pildil kavatsen edasi tuhnida küll, ise visalt uskudes, et aegridadel on mälu.Näeme, et DJIA on teinud kaks toetuskohta. Eilne tõusupäev on selle tõestuseks. OK, kui pullidel on jätkuvalt jaksu edasi minna, siis on selge, et nad peavad seda tõestama 12 361 taseme kätte saamisega. Seni on seda edukalt tehtud, sest iga järgnev tipp on eelmisest kõrgemal olnud. Juhul, kui eelmainitud taset kätte ei saada, on karud platsis, kaasa arvatud mina öeldes, et "DJIA tegi madalama tipu" :)

Täna on eelturul futuurid plusspoolel, seega positiivne sentiment jätkub. Ka volatiilsusindeks VIX on peale järsku tõusu ja teinud sama järsu liikumise allpoole 50 päeva libisevat keskmist.

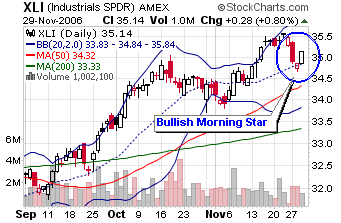

Vaatasin põgusalt erinevaite sektorite graafikuid, kui üldiselt on sektorid üsna positiivsed, siis märkasin, et Industrialsil on kena Bullish Morning Star muster ning põrgatud on 20 päeva libiseval keskmisel.

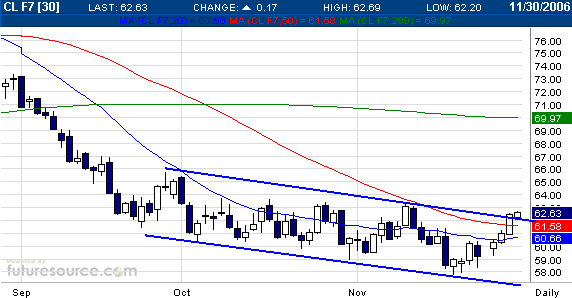

Mida teeb toornafta! Mõtlesin üsna pikka aega, kuhu tõmmata ülemine vastupanu. Ühte võimalust näeb siis juuresolevalt pildilt. Nagu näeme, on Crude murdnud ülespoole kahekuisest kauplemisvahemikust ning ka ülespoole 50 päeva libisevast keskmisest. Lisan allapoole ka pikema, nädalase graafiku, millelt on näha ka kaugust 200 päeva libiseva keskmise suhtes ning viimase nädala hästi kosunud küünalt.

Crude Weekly

-

Ülespoole avanevad:

DRRX +41% (positive phase 1 Results for opioid pain medicine), DGIN +16% (to be acquired by INTU), HEPH +13% (positive clinical data for rheumatoid arthritis drug), DSW +11% (reports OctQ), SNPS +11% (reports OctQ, guides higher), HOTT +8.1% (reports Nov revs, guides higher), MEDX +6.7% (Morgan Stanley upgrade), ECMV +5.3%, VIP +4.1% (reports Q3), IDEV +4%, LTXX +3.6% (Merriman upgrade), ORCT +3.6%, CORI +3.5% (seen as a sympathy play on DGIN), BEAS +2.8%, RMBS +2.6% (technology adopted in Playstation 3), DVAX +1.4% (two firms raises price targets), PFE +1.4% (guides higher, says pipeline is robust), BSX +1%.

Allapoole avanevad:

SCSS -18% (guides lower, citing housing weakness), CNLG -8.5% (momentum stock seeing some profit taking), ZOLT -7.6% (jury decides co must pay damages for breaching a supply agreement), NPSN -5.7% (profit taking after recent run), RNIN -4.6% (momentum stock seeing some profit taking), TIVO -3.8% (reports OctQ; also OpCo downgrades to Sell), ARNA -3.1% (extends yesterday's 5% slide following announcement of a stock offering), RA -2.5% (SLG says it will not raise its bid for RA), EFUT -2.3% (momentum stock seeing some profit taking), NVLS -2.1% (Stifel downgrades to Sell ahead of mid-qtr update on Monday), ADBE -1.8% (initated with a Sell at Amtech, $33 tgt)... Retailers gapping down on disappointing Nov same store sales: BEBE -7.7%, DDS -5.7%, ANF -3.4%, GYMB -2.5%, GPS -2.9% (also Lazard downgrade), JCP -1.7%. -

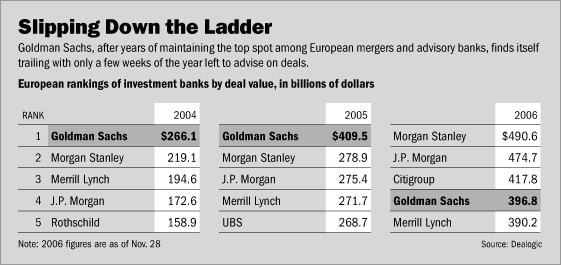

WSJ toob täna välja GS turupositsiooni kaotuse Euroopas:

Despite a deal-making boom, Goldman might end the year below the top spot for the first time since 1998, when it placed second behind Morgan Stanley. With a few weeks left in a year that has seen a record $1.42 trillion of European deals so far, Goldman is ranked fourth in announced transactions.

Goldman on oma tulude mitmekesistamise poolest olnud tuntud juba ammu – olgu siin üheks näiteks eesmärk teenida pool tulust USAst väljaspool. Nüüd siis tundub, et turu kasvust on saadud konkurentidega võrreldes väiksem osa.

Olukorra muudab veel hullemaks see, et

1) Sellel aastal on Euroopa nii tehingute arvult kui mahult ületanud USAt.

2) Goldmani positsioon on tabelis selliselgi kohal ainult tänu sellele, et viimasel ajal on oma nimi saadud lisada tehingute juurde, kus GS nõustamise osa tegelikult minimaale.

3) Olulisel Londoni turul ollakse langenud neljandaks, tagapool DBi, MSi ja UBSi. Eelmisel aastal oldi seal turuliidrid.Samas ei ole kõik veel kadunud. USAs, Aasias ja globaalselt ollakse endiselt esinumber. Lisaks on tehinguid veel pooleli, mis võivad GSi ka Euroopas ettepoole kergitada. Seotud ollakse kaudselt ka näiteks MANi pakkumisega Scaniale, mis aga praegusel kujul Rootsis almighty Wallenbergide perekonna tahte vastu vaevalt läbi läheb.

-

Chicago PMI 49.9 vs 54.5 consensus. Turu reaktsioon alla

-

Natural Gas Inventory fell 32 bcf to 3417 bcf, analysts were expecting a draw of 24 bcf, ranging from a draw of 40 bcf to 5 bcf

Eilsele naftaraportile loogiline jätk, kuid sellest hoolimata on esmase reaktsioonina energiale veel lisajõudu andnud. -

Tehnoloogia ja broker/dealerid on eilsest saadik näidanud võrreldes muu turuga suuremat nõrkust. Üldiselt selline areng turule head ei tähenda, arvestades ka jaemüüjate nõrkust.

-

GSis võetakse asja ilmselt siiski tõsisemalt kui esmapilgul tundus

Goldman Sachs is moving its head of French investment banking from Paris to London to take charge of relationships with some of its largest European corporate clients.

-

GM General Motors: Kerkorian's Tracinda cuts GM stake to 4.95%

GM General Motors: Kerkorian sells 14 mln more GM shares for $28.75/shr -

FCX Freeport-McMoRan CEO says copper industry falling short on output; says copper is fundamentally very tight

-

30. novmebril lõppes siis ametlikult USAs orkaanihooaeg. Lõppenud hooajaks ennustati taas võimast orkaanilainet ning mitmed fondid spekuleerisid naftahinna tõusule. Tulemuseks aga 0 orkaani ning naftahinna langus. Hea aeg kindlustajatele e.g. Allstate Corporation (ALL).

-

Aimar:

"Hea aeg kindlustajatele e.g. Allstate Corporation (All)."

Sa jäid selle lausega ainult 5 kuud hiljaks. -

... oli ju hea aeg?

-

odav nipp väljavabandamiseks... aga hea küll.

mis me siis nüüd selle vana teadmisega peale hakkame? -

ei midagi?

aga ok, ma lootsin vähemalt selleni jõuda, et sa avastad, et ALLis ja teistes oleks vbla aeg hakata kasumit võtma :)