Börsipäev 29. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Baltic Morning News

2006 - the year of retailers. The three best performing Baltic companies in 2006 all come from retail sector. The top gainer is Tallinna Kaubamaja, which is up 148% year-to-date. This is followed by two other Estonian retailers, PTA and Baltika, which are up 74% and 69% year-to-date, respectively. The loser of the year is Ekranas (TV tubes), down 84% year-to-date (also in bankrupt). The second and the third worst performers are Lithuanian companies Vilniaus Baldai (furniture manufacturer) and Snaige (fridge maker), down by 50% and 30% year-to-date, respectively. All Baltic IPOs this year have gone well: Eesti Ehitus is up 83% since listing in May and Olympic is up 88% since listing in October. The Baltic market starts the last trading day of the year at PER 2006 of 20.0x (Estonia 18.8x, Latvia 20.2x, Lithuania 21.8x), and PER 2007 of 19.2x (Estonia 17.4x, Latvia 21.3x, Lithuania 20.5x).

LASCO to expand its tanker fleet. Latvian Shipping Company (LASCO) announced that they could order another 4 mid-range tankers with total tonnage of ca 200 DWT. In addition, the company has already ordered 14 new tankers (many of them completed in 2007). At present LASCO's fleet comprises 31 product tankers, 5 reefer vessels, 2 LPG carriers, 1 Ro-Ro/general cargo vessel, as well as 3 tankers time chartered in from other ship-owners. LASCO has been selling its older vessels lately and could continue this in the future to finance its new purchases.

Fleet reorganization continues. Tallink said that Rostock-Helsinki route will be extended to Tallinn from January. The company also tried similar routes in the spring (Rostock-Paldiski-Hanko), but changed their plans most probably due to troubles with Finnish seamen union. Given that Helsinki and Tallinn are more attractive locations than Hanko and Paldiski, respectively, the current route could be more successful.

Slight price change for Latvian Gas. As from Jan 1, 2007, tariffs for the customers with annual gas consumption over 25 000 m3 will decrease by 1.4% - 1.8%. Tariffs for the customers with consumption up to 25 000 m3 (stoves, heating of private houses) will decrease by 3.5%, Latvian Gas said. Tariffs are decreased due to drop of oil prices in the world. However, a lot more important is the price increase Gazprom can push through. After that is clear, the company can start tariff negotiations with Public Utilities Commission.

The pay gap between males and females is increasing. According to Estonian Statistical Office, in 2005 the hourly gross earnings of female employees were 25% lower compared to male employees. Compared to 2004, the hourly earnings of males increased by 14.6%, while the earnings of females went up by 11.8% in the same time. However, interesting that such statistics came out at the end of 2006.

-

Hommik on vaikne olnud, kuid suurimad uudised arvatavasti Applelt (AAPL), mis kaupleb eelturul üle 3% plusspoolel. Kuigi esialgu uskusid paljud, et Jobs ei ole asjaoludest teadlik, kinnitab 10-K praegu vastupidist. Iseenesest võiks see lisada kaalu eilsetele kommentaaridele juhiriski osas.

10-K: The independent counsel and its forensic accountants (“Investigative Team”) reviewed the facts and circumstances surrounding stock option grants made on 259 dates. The Investigative Team spent over 26,500 person-hours searching more than one million physical and electronic documents and interviewing more than 40 current and former directors, officers, employees, and advisors. Based on a review of the totality of evidence and the applicable law, the Special Committee found no misconduct by current management. The Special Committee’s investigation identified a number of grants for which grant dates were intentionally selected in order to obtain favorable exercise prices. The terms of these and certain other grants, as discussed below, were finalized after the originally assigned grant dates. The Special Committee concluded that the procedures for granting, accounting for, and reporting stock option grants did not include sufficient safeguards to prevent manipulation. Although the investigation found that CEO Steve Jobs was aware or recommended the selection of some favorable grant dates, he did not receive or financially benefit from these grants or appreciate the accounting implications. The Special Committee also found that the investigation had raised serious concerns regarding the actions of two former officers in connection with the accounting, recording and reporting of stock option grants.

Briefing: AAPL Apple Computer: Details from 10-K (80.87 ) -Update- From today's 10-K: "During the relevant period, the Company made two grants to CEO Steve Jobs. The first grant, dated January 12, 2000, was for 10 million option shares. The second grant, dated October 19, 2001, was for 7.5 million option shares. Both grants were cancelled in March 2003 prior to being exercised, when Mr. Jobs received 5 million shares of restricted stock. With respect to the grant dated January 12, 2000, the Board on December 2, 1999, authorized a special "CEO Compensation Committee" to grant Mr. Jobs up to 15 million shares. The evidence indicates that the CEO Compensation Committee finalized the terms of the grant on January 12, 2000, although the Committee's action was memorialized in a UWC transmitted on January 18, 2000. Because the measurement date is the originally assigned grant date, the Company has not recognized any stock-based compensation expense from this grant. If the Company had determined that the measurement date was the date when the UWC was executed or received, then additional stock-based compensation would have been recognized. The grant dated October 19, 2001 was originally approved at a Board meeting on August 29, 2001, with an exercise price of $17.83. The terms of the grant, however, were not finalized until December 18, 2001. The grant was dated October 19, 2001, with an exercise price of $18.30. The approval for the grant was improperly recorded as occurring at a special Board meeting on October 19, 2001. Such a special Board meeting did not occur. There was no evidence, however, that any current member of management was aware of this irregularity. The Company has recognized $20 million in stock-based compensation expense for this grant, reflecting the difference between the exercise price of $18.30 and the share price on December 18, 2001 of $21.01."

BusinessWeek Online reports long-term growth investor Richard Driehaus of Driehaus Capital Management says the prospects are hot for Green Mountain Coffee Roasters (GMCR). Driehaus calls Green Mountain the "best retail story out there. This is like the razor to Gillette (PG) or the printer cartridge to Hewlett-Packard (HPQ)." Some investors got the jitters when the co reported an earnings hit for its fiscal fourth quarter ended Sept. 30: Net income dropped 37%, to $1.5 mln, or 19 cents per share, mostly because of costs related to its June acquisition of Keurig, which sells single-cup brewing systems. They overlooked that sales zoomed 87% in the quarter, in part because Keurig added $21.6 mln to revenues. Sales have been brisk at Macy's (FD), Bed Bath & Beyond (BBBY), Target (TGT), and Costco (COST), says Mitchell Pinheiro of Janney Montgomery Scott, who on Dec. 6 reiterated his "buy" rating and his 12-month price target of 60. He sees EPS jumping from $1.07 in fiscal 2006, to $1.51 in 2007. Driehaus adds that because the co now roasts, distributes, and sells organic coffee products, its vertical business model will allow it to ink more deals the way it did last year with McDonald's (MCD), which in part credits better sales at 650 of its New England and New York stores to better-tasting coffee. Driehaus figures the stock could quadruple in a few years.

5 oil service names mentioned positively in Weekday Trader: Barron's Online reports exploration and production companies EnCana (ECA) and EOG Resources (EOG), driller GlobalSantaFe (GSF), oilfield-services giant Halliburton (HAL) and services-equipment maker National Oilwell Varco (NOV) all look reasonably priced and should continue producing strong cash flow and earnings. More than half of EOG's natural-gas reserves are in the U.S., with significant projects in Texas. EnCana's North American reserves are in spots including Alberta's oil sands and Rocky Mountain coal beds. These reserves are known and offer opportunity with low risk, and each co is competitive on costs, says Sheraz Mian, an analyst at Zacks Investment Research. While those reserves are not reflected in 2007 earnings or cash flow estimates, their value in the future justifies loftier valuations for each stock, Mian says. Neither stock looks pricey, though EOG is slightly more expensive, trading at 12.1 times estimated earnings for 2007, while EnCana is trading near 10.6 times next year's earnings, according to Thomson Financial/Baseline. Halliburton shares have not rallied along with other international providers of equipment, technology and expertise for rigs. One reason is the co's exposure to North American natural-gas projects where future growth and spending is more uncertain than deep-water plays. "You will see most of the deep-sea drillers show huge [earnings] increases next year," says Donald Hodges, who owns GlobalSantaFe in the Hodges Fund. "They have the financial strength to make additional acquisitions, buy shares or pay larger dividends." Another beneficiary of oilfield-services spending is National Oilwell Varco. The shares are trading at a 25% discount to their 10-year median p/e ratio, based on forward earnings, and a discount to competitors, taking into account the merger that created the co earlier this year, says Geoff Kieburtz, an analyst with Citigroup.

-

Another company founded by Steve Jobs - Pixar, the animation studio - is also being investigated by the SEC over stock option awards but Mr Jobs never received any options himself. Walt Disney, which acquired the company in May, said last month that its board was carrying out an independent review of stock option practices at Pixar after receiving inquiries from the SEC and Justice Department, although it played down any likely financial impact from the issue. Richard Farmer, Merrill Lynch analyst, in a research report earlier this year into whether Steve Jobs might have been involved in options regularities, said: "Our review of Pixar disclosures does not allow us to rule out the possibility, given Jobs was a member of the board that made options decisions, and our analysis suggests these may contain irregularities." His research found that, between 1997 and 2004, four out of seven awards were recorded at the lowest possible price in the fiscal years they were granted - with the odds of this happening by chance being 112m to one. Pixar's compensation committee did not meet between 1997 and 2004 but acted by written consent in two of those years, according to proxy filing

-

Stocks to watch:

- Apple (AAPL) said in an SEC filing that Jobs was aware or recommended the selection of some favorable stock-option grant dates, but didn't personally benefit from it. The company is restating financial statements from 2004-2006.

- AT&T (T) made numerous concessions, including price caps on high-volume data lines, in an effort to win FCC approval of its $85 billion merger with BellSouth by year end.

- Ford (F) is hoping an effort with Microsoft to bring Bluetooth wireless and an in-vehicle operating system into its cars will spruce up its U.S. product portfolio.

- Goldman Sachs (GS) closed its first infrastructure-investment fund with more than $6.5 billion in committed capital. Investments could include toll roads and utilities.

- Ipsco (IPS) cut its fourth-quarter earnings outlook to a range of $3 to $3.10 a share, excluding certain items. The Lisle, Ill.-based maker of steel products had previously forecast earnings in a range of $3.30 to $3.50 a share. The company said it has experienced a larger-than-expected decline in demand for plate and tube shipments in the fourth quarter.

- Marsh & McLennan (MMC) agreed to sell Putnam for $3.9 billion to Power Corp. of Canada as part of CEO Cherkasky's effort to retool after a share-trading scandal.

- Sprint (S) is close to choosing Nokia as its third network-equipment provider for its planned nationwide WiMax wireless system.

- Standard Motor (SMP) said it has sold a majority portion of its European Temperature Control unit to a current manager of the business. The proceeds from the sale are $3.1 million, and the company will incur a loss on the divestiture of $3 million to $4 million in the fourth quarter.

- Ternium (TX) said it has acquired CVRD International S.A.'s 4.85% stake in Siderar S.A. for $107.5 million. Luxembourg-based Ternium said it paid a discounted price of $6.376 a share for CVRD's stake, increasing its ownership in Siderar to 60.93%. CVRD International is a unit of Companhia Vale do Rio Doce (RIO).

Market Summary- Asian trading closed with the Hang Seng -0.19%, Nikkei +0.01%, Sensex -0.43%, Shanghai +4.20% and Taiwan +1.17%.

-

Shark'i sedakordne lühimõte pärineb Jaapanist. Sügavasisuline ja tuleb enda jaokski tuttavaid situatsioone ette.

The Market's New Year Gift: Start Over

By Rev Shark

RealMoney.com Contributor

12/29/2006 8:08 AM EST

Click here for more stories by Rev Shark

"When you have completed 95 percent of your journey, you are only halfway there."

-- Japanese Proverb

Although our market journey for 2006 may nearly be over, our preparation for what lies ahead has barely begun. One of the great things about the stock market is that you can have a fresh start any time you like -- simply sell your holdings and start over.

What is even better is that you can be certain that there will be money-making opportunities in the future. As long as you have capital, there will be chances to find good trades or investments.

As we relegate 2006 to the record books, we might reflect on the lessons learned, the mistakes made and the opportunities squandered, but no matter what happened we can take solace in the fact that we can wipe the slate clean and begin the battle anew. There is no way to know what lies ahead, but if you are patient and stay vigilant, you will have plenty of chances to profit. It truly is a remarkable thing that we have so many fantastic opportunities day after day. We simply need to make sure that we have capital to work with and nothing can stop us.

Too many market players fail to understand that opportunities in the market are a function of our flexibility and not the market itself. You can have a great year even if the market declines. It is up to you and the only thing that can stop you is if you allow yourself to be sucked into close-minded thinking. Keep your mind open about how the market will unfold and you will always have the potential for great success.

We have a quiet morning with little news on the wires. Action is mixed with a slight negative bias. The Nasdaq has confirmed that it will be closed on Tuesday but management at the NYSE, which has little repeatedly shown its disrespect for the working man, has yet to comment. -

Ülespoole avanevad:

ALTI +5.8% (announces shipment of first 10 batteries to Phoenix), RICK +5.3% (continues yesterday's momentum), NAPS +4.8%, ZOLT +4.7% (following co's Q4 conference call), LWSN +4.5%, CHA +4.5% (continues momentum), AAPL +4.2% (files 10-Q & 10-K with details regarding options grants), AT +3.8% (WSJ article reports private-equity firms are interested in co), CY +2.6% (EETimes reports a hedge fund is urging co to go private), CHINA +2.0%, (China stock momentum), TASR +1.2% (co announced orders before the close yesterday, Merriman made comments this morning).

Allapoole avanevad:

BDY -12.0% (Boca Pharmacal gets approval for generic Pamine tablets), CMED -11.8%, BULK -7.8% (announced program for early exercise of warrants), MFN -6.7%, EDGR -5.8%, ENCY -2.7% (continuation of yesterday's weakness). -

Aasta viimast kauplemispäeva on kena lõpetada pikema tehnilise pildiga. Samasuguse pikema pildi panin foorumisse ka kuu aega tagasi. Näeme, et Nasdaq on teinud põrke ja pikaajalise vastupanutaseme. Indeks on liikunud alla 50 päeva libiseva keskmise juurde. Üldiselt on aasta lõpud positiivsed, kuid kauplemine jääb üha õhukesemaks ning indikaatorid räägivad kohe ka teist keelt. 2006. aasta lagus oli ilus ja jätkusuutlik kuni maikuuni, kui nägime teravat kukkumist, peale mida tuli pikaajaline taastumine - samasugust mustrit näeme ka 2004. aasta lõpus.

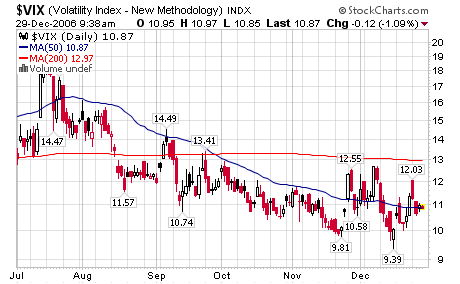

Igatahes algab uus aasta suhteliselt määramatult, mis omakorda tähendab investorite jaoks riski. Riskikartlikkus ei peegeldu aga volatiilsusindeksi VIX graafikul, mis on oma ajalooliste põhjade lähedal. No fear.

-

Kuna nädala alguses olid pühad ja börs kinni, siis tavapärase neljapäeva asemel avaldatakse maagaasivarude raport täna.

Raport näitas, et maagaasivarud vähenesid eelmisel nädalal -46 bcf-i vs -65 bcf-i konsensus . Eelmise aasta vastav näitaja oli -162 bcfi. Vaadates veel pisut tahapoole, näeme, et tegelikult on varude vähenemine absoluutarvult juba 6. nädalat järjest eelmise aasta näidule alla jäänud. See-eest varsti võrdluse alla tulevad jaanuari näitajad on üpriski väikesed ning suurema tarbimise ja külmema ilma korral võivad 'kaalud' taas gaasi kasuks kalduda. -

Head käesoleva aasta lõppu veel kõigile ning huvitavat järgmist! Pro all välja käidud investeerimisidee Cryptologic (CRYP) on täna kerkinud praktiliselt meie esmase hinnasihini ($24) ning väga äkilise tõusu tõttu soovitame kasum lukustada. Olukord on firma jaoks muutunud aina kindlamaks ning ootame madalamaid tasemeid sisenemiseks. Kommenteerime mõne aja pärast ka Pro all täpsemalt.

Parimat,

Oliver&Joel -

Täna jääb üle mitme päeva väiksemate aktsiate liikumist kajastav indeks IWM alla Nasdaqile..

-

Briefing:

12:41 Saddam could be executed with hours says Sr Iraqi source - Reuters -

So popular is the Google search engine that Webster’s this year decided to include the word “Google” in its dictionaries. Webster’s defines it as a transitive verb, as in, “I’m going to Google that job candidate to see if he really worked at McDonald’s.”

-

See seletab, miks toornafta varud väidetavalt -8.1 miljonit barrelit vähenesid, oodatust oluliselt rohkem, kui samal ajal rafineerimistehaste töövõimsus ei olnud eriliselt muutunud ning kütuse varud suurenesid ootuspäraselt. Tegu varasema aruandlusvea korrigeerimisega.

Dow Jones is reporting a large, unexpected 8.1 million-barrel fall in U.S. crude oil inventories reported Thursday by the Department of Energy was largely due to the correction of an error in a previous government report, a person close to the department said Friday. -

Väike kokkuvõte veel 2006. aasta liikujatest:

Stocks over $5 posting the largest percentage gains in 2006 include: FRPT +1950%, IFLI +1688%, MDV +512%, PNPFF +488%, CLEC +447%, AMAG +439%, GROW +419%, APN +404%, AXR +388%, INAP +363%, PALAF +351%, ANGN +350%, IIG +342%, RNAI +329%, FTGX +329%, ININ +323%, LFC +294%, JST +285%, CRVL +284%, CTDC +270%, CHDX +269%, SIM +267%, UAHC +255%, BUF +251%, WSDT +250%.

Stocks over $1 posting the largest percentage losses in 2006 include: GVSS -89%, ROHI -86%, ICGN -84%, NEOL -84%, AVNR -84%, NBIX -83%, BKFG -82%, NTMD -82%, VXGN -81%, INHX -80%, IMRP -80%, RNVS -80%, DCNAQ -80%, PXPL -79%, JDO -79%, SCT -78%, OCCX -78%, OSCI -77%, WLV -77%, JRCC -77%, NEST -75%, WRSP -75%. -

2006. aasta viimase börsipäeva lõpetuseks soovin kõigile mõnusat aastavahetust ja veelgi toredamat uut!

Joel