Börsipäev 27. juuni

Kommentaari jätmiseks loo konto või logi sisse

-

Täna alandab Citigroup mitmete USA rafineerijate reitinguid. Analüüsimaja arvates on valuatsioonid kerkinud agressiivselt kõrgemale tasemetest, mis nende arvates oleksid mõistlikud ning võtaksid arvesse muutusi, mis on toetanud nende positiivset vaadet.

Samas on aktsiahinnad kerkinud tänu mitmetele faktoritele, mis on kergitanud kasumiootusi kõrgemale tasemetest, mis citi arvates oleks uuesti saavutatavad. Analüüsimaja usub, et lühemas perspektiivis tähendab see suuremat riski ning praegustelt hinnatasemetelt nähakse vaid limiteeritud tõusupotentsiaali. Citi soovitab praegu kõrvalseisjaks jääda ja oodata paremat sisenemispunkti sektorisse, mis on volatiilne ning seeläbi vältida riske (seotud sesoonsete marginaalide vähenemisega ning seega ka madalamte valuatsioonidega.

Citigroup downgrades Tesoro (TSO 57.91) to Sell from Hold, downgrades Valero (VLO 74.66) to Sell from Hold, downgrades Sunoco (SUN 80.33) to Hold from Buy

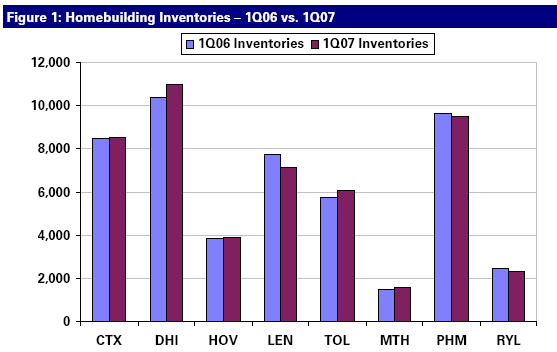

Peale eilseid LEN tulemusi on jätkuvalt tähelepanu keskpunktis lisaks finantssektoris toimuvale majadeehitajad ning tooksin ära järgmise võrdluse, mis näitab mitmete ehitajate varude olukorda. Ehk pikk tee on veel minna enne kui turg need absorbeerida jõuab.

DB kommentaar: reported balance sheet inventories for our builders under coverage areup only slightly in the past year to $51.7 billion at 1Q07 from $51.4 billion at 1Q06, or an increase of roughly 1%. DR Horton and Toll’s inventories were up the most at 6%, while Lennar’s were down the most at -8%.

-

Futuurid on teinud majandusstatistika peale sammu alla:

Durable Goods ex-trans -1.0% vs +0.2% consensus

Durable Goods -2.8% vs -1.0% consensus -

Igatsen hiievanat! Sest ennustused ongi see mida nimetatkse tänamatuks.,

-

Tänane Sharki kommentaar on päris hea.

Cracks in the Foundation

By Rev Shark

RealMoney.com Contributor

6/27/2007 8:45 AM EDT

Click here for more stories by Rev Shark

It is unwise to be too sure of one's own wisdom. It is healthy to be reminded that the strongest might weaken and the wisest might err.

-- Mahatma Gandhi

The market has enjoyed a very strong run since August. However, it now looks like some cracks are beginning to form in this powerful uptrend. The mood is definitely turning more cautious as negative news about housing and subprime debt issues dominates the headlines.

Technical conditions are starting to crack, particularly in the S&P 500, which has broken below its 50-day simple moving average and has an ugly double-top formation. However, we have yet to see any really major technical damage. All three major indices are less than 3% off their yearly highs, and the Nasdaq is still above its 50-day simple moving average. We are not in a confirmed downtrend yet, but it wouldn't take much for that to develop.

Even though we haven't completely collapsed, the deterioration in the market is sufficient at this point to prompt us to raise cash, aggressively cut losing positions and adopt a more defensive market posture. There is a very strong likelihood that the market will see a bounce as the Federal Reserve issues its interest rate decision tomorrow and we wind up the second quarter of the year. However, we can no longer be as trusting of spikes and bounces as we were when the market was running up so strongly. We have had several failures lately that indicate that the market attitude is changing, and we need to respect that fact.

There are several things bothering the market right now. First is the subprime debt issue. The market simply doesn't know the extent of the problem, and uncertainty is always a negative for stocks. According to The Wall Street Journal, there have been more than $1.8 trillion (with a "t") of securities backed by subprime mortgages created since 2000, so this problem is likely more pervasive than the bulls would like to admit. Until we have some greater clarity about the problems, this is likely to pressure the market.

The second thing that has been a problem lately is the increased recognition that housing hasn't bottomed yet and that it may get worse before it gets better. We have had scores of "experts" declaring that the worst is over for the housing market, and it is now quite clear that they are wrong.

A third issue, which is related to the first two, is upward pressure on interest rates. Rates have been inching up, and that exacerbates the subprime and housing problems and causes a number of other problems as well. Higher rates are essentially a tax on business that suppresses valuations and makes bonds a more attractive alternative.

Despite those negatives there are still a number of positives lurking about. Negativity and short interest remain quite high, which means that many are already defensively positioned, which may help temper further selling pressure. We have second-quarter earnings coming up and last quarter they were downright great. Many of the large multinational firms are very likely to benefit once again from overseas strength.

My game plan right now is to look for a short-term bounce to play to the upside. However, I expect there will be an opportunity to do some aggressive selling and to start taking on some short positions. We still have a couple of weeks before earnings hit, and I suspect that the negatives out there are going to continue to act as a weight.

We have a sea of red overseas and another shaky open on the way. I'm looking for a long-side trade into this morning's weakness.

--------------------------------

Ülespoole avanevad:

Gapping up on strong earnings/guidance: NKE +4.9%, CAG +2.7%... M&A: GTRC +20.8% (to be acquired by Bain Capital For $63.00 per share in cash), ANDW +13.0% (to be acquired by CommScope for $15.00 per share), EFD +2.3% (to be acquired by FIS for $36.50 per share in cash)... Other news: JSDA +9.8% (co announced exclusive rights to natural ingredient from Japan for use in new type of energy drink), ALAN +7.7% (before the close yesterday co filed 8-K related to co providing GenTrak genset-based monitoring devices for Maersk Line's refrigerated containers), VSGN +7.2% (FDA has strongly recommended that Vasogen conduct a confirmatory study), SRDX 9.7% (co and Merck enter ophthalmic license and research collaboration agreement), ONT +5.4% (ViewCast has licensed ONT's live Flash video encoding technologies), BBY +2.0% (announces $5.5 bln share repurchase program).

Allapoole avanevad:

Gapping down on news: NUVO -22.2% (announces that it will resume development of alfimeprase, terminates collaboration with BAY), IOC -12.9%% (issues Elk-2 appraisal well drilling report No. 4), TRMP -11.8% (Philadelphia Inquirer reports the deal to sell Donald Trump's casino co has hit several snags), HOKU -2.7% (cautious comments out of boutique firm), FFIV -1.7% (Baird downgrades FFIV to Neutral), BHP -1.3% (stock traded down in Australian trading after prices of commodities including copper, zinc and oil dropped - Bloomberg.com). -

Eraldi infokilluna olgu öeldud, et Rahvusvaheline Energia Agentuur prognoosib, et nafta hinnad jäävad ka järgmisel aastal $70 kanti seoses poliitiliste pingetega Iraagis, Iraanis ja Nigeerias.

-

Ehitusettevõtte Toll Brothers tegevdirektor ütlemas, et ei usu kinnisvaraturu jõu taastumisse enne 2008. aasta 2. kvartalit.

Toll Brothers CEO says does not see market rebounding before April '08 -

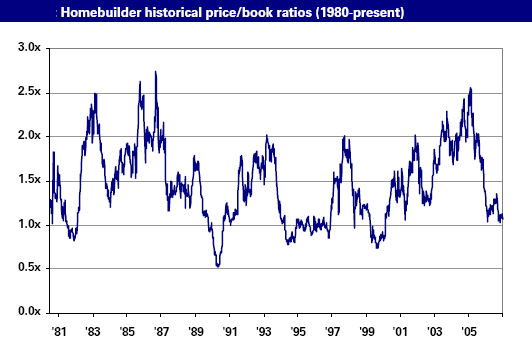

TOLi kommentaar on huvitav. Negatiivsus sektoris on äärmiselt suur ja seda ka muidugi põhjusega, kuid 2007. aasta lõpul võivad aktsiad juba atraktiivseks muutuma hakata. Iga positiivsemgi kommentaar võiks tekitada ostuhuvi ning valuatsioon ei ole tegelikult ettevõtetel kallis. Hetkel on määramatus tuleviku osas väga suur ja olukord sektors halveneb arvatavasti veelgi. Investeerimiseks selline keskkond hetkel kindlasti ei sobi, kuid tasub meeles pidada, et aktsiaturg on tulevikku vaatav. Ilmselt olukord enne 2008. aasta keskpaika sektoris ei stabiliseeru - investeerimisvõimaluse otsijad peavad aga kindlasti varem valmis olema.

Lisaks võib juhtuda, et mõni ettevõte sektoris võetakse enne seda üle. Praegusel ajal on see küll natuke keeruline, kuid meenub 2005. aasta lõpp ja 2006. aasta algus terasesektoris (kuigi tegemist erineva maailmaga)

-

Sulgesime LHV Pro all Cloroxi (CLX) lühikese idee aktsia äkilise languse tõttu ning lähiajal plaanime klientidele pakkuda sarnasesse "teemasse" langeva idee.