Börsipäev 10. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Majadeehitaja DR Horton (DHI) teatas oma kolmanda kvartali müügitellimused. Huvitav on siinjuures vaadata tühistamisemäära, mis ulatus 38% juurde.

Co reported net sales orders for the third quarter ended June 30, 2007 of 8,559 homes ($2.0 bln), compared to 14,316 homes ($3.8 bln) for the same quarter of fiscal year 2006. Net sales orders for the first nine months of fiscal year 2007 totaled 27,313 homes ($6.9 bln), compared to 41,550 homes ($11.4 bln) for the same period of fiscal year 2006. The Company's cancellation rate (sales orders cancelled divided by gross sales orders) for the third quarter of fiscal 2007 was 38%.

JP Morgan upgrades General Motors (GM 36.77) to Overweight from Neutral and adds it to their Focus list the firm also upgrades Ford (F 9.08) to Overweight from Underweight saying signs are emerging that unions will engage in radical changes as the car makers face rising costs from health care benefits. The firm says a health care deal along the same lines as that done by Goodyear could represent the biggest source of earnings upside at both GM and Ford...

Morgan Stanley initiates Abercrombie & Fitch (ANF 73.04) and Urban Outfitters (URBN 23.15) with an Underweights

Jefferies upgrades Micron Tech (MU 13.42) to Buy from Hold and raises their tgt to $17 from $12 saying they believe that D.R.A.M and N.A.N.D flash demand will increase as the co enter's the seasonally strong 2H07. THe firm projects Intel's (INTC) July price cut on Micro Processors coupled with innovative products such as iPhone and new generation iPod from Apple (AAPL) will generate better then expected demand for memory products

-

Applelt oodatakse teise telefoni lansseerimist selle aasta neljandas kvartalis. Seade peaks põhinema iPod Nanol, mis tagaks võimaluse turule tulla odava segmendi telefoniga, samal ajal liigselt kahjustamata iPodide müüki. Telefon peaks olema väiksema funktsionaalsusega ja navigeeritav scroll wheelega. Hinnaks pakutakse JP Morgani analüütiku poolt u $300. Telefonile, mida hetkel veel nähtudki pole, pakutakse potentsiaalseks müügimahuks 30 - 40 miljonit ühikut 2008. aasta jooksul.

-

Home Depot (HD) langetab 2007. a kasumiprognoosi. Kui varasemalt oodati kasumi 9%-list langust, siis nüüd korrigeeriti need numbrid 15-18%-lise languse peale. Põhjustena tuuakse välja nõrkust housing-sektoris ja jaemüügiäri müüki private-equity investorite grupile. Lisaks sellele aastale näeb CFO Carol Tome kinnisvarasektorist tulenevaid ohte ka 2008. aastal:

“While we expect the housing market to remain challenging for the rest of 2007 and into 2008, we plan to continue our reinvestment plans for the long-term health of our business, understanding that it will put short-term pressure on earnings.”

Sellest hoolimata plaanitakse sellel aastal avada 108 uut poodi. Samuti teatati 250 mln enda aktsia tagasiostmisest, mis on osa hiiglaslikust $22.5 mlrd suurusest aktsiate tagasiostuprogrammist.

Sears Holdings (SHLD) hoiatab, et Q2 kasum jääb ootustele alla. Esimesed üheksa nädalat on näidatud negatiivseid SSS numbreid nii K-marti (-3.9%) kui ka Searsi (-4.0%) kauplustes. Juhul kui need trendid kestavad kvartali lõpuni, näeb SHLD kasuminumbreid aktsia kohta $0.98-1.24 vahel (va ühekordne kasum). Analüütikute konsensus oli $2.12. Kuigi otseselt juhtkond allajäämise põhjuseid välja ei too, on suure tõenäosusega probleemid sarnased HD-ga ehk tarbija nõrkus housing-sektorist tulenevalt.

Samuti teatati $1 mlrd lisamisest aktsiate tagasiostuprogrammi. Hetkel kaupleb aktsia eelturul ligi 5% madalamal.

Tuletan ka meelde, et jaemüügisektor on LHV Pro’lt saanud müügisoovituse. Vastava analüüsiga on võimalik klientidel tutvuda siin -

Täna on tulnud negatiivseid uudiseid jaemüüjatelt, mida ka foorumis täna käsitlesime. Eilses börsipäevas sai räägitud kinnisvaraturust ja sellest, kuidas majadeehitajate aktsiaid hakatakse ilmselt ostma varem kui ettevõtete kasumid tegelikult taastumas on.

Nagu tellitult, tuli eile õhtul tuli huvitav uudis selle kohta, kuidas Moore Capital on omandanud 5.08% Beazer Homesi (BZH) aktsiatest. Moore Capitali üle valitseb Louis Bacon, kes on keskendunud agressiivsele makroinvesteerimisele, panustades nii aktsiate, võlakirjade kui ka valuutade ja toorainete suunale. Baconi lipulaev Moore Capital on hedge fundide grupp, mis haldab üle $10 miljardi väärtuses varasid. Moore Global Investments on näidanud 31-protsendilist tootlust peale feesid alates 1990. aastast. Eelmisel aastal näitas fond 26-protsendilist tootlust.

Lähemalt saab lugeda mehest siin ning fondi mõningatele aktsiavalikutele saab pilgu peale heita siin.

-

Huvitav on veel märkida, et reedel rallisid kogu jaemüüjate sektori aktsiad üsna kobedasti. Tõenäoliselt oli see puhas spekulatsioon.

-

tõsi, stocker. Reedese aktsiooni taga oli nii Target (TGT) kui ka Macy's (M) ning väga palju juttu ülevõtmiste kohta. Target on siiski minu silmis hea näide sellest, kuidas pullid ignoreerivad ülevõtumaania saatel langevaid võrreldavate poodide müüginäitajaid.

-

täna-homme lastakse haigel natuke aadrit, aga tõsisemaks operatsiooniks pole asi veel küps.

-

Ise arvan, et peaks selle okt@105 put-i ikkagi soetama.

-

Ma arvan, et esimesed kommentaarid jaemüüjatelt peegeldavad lähitulevikku päris hästi..

-

Watch the Big Picture

By Rev Shark

RealMoney.com Contributor

7/10/2007 8:11 AM EDT

What we see depends mainly on what we look for.

-- John Lubbock

Like the ancient Buddhist parable about blind men who confront an elephant, the way the market is perceived depends on which part of it you contemplate. If you just consider an elephant's leg you might think it is like a tree but if you consider just its trunk you might think it is like a snake.

In the stock market if you consider just the DJIA you will have one view of things, while your opinion may be quite different if you consider the Nasdaq 100 or momentum stocks or small-caps or some other subset or sector.

Many market players struggled with the market rally earlier this year and late last year because the groups they focused on where not leading the way they usually do. The IBD-100-type stocks, smaller-caps, semiconductors and the like were lagging, while DJIA-type stocks like Coca-Cola (KO) , Honeywell (HON) and IBM (IBM) were driving things higher.

There was much consternation among traders, and one of the consequences was that there was a very high level of skepticism about the market. Bearish sentiment stayed high as the major indices were hitting new highs, because many market players simply weren't involved in the stocks that were the strongest.

In the past couple weeks that has changed. We are now seeing what many consider to be the more traditional style of market strength with heavy momentum in IBD-type stocks, leadership from chips and technology and some big-moving small-caps. That is what anyone who has traded over the last decade has been used to seeing when the market is strong.

If you stuck with the mega-cap stocks that led us previously, you are likely feeling a bit left out, just like the smaller-cap momentum players were feeling left out earlier in the year.

The point here is that to excel in the market it is extremely important to have the right perspective. I struggled quite a bit when the mega-cap stocks were leading and found it quite difficult to embrace the different leadership. Now I am seeing a market that is much more suited for my style, but I'm sure that there are many out there who are finding this a more difficult environment.

If you know yourself and your style and are appreciative of how market leadership can ebb and flow, you have a much better chance of producing better results. The market is all about having the right perspective at the right time. Don't be overly rigid in the way you view this beast. It is quite easy to miss the bigger picture if you don't consider all the parts.

We have a soft open on the way as some negative comments from Home Depot (HD) and Sears (SHLD) are causing some problems. The market is technically extended and in need of a rest, so it doesn't take much news to trigger some selling. Fed head Ben Bernanke is making a speech this afternoon that many will be considering. Overseas markets were mixed. Gold is up and oil is down.

--------------------------------

Ülespoole avanevad:

Gapping up on strong earnings/guidance: OBCI +35.8%, GBX +21.4%, PBG +5.3%, CAKE +3.5%... Other news: RBY +23.2% (announced gold discovered at Rubicon's 100%-owned Alaska claims), GMST +13.9% (announces review of strategic alternatives), CMVT +7.4% (media reports say Comverse now for sale - FBR), KNSY +6.2% (co will exit embolic protection markets), CTIC +4.8% (still checking for news), AKAM +4.1% (to replace BMET in the S&P 500), BBND +3.6% (upgraded to Buy at Merrill), GMKT +3.6% (announces 2Q07 gross merchandise value increases 43% YoY), YGE +3.6% (announces long-term agreement with Wacker Chemie AG of Germany), TASR +3.8% (continued momentum from yesterday's 18%+ move), ATVI +3.0% (announces it ships more than 8 mln units worldwide during 1Q08).

Allapoole avanevad:

Gapping down on weak earnings/guidance: FACE -17.3%, UNCA -16.7%, PTRY -11.5%, WDFC -11.3%, SHLD -6.3%... Modest profit taking in some of the solar names: TSL -3.5%, JASO -3.0%, HOKU -2.9%, ESLR -2.6%, FSLR -1.4%... Other news: BCON 3.5% (profit taking after yesterday's 20%+ move higher), LOCM -3.3% (profit taking), BHP -2.9% (Times of London reports that BHP is seeking a private equity partner to make a $40 bln offer for AA), CCL -1.7% (still checking). -

Shortige APPLET! Põhjus: http://www.digg.ee/story/8304/

-

Pakun, et selliseid mõtteavaldusi võib aastas nii suure ettevõtte vastu kokku lugeda kümnetes.

-

Minu argument on see, et RMS ehk Richard Stallman on väga mõjuvõimas. Kui tema ütleb siis on asi jama. Eks muidugi tagantjärele tarkus näitab paremini. Mina võtsin positsiooni sisse.

-

Richard Stallman tahab saada FSFile 100% iga iPhone pealt

Free Software Foundation on leidnud, et iPhone sees jookseb vabavara ning nõuab kompensatsiooniks "kõigest" 100% iPhone hinnast.

Oleneb, mida Richard Stallman vabavara all silmas peab.

Kui iPhone sees on GPL litsentsile vastavat koodi, siis tõenäoliselt on rikutud GPL litsentsi. Richard Stallman, ( kes on ka Eestis esinemas käinud, seoses tarkvarapatentide vastase võitlusega), seda raha endale küll ei saa, ei teagi üldse kellele see raha läheks, kui kohus otsustaks rahamaksmise.

Samas küsiks, et kas siis MacOSX sees pole siis GPL litsentsile vastavat koodi? Ma eeldaks, et iPhone sisse pole midagi uut leiutatud.

Kui aga on kasutusel mingid muud litsentsid, nagu LGPL, siis ütleks, et LGPL litsentsile vastavat koodi on ka microsoft windowsi mingites versioonides (win2000 vist) ja selle litsentsi alla käivat koodi kasutust ei saa piirata.

Samuti tuleb vaadata milline see konkreetne GPL litsentsitud kood on, kes on konkreetne autor. -

Ja BIDU, aktsia on üle 5% üleval teate peale, et tulemused avaldatakse 25 juuli.:) ootused on üle mõistuse taevas.

-

Eks ta keeruline teema ole. Üldiselt on GPL asjad (mitte kõik) siiski litsentsilepingu alusel üle antud FSF-le ja FSF võib neid esindada. Ning kui juba RMS suu lahti tegi on miski asi seal mäda. FSF ei leaks seda üle kui nad lahmiks sellise asjaga ning pärast ise AAPL-le maksma peaks. Börsi suhtes olen ma kahjuks roheline, ei suuda öelda millal ja palju see allapoole hinda mõjutab. Aga võiks nagu jahutada seda ekstaasi küll. AAPL paisub nagu rase jänes :)

-

Küsimus tekkis. Kas mingit aktsiat pole mida AAPL vastu pikaks osta saaks? Maakler vana ¤"#!"# kantseldas mu puti otderi ära :(

-

Apple (AAPL) teema peale paneks üles ühe huvitava kommentaari:

Get Smart About the Smartphone's Potential

By Noah Blackstein

RealMoney.com Contributor

7/10/2007 5:55 AM EDT

Editor's note: This is Noah Blackstein's debut column on RealMoney. Look for more of his commentary on finding growth in a challenging market.

Who am I? It's a great question to ask yourself every few years. In this case, it's an important question for me to answer before you read what I have to say.

I am a portfolio manager of primarily, but not exclusively, long-only funds. While I have the ability to short, my efforts are mostly skewed long. I manage the American and Global Growth funds. I am a growth investor.

My philosophy and analysis are rooted in the works of Philip Fisher, Thomas Rowe Price and others, and updated for current times.

If I'm accused of being optimistic or biased because I am mostly long-only and a growth investor, well, that's valid. However, that raises the question of whether I'd be a growth investor if I didn't run growth funds. The answer is a resounding yes.

I have managed through both the boom years and the awful years for growth investing. Of course, you can make money in other ways, such as value investing and opportunistic trading. But my expertise is in finding companies with the opportunity to become significantly larger companies -- in terms of revenue and earnings -- over time.

One area where I see this kind of opportunity is the smartphone space, on which I am very bullish. The two likely future leaders in this segment are Research In Motion's (RIMM) Blackberry and Apple's (AAPL) iPhone.

Consider this: Handset sales are at least 1 billion units annually. The seemingly ubiquitous Blackberry now makes up slightly less than 1% of that market, and Apple hopes its iPhone will make up 1% of the market next year.

Each company brings tremendous advantages to the table, as well.

Research In Motion is much more than a "hot" device maker. Most people fail to appreciate the infrastructure advantage that the company has built through investing heavily in its own network and server software. Consumers do buy the competition's products, including those issued by huge cell-phone companies, but they prefer to do so only if they get the Blackberry Connect program, which allows users to connect to BlackBerry's Internet service and enterprise server.

Motorola's (MOT) recent acquisition of Good Technology, which makes enterprise wireless handheld computing software, is a clear sign that most other device makers can't beat Research in Motion's solution in the enterprise market.

Apple's recent entry into the space is another indication of the future potential in smartphones. The company's strengths are well known: quality software, ease of use and industrial design.

Many pundits have argued that, at roughly $600, the iPhone is too expensive. I view it a little differently: I believe that for most people, it's an amazing and cheap laptop, with a better interface than 88% of comparable products on the market.

With functions that include Web browsing, email, music, movies and phone calls, the iPhone is the only device most people will need to carry. And when Google (GOOG) successfully ports Google Apps to the iPhone? The potential is enormous.

Many investors will tell you to avoid buying Research In Motion and Apple, saying that both stocks are too expensive. Most of these same investors never told you to buy them when Research In Motion traded at cash value in 2002 or when Apple got down to cash plus real estate value in that same year. Many chartists can help you time the best short-term entry in these stocks; that's not my strength. However, I believe that, over the long term, both have more room to run on the upside.

Recently, Research In Motion's CEO Jim Balsillie fielded a question about the iPhone by thanking Apple. He believes the iPhone launch will raise broader awareness for the smartphone category, and I concur.

These are the two best companies in a rapidly growing category. Even if they far exceed projections over the next few years, there will still be plenty of share to take and room to grow. Apple and Research in Motion can both be owned. And I own them both. -

Kes AAPL shortis on isegi praegu pluss

-

Ärge pahaks pange aga mulle meeldib hetkel mõelda, et minul oli õigus. Kuigi jah ta võib langeda lihtsalt niisama ka. Aga ikkagi langeb :)

Ma lähen USO-ga pikaks jälle, metsa see AAPL. -

ISLN äkki pikaajalisemaks hoidmiseks AAPL-i asemel?

-

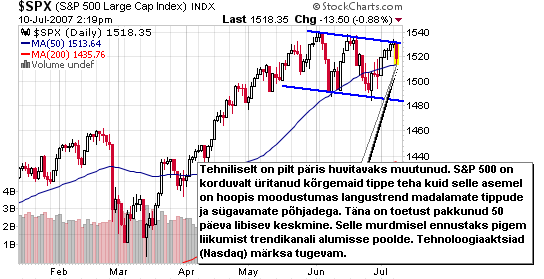

Päris korraliku languspäeva kõrval kiire pilk ka graafikule:

-

Kerstika, Isilon Systems (ISLN) on päris huvitav ettevõte tõesti. Firma toodab andmesalvestussüsteeme just digitaalsete andmete tarvis (video, audio, pildid, PDF failid jne). Traditsioonilised andmesalvestussüsteemid on disainitud pigem emailide, andmebaaside jne aplikatsioonide tarvis ning vaatamata sellele, et neile salvestatakse samuti digitaalseid andmeid, ei ole nad otseselt selleks disainitud. Pikaajaliselt ilmselt on taoliseid andmeformaate aina rohkem vaja talletada ning seega vajadus ISLN toodete järele peaks kasvama tõesti, võttes näiteks kasvõi VOD arengu ja digitaalmeedia üldse.

Ettevõte ei ole hetkel kasumlik, kuid läheneb break even punktile. Esimeses kvartalis kasvas käive 107% $21.6 miljonini. Peale IPOT on firmal ka hea rahatagavara ning pikaajaline võlg puudub.

Hiljuti alustas FBR ettevõtte katmist outperform reitinguga ja hinnasihiga $30. Friedman Billings initiates ISLN with an Outperform and a $30 tgt saying they believe that Isilon has the superior and sustainably differentiated technology to address the rapidly growing market opportunity for storing data in file format. The firm believes that this growth will continue to present a multi-billion-dollar annual storage system market opportunity for the foreseeable future, and Isilon's products address this opportunity better than other products on the market.

-

Huvitav, mille poolest Isilon Systems'i (ISLN) poolt promotud andmesalvestussüsteemid video, audio, piltide jne salvestamiseks paremad on, kui seda on traditsioonilised andmesalvestussüsteemid?

-

tonuonu,

pigem mine pikaks OIH'is. USO ei reageeri piisavalt toornafta hinnatõusule. Tasub visata pilk mõlema alusvara graafikutesse. -

merrill,

mina läheksin soodsa momendi avanedes OIH-is pigem lühikeseks... -

Briefing andis mõned nädalad tagasi ISLN-st niisuguse ülevaate

Isilon Systems: broken down IPO is starting to trend higher; strong top line growth (14.51 -0.12) : After steadily falling from its IPO in December to early May, Isilon Systems (ISLN) has been slowly climbing higher and has broken its downward trend. The co sells storage systems for digital content (video, audio, digital images, PDF files, scanned images). Traditional storage system architectures were designed for structured applications such as email, accounting, databases etc. These systems are also being used by default to store and manage digital content, but they were never designed for digital content. For example, the explosion in rich media downloads from the internet or video-on-demand from cable companies creates a need for systems designed specifically for digital content storage. Another example, in the oil & gas industry, is exploration cos using the Isilon IQ to store vast amounts of 3D seismic data making it much easier to analyze. Another example is ISLN being used by biotech cos to store high resolution neuro imaging data and a breast cancer research lab uses it to store 80,000 diagnostic images. Currently, digital content files are often stored in several different formats and locations.... The co is not yet profitable but is getting there, posting a $0.06 loss vs $(0.79) a year ago. The top line is growing strongly as Q1 revenue jumped 107% to $21.6 mln. Also, the co expects Q2 revenue of $24.5-27.5 mln, which computes to impressive 13-27% sequential rev growth. Also, thanks to the IPO, the co is awash in cash with $99.4 mln, or about $1.60 per share, with no LT debt. On a technical basis: After reaching its post-IPO high of 28.50 in late Dec, ISLN has consistently slid lower before bottoming out in early May at 11.48. The stock then staged a ~30% advance throughout May before giving back some of those gains at the beginning of Jun. Recently, the stock has pushed higher off last wk's reaction low of 12.80 to challenge its multi-mth downtrend line (daily chart). If the stock can manage to sustain its recent gains and/or hold a successful test of the ~14.00 level, then the late May range highs of 15.62 come into play overhead, followed by the Apr low near ~16.00. Mkt cap $895 mln, float 41.7 mln, avg vol 410K. -

masendav 170% jäi täna teenimata- närvid:)

-

USOga ärge pikaajaliselt küll pikaks minge.

See ikka selline max paari nädala - kuu instrument nagu kõik futuuridel põhinevad asjad, arvestades just seda, et nafta futuurid on vast alati? olnud contangos... -

OIH ei sobi kõige paremini naftas pikaks minemiseks kuna sisaldab aktsiaturu riske. Kui aktsiaturul toimub suurem korrektsioon, siis ei jää naftateenuste aktsiad sugugi puutumata (nt. eelmise aasta mai paanika). Praegu on OIH investeeringu risk isegi suurem, kui nafta instrumente hoides, sest OIH aktsiad on kerkinud nafta hinnast kiiremini (nafta kaupleb praegu eelmise aasta tipust madalamal).

-

tegelt oli küs selles, et ei jälginud konto seisu, müüsin esmasp spy 150 ja 151 putid, et võtta 153 aga siis selgus, et ei saa tagasi osta, idioot olen!

-

upaer

Ole mureta. Nagu turuosalised on öelnud, et turg on alati olemas. Ta ei kao kuhugule. Arvan, et selline kukkumined ei jää viimaseks. -

loogiline et ei jää, ja alles algab langus. aga 100t jäi tulemata, lisaks puhkusel metsas ilma pideva levita oli kaotust kogunenud!