Börsipäev 4. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Polo Ralph Lauren (RL) on nädalavahetusel pullide ja karude haardes. Kuulus lühikeseksmüüja Doug Kass väidab, et on aktsiaid agressiivselt lühikeseks müünud ning näeb õiglast hinda pigem $60 kandis.

Follow Up reports shares of Polo Ralph Lauren (RL) could advance into the mid-80s in the next year or so. At 19x analysts' FY08 earnings estimates of $4.08/share, RL isn't expensive. Its PEG is an appealing 1.18. Some critics, like Douglas Kass of Seabreeze Partners, think the shares will unravel as consumers rein in spending. Kass says he has been "shorting Polo aggressively" on a bet that it will retreat to the low 60s. The hedge-fund manager expects Polo and other upscale retailers to face a downbeat Christmas, as a slowdown in cash refinancing of home mortgages curtails the purchase of high-priced items. Kass also cites "enormous" insider selling, by Chairman Ralph Lauren, among others. Insiders unloaded more than 300,000 shares over the past six months, according to regulatory filings. Polo senior vice president Nancy Murray says most of the transactions are programmed and tax-related selling. "We think the stock is just beginning to enter its appropriate valuation level," she says. "And I stress 'beginning.' " Polo could be energized by new store openings, which are expected to jump to 40 to 50 a year, from 20 to 25. "We firmly believe that [company-owned] retail represents the company's largest growth opportunity," says Credit Suisse analyst Omar Saad, who has an 87 price target for the shares. Some investors might be tempted to follow Lauren's lead and take some profits at current levels. The long-term story is still in place, however.

-

Digitimes reports overall growth in the number of PCs sold in the US retail channel slowed during the Black Friday week of 2006, compared with the Black Friday week of 2005, according to Current Analysis. On year growth for Black Friday 2006 for all PC unit sales was 22.9%, compared to 36.2% during the same period last year. Desktop unit sales were down 7.2% and notebook unit sales were up a robust 51.6%. The Black Friday week is traditionally the highest-volume week of the year for PCs, as holiday shoppers flock to retail outlets to take advantage of deeply discounted systems. The slowing is not all bad news for the PC industry, though, as the notebook category continued its strong performance (notebook unit sales are up 44.8% sequentially so far in 2006).

-

Bank of New York Co. Inc. and Mellon Financial Corp. said Monday they planned to merge to create the world's largest securities servicing and asset management firm. The move will position the merged bank to compete with the likes of Citigroup and JPMorgan for asset management and securities services.

Teise nurga alt - The merger would leave Northern Trust Corp. and State Street Corp. the only major rivals in the low-margin area of securities servicing, which involves the custody of assets for institutional investors.

-

Prudential downgrades Nokia (NOK 19.96) to Neutral from Overweight and lowers their tgt to $22 from $24, based on a slowing handset market, a new handset strategy, a new web-services strategy, the integration of NOK-SI, shifting handset trends to developing markets where new competitors will pressure ASPs, and a pending battle with QCOM

Deutsche Bank lowers their Pfizer (PFE 27.86) tgt to $28 from $33, based on a multiple contraction that will very likely result from the loss of torcetrapib

JP Morgan downgrades Pfizer (PFE 27.86) to Neutral from OverweightMorgan Stanley downgrades Pfizer (PFE 27.86) to Equal Weight from Overweight

Credit Suisse upgrades Vodafone (VOD 26.33) to Outperform from Neutral

Credit Suisse initiates The Charles Schwab Corp. (SCHW 18.02) with an Outperform and a $24 tgt saying the co's transformation is complete. The firm says the co is well past recent years' restructuring efforts—non-core businesses are gone, expenses have been managed down and core franchise growth is accelerating. They believe continued asset gathering, expense control and active capital management should drive 20%+ EPS growth, 30%+ operating margins and 20%+ returns on equity.

Citigroup downgrades Danager Corp (DHR 72.19) to Hold from Buy

AG Edwards upgrades Altera (ALTR 19.58) to Buy from Hold and $24 tgt, based on the resolution of its accounting issues, brought its financial filings up to date and resolved its supply issues

Suisse initiates E*Trade (ET 23.23) with a Neutral and a $26 tgt based on relative return to their tgt. The firm says E*Trade remains ahead of peers in migrating to a more integrated financial services firm—and has been successful in building its trading, investing, lending and banking capabilities onto a single global platform

Credit Suisse believes they are in the midst of a dangerous trading time for many of their hardline retail stocks -- they note that bad news does not send the stocks down for long, as investors assume cheap stocks will be LBO'd thereby protecting the downside. The firm says an example of that last week was the movement in Home Depot (HD 38.97). Despite mgmt's and the Board comments that they have been in no discussions related to a buyout, they say the stock was their best performing retailer on the strength of the buyout stories. They do view HD as in play as they wrote on Friday.

-

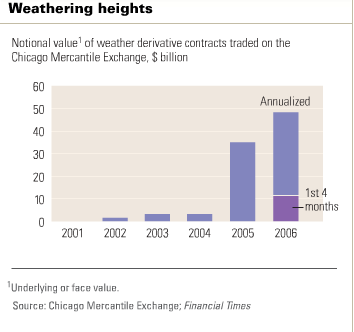

Mõne päeva eest sai ära märgitud, et DB hakkab pakkuma "loodusõnnetuste derivatiive". Siin ettekujutus järgmise kuuma varaklassi arengust:

-

Citi pakub välja omapoolse nägemuse eelmise nädala suurest varude langusest nii toornafta kui ka mootorkütuste osas. Esiteks, toornafta varude kukkumisele aitas kaasa impordi vähenemine 7% võrra ning mootorkütuse vähenemist mõjutas tugevalt veel paljudes rafineerimistehastes jätkuvalt käimasolevad hooldused (utilisatsioon ca 88% ning seega madalaimate tasemete juures alates 1991. aastast).

Eelkõige impordi vähenemisele viidates, pakub Citigroup, et võttes arvesse nafta transportimise pika aja, võib sedasorti efekt tuleneda OPECi tootmise kärpimisest. Kas see ka nii on, või on tegu ühekordse juhtumiga, selgub järgnevate raportite läbi.

Tuletaks veel siinkohal meelde, et OPECi plaanipärane kogunemine on 14. detsembril ning võttes arvesse hiljutist dollari nõrgenemist(mis ‘lahjendab’ nafta hinda), on juba kuulda ka, et võiks oodata veelgi tootmise kärpeid.

---------------------

Eraldi uudisena teatas Baidu.com(BIDU) täna varahommikul, et kavatseb 2007. aastal siseneda Jaapani otsingumootori turule. -

Reedel tuli välja ISM indeks, millest paari sõnaga tahaks siin uuesti lähemalt rääkida. Indeksi näit oli 49.5, kusjuures number alla 50.0 tähendab seda, et tööstuslik tootmine vähenes. Tegu on esmakordse langusega viimase 3 aasta jooksul ning see tõstis õhku taas hirmud, et USA majandus ei pruugi saavutada soovitud pehmet maandumist. ISM number alla 50 on alates 1960st aastast eelnenud kõigile USA majanduslangustele.

"This is just additional confirmation that the economy is not only slowing but quite possibly going into a recession," said Hugh Moore, a partner with investment firm Guerite Advisors. "It's not just the housing and auto industry any longer, now we're finding out that manufacturing in general is slowing."

Moore said an ISM number below 50 has preceded every U.S. recession since the 1960s.

-

Lisan siia sedakorda Sharki reedeõhtuse kommentaari turule, kus ta hoiatab, et sedasorti turg, kus enam mõtlema ja aktsiaid valima ei pea, on läbi saamas.

No-Brainer Market Over

By Rev Shark

RealMoney.com Contributor

12/1/2006 4:46 PM EST

Click here for more stories by Rev Shark

A bout of short-covering in the final 30 minutes of trading took the indices well off their lows, but it was too little and too late to completely undo the damage that was done.

Once again, rotation played out with the oils and drugs advancing while technology stocks lagged. Volume was down probably in part due to the poor weather, but there still was some technical damage done to the indices.

I used the closing bounce to load up a short-side trade in the Semiconductor HOLDRs (SMH), but I also added a few individual longs as well. I believe the heavy upside momentum has been broken now and that it is going to be much tougher sledding going forward.

For a while it has been a "no brainer" market, with some people actually thinking all they have to do to succeed is to buy a stock like Apple (AAPL) or Cisco (CSCO) and ride it into the new year.

The action this week may cause some to rethink that "logic" a little. Of course, the "true believer" bulls always overstay the party, which makes the market sticky to the upside even after it begins to crack.

We have some interesting crosscurrents at work, and that should provide some good volatility for trading. I for one am very pleased to see the parabolic upside move end this week because it will give us much better trading into the end of the year. Straight up moves are great if you like to sit and watch, but not much fun for the active trader looking for high-probability entries.

---------------

Ülespoole avanevad:

STN +17% (receives management-led buyout offer), AGR +14% (to be acquired by LSI), STEC +10% (raises guidance), ISIS +9.5% (speculation that PFE may be interested in acquiring co following its cholesterol trial difficulties, also OSCID +7%), BK +9% (to acquire MEL +5%), CVTX +7.1% (positive clinical data), IOTN +5.3%, COGO +4.7%, GKIS +4.4% (to be acquired by PPC), BYD +4.3% (up in sympathy with STN), OPWV +4.2% (files 10-K which completes stock option review), NUAN +3.8% (positive broker comments from FBR), ENPT +3.8% (extends Friday's 102% move), ABT +3.7% (negative PFE news seen as a positive for ABT), BIDU +3.6% (to enter Japanese market in 2007)... Under $3: IMMU +13% (positive clinical data), TRIS +13% (announces contract), CTIC +8.5% (provides a progress report on its development programs).

Allapoole avanevad:

ONXX -29% (melanoma drug does not meet Phase 3 endpoint), PFE -15% (scraps development of torcetrapib; also multiple downgrades), LSI -7.1% (to acquire AGR), RA -5.5% (CLI withdraws from Icahn investor group to acquire RA), DA -2.8% (Credit Suisse sells 800,000 shares - Bloomberg), LRCX -2.6%, OXGN -2.4% (profit taking after strong run last week), BAC -1.7% (CFO resigns; also Keefe Bruyette downgrade), LPL -1%, Under $3: FMTI -43% (announces disappointing Phase 2 trial results). -

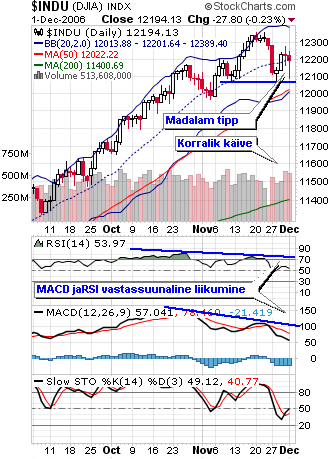

Tänane sentiment on positiivne, lühiajaline pilt aga küllaltki külgsuunas. Investorite hirmuideks VIX avanes täna kõrgemalt, 12 punkti alt, kuid indeksid Nasdaq, DJIA, S&P on ise korralikult plussis avanenud. Reedel tõusis VIX üle 50 päeva libiseva keskmise ning järgmiseks tasemeks võiks ootada 200 päeva libisevat keskmise testimist, mis asub hetkel 13.06 punkti juures. Hetkel näeme küll indeksite enda volatiilsuse raugemist ning oluliste sündmuste saabumiseni liigume arvatavasti kerges külgsuunas. Toornafta jaanuarilepingud on pisut järele andnud, kuid kauplevad 63 dollari all.

Vaadates indeksite mustreid, näeme, et DJIA on teinud madalama tipu keskmiselt suurema käibega. Jätkuvalt on erinevad negatiivsed signaalid ohu märgiks, mistõttu indikaatorite järgi ootaks toetuse murdmist allapoole, Bollingeri alaserva poole liikumist või 50 päeva libiseva keskmise testimist.

-

According to the Inquirer.net, AAPL's iPhone will be carrier independent and very small. The phone will have 2 batteries, one for the phone, one for the MP3 side, a slide out keyboard and a partial touch screen. It will be coming in two variants 4 and 8 gig for $249 and $449.

-

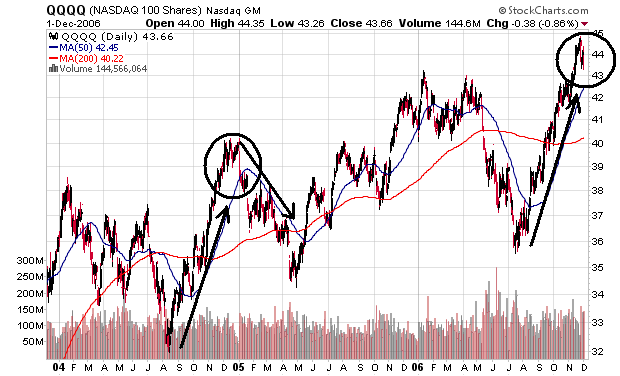

Pakuks siinkohal välja 'Kuubikute' graafiku 2006. aasta lõpu ja 2004. aasta lõpu hämmastava sarnasuse. Ka siis oli tõus väga järsk, kuid olulisi kasumivõtmisi üritati iga hinna eest edasi lükata - esiteks alati on kasulikum suures kasumis positsiooni müüa aasta alguses, et maksude maksmist võimalikult kaugele edasi lükata ning teiseks, on fondid huvitatud, et tootlus väga ära ei vajuks(ja seetõttu on teatud piirini nõus ka languse korral tuge pakkuma). 2005. aasta algaski aga korraliku kasumivõtmisega, mis tõi pea pool aastat kestnud languse kaasa. Ka 2006. aastaga on hetkel võimalik paralleele tõmmata - saame näha, kas kasumit hakatakse aga seekord enne teisi juba enne aastalõppu võtma või oodatakse ikkagi uus aastanumber ära.

-

Eelmine link vist vale, see õige www.ft.com/cms/s/acd9459c-83c8-11db-9e95-0000779e2340,s01=1.html