Börsipäev 8. veebruar

Kommentaari jätmiseks loo konto või logi sisse

-

Baltic Morning News

Norma surprises positively. The total Q4 sales came in at EUR 18.335, equal to a y-o-y growth of 20%. Sales to Russian customers (mainly AvtoVaz and GAZ) increased 36% y-o-y to EUR 6.86m, while sales to Autoliv grew by 23% y-o-y to EUR 11m. The Q4 pre-tax profit was EUR 1.919m, corresponding to a pre-tax margin of 10.5%. It is now the second sequential quarter when Russia posted promising figures, it seems that sales to Russia have finally started to pick up.

Inflation remains high in Estonia. According to Estonian Statistical Office, consumer prices in January were 5.1% higher compared to a year ago. The consumer price index was mainly influenced by the increase in housing expenditures (+14.6% y-o-y), and also by the increase in the prices of food (+7.9%). Transportation expenditures remained flat, while the highest decrease occurred in communication costs (-5.2%).

Sanitas losses in 2006. The Lithuanian pharmaceutical manufacturer Sanitas posted 2006 sales of LTL 161.5m, up 156% y-o-y. The full year EBITDA was LTL 16.393m, while the net loss came in at LTL 10.768m. According to the company, the net loss was mainly due to losses in subsidiary Jelfa. In January, the company generated sales of LTL 24.86m, equal to a y-o-y increase of 364.5%. Excluding the acquisition of Jelfa, sales of Sanitas AB increased by 52.4% y-o-y to LTL 4.875m in January, and the sales of the subsidiary Hoechst-Biotika went up by 6.3% y-o-y to LTL 2.368m over the same period.

Alytaus Tekstile facing bankruptcy. The Lithuanian manufacturer of cotton and mixed fiber fabrics, Alytaus Tekstile, said it needed an injection of over LTL 30m to survive, BBN reported. According to Valdas Araminas, CEO, the company has debts of about LTL 42m, and it is not able to continue without additional investments. Clearly, labour-intensive low value added manufacturing sector is currently facing tough times. I would also be quite sceptical on other similar companies, i.e. Utenos Trikotazas and Vilniaus Baldai.

Utenos Trikotazas sales target for 2007. The Lithuanian garment manufacturer Utenos Trikotazas has set its sales target for 2007 at LTL 184.5m, equal to a y-o-y growth of 5.4%. When looking at cost side, we believe the bottom-line will be affected by continuing strong wage inflation, i.e. earnings growth will be low. Assuming the company manages to keep margins at the current level, the share trades at a PER 2007 of 19.3x.

-

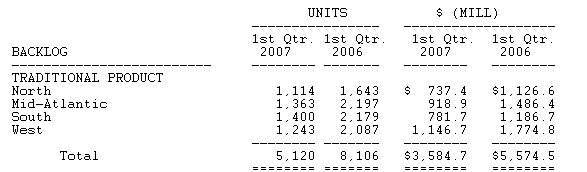

Täna hommikul teatas Toll Brothers (TOL), et ootab 2007. aasta esimese kvartali käivet allapoole konsensust ehk $1.11 miljardit vs $1.19 (reuters estimates). Probleemid hinnastatuses ning oodatust madalamas unitite müügis. Kuigi tellimuste tühistamise protsent oli seekord väiksem võrreldes eelmise aasta sama perioodiga, on see ajaloolisest keskmisest tunduvalt kõrgemal. Täitmata tellimuste maht langes kvartalis 30%.

Juhi sõnul on Hoboken, Jersey City, Manhattan ja Brooklyn piirkonnad suhteliselt tugevad, samas Detroit, Minneapolis, Chicago, Reno ja mõned Florida osad ei ole stabiliseerumise märke näidanud. Esimese kvartali write-downe oodatakse vahemikku 60-160 miljonit dollarit.

Üks kommentaar pressikast, mis praeguses olukorras tundub suhteliselt naljakas:

``We continue to believe that buyer confidence is the key to a turnaround in the new home market. It appears that the media's sentiment toward the housing market is becoming more balanced and their messages are making customers aware that, in the current climate of attractive interest rates, motivated sellers and a generally healthy economy, now is a good time to buy a home.''

Võimalik, et müüdavate elamute prognoos on järgnevateks kvartaliteks samuti liiga positiivne( Q2, Q3 ja Q4 prognoos vastavalt 1550-1750, 1650-1800, 1550-1800) .

South regioonis (Florida, North Carolina, South Carolina ja Texas) on esindatud tugevalt MTH, LEV, LEN, WCI. Kuigi kokkuvõttes ei ole tegemist üllatusega, siis järjekordne prognooside alandamine toob kinnitust, et housing tsükkel ei pruugi veel läbi olla.

-

Citigroup upgrades Alcoa (AA 32.15) and Alcan (AL 50.66) to Buy from Hold

J.P Morgan downgrades AK Steel (AKS 21.54) to Neutral from Overweight

A.G Edwards downgrades General Growth Properties (GGP 66.39) to Hold from Buy saying the retail business remains solid, however given recent share price performance they believe the positives are factored into the shares

CIBC upgrades Sina Corp (SINA 33.05) to Outperform from Sector Perform with a $40 tgt following earnings and due to evidence of strengthening fundamentals in its online advertising business, their belief that SINA's wireless challenges will trough in 1H'07, and the potential benefit of the '08 Olympics

Oppenheimer upgrades Digital River (DRIV 50.54) to Buy from Neutral and sets a $58 tgt, based on valuation, continued strong execution, addition of MSFT as a customer, anticipated Commerce 5 relationships and strong 2H.

Bear Stearns downgrades Pacer International (PACR 33.29) to Underperform from Peer Perform

Goldman adds Hewlett Packard (HPQ 42.30) to their Conviction Buy List and removes Apple (AAPL 86.15)

-

Täna tulemustega väljas Martin Marietta (MLM), jälgida tasub prognoose:

Reports Q4 (Dec) earnings of $1.41 per share, excluding non-recurring items, $0.07 better than the Reuters Estimates consensus of $1.34; revenues rose 6.2% year/year to $532.4 mln vs the $514.1 mln consensus. Co issues downside guidance for Q1, sees EPS of $0.36-0.52 vs. $0.62 consensus. Co issues downside guidance for FY07, sees EPS of $5.95-6.50 vs. $6.52 consensus.

Kui nädal tagasi tuli välja Vulcan Materials (VMC) oma tulemustega, siis kinnitasid nad oma konverentsikõnes tugevat hinnamomentumit (10-11% sel aastal) ning uskusid tugevat non-residential turu olukorda ning selle tugevnemist aastal 2007. Täna kinnitab sarnast hinnamomentumit (9-11%) MLM, kuid usuvad üldiselt nõudluse samaksjäämist. Tugevust võiks oodata aasta teisest poolest, kuid esimene pool võib osutuda pigem nõrgaks.

Commercial ja infrastruktuurikulutused peaksid tõusma, kuid mitte sama tugevalt kui 2006. aastal. Infrastruktuurikulutuste edasilükkamist on märgata Carolinas ja seda oodatakse ka 2007. aastal.

We believe residential construction is likely to decline in the first half of 2007 with the downturn beginning to moderate during the latter part of the year.

Praegused hinnatasemed on suhteliselt kooskõlas ajaloolisega ning ei anna eksimuseks minu arvates just palju ruumi. Eriti arvestades, et tsemenditootjad (CX, EXP, RMIX, TXI) on tulnud juba suhteliselt positiivsete kommentaaridega, mis peegeldub ka aktsiahindades.

-

These Bears Are Weak

By Rev Shark

RealMoney.com Contributor

2/8/2007 8:11 AM EST

Click here for more stories by Rev Shark

"If I look confused it's because I'm thinking."

-- Samuel Goldwyn

There were many confusing aspects to the market action yesterday, such as the strong action in technology stocks while Cisco pulled back most of the day after a gap up, and the strength in the Nasdaq while the senior indices did nothing and suffered a sharp afternoon pullback tempered by some final hour relief.

We have had this mix of action for a while now and it has necessitated a shorter-term approach on the long side because the groups that end up leading have changed so quickly.

One thing that has remained fairly consistent is the inability of the bears to gain any traction. Time and again they look to have a slight advantage and then fail miserably at exploiting it. Not only are the bulls not acting worried about technical breaches we have suffered -- they are using them as buying opportunities and that has worked well.

As usual there are plenty of things about the market not to like if you are so inclined. The bearish arguments are not difficult to understand and there are many folks, including me, who are itching to embrace them. I have no qualms about admitting that I'm rooting for a strong pullback simply because I believe it will make for a better market in the months ahead.

The problem for the bears is that no one cares what they think right now. The bulls are firmly in control and fighting them is a good way to lose money. At some point that will change but that anticipating that moment is one of the most costly things you can do.

We have some weakness in the early going today. There is not much news on the wires and overseas markets are a bit mixed. The key for the bulls today will be follow-through in technology stocks and at the moment they are looking a bit nervous.

----------------------------

Ülespoole avanevad:

SLNK +32%, TTEC +12%, WSPI +10.4%, ALKS +6.6%, FLIR +6.8%, SNN +5.3%, BGC +5.2%, NLS +5.2% (BB&T upgrade), SCSS +4.3%, EDS +3.9%, AMX +3.1%, SINA +2.8% (also CIBC upgrade), ESRX +2.5%, DIS +2.2%... Other News: NXTM +45% (announces deal with DavIta, a large chain of dialysis centers that will now use NXTM's machines, DaVita also takes 7% stake in NXTM), MAMA +18% (announces deal with Yahoo Canada), EMC +10.2% (to spin off VMware in an IPO; also Goldman upgrade), ISTA +9.2% (positive clinical data), CTRN +6.3% (reports Jan comps; Wachovia upgrade), GPS +5.2% (guides higher and announces Jan comps), FL +3.9% (reports Jan comps, guides to high end of prior guidance), RMBS +2.9% (receives stay for continued Nasdaq listing), SLAB +1.6% (to sell its Aero product line), GSK +1.6% (FDA approves weight loss capsules), VAR +1.1% (to be added to S&P 500), AA +0.8% (Citigroup upgrade).

Allapoole avanevad:

BRLC -17%, BECN -15%, CENT -14%, PACR -11% (also Baird downgrade), APKT -10%, EICU -9.2%, RVBD -8.8% (also announces secondary offering; Baird downgrade), PMTI -7.5%, RTEC -5.6%, GDI -5.2% (also Bear Stearns downgrade), Q -4.9%, TBL -4.7%, PENN -4.4%, LOOP -3.7%, ACET -3.6%, SYT -3.5%, UN -3.1%, LVLT -2.1%, AKAM -2%... Other News: NEW -25% (co guides to an unexpected Q4 loss, will restate each of the previous 3 qtrs; also downgrades from Merrill (to Sell), Jefferies, FBR; other subprime mortgage lenders down in sympathy: LEND -12%, NFI -10%), GYMB -9.5% (weak Jan comps), RAME -7% (prices offering), WTSLA -4.3% (reports Jan comps, lowers guidance), MYGN -3.6% (prices offering), ALU -2.1% (Bear Stearns initiates at Peer Perform). -

Väike tagasivaatav kommentaar tänasele maagaasi raportile. Varud vähenesid -224 bcfi võrra, mis oli tegelikult analüütikute konsensusootusest -218 bcfi kõrgem. Ootuste vahemik oli 204 kuni 231. Suure languse põhjustas USA põhja-, kirde- ja idaosariikidesse laskunud arktiline külm õhumass. Niivõrd suures koguses pole varud kordagi veel vähenenud alates 2004. aasta 6. veebruarist, mil külma tõttu vähenes gaas maa-alustes reservuaarides -224 bcfi.

Lühidalt - tänase varude suure languse tulemusena on gaasi reservuaarides vähem kui eelmine aasta samal ajal. Suur osa analüütikutest seda peale talve sooja algust ei oodanud. Minu poolt 5. jaanuari foorumis avaldatud mõtted CHK teemadel ning ootamatute üllatuskülmade võimalikkusest on realiseerumas/realiseerunud. Nüüdseks on eelmise aasta keskmisest soojemad nädalad selja taga ja nii-öelda eelmise perioodiga võrreldes ees pisut raskemad numbrid järjekorras -102, -123 ja -171. Kui 5-aasta keskmise tasemega võrreldes ollakse veel ca 20% ülejäägis, siis lääne-osariikides on sedapuhku seis pisut kriitilisem, kus varud on kõigest 1.1% 5-aasta keskmisest kõrgemal. Kui gaasiaktsiad(nt CHK, XTO) müüdi selle peale alguses maha, siis päeva edenedes on need nõrkused kogu energiasektoris üles ostetud.

XTO tulemused on 13. veebruaril ning CHK omad 22. veebruaril. Viimasel hoian kindlasti silma peal ning vahendan sealt tulevaid sündmusi/kommentaare, seda enam, et CHK juhtkond oli see, kes julges tegevusharus välja öelda juba talve alguses, et nemad usuvad, et võrdlus eelmise aasta varudega läheb talve edenedes defitsiiti.