Börsipäev 8. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Aasia turud reedese USA tööjõuraporti ja aktsiaturu korraliku liikumise peale uutel tippudel. Samas, sealse piirkonna graafikud lähevad üha enam ja enam paraboolseteks ning reeglina aktsiaturud niimoodi püstseinas üles liikuda ei saa.

Hong Kongi Hang Seng vasakul graafikul ja Hiina Shanghai A indeks paremal:

-

BBC Panoramas täna UK subprime-st saade. House of Cards. Kui ma õieti arvutasin, siis 22:30

-

Aga tundub, et veebi läheb ka viimane osa.

-

Inflatsioon kerkis augusti 5,5 protsendilt septembris 7,1 protsendile. See on kõrgeim näit 1997. a detsembrist, teatas Leedu statistikaamet.

Ka sina, Leedu! -

CIBC kommenteerib Pro pikaajalist investeerimisideed Motorola (MOT), tõstes 2007-2008. aasta EPS, ASP ja marginaalide prognoose. Kõike seda tänu tugevamatele müügitrendidele ning parematele varude haldamisele. Lisaks on suudetud RAZR V3 hindu isegi tõsta. Müügistrateegia muutmine on alles algus ning põhilist “taganttuult” ootab CIBC ikkagi uutelt mudelitelt.

Tuleb tõdeda, et siiani on Motorola üpriski kiirest probleemidele reageerinud ning erinevate astmete juhtide väljavahetamine tundub olevat ka vilja kandnud. Samas on võti tulevikku ikkagi uued mudelid ning aasta lõpp peaks selles osas tooma ka uudiseid.

Hinnasihiks on CIBC seadnud $23 ning reitinguks “outperform.” Lähemalt saab lugeda idee fundamentaalidest Pro alt.

_ Our overall impression of MOT's current business environment is turningmore positive as our checks suggest improving handset shipments (as wellas sell-through) and ASP trends.

_ Our checks suggest Motorola's handsets are sold out for the quarter (3Q07)in certain regions (mainly Asia and North America) on certain models(mainly RAZR) relative to its targets. We believe 3Q07 inventories couldshrink to around 7-8 weeks from 20 weeks in 2Q07, helping cash flow.

_ We feel more comfortable in MOT's ability to turn around its business. Withnew models coming over the next 6 months (some this week), MOT'smomentum could be sustained although we still expect a bumpy ride. Wereiterate our Sector Outperformer rating and $23 price target.

Lisaks paar pilti ka kinnisvaraturu tervise kohta USAs.

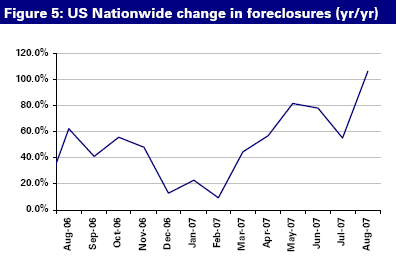

Deutsche toob välja natukene huvitavat statistikat. Laenu katteks tagatiste äravõtmine (foreclosures) on tublisti kasvanud võrreldes eelmise aastaga. Samuti toob DB välja, et 2003. aasta 5-aastaste ARMide refinantseeringute tipp hakkab nüüd kätte jõudma järgneva 14-16 kuu jooksul, mistõttu oodatakse foreclosure’te veelgi suuremat kerkmist.

DB: More than doubling of foreclosures across the US. In August, foreclosures across the United States have doubled since this time last year. US lenders foreclosed on about 244k homes, up +107% year/ year from 113k at August 2006. 2003 was the peak year in re-financings many of which were 5 year ARMs which will be resetting in the next 14-16 months. As such, we expect foreclosures to increase significantly through the end of 2007 and into 2008. Some may argue that foreclosures will be muted in the coming months due to the Fed cutting rates, we disagree. We do not think the recent 50bp federal funds rate cut will dampen the pace of foreclosures at a significant pace going forward..

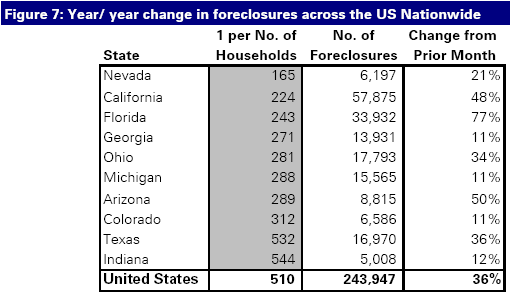

Huvitav on vaadata ka foreclosureid turgude lõikes.

Kõige keerulisemas situatsioonis olevatel turgudel tegutseb näiteks Lennar (LEN) ning firma ei ole ise ka probleeme sugugi varjanud. Nagu näha, on suured probleemid Californias, Arizonas ja Floridas. Californias on Subrime osakaal ca 33% ning Alt-A laenude osakaal 2006. aastal ca 23%. Just Californias ja Arizonas tegutseb selline pank nagu Downey Financial Corp (DSL) ning firma müüdud laenudest moodustavad enamuse ARMid - firma on seejuures suhteliselt vähe kontrollinud laenuvõtjate tausta. Ettevõte tuleb 17. oktoobril enne turu avanemist tulemustega ning väga huvitav on jälgida, mis sealt tulemas on. Eelmine kvartal eriti kena ei olnud ning short % aktsias on vaid suurenenud.

-

Mulli tekkimisest Hiina turuga seotud aktsiate osas annab aimu Buffetti Berkshire Hathaway järjepidevad müügid PetroChina aktsias. Kevadel oli nende positsioon ettevõttes veel üle 10%...

PTR PetroChina: Berkshire pares stake - WSJ (190.83 )

WSJ reports Warren Buffett's Berkshire Hathaway further cut its stake in the listed shares of PetroChina Co. to 6.97% from 7.29%, according to a filing by the U.S. co to the Hong Kong stock exchange Monday. -

NY Post reports Former Federal Reserve Chairman Alan Greenspan said yesterday that the rate of U.S. economic growth was slowing, but the odds of a recession are less than 50/50. Greenspan also said in an interview on CNN's "Late Edition with Wolf Blitzer" that the turmoil caused by the subprime mortgage crisis was easing and financial mkts were beginning to go back to normal. Greenspan said Americans should be "cautious" about the economy, but not necessarily nervous.

Varem on Greenspan majanduslanguse tõenäosuseks pidanud 1/3... tema silmis on see tõenäosus siis jätkuvalt enam-vähem samal tasemel. -

Ryder System (R), mis pakub rendi ja liisimisteenuseid (mcap $3 miljardit), alandab täna oma prognoose. Tegelikult ollakse juba mitmes ettevõte antud sektorist, mis peab oma tulevikunägemust negatiivsemaks korrigeerima, kuid firma sõnastus majanduskeskkonna kohta on huvitav:

Economic conditions have softened considerably in more industries beyond those related to housing and construction. Consequently, freight and shipment levels have weakened to a greater extent than previously anticipated. -

Saksamaa DAX -0.30%

Prantsusmaa CAC 40 -0.24%

Inglismaa FTSE 100 -0.49%

Hispaania IBEX -0.34%

Venemaa RTS +0.51%

Poola WIG -0.05%

Aasia turud:

Jaapani Nikkei 225 N/A (börs suletud)

Hong Kongi Hang Seng -0.22%

Hiina Shanghai A (kodumaine) +2.55%

Hiina Shanghai B (välismaine) +0.31%

Lõuna-Korea Kosdaq +0.36%

Tai Set +1.54%

India Sensex -1.59%

USA alustab päeva reedeste rekordite järgselt pisut tagasihoidlikumalt - hetkel indikeerivad futuurid päeva -0.2%list avanemist.

-

Momentum Ignores the 'Negative' News

By Rev Shark

RealMoney.com Contributor

10/8/2007 8:14 AM EDT

My theory is that if you look confident, you can pull off anything -- even if you have no clue what you're doing.

-- Jessica Alba

Although a number of market observers thought that we would see a negative reaction to strong jobs data on Friday, that certainly did not turn out to be the case. We gapped up and moved steadily higher all day. The news was embraced as positive, and the longer there were no signs of doubt, the stronger the action.

Logically, there was a good argument to be made for the proposition that we would see some pressure on a strong report, because it would mean less chance of further aggressive interest rate cuts by the Fed. The primary driving force in this market since mid-August has been a friendly Fed. We rallied in anticipation that it would cut, and we continued to rally after it cut because it gave us more than expected.

Given how much the market has focused on the great benefit of a dovish Fed, you might think that we'd see some selling pressure on any news that indicated that it has reason to not be as friendly in the near future.

So why wasn't the case? Why didn't the market care that the chances of more rate cuts declined?

The No. 1 reason is good old-fashioned momentum. Markets that act confident and unconcerned tend to attract buyers who don't want to be left out. Why worry about this interest rate issue when folks are buying and making money? You make money by buying stocks that are acting well, not by dwelling on some theoretic issues that may or may not matter.

The market has been acting well, so we have to assume that things aren't that bad. Maybe we don't need more interest rate cuts. Maybe "one and done" solves the liquidity issue that hit us in August, and now the economy is ready to plod along to the upside once again. Obviously, the big banks are reacting well to taking some massive loan losses, so maybe the worst has already been fully discounted.

There is no question there are negatives out there. The economy still faces many pressures, debt issues may still lurk under the surface, the dollar is struggling, oil is at highs and real estate is in pitiful shape. But in the market fundamentals don't matter until they matter. Only after we start to see some weakness will people point at those issues as the reason for selling.

Many market players make the mistake of thinking it's the news that drives the market. To a great degree, it is the market that drives the news. The media are always looking for explanations behind the action. When we go up, they focus on things that seem positive, and when we go down, they will hit on all the negatives. The facts don't change, but the market action determines the way that those facts are spun.

We have a soft open shaping up this morning as there seems to be some second thoughts about the justification for the buying on Friday. Overseas markets were mixed with positive action in Shanghai after a weeklong vacation. Europe was moderately lower despite a takeover of Business Objects (BOBJ) by SAP (SAP) . The bond market is closed today for the Columbus Day holiday, and we have no economic reports due.

----------------------------

Ülespoole avanevad:

Gapping up on strong earnings/guidance: CTDC +29.3% (co issues press release with previously reported 1H results (originally reported Fri morning), provides additional commentary)... M&A: NGPS +16.1% (to be acquired by Hexagon for $50 per share), BOBJ +15.1% (to be acquired by SAP for ~$59.64 per ADS -- secondary plays COGN +6.2%, INFA +2.6%, MSTR +2.6% are trading higher in pre-mkt), UIC +5.8% (to be acquired by Textron for $81/share)... Select China names are bid up in pre-market trading: XFML +22.0% (hearing early strength attributed to newsletter mention), HRAY +16.4%, CDS +9.9%, CNTF +8.6% (announces the launch of the world's first WCDMA/GSM dual mode phone), CLWT +8.5%, STV +7.5% (stock had its IPO on Friday), CPSL +7.0%, ATS +6.6%, ORS +6.3%... Other news: AVNR +29.3% (granted special protocol assessment from FDA for confirmatory phase III trial of Zenvia in patients with P.B.A.), UCBH +14.3% (signs agreement for China Minsheng Banking to take minority strategic investment), MASI (Cramer names stock as an overlooked IPO), CHDX +7.5% (tgt raised to $38 at Brean Murray, saying co has been selected as the preferred 2008 Beijing Olympics healthcare service provider), HEPH +5.5% (presents positive data demonstrating HE3286 provides benefit in animal model of ulcerative colitis).

Allapoole avanevad:

On weak earnings/guidance: R -6.3%... Other news: NOVN -21.8% (announces a Phase 3 study lithium carbonate product did not meet its primary endpoint), LDK -11.2% (mentioned negatively in Barron's -- CSIQ -4.9%, JASO -4%, SOLF -3.7% trading lower in sympathy), SAP -6% (acquires BOBJ, expects transaction to be dilutive by mid single digits EUR cents in 2008), EMKR -4.2% (receives notice from NASDAQ regarding the co's 2006 annual meeting of shareholders), EPEX -3.9% (logged a total of 18 wells in the third quarter), PTR -3.8% (Berkshire cuts ownership stake to 6.97%). -

Google võitlemas $600 piiriga ja sealt juba mitu korda läbi hüpanud.

Päevasisene graafik LHV Trader'ist: -

GPhone'st oli olnud hommikul kuskil suures lehes (NYT?) kuulujutuartikkel, seepärast seda GOOG jahitakse.

Pidi olema Linuxipõhine, suur hulk insenere taga. Pidi kirjutama uuesti peatüki "reklaam mobiiltelefonis".

P.S. jah, leidsin üles: http://www.nytimes.com/2007/10/08/business/media/08googlephone.html?_r=1&oref=slogin -

Just nii. Google peaks oma edusammudest mobiiltelefonide vallas juba selle aasta lõpus teada andma ning võimalikud nendepoolsed telefonid võivad turule jõuda järgmisel aastal.

-

tere.

kas tulemuste hooaega on ka plaanis kajastada sellisel kujul nagu eelmine kvartal? -

Tulemuste hooaeg tasapisi jah uksele koputamas (kalendriaastat kasutavatel ettevõtetel siis 1.5 kuud aega pärast septembri lõppu oma finantstulemused avaldada) ning 'ametlikult' avatakse hooaeg homme järelturul oma tulemused avaldava Alcoa (AA) poolt.

Põhiliste teatajateni on veel pisut aega, kuid tundub, et nõudlust sellise tulemuste kajastamise järele on ning vähemasti ülevaatlikku tabelit tähtsamate ettevõtete tulemustest, ootustest ja aktsia reageeringutest üritan küll täita, nagu seda 2. kvartali puhul tehtud sai ning kindlasti teeme kogu meeskonna poolt kõik, et tähtsamad sündmused kajastatud saaks.

Parimat,

Joel