Võlakirjade ja võlakirjafondide tulevik

Kommentaari jätmiseks loo konto või logi sisse

-

http://www.bloomberg.com/apps/news?pid=20601109&sid=ab.Ld5DC2sb0&refer=exclusive

Siis võlakirjadest, riskist ja riskita investeerimisest koos võlakirjaderivatiivdega. Kuna järjest lihtsam ja odavam on osta kindlustust mingite võlakirjade maksete mittetoimumise vastu (credit default swaps) siis on võimlik osta firmade võlakirju, kindlsutus sellega kaasneva riski vastu ja saada kokkuvõttes ikkagi suuremat tulu kui valitsuste võlakirjadesse investeerides. Tulemusena käivad fondid kes derivatiive ei kasuta alla (neid võlakirjafonde kellel on masendav tootlus on suht palju) ja need kes kasutavad õitsevad, samas omakorda viies rohkem raha derivatiivide turule ja alandades võlakirjade kindluastmise hinda. Kahjuks võib selline kindlustamine olla vaid näiline, need derivatiivid pole läbinud aja ja kriisitesti. Jamuidugi - üksikinvestori jaoks teeb see elu oluliselt raskemaks kuna "riskivaba" investeering eeldab jätkuvalt valitsuse võlakirjade ostmist.

Seega - quo vadis võlakirjad, väikeinvestor ja võlakirjafondid? -

Joel kirjutas tänases turuülevaates: ...võiks ehk isegi öelda, et riigivõlakirjaturg hakkab mullistuma. Ühel hetkel hakkab raha riigivõlakirjadest välja voolama ning suur osa sellest võiks leida tee aktsiaturgudele.

Mida arvatakse? Kas on siis riigivõlakirjades mull või ei ole?

Ennast häirib selle "mulli" juures kaks asjaolu:

a) Kõik turuosalised näivad teadvat, et see on mull.

b) Riigivõlakirjadele on tugev struktuurne nõudlus. Suur osa fondimaailmast (sh. suurriikide pensionifondid) on kohustatud neid määratud osakaalus hoidma.

Ise olen siiski hakanud ettevaatlikult TBT-ga panustama. Esimene ost on tehtud, järgneva teen 10% languse järel (kui see peaks tulema) jne. -

Ajaloo huvides olgu fikseeritud, et hetkel:

^FVX = 1,34

^TNX = 2,50

^TYX = 3,57

TBT = 30,74 -

Mulli kohta ei tea, aga valitsusvõlakirjade fondid on viimasel paaril aastal väga hea tootlusega olnud võrreldes teiste varaklassidega. Kus põhjus, kus tagajärg, ehk tõesti: kas on mull? Samas, praegu pidavat olema väga populaarne ka igasugune high-yield-kraam (nii pakkumise kui nõudmise poolelt).

On valminud üks korralik magistritöö võlakirjade teemal, ma ise lugenud veel pole, aga kel huvi, võin lisainfot poetada, kust saab. Loodetavasti on seal ka kohalikku konteksti. -

Leesik, pane natuke infot selle töö kohta. opminvestment@yahoo.com

-

Leesik, ole lahke ja jaga magistriööd priituskuusik@hotmail.com

tänud! -

Peaks vist ka ühinema nõudlejate parvega. reinumag ät gmail.com, aitäh.

-

Hea meelega hariks ennast võlakirjade alal, kui ei ole suur vaev siis paluks ka magistritööd catalaunia ätt gmail.com

-

Pealiku viidatud lingil on täielik kräpp. Mees räägib asjadest, millest ta mõhkugi aru ei saa.

Kui ei ole kräpp, siis peaks USAd ootama hüperinflatsioon. Artikkel on täis vasturääkivusi. See ei ole väärt lõpuni lugemist. -

"Mees räägib asjadest, millest ta mõhkugi aru ei saa/.../siis peaks USAd ootama hüperinflatsioon...."

Oot... aga kas siis ei ootagi või...? See dzinn on ju juba pudelist välja lastud ja seda enam tagasi ei topi. -

"Mees räägib asjadest, millest ta mõhkugi aru ei saa/.../siis peaks USAd ootama hüperinflatsioon...."

Oot... aga kas siis ei ootagi või...? See dzinn on ju juba pudelist välja lastud ja seda enam tagasi ei topi. -

Jaapani Treasury võlakirjadega on kõik kõige paremas korras. Võlg ca 200% SKPst Jaapanil, inflatsiooni pole, jeen on üks tugevamaid valuiutasid maailmas.

http://www.mof.go.jp/english/bonds/interest_rate/current.htm -

Ajaloo huvides olgu fikseeritud, et hetkel:

^FVX = 1,34

^TNX = 2,50

^TYX = 3,57

TBT = 30,74

^FVX = 1,21 -10%

^TNX = 2,72 +9%

^TYX = 4,25 +19%

TBT = 36,47 +19%

30-Year Treasury Auction Disaster: Yield Now 4.32%

Hardly anybody showed up to the 30-year Treasury auction. -

^FVX = 1,75 +30%

^TNX = 3,17 +27%

^TYX = 4,43 +24%

TBT = 37,49 +22%

Wasn't QE2 Supposed to Make Rates Lower? -

^FVX = 2,10 +57%

^TNX = 3,52 +40%

^TYX = 4,60 +29%

TBT = 40,12 +30%

Unustage aktsiad! Võlakirjaturud vaid kriipsukese kaugusel ametliku karuturu staatusest. Napilt kolme kuuga on USA valitsuse jaoks lühiajalise võla refinantseerimine kallinenud 50% ja pikaajalise 30%. Sarnane pilt avaneb ka UK, Jaapani ja Euroopa riigivõlakirjade turul. Kui seda, aktsiaturgudega võerreldes hiiglaslikku, 91 triljoni dollari suuruse kogumahuga turgu maha rahustada ei suudeta, on tulemas massiivne riikide pankrotilaine, mille kõrval vana hea krediidikriis tundub jalutuskäiguna rohelusse. -

Pealiku jutt on vale. Mingisugust riikide pankrotilainet ei tule. See saab tulla vaid EMUs, kui poliitiline tahe otsa saab.

Intressid on tõusnud tõenäoliselt ootuste tõttu keskpankade tegevusele tulevikus(nähakse majanduskasvu ja oodatakse intressitõuse tulevikus). Intressid hakkasid tõusma kohe peale maksusoodustuste jätkumise väljakuulutamist(USA defitsiitne kulutamine, milles tõenäoliselt nähakse majanduskasvu).

USA Jaapan UK- vabatahtlik maksevõimetus koduvaluutas on võimatu.

Samuti pole olnud mingisugust katastroofilist tõusu intressimäärades

http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/Historic-LongTerm-Rate-Data-Visualization.aspx -

Lähiajaks küll intressitõuse ei oodata.

FED funds implied probability 2010 December

FED funds implied probability 2011 January

FED funds implied probability 2011 March

LHV inimesed võiks Bloombergist otsida ka kaugemate istungite jaoks FED Fundsi implied probability graafikud. Mul on juba ette kahtlused et me ei näe praeguse ralliga kooskõlas olevat ootuste muutust nendel graafikutel kaugemate istungite jaoks. -

DECEMBER 15, 2010, 3:45 P.M. ET.RATE FUTURES REPORT: Prices Tumble As Market Sells Rallies

.

By Howard Packowitz

Of DOW JONES NEWSWIRES

CHICAGO (Dow Jones)--Even a modest rally enticed sellers Wednesday of U.S. interest rate futures contracts.

Overwhelming U.S. Senate passage of the Obama Administration-Republican tax break compromise fueled optimism of better economic growth and higher inflation, along with higher interest rates including the short-term federal-funds rate.

Wednesday's sharp price slide reflected the market's view that short- and long-term rates are moving higher.

Fed-funds futures were fully priced at Wednesday's settlement for the Federal Open Market Committee to begin raising its key short-term rate in December of next year, having priced in only a 20% chance as recently as the settlement on Dec. 6.

That was before President Barack Obama and rival GOP lawmakers came to terms on a deal that preserves tax breaks for the wealthy, reduces payroll taxes and extends jobless benefits for 13 months. The U.S. House of Representatives has yet to approve the measure.

The short-lived rally came as Moody's Investors Service had placed Spain's credit rating on review for a potential downgrade.

Moody's warning generated some safe-haven buying as investors sought the protection of contracts tied to relatively safe U.S. government debt.

However, traders took advantage of the uptick in prices to exit losing positions. Also, a general unloading of risk at year's end added to the selling pressure, said Brian Meehan, rate futures broker for Jefferies & Co.

Concern that some European countries might go into default on their debt weighed the entire day on near-dated Eurodollar futures prices.

Selling pressure was based on the belief that banks would be reluctant to loan U.S. dollars to other banks for fear of exposure to troubled European government debt.

Eurodollar futures are tied to expectations for the three-month London Interbank Offered Rate. In addition to measuring the cost of borrowing U.S. dollars in the interbank market, the three-month Libor is viewed as a benchmark for loans to businesses and households.

The three-month dollar Libor was unchanged at Wednesday's cash fixing, staying at 0.30188%, according to the British Bankers Association.

However, near-dated Eurodollar futures contracts see the Libor moving higher.

March 2011 Eurodollar futures, at Wednesday's settlement, saw the three-month dollar Libor reaching 0.47% at the March 14 contract expiration. That's up from a projected rate of 0.415% at Tuesday's settlement.

Libor expectations are calculated by subtracting the Eurodollar futures price from 100.

March 2011 Eurodollars settled 5.5 basis points lower at 99.53.

Meantime, federal-funds futures traders became increasingly confident the economic recovery will be strong enough in late 2011 for the FOMC to begin a series of inflation-fighting rate increases.

The FOMC's funds target has been locked in a lowest-ever range of 0% to 0.25% for the past two years as the central bank attempted to fight off the worst economic slowdown since the Great Depression.

January 2012 fed-funds futures, measuring expectations for the December 2011 FOMC meeting, were fully priced Wednesday for the committee to raise the rate to 0.5%. That's up from a 94% chance at Tuesday's settlement. The same contract had priced in only a 20% chance for a 0.5% rate on Dec. 6, which came on the heels of a weaker-than-expected monthly employment report.

The lightly traded July 2012 fed-funds contract was fully priced Wednesday for a further tightening to 0.75%, with a 78% chance for an even higher rate of 1.0%.

The same contract on Dec. 6 priced in only an 18% chance for a 0.75% yield, and no expectation for a 1.0% rate.

Also on Wednesday, March 2011 10-year Treasury note futures price plunged to a 5 1/2-month low during the final hour of regular trading. The move lifted the contract's 10-year cash yield equivalent above 3.5%.

Similar to cash Treasury markets, lower futures prices amount to expectations for higher rates. -

Portugali riigi võlakirjade intress on jõudnud samale tasemele kus mängiti maha Kreeka draama esimene vaatus.Kes tahavad paremaid kohti,võiksid eelmüügist piletid ära osta,kuskil kuu jooksul peaksime näidendit nägema?

-

Jan. 6 (Bloomberg) -- The Portuguese government said it met

its target for a budget deficit of 7.3 percent of gross domestic

product last year, narrowing a shortfall that was the fourth-

biggest in the euro region in 2009.

The country’s government debt agency plans to sell between

750 million euros and 1.25 billion euros of bonds due in 2014

and 2020 on Jan. 12. - siis saab täpsemalt näha mis huvi investoritel on. Samas Portugali "first bond redemption" sellel aastal on alles aprillis. -

Katsetan ka siis esimest korda uue kujundusega foorumis kätt.

Kuidas müüa oma võlga hiinlastele lisades intressile mõned "goodies": <a href=http://www.unexpectedutility.com/?p=702>China: The Warren Buffett of the EU Sovereign Debt Crisis?</a>

The city of Chateauroux, under the aegis of the French Economics Ministry, signed a deal that will bring 30 to 50 Chinese companies to the region. A business park, covering some 500 hectares, will be created on a site that formerly housed a military base. The principal activity will be the assembly of electronic components imported from China. The components will arrive by air at the nearby Chateauroux airport – a former NATO airbase whose 3.5km runway is capable of welcoming even the largest transport aircraft – or by sea. The end products, mobile phones, GPS navigation systems, flat screens and the like, all duly labelled ‘Made in France’, will be distributed throughout the eurozone. Low land prices, tax breaks as well as some substantial investment by the regional authorities also played a role in the deal. -

Proovin siis nii:

http://www.unexpectedutility.com/?p=702 -

* Portugal has raised 1.249bn euros in an auction of four and 10-year bonds.

* The yield, or the interest rate Portugal must pay to borrow funds, on the 10-year bond was an average 6.719%.

* Bond buying by the European Central Bank (ECB) had helped keep the yield below 7%.

http://www.bbc.co.uk/news/business-12169302 -

PIMCO's Battle Call to Bond Vigilantes

http://seekingalpha.com/article/251064-pimco-s-battle-call-to-bond-vigilantes

^FVX = 2,28 +70%

^TNX = 3,65 +46%

^TYX = 4,74 +32%

TBT = 40,89 +33%

Võlakirjafutuuridega raha kokku kühveldamine on viimased pool aastat olnud ikka täielik no-brainer. -

Do You Still Need Bonds?

http://www.smartmoney.com/Investing/Bonds/do-you-still-need-bonds-1297631933073/

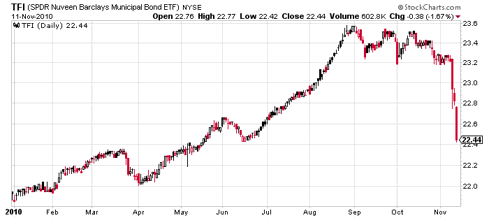

"Fund investors have taken $22.5 billion out of bonds since October, an abrupt reversal after almost two straight years of inflows." -

PIMCOs Gross Exits Treasuries – What About ETFs?

http://finance.yahoo.com/news/PIMCOs-Gross-Exits-Treasuries-ETFTrends-2426228114.html?x=0&.v=1

"The world’s largest bond fund, PIMCO Total Return Fund (PTTRX), reduced its exposure to U.S. government debt to zero last month." -

Bill Gross, the founder of PIMCO, made waves this week by selling his holdings of US Treasuries. Bloomberg reported on the dramatic news:

Bill Gross, who runs the world’s biggest bond fund at Pacific Investment Management Co., told PBS this week that yields are too low. His $237 billion Total Return Fund held no government-related debt as of Feb. 28, according to a report on the Pimco website.

That’s dramatic. After all, Mr. Gross says the Fed is now helping the US government implement a ponzi scheme. He also believes QE is helping to dramatically reduce rates. He says the end of QE2 will be a “d-day” for the bond market. Those are comments that you’d certainly want to take notice of considering this is the largest bond manager in the world, right? Not necessarily. Unfortunately, this isn’t the first time Bill Gross has sounded the alarm for the U.S. bond market.

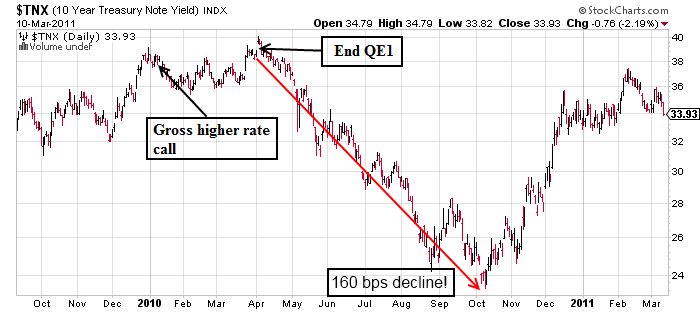

In early 2010 he was interviewed by TIME magazine about the economic outlook. Mr. Gross was asked about the end of QE1 and how it would impact rates. He answered:

Won’t that (the end of QE1) put upward pressure on interest rates?

“I think it will. I mean, the mortgage market would be your first place to look, in terms of something that’s overvalued that would become normalized. Nobody knows what the Fed’s buying is worth — we think about half a percentage point on rates, but we don’t know.”

What happened when QE1 ended? Rates did the exact opposite of what Mr. Gross expected. In fact, they went into a tailspin. He top ticked it to the day

So, do the current opinions about “d-day” and the end of the bond bull market matter? Yes, as much as the (ever changing) headline grabbing opinions of the last 10 years…. -

-

Ma mõtlesin, et äkki läheb selle teemaga kokku siin. Lugesin hiljuti sellist artiklit

ja ausalltöeldes viskab mul alati siibri ette, kui arst valetab enda patsiendile, kui politseinik on tegelikult hoopis ise varas jne, seekord siis majandusteadlane ajab täiesti valet juttu(minu arvates tahtlikult) ajaleheveergudel ja muidugi kõik suhtuvad sellesse kui kõrgemasse teadusse. Gregory Mankiw on kõva tegelane USA poliitökonoomias, Harwardi professor, valge majaga seotud jne... otsustasin talle kirjutada:

Hi,

I regularly read your blog, too bad I can't ask you there all the questions I would like to.

I am writing to you from Estonia regarding the interesting article you recently wrote.

http://www.nytimes.com/2011/03/27/business/27view.html?_r=1

The topic is very much talked of recently. There is crises in Eurozone and all these countries are supposably living beyond their means. Everyone is asking how this is going to end. Is there going to be a cathastrophic end to all this?

I didn't understand the part in your article where you were talking about securing a credit line with IMF. US is the sole issuer of dollars, IMF is not. Were you talking about borrowing resources from abroad. I am confused. Can you guide me please.

Yours truly,

Kristjan

Ja Mankiw vastas:

Yes, borrowing from abroad.

Thank you for your comments.

Greg

Minu küsimusele ta muidugi ei vastanud, sest oleks ennast lihtsalt lolliks teinud, seetõttu ei saa me kunagi teada kas USA peab näiteks Eestist hakkama dollareid laenama. Või tuleb meil hoopis mulgi kapsaid USAsse saata, kui nad hätta jäävad. -

Greek 2 Year Bond Yield Passes 20%

http://www.zerohedge.com/article/greek-2-year-bond-yield-passes-20

Ööh... -

From: Hadden, Glenn

Subject: IMPORTANT – thoughts on S+P action re USA

April 18, 2011

I would like to address the action taken today by S+P in revising the United

States credit outlook to negative.

Simply, I believe the argument behind S+P’s decision is flawed and displays

a misunderstanding of how the monetary system operates. My view is not

predicated on any political ideology. I am merely attempting to demonstrate

the incorrect logic regarding United States credit quality and solvency.

1. FINANCIAL BALANCE FRAMEWORK:

The first fundamental item that must be understood is how financial balances

relate to government indebtedness. In a closed economy (or an economy with a

perpetually balanced current account), government deficits must equal

private savings. If private savings desires increase, a government’s deficit

must increase by precisely the same amount all things equal. There is no

other way.

In the case of the United States, the budget deficit has grown to 10% of gdp

from approximately 4% of gdp because the savings rate has shifted from

approximately negative 2% to approximately positive 6%. Simply stated, the

federal budget isn’t a function of profligate government spending, its a

function of higher desired private savings causing a shortage of aggregate

demand. This shortage of aggregate demand is putting downward pressure on

tax revenues (lower nominal gdp implies lower tax revenues) and upward

pressures on expenditures owing to automatic stabilizers such as UI.

With this example, it is theoretically possible to have much larger

government deficit and debt levels if savings desires grow commensurately.

If private sector savings desires were to fall, which implies higher

aggregate demand (because the spending of a person in the private sector

simply creates another person’s income), the government deficit would fall

commensurately owing to higher tax revenues and possibly lower expenditures.

2. MYTHS REGARDING FOREIGN INVESTORS FUNDING THE UNITED STATES AND EXTERNAL LIABILITIES:

Firstly, the most important item to understand is the USA discharges its

debt in $US. So the entire argument of rating agencies behind ‘external

funding pressures’ is moot. Functionally there is no difference between a

holder of UST’s who is domiciled in USA or abroad, as they are both $US

dominated savers. The only difference is the foreign saver has no ‘need’ to

save in $US (where a USA investors needs $US as a means of exchange and to

pay his taxes).

So, what if foreign now dump their ust’s?

Foreign investors own ust’s and $us because they WANT to own them. By

engaging in fx driven trade policies, foreigners ‘pay up’ to get $US which

allows them greater sales into the USA market. If foreigners didn’t want to

save in $US, they would change their fx policy which would result in less

market share in USA economy. Foreigners can’t be both buyers and sellers

simultaneously. If foreigners wanted to own less $US, the result would be a

smaller current account deficit in USA, which again using a financial

balance framework would either result in more private savings, or a smaller

govt deficit. Bottom line – if foreigners want to have fewer savings in $US,

either private savers must increase savings, or the govt deficit must fall.

3. MYTHS REGARDING FOREIGN INVESTORS FUNDING THE UNITED STATES AND EXTERNAL LIABILITIES part II:

The same way banks offer savers demand deposits and term deposits (ie

chequing accounts versus savings accounts) the USA economy offers savers the

same in the form of $US (demand assets) or UST (term asset). Foreign savers

can therefore keep their $ at their Fed Reserve account and earn basically

zero (functionally a ‘chequing’ or demand account) or buy UST’s

(functionally a ’savings’ or term account) and earn a coupon. There is no

other way to save in risk free space. As said above, foreigners who engage

in fx driven trade policies must accumulate $US demoninated assets. The only

choice they have is term vs demand assets. So indeed if foreigners declined

to own ust’s and alternatively kept their savings in $US at the Fed, the

result could be a higher and steeper term structure for USA rates. If the

Treasury decided to sell less ust’s and more tbills, this term structure

rise could be negated. Note foreigners actions are never about SOLVENCY, its

merely a function of liquidity preference.

4. THE DEFAULT BY THE SOVEREIGN OPERATING WITHIN A NON-CONVERTABLE EXCHANGE RATE REGIME IS A *FUNCTIONAL* IMPOSSIBILITY:

One must also understand the mechanics of government spending. A government

purchases goods and services from the private sector and then the Federal

Reserve credits the reserve accounts of the commercial banks whom the

sellers of such good and services bank. The Fed then debits the reserve

account of The US Treasury. The Treasury then sells ust’s, where the Fed

then credits the Treasury’s reserve account while debiting the reserve

accounts of the banking system.

So all that has happened is the government has created savings in the

economy by spending (from point 1 above: govt spending = private savings).

So as is illustrated, there is no issue of ’solvency’ per se. The

government, by spending, is creating the savings to buy the ust’s. The only

issue here is the term gap. Specifically if savers only want demand assets

(ie $us), while the Treasury only wants to sell term assets (ie ust’s), the

resolution will be price and risk premium: ie how much interest rate spread

will a bank or arbitrageur need to intermediate this imbalance. This can all

be negated of course, if the Treasury only issued T-bills.

5. THE DEFAULT BY THE SOVEREIGN OPERATING WITHIN A NON-CONVERTABLE EXCHANGE RATE REGIME IS A *FUNCTIONAL* IMPOSSIBILITY part II:

This is the fundamental flaw of the S+P decision. The basis of their

sovereign rating criteria is as they describe it is: “The capacity and

willingness to pay its debts on time”. As mentioned above, there is

functionally no reason for the USA to ever not pay its debts – the USA’s

debts are and will always be equal to savings desires of the private and

foreign sectors. So ‘CAPACITY’ can never be an issue.

Hence the only reason the USA would ever default was because they ‘wanted’

to default, they never under any circumstance NEED to default so long as the

$US remains a non-convertable currency. The implications for a voluntary

default (again, this is the only kind of default possible by the USA) make

such a default an impossibility. The reason is because the 2nd largest

liability of the federal government is deposit insurance. If the USA decided

it wanted to default to escape its obligations, it would bankrupt its

banking system, who’s holdings of ust’s are greater than system-wide bank

capital of $1.4 Trillion. In fact the contingent liability put the

government has issue via deposit insurance is almost as large as USA debt

held by the public at $6.2 Trillion. So essentially a voluntary default

would actually INCREASE USA indebtedness by almost 100% while

simultaneouslybankrupting its banking system. So if ABILITY to pay is

assured, and a voluntary default actually raises indebtedness while

collapsing the banking system and economy, why would USA ever voluntarily

default? So S+P’s criteria of ‘WILLINGNESS’ to pay is also not applicable.

SUMMARY:

So as demonstrated, the bottom line is ABILITY to pay can never be an issue

in a non-convertable currency system. The only issue is WILLINGNESS to pay.

So if the argument by S+P relates to “the capacity and willingness to pay

its debts on time” as they described on Monday’s call, then their argument

simply isn’t cogent.

The last point I want to make is it would be incorrect to attempt to draw an

analogy to the placement of the UK on credit watch in mid May 2009 relating

to market performance. Yes indeed gilts sold off shortly after this

announcement. However this was more a function of the unhinging of the USA

MBS market. There existed a perception that the Fed via QE1 was attempting

to cap current coupon mortgage rates at 4%. Once this level was breached and

it became clear in mid/late May that this view was incorrect, a convexity

sell event hit the USA rates market which dragged all global bond yields

higher including Gilts.

To conclude – I view the decision today by S+P as having zero impact on

valuations of USA sovereign debt. We continue to engage in trades that

express the correct view that the solvency of the United States can never be

an issue in nominal terms; specifically we are buyers of 30yr assets swaps

at -25bps. -

Siin veel kokku võetud kogu see hullus:

The ratings agencies’ poor track record and flawed logic speaks for itself.

So ratings agency Standard & Poor’s revised the U.S. rating outlook to negative from stable after affirming its sovereign rating at ‘AAA/A-1+’ sovereign credit ratings. Why people give credibility to the organization that gave us “triple AAA rated” subprime toxic garbage is beyond me. And take a look at the history: Debt downgrades had no impact on Japan when Moody’s and S&P tried to pull the same stunt with them.

In November 1998, the day after the Japanese government announced a large-scale fiscal stimulus to its ailing economy, Moody’s Investors Service began the first of a series of downgradings of the Japanese government’s yen-denominated bonds, by taking the Aaa (triple A) rating away. The next major Moody’s downgrade occurred on September 8, 2000. Then, in December 2001, Moody’s further downgraded the Japan government’s yen-denominated bond rating to Aa3 from Aa2. On May 31, 2002, Moody’s Investors Service cut Japan’s long-term credit rating by a further two grades to A2, or below that given to Botswana, Chile and Hungary. Well, over a decade later and this has had no discernable impact on Japan’s ability to borrow at the rate the Bank of Japan sets, NOT the ratings agencies or the “bond market vigilantes”.

Rating sovereign debt according to default risk doesn’t really make sense. While Japan’s economy was struggling at the time, the default risk on yen-denominated sovereign debt was nil given that the yen is a floating exchange rate.

The only difference today is a political one. If the U.S. government chooses not to raise its debt ceiling (in itself a wrong-headed, self-imposed limit which constrains the effective use of fiscal policy), then there is a problem. But this is a legal, as opposed to an operational problem.

There are two considerations used by all ratings agencies when determining the credit worthiness of a government. They are ‘ability to pay’ and ‘willingness to pay.’ The ability of the US to make timely payment of $US is never in question. But willingness to pay is in doubt. Paying is obligated by law, and yet not paying is continuously and openly being discussed as a viable option by the same legislators tasked with making the final decisions. That’s what is happening today.

The debt ceiling itself is a foolish idea. Yes, we have a speed limit in cars, but we don’t design the automobile to shut down when the car exceeds, say, 65 miles per hour on the highway. If we did, we might have considerably more car pile ups and serious fatalities. But somehow, this is how we conduct our fiscal policy. And now we’re paying the price as we continue to underestimate the deflationary impact of global austerity measures. The austerity route, despite a lot of demonstrably flawed arguments floating around, is harmful to our fragile economy, as the current case of the U.K. clearly shows.

Marshall Auerback -

On April 11, "Bond King" Bill Gross of Pimco revealed on CNBC that he was short the Treasury market. It looks like he sold the bottom of the move.

It's not suprising that Gross would get himself in trouble on this. His flawed understanding of sovereign monetary system--where he constantly conflates a household's balance sheet with that of the sovereign government--is a recipe for disaster for a government bond trader. Gross should know better.

Gross is not the only one who doesn't understand fiat monetary system. There are many others as we all know It. -

kas eesmärk oli panustada poolekuulise horisondiga?

pigem vist on jutt ikka aastatest tema puhul?

seega tuua siia poole kuu pikkune graafik?

kas muid argumente enam ei leidnud? -

Kas Hr. Gross mitte 99% konkurente seni outperforminud pole ja muuhulgas maailma suurimat fondi ei juhi? Kes see kõva kärbes on, kes väidab, et Gross on ebakompetentne?

-

No kui on lühike USA paberites siis on ju ebakompetentne. Need on kõige paremad paberid, sest nende lunastamiseks trükitakse aina rohkem raha.

-

John Thomas arvas ka, et UST yieldid hakkavad QE2 lõppemisel hoopis langema. Põhjendus oli see, et just seda keegi ei arva ;) Grossi kritiseerimiseks muidugi peab ikka erikõva kärbes olema. Ehk siis mingi blogimees pole tõesti lihtsalt good enough. 30 aastat on USA riigivõla yield'd kukkunud ning praeguses kontekstis on neis küll kõvasti upside'i rohkem kui downside'i. Lisaks, meie, kes me ostame piima ja leiba euros - well, selle poindi tõi Cynic juba hästi välja...

-

kogu jutu point on siin: His flawed understanding of sovereign monetary system--where he constantly conflates a household's balance sheet with that of the sovereign government--is a recipe for disaster for a government bond trader. Gross should know better.

Cynic ja karum6mm teavad trykkimise tagajärgedest samapalju nagu lehm lennu6nnetusest. Kas Jaapanis kehtivad teistsugused majandusseadused. Kuidas Cynic ja Karum6mm seda fenomeni seletavad, et jeen on yks maailma tugevamaid valuutasid ja intressid on ylimadalad. Vabandan väljenduse eest, kuid ära hakkab tyytama see loll möla v6hikutelt. -

Jaapani reaalintressid pole sugugi üle mõistuse madalad. Teiseks kompenseerib valitsuse võlahunniku osaliselt majapidamiste suur säästmine.

-

Kristjan1 - mul on sulle palve - palun avalda oma CV, et mul/meil oleks võimalik hinnata seda, milliselt hariduslikult ja kogemuslikult baasilt sa siin nii julgelt igas suunas tulistad. Lisaks võiksid ka oma viimased paremad treidid avaldada, millega sa oled kas endale või klientidele rulli kokku lükanud.

Enda kallal ma võin lasta julgelt möliseda, sest ma võin ka ennast ise vabalt võhikuks nimetada - aga näiteks Cynic'ul peaks olema kogemust turgudel vast aastast 1996 ning seega eksisteerib suhteliselt suur tõenäosus, et ta ikka päris võhik ei ole. Kui ma vaatan ka Gross'i ajalugu, siis tundub küll, et tegelane suudab päris hästi ka üle tsükli konteksti aduda ning kriitikutele tahaks öelda eelkõige show me the money - ehk siis selline oi-ma-olen-tark-Gross-on-loll-jutt on suhteliselt väärtusetu kellegi suust, kes ise mingeid varasid ei halda ja kellel ei ole võimalik mingit track'i ette näidata.

Lisaks tahaksin ma sulle anda ka koduse ülesande - mõelda välja, mida ma võiksin vastata sinu küsimusele JPY suhtes? -

Näh. Cynic andis koduse ülesande vastuse ära.

-

OK, nyyd ma Karum6mm näitan sulle, et Cynik on täielik v6hik, kes räägib millegist sellisest, millest tal 6rna aimugi pole. Kas sulle sellest piisab? Seda ma ei tea.

Cynic ei saa kahjuks makromajanduses toimuvast aru. Nyyd pakun ma sulle välja yhe makromajandusliku arestusliku identiteedi ja olenemata sellest kas me teineteisele meeldime v6i mitte, tuleb meil tunnistada, et see on t6si.

Kui me jagame majanduse kaheks, erasektoriks ja valitsussektoriks, siis yhe sektori defitsiit v6rdub teise sektori ylejäägiga. Kas on see arusaadav? Lihtsas eesti keeles kirjutatud ja usun, et on. Ehk valitsussektori defitsiit v6rdub erasektori säästudega. Kui on midagi selle vastu nyyd, siis palun esitage enda argumendid, sest Cynicu jutt osutub nyyd valeks. Need erasektori säästud on seal tänu valitsuse defitsiitsele kulutamisele. Piinlik kyll aga yhele Tartu Ylikooli professorile pidin seda hiljuti meelde tuletama. Kui on tegu avatud majandusega, siis lisandub siia veel välismaine sektor. K6ik kolm peavad kokku andma ikkagi nulli, aga see ei tähenda, et yks sektor ei tohiks teise suhtes ylejäägis olla v6i vastupidi. Seega valitsussektori ylejääk tähendab mitte-valitsuse defitsiiti(sina ja mina oleme defitsiidis-kulutame rohkem, kui teenime).

Cynic muidugi alustab ja l6petab, eespool pidin talle näitama, et intressid treasury v6lalt t6usid tänu ootustele fedi tegevuse suhtes tulevikus, mitte sellepärast, et USA hakkaks defaultima.

Sinu juurde tööle ei taha karum6mm, seega pole sul mingit p6hjust minu CVd näha.

V6ta makro 6pik kätte ja kontrolli kas minu jutt on 6ige v6i vale. V6i on Cynicul 6igus? -

Kristjan1,

Kui Gross on kõigest valesti aru saanud ja ikkagi turgu räigelt outperforminud, siis äkki oled sina vaevatud geenius ja kogu maailm on sinu vastu?

Täiesti ebatõenäolise variandina räägid sa aiaaugust. Muuseas, Eesti asub Läänemere kaldal koos Soome ja Rootsiga. Eesti majandus on tugevalt integreeritud Rootsi ja Soomega. Sealjuures on meil madalamad maksud, väiksem võlakoorem ja õhem riik. Seega järeldub, et Eesti elatustase on Rootsist ja Soomest kõrgem. Ütle mulle, milline mu väide on vale või vaiki igavesti.