Börsipäev 4. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Üllatavad arengud maailmas toimumas. Põhja-Korea ja Lõuna-Korea vahel kehtib alates 1953. aastast vaherahu (cease-fire) ning riikide juhid on teineteisega kohtunud haruharva. Nüüd on viimasel kohtumisel aga leitud üksmeel ning lubatakse töötada selle kallal, et ajutine vaherahu plaan asendada püsiva rahuga ning lõpetada tehniliselt 54 aastat kestnud sõda. Kolmapäeval alanud kahe riigi vaheline kohtumine oli esimene viimase 7 aasta jooksul.

-

WSJ kirjutab täna päris huvitava artikli Chicago Mercantile Exchangel (CME) kaubeldavatest lepingutest, mis indikeerivad tulevikus suurt langust majadehindades. CME-l kaubeldavate lepingute järgi nähakse elamute hindu 10s suuremas linnas langemas keskmiselt ca 10% 2007. aasta keskelt kuni novembrini 2011. Kauplemine baseerub S&P/Case-Shiller house price indeksite oodataval liikumisel. Kuigi kauplemismahud on väikesed, on trend kahtlemata alla.

WSJ: The current contract prices show that traders expect prices in the Miami metro area in November 2011 to be down 28% from the mid-2007 level. (The indexes cover metro areas as defined by the U.S. Census Bureau.) The expected drops in other metro areas for the same period are 18% for Las Vegas, 12% for New York, 19% for San Diego, 26% for San Francisco and 13% for Washington, D.C.

Inventories at the end of September were up about 18% from a year earlier in the 17 metro areas for which comparable figures from September 2006 were available.

Pilt elamuhindade languse prognoosidest näeb välja iseenesest selline. Miamis oodatakse väga tugevat kukkumist. Karune Douglas Kass usub, et umbes 20-protsendiline langus elamuhindades üle riigi tähendab $4-trillionilist kadu tarbija jõukuses. Võrdluseks võib vaadata USA sisemajandusliku koguprodukti, milleks oli 2006. aastal 13.2 triljonit.

Tarbijale kindlasti selline langus mõju avaldaks ning septembrikuised müügitrendid on ka mõningate jaemüüjate sõnade kohaselt äkiliselt halvenenud. Seda kommenteerib ka Deutsche Bank:

September sales are likely to decelerate from the July/August period, as the consumer continues to face considerable headwinds from the weakening housing and labor markets, and as unusually mild temperatures (particularly in the Northeast) likely impacted demand for seasonal apparel.

Slowing Economy Impacting the Consumer

The continuing decline in housing, painful mortgage resets, still-elevated energy prices, and a slackening labor market are beginning to put pressure on consumer confidence and spending. While the recent -50bp Fed cut should help stabilize the credit markets and investor confidence, it may be 6 months or so before housing and overall consumer sentiment improves. DB Economics continues to forecast below-trend GDP growth in Q3 (+2.2%) and Q4 (+2.1%), with another -25bp Fed Funds cut (to 4.50%) in October.

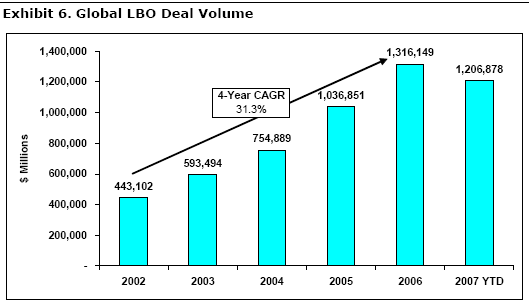

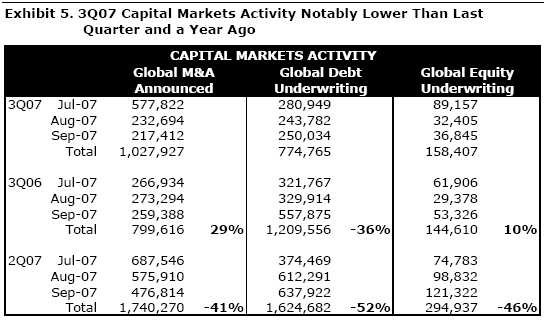

Natuke teisel teemal ka. CIBC toob välja mõne huvitavama pildi, mis puudutavad suuremaid pankasid. Täpsemalt kajastavad need langenud aktiivsust kapitaliturgudel ning LBO tehingute mahtu käesoleval aastal võrreldes varasemaga.

-

Täna siis kell 1.45 p.m. (CET) avaldatakse ECB rahapoliitika otsus..

-

ma ei saa aru miks LDK eile nii räigelt kukkus. see controlleri lahkumine ja muu on vana asi ju (nädal või rohkem).

-

mm...pole kursis, kuid süüdistused SECile väga väike asi ei ole? Mingi jama ka varudega, hiljuti kommenteeritu pushoute ju equipenti osas.

-

LDK tõmbas ka TSLi kaasa. Täiesti arusaamatu. Ilmselt hirm polysiliconi pärast.

-

nagu 2. oktoobri börsipäeva foorumis juba mainisin, siis musta notsu mängus katsetavad mõned osalised uusi reegleid, mis äkki peagi turul trendiks saavad ...

hedge fund manager või private equity firma paneb 1/3 omakapitali ja Citigroup annab 2/3 laenu ja kogusumma eest ostetakse Citigroup bilansist hapuka kõrvalmaitse omandanud finatsprodukte -

Henno, see on huvitav jah. Laenutingimused on ilmselt ka väga soodsad?

-

The Financial Times reports Citigroup (C) is in talks with KKR to provide financing to buy some of the leveraged loans on its balance sheet. It has also talked to other private equity firms about providing such funding. However, people close to the talks say such deals have so far proved difficult to structure. The talks with KKR's asset management arm have brought together the private equity firm responsible for some of the biggest leveraged buy-outs in the run-up to the credit freeze and the investment bank that agreed to provide the financing for many of the deals. KKR is raising money for an existing hedge fund to buy leveraged loans and other impaired debt.

Pank ei peaks ilmselt laenutingimuste osas väga pirtsakas olema, sest kahtlast kraami jääb sellise deali lõpptulemusena panga bilanssi ikkagi 1/3 võrra vähem

Aga oluline on teema sellepärast, et ilmselt hedge fondide juhid ei plaanitse 1/3 osaluse omandamisega hapuvõitu kraamis ka mitte lossi saada ja põhimõtteliselt on tegu turu taastumisega, kus on olemas ostjad, likviidsus ja uus "õiglane" hinnatase ... viimati mainitute puudumine ei ole võimaldanud vahepeal varaklassis portfellide väärtust adekvaatselt hinnata -

Eilses foorumis oli NTRI -22.6% langusest juttu. Prognoosid siis firma poolt suhteliselt hapud. Citi kommenteerib vana pullina situatsiooni, kuid langetab prognoose. Ma tegelikult ei usu, et tegu põrkemänguga on (vaatamata citi suhteliselt loogilistele pointidele) - arvestades, palju stock investoritele pettumust on valmistanud, siis viimane uudis uute klientide lisandumise kohta konkurentsiohu tõttu ikka positiivsust ei ole lisanud.

New Customers Likely Impacted by Alli — 3Q new customers are expected to decline 7% to 218k customers vs. guidance of 4% growth or 245k new customers.

Encouragingly, NTRI mentioned they were satisfied with reactivating former customers. This indicates to us that the issues are likely short term in nature and NTRIs’ business model is in tact.

We note 2H07 is the end of the diet season, so negative short-term trends are less relevant in our view. The Q to focus on is 1Q08, which is when the diet season begins...

Hinnasiht $81 pealt $55-le.

-

Lazard downgrades Nutrisystem (NTRI 47.57) to Hold from Buy following the co's pre-announcement of lower than expected 3Q revenues and EPS. The firm says while the co previously tempered its outlook for 2H07 as a result of competitive headwinds following the launch of diet drug Alli, they believe that the weaker-than-expected results warrant a more cautious view in the near term

-

Bank of England maintains benchmark interest rate at 5.75%, as expected

-

abesiki, kas bidisid LDK?

-

ECB leaves policy rates unchanged at 4.00% as expected

-

Otsus, et 4% peale jäeti, ei ole mingi üllatus ja ka turud ei reageeri sellele - olulisem on aga Eesti aja järgi kell 15.30 algav pressikonverents, kus antakse vihjeid sellele, et kas Euroopa Keskpank võib olla novembris inflatsiooniga võitlemiseks ikkagi intresside tõstmise teed minemas või mitte.

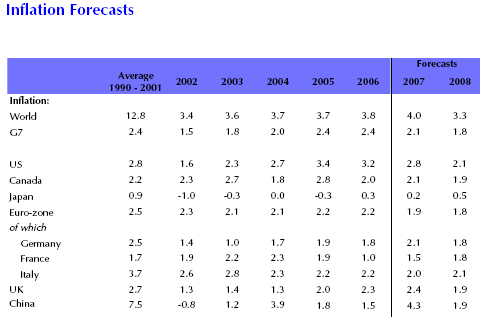

Panen siia mõne päeva tagused Capital Economicsi inflatsiooniprognoosid:

Ja jätkuvalt ei tasu ära unustada, et ECB eesmärk on hoida inflatsioon vähemasti nende endi sõnade järgi 'near, but below 2%' - viimasel kuul oli see 2.1%, mistõttu ootaksin ikkagi karmi joont hoidvat sõnavõttu.

-

RBC kärbib Gmarketi (GMKT) 3Q07 prognoose allapoole konsensust kuna pühad Koreas mõjusid oodatust kehvemalt aktiivsusele veebilehel. Chuseok holiday (Korean Thanksgiving, is held on the 15th day of the 8th lunar month)..

RBC believes GMKT will report flattish GMV vs. 2Q07. They have lowered their estimates to GMV 775b KRW vs. prior 791b KRW, revenue $60mm vs. prior $62mm, and EPS $0.15 vs. prior $0.18. (Consensus stands at $0.18/ $62.7 mm).

Samal ajal usub analüüsimaja, et neljas kvartal tuleb tugev ning jätab 2007. aasta prognoosid muutmata. Soovitatakse vaadata mööda sesoonsusest ning pigem pikaajalisi toetavaid trende. Hinnasiht $27.

Vaata lähemalt: http://notablecalls.blogspot.com/

-

Kes tahab Euroopa Keskpanga kohe-kohe algavat konverentsi otseülekannet kuulata, siis teha saab seda siit.

-

Kuulan ülekannet ning milline on esmamulje - nagu varem juba korduvalt olen arvamust avaldanud, räägib ECB inflatsiooniohust ning Trichet kasutab sõna 'vigilance'...

-

Goldman Sachs kommenteerib, et Gmarket on tõusnud viimasel ajal tugevalt ning eemaldab aktsia oma Conviction Buy Listist. Samuti kärbitakse prognoose Chusok holiday tõttu. Reklaamijad on vähendanud natuke reklaamikulutusi, teades, et pühade ajal on müügi- ja aktiivsusnäitajad väiksemad. See omakorda mõjub nii Gmarketi reklaamimüügile kui ka GMV-le.

We reduce our 2007E EPS by 6% to $0.72, 2008E by 2% to $1.06, and 2009E by 4% to $1.45.

We estimate that the Chusok holiday reduced 4Q06 activity by up to 4%, and 3Q07 by up to 5%, distorting yoy growth rates. We reduce our 3Q07 GMV estimate by 1% to W775 bn, up 36% yoy, and our 3Q07 advertising revenue estimate by 7% to W23 bn, up 50% yoy.

Samuti usub analüüsimaja, et edaspidi näitab Gmarket tugevat kasvu ning nende 2008. aasta GMV kasvuprognoos (+19%) võib jääda konservatiivseks.

Hinnasiht $28 ning ikka on õhus võimalus, et Yahoo! kas ostab firma ära või siis suurendab aktsiapositsiooni.

-

Ning ka Briefingust siis väikse hilinemisega tähtsamad sõnumid:

ECB President Trichet: Upward risks to price stability over medium term -

mingi lühiajaline põrge võib NTRI'st tulla sellise short interesti peale

kuid MT jääb tõenäoliselt siia loksuma -

nojah, mis tasemelt seda põrget mõõtma hakata?! Või milline on õige tase ostmiseks? Praegu on stock juba tunduvalt madalamal eilsest järelturust ning oleks eelturul ostma hakanud põrkemänguna, oleksid praegu vee all. NTRIle omaselt kommentaare situatsiooni kohta ka täpsemalt ei jagata enne tulemusi, mis hirmutab kindlasti investoreid. Praegu tundub suht broken ja huvi ei ole eriti tekkinud. Agressiivsed tgt cutid ka...

Nutrisystem downgraded to Hold at Kaufman- tgt cut to $40 from $90

Nutrisystem downgraded to Buy at Broadpoint Capital- tgt cut to $50 from $75

aga eks millalgi ikka põrkab jah : ) -

jah, see põrge võib kuskilt altpoolt tulla

dead on ta mõneks ajaks nii ehk naa

for the record - ei mängi põrget

ja positsiooni kohta otsus veel tegemata -

NTRI puhul on alles 31-32$ tase kust tasub põrget oodata. Esiteks on see oluline Fibonacci tase ja teiseks toimus seal 2005 lõpp/2006 algus konsolideerumine.

-

Saksamaa DAX -0.05%

Prantsusmaa CAC 40 +0.11%

Inglismaa FTSE 100 +0.69%

Hispaania IBEX -0.06%

Venemaa RTS -0.15%

Poola WIG +0.29%

Aasia turud:

Jaapani Nikkei 225 -0.62%

Hong Kongi Hang Seng N/A -1.84%

Hiina Shanghai A (kodumaine) +2.65%

Hiina Shanghai B (välismaine) +1.44%

Lõuna-Korea Kosdaq +0.54%

Tai Set -0.26%

India Sensex -0.39%

USA turgudel positiivsed meeleolud ning oleme avanemas ca 0.2-0.3% plusspoolel.

-

Don't Buck the Trend

By Rev Shark

RealMoney.com Contributor

10/4/2007 8:35 AM EDT

Trends, like horses, are easier to ride in the direction they are going.

-- John Naisbitt

When a market has rallied as furiously as this one has since mid-August, there can be a great temptation to try to determine when the uptrend might finally end. It is a particularly hard temptation to avoid in the present situation, since there seems to be so many macroeconomic negatives that are seemingly at odds with a strong market.

The market is obviously acting very well, but we all know that there are concerns that the economy will slow in the near future. What could be more logical or appealing than trying to guess at what point those worries and concerns may actually kick in and end this strong uptrend?

The problem with that approach is that it is just so darn hard to do. There is no way to logically conclude when buyers are finally going to relent. The problem is that buyers are driven mainly by emotions. The majority don't buy because they think stocks are cheap or that the weak dollar is going to boost earnings of multinationals. Those might be justifications they use for their actions, but most buyers buy because they see things going up and don't want to be left behind while others are making money.

The market is an exercise in crowd psychology. Investors want to run with the herd. Eventually the herd will go too far and things will reverse, but it is extremely easy to underestimate the persistence of herd behavior, Stocks always go higher or lower than seems reasonable. If you try to apply cold, hard logic to emotional behavior you are very likely to be disappointed.

Rather than being overly anticipatory about when the market trend may finally end, the better approach is to be reactive as things develop. When the market eventually starts to top, there will be signs that will tip us off that a change is taking place. The dip-buyers will begin to lose their enthusiasm, the momentum players will stop chasing as vigorously, breakouts will fail to hold and the character of the action in individual stocks will start to change. Many of the warning signs of a trend change are subtle, but if you stay vigilant, you can begin to spot them and start to adjust your market posture.

For now, the trend remains solidly up and there are few signs that it is ready to end. The profit-taking yesterday looked like simple consolidation within an uptrend. It may develop into something more dire, but we don't have any major indications of that right now.

The most likely catalyst for a change in market trend, if one is going to occur, is the upcoming earnings reports for the third quarter. That news will provide very clear excuses for buying or selling and is likely to determine whether the trend continues.

Until earnings hit, we are likely to stay in a choppy trading range with a somewhat positive bias. It is certainly premature to anticipate a market breakdown, but it is never too early to watch for signs of one.

We have a slightly positive open shaping up. Asian markets were mostly negative while Europe was slightly positive as interest rates were left unchanged by the ECB.

-----------------------------

Ülespoole avanevad:

Chinese momentum names moving higher again in pre-mkt, despite a second down day in Hong Kong trading (Hang Seng -1.8%): GAI +16.6%, RCH +15.7%, NOEC +10.4%, CHNR +9.6%, CHINA +8.9%, GRRF +8.0%, CSUN +7.5%, WX +6.5%, TSTC +6.4%, HIHO +6.3%, EFUT +5.7%, CDS +3.7%... Other news: HEPH +41.7% (announced new preclinical data demonstrated that HE3235 significantly inhibited tumor growth), TBUS +% (receives order from General Electric; Order for digital recorders products valued at approximately $1 mln), CTCT +8.5% (continued momentum after strong IPO opening yesterday), CKNN +7.5% (upgraded to Buy at ThinkEquity), ASTI +7.0% (US Air Force increases funding of ASTI's solar cell program), LDK +6.5% (co issued statement regarding recent allegations, which they believe have "no merit"; we're hearing stock was downgraded at CIBC as well), ATHN +5.7% (Cramer called ATHN the best of his overlooked IPO lot), SPF +5.1% (Upgraded to Neutral at UBS), ISIS +4.8% (reports positive results of Phase 2 study of ISIS 301012 in Heterozygous FH patients), HMY +4.0% (reports that the trapped miners S. Africa are being evacuated).

Allapoole avanevad:

On weak earnings/guidance: RNIN -27.6%, NTRI -24.3% (also downgraded at Broadpoint Capital and Kaufman), WTSLA -15.8% (also downgraded to Neutral at Cowen), ISLN -16.1% (also downgraded at RBC Capital and Caris & Co), ARM -7.1%, SMOD -6.5%, CNX -4.4... China stocks continue to see volatility, with mixed trading in individual names this morning after the Hang Seng index was down 1.8% (We note that a number of China stocks are gapping up as well): CRNT -5.1% (downgraded to Neutral at Oppenheimer), SSRX -5% (downgraded to Sector Perform at CIBC), YGE -4.2%, CEO -3%, LDK -3% (downgraded to Underperform at CIBC)... Other news: PPCO -28.1% (Endo and Penwest receive paragraph IV certification notice for OPANA ER), HANS -5% (downgraded to neutral at tier-1 firm), ISIL -1.4% (added to sell list at tier-1 firm). -

Järgmine video peaks küll kõigile vandenõuteoreetikutele meeldima.

Debating whether or not Bob Rubin (citigroup) turned Ben Bernanke around on rate cuts, with Ken Thomas, Wharton School of Business, and CNBC's Larry Kudlow.

http://www.cnbc.com/id/15840232?video=542967673&play=1# -

Nutrisystem drops another 2.50 at the open to new lows; now down over 30%

-

Nii, 31$ peaks algama NTRI põrge

-

Briefing.com tuletab täna meelde nn. "Dow teooriat", mille kohaselt Dow Industrials uued tipud peavad saama kinnitatud ka Dow Transports ja Dow Utilities indeksite poolt, vastupidine olukord viitab ületootmisele tööstuses ja ennustab Dow langust või siis peaksid Transports ja Utilities hoogsalt järgi võtma

Vaata graafikut -

Toon Beari arvamuse ära, kes ootab Föderaalreservi intressimäärade edasisi langetamisi, kuigi vahemik on päris suur:

BSC Bear Stearns Mortgage Head says expects Fed to cut by 50 to 100 basis points over next three quarters -

Tänaseks pole Dow Transports ja Dow Utilities küll erilist tõusmise märki näidata suutnud kui siis ehk viimane

-

The credit markets are more stable than they were in August, but problems with asset-backed securities still exist, said Dallas Federal Reserve President Richard Fisher. (Dow Jones)

-

RIMMi tulemused inline: RIMM prelim $0.50 vs $0.49 Reuters consensus; revs $1.37 bln vs $1.36 bln Reuters consensus.

Aktsia +4% pealt praegu -1% peale kukkunud. -

Aga praeguseks juba kõrgemal plussis tagaisi

-

Co issues upside guidance for Q3, sees EPS of $0.59-0.63 vs. $0.55 consensus; sees Q3 revs of $1.60-1.67 bln vs. $1.52 bln consensus.