Börsipäev 18. oktoober

Kommentaari jätmiseks loo konto või logi sisse

-

Peale eilset paanikat teeb India aktsiaturg täna uue tipu :)

-

Hiina hetkel 3,5% miinuses, samas selle aktsiaturu volatiilsust arvestades on tegemist suhteliselt tühise langusega.

Täna on Nokia päev ehk kell 13.00 avaldab Nokia oma kvartalitulemused. Usk firma tegevusse on viimastel aegadel ainult kinnitust leidnud, ainuke tõrvatilk meepotis on Ericssoni dramaatiline langus peale kasumihoiatust.

Nokialt oodatakse kasumi kasvu 23 sendilt (eelmine aasta sama kvartal) 34 eurosendini aktsia kohta, käibe kasvu oodatakse 10,1 miljardilt eurolt 13,2 miljardile. Turuosaks prognoositakse 38,9% ning kasumimarginaaliks 20,4%, viimane number ehk vast suurema tähelepanu all. -

Panime Pro alla kommentaari Altria (MO) kolmanda kvartali majandustulemuste kohta. Oleme endiselt positiivselt meelestatud ja investeerimistees on loomulikult jõus.

-

Täna on oodata tõelist tulemustesadu, USA turgudel avaldavad oma kvartalitulemused üle 100 ettevõtte. Eelturul tulevad majandustulemustega teiste seas Bank of America (BAC), Continental Air (CAL), Danaher (DHR), Dow Jones (DJ), Eli Lilly (LLY), Hershey Foods (HSY), Pfizer (PFE), Novartsi (NVS), Sify Technologies (SIFY), Sunpower (SPWR), Union Pacific (UNP), peale turgu aga Advanced Micro Devices(AMD), Google (GOOG) ja SanDisk (SNDK).

-

Eile andis Goldman Sachs "Osta" soovituse suitsuvabade tubakatoodete tootjale UST, 12-kuu hinnasiht tõsteti $61 tasemele (eelmine hinnasiht oli $60). Tõstetakse ka oodatavat EPSi, 2008. aastal prognoositakse kasumiks aktsia kohta $3.71 ja 2009. aastal $4.08, ootused on vastavalt 4% ja 9% üle analüütikute konsensuse.

Põhjuseks tuuakse sektori kasvu (6% järgnevate aastate jooksul) ja võimalikku aktsiate tagasiostu suurendamist. Goldman Sachsi meelest väärtustab turg USTi aktsiaid valesti, sest kardetakse konkurentsi suurenemist uute toodete turule tulemisel. Sellest on juba varem räägitud ning tõepõhi on neil väidetel ka -all. Kui turule tulevad mitmed konkureerivad tooted, eesotsas oluliselt madalamalt hinnatud Marlboroga, siis peaks põhjust muretsemiseks olema. Siiski on UST näidanud tugevust just premium-segmendis, kus hoitakse ligi 61%-list turuosa.

Goldman Sachs ootab häid kolmanda kvartali tulemusi, samuti loodetakse 2008. aasta prognoose üle konsensuse ning suuremaid dividende.

-

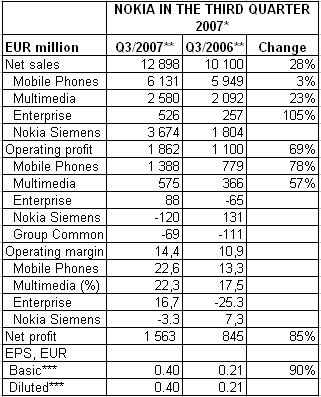

Nokia (NOK) avaldas oma kolmanda kvartali majandustulemused, tulu teeniti EUR 12.9 miljardit (vs EUR 10.1 miljardit Q3 06), mis negatiivse valuutaefekti tõttu kannatada sai. Kasumiks aktsia kohta kujunes EUR 0.40 vs eelmise aasta EUR 0.21. Konsensus oli oodanud $0.36 suurust kasumit aktsia kohta.

Kvartali jooksul müüdi 111.7 miljonit telefoni, mis on 26% rohkem võrreldes 2006. aasta kolmanda kvartaliga ning suuresti kooskõlas analüütikute ootustega. Hinnangute järgi tõusis kogu tööstuse müük 17% aastasel baasil, mis tähendab taas Nokia turuosa suurenemist 39%-ni. Eelmine kvartal hoiti 38%-list ja eelmine aasta 36%-list turuosa. Ettevõtte tegevjuht Olli-pekka Kallasvuo võttis tulemused kokku: "Nokia strengthened its leading position in the device industry in the third quarter. In a strong market, we simultaneously gained market share and increased our operating margins. The quality and depth of our device portfolio continues to give us a good competitive edge and we believe our portfolio looks promising for next year."

Segmentide kaupa kasvasid tulud:

Mobile Phones, Multimedia and Enterprise Solutions müüs kokku 26% rohkem telefone, nt. N-seeria telefone müüdi 9 miljonit, E-seeria omasid 2 miljonit. Geograafiliselt näidati kõige suuremat tõusu Lähis-Idas ja Aafrikas, peaaegu sama suur kasv oli Hiinas ja mujal Aasias. Aastasel baasil näidati nõrkust Ladina- ja Põhja-Ameerikas, kuid viimases on tugevat tõusu näidatud võrrelduna eelmise kvartaliga.

Üksuste lõikes näidati kõige suuremat tõusu Enterprise Solutions'is (+105%), põhjuseks peamisel E65 kõrged müüginumbrid ning kasv kõikides regioonides, va. Põhja-Ameerikas. Multimedia üksus tõusis 23%, kiireim kasv tuli madalalt baasilt Põhja- ja Ladina-Ameerikas ning tõusu vedasid N-seeria telefonid. Mobile Phones'i tulud kasvasid 3%, müügimahtude tugeva kasvu nullis ASP langus.

Nokia Siemens Networks'i ei saa küll võrrelda eelmise aastaga, kuid kvartali baasil tõusid tulud 7%, kõige suurem kasv tuli Ladina-Ameerikas, samuti olid tugevad Hiina ja Euroopa, tulu vähenes Põhja-Ameerikas ja Aasia rannikualadel.

Kolmanda kvartali tähtsamate sündmuste hulgas tuuakse välja internetiteenuste Ovi tutvustamise, interneti muusikapoe avamise ja Twango ostmise, samuti tutvustasid kõik üksused hulgaliselt uusi telefone.

Neljandaks kvartaliks ootab ettevõte q-o-q müügimahtude kasve, kuid turuosa tõusu kvartali jooksul ei arvata ning arenguriikide mõju ja sisenemise tõttu uutele turgudele langeb keskmine telefoni hind ka edaspidi. Samuti on tõstetud EUR 500 miljoni võrra Nokia Siemens Networks'is saavutatavat kokkuhoidu ning 2008. aasta lõpuks loodetakse juba sünergiast tulenevat EUR 2 miljardilist kokkuhoidu.

-

Deutsche Bank downgrades Ebay (EBAY 40.60) to Sell from Hold and maintains their $33 tgt following earnings, and as underlying fundamentals appear to be getting worse. The firm thinks eBay is facing a worst case scenario in its business, due to 2% transaction volume growth (& potentially declining soon), user dis-engagement, higher ad costs, declining purchase frequency, rising seller costs and operating margin pressures

-

Bank of America (BAC) raporteeris tulemused, jäädes alla nii kasumiprognoosidele kui ka käibeprognoosidele. Aktsia kaupleb eelturul üle 3% madalamal.

BAC reports Q3 (Sep) earnings of $0.82 per share, $0.24 worse than the Reuters Estimates consensus of $1.06; revenues fell 11.8% year/year to $16.3 bln vs the $18.01 bln consensus. Lower net income resulted from a $1.33 bln decline in earnings in Global Corporate and Investment Banking given the significant disruption in the financial markets during the quarter. Provision expense increased $865 mln due to consumer and small business credit costs rising from post bankruptcy reform lows, growth and seasoning in various portfolios and stress in several portfolios driven by the weakened U.S. housing market.

Hershey Foods (HSY) jäi samuti prognoosidele alla ning langetab seetõttu ka tulevikuväljavaateid. Aktsia eelturul kauplemas 5% madalamal. Peamiseks probleemiks tõusvad sisendihinnad.

Reports Q3 (Sep) earnings of $0.68 per share, $0.03 worse than the Reuters Estimates consensus of $0.71; revenues fell 1.2% year/year to $1.4 bln vs the $1.44 bln consensus. Co issues downside guidance for FY07, sees EPS of $2.08-2.12 vs. $2.24 consensus.

"Reported net sales for the quarter were down 1%, primarily driven by the timing of seasonal shipments and a significant reduction in inventory levels at distributors. This reduction is the result of slower-than- anticipated improvement in the convenience store class of trade and tighter credit conditions for these distributors. Importantly, Hershey's international business continued to gain traction behind our joint ventures in emerging markets. Third quarter profitability was curtailed by lower sales, including increased trade promotion, and the impact of higher dairy costs... We do expect a sequential improvement in marketplace performance in the fourth quarter. However, continued competitive activity as well as a tightening of inventory levels at select distributors will dampen sales performance in the fourth quarter. Therefore, organic net sales for 2007 are expected to decrease about 1 percent. Profitability will be impacted by higher dairy costs and increased business investment."

-

Tõestust selle kohta, et toormaterjalidega kauplemine on poulaarseks läinud, pakub täna Bloomberg. Asi on läinud isegi nii kaugele, et subprime'ga tegelenud endistele finantssektori töötajatele, kes on tänaseks vallandatud, on hakatud pakkuma toormaterjalidega kauplemise kohti. Päris huvitav lugemine:

http://www.bloomberg.com/apps/news?pid=20601109&sid=atKzfe69gP1E&refer=home -

Dollar on 1.43

-

DHR'l läheb täitsa ok

kuidas 2.6B ost järgmiste perioodide kasumeid mõjutab on ehk üks võtmeküsimusi

käivet aitab see kasvatada, aga Tektronix'i kasumid paistavad kuidagi nigelad -

ma ei olegi veel jõudnud DHR väga sügavalt vaadata, kuid mõningates käibesegmentides nad ikka jahtumist tunnistasid. Pakun, et järgnevatel kvartalitel saame seda siiski tugevamalt tunda veel. Aga täpsem kommentaar siis kui sügavamalt olen saanud aega vaadata.

-

Volatility Will Likely Stick Around for a While

By Rev Shark

RealMoney.com Contributor

10/18/2007 8:06 AM EDT

Indecision and delays are the parents of failure.

-- George Canning

In the past week, the market has seen a sharp increase in volatility. Last Thursday we reversed big intraday, on Monday we opened higher and then reversed down, and then yesterday we were all over the place as we gapped up on good earnings, sold off at midday and then rebounded into the close.

Volatility like this is an indication that indecision about the market is increasing. We still have an oversupply of bulls, as the recent sentiment surveys have indicated, but doubts are starting to creep in as earnings roll out, bad news continues to flow for real estate, oil hits record highs and the financial sector struggles. Market players are still mostly positive, but they are increasingly skittish and quick to hit the sell button at the first sign of trouble.

When we suffered the ugly intraday reversal last Thursday, I discussed how such action might mark the beginning of the topping process. A market that has been as strong as this one has been doesn't give up without a fight. There will be a number of rallies and failures along the way before the trend finally does turn. The tip-off that things might be changing is a surge in volatility. Constant spikes and failures tell us that the trust level is decreasing and that buyers may not be as confident as they were previously.

In addition, the longer we go without pushing over recent highs, the more inclined some folks will be take profits. We have had a very nice rally off the August lows, and the smart move has been to stay long and strong. When the momentum starts to falter and new highs are delayed, however, more folks start to think that maybe it's now prudent to be more defensive and lock in some good-sized profits.

Another important consideration in the topping process is potential catalysts. Markets look for excuses to do what they are destined to do. One of the most convenient excuses for a change in market direction is earnings reports. Whether the numbers are good or bad isn't even that important. The fact there is a significant news event is all that matters when the market wants to change direction.

The market will spin the perception of the news to justify whatever direction it chooses to go in. If we roll over, the media will be quick to find the negatives in the earnings reports, and vice versa should we rally. The actual numbers are irrelevant. It is the market that will ultimately determine whether the news is good or bad.

At this point, the market looks to be forming a short-term top. A high level of volatility is likely to continue but with a generally negative bias. We are likely to see some sharp spikes higher, but they will ultimately fail, which is when the danger of more downside will be the greatest.

Earnings season is always full of land mines, and this one is particularly dangerous, because this market is technically ripe for a correction.

We have a soft start on the way. Some of the early earnings looked good, but poor news form Bank of America (BAC - commentary - Cramer's Take - Rating) put pressure on things. Overseas markets were mixed, with Tokyo up but Europe solidly negative. Oil is down slightly and gold is up. -

DHR pos. läks päeva algul mul mikro kasumiga kinni

positiivseid signaale oli liiga palju ning enamus majadel on overweight soovitus, siiani

vaatame, mida hind lähipäevadel teeb ning mida LHV poisid ütlevad

tõenäoliselt saab kõrgemalt taas uuesti shorti proovida võtta -

Päris hea ülevaate annab Google'i tulemuste eel ettevõttest Briefing. Tasub lugeda:

Google (GOOG) is set to report earnings after the close today with expectations high as usual for this traders fave. Last quarter the co stopped the presses by missing on bottom line results by $0.03. The co had beaten by an average of 20 cents a quarter in their previous 12 quarters, before last quarters miss. Revenue growth also hit lows of 57%. The main reason why the co missed last quarter was due to an aggressive build up of their International employee base. Total operating expense jumped to 31% of revenues compared to 26.7% in prior quarter. We suppose the irony here is that the International build up that hurt them last quarter should benefit them in Q3 as International revenues are expected to be at record highs (were ~48% last quarter), and thus co should gain some points on ForEx with the weak dollar. Current EPS consensus is $3.78 for Q3 which would place the co back on track for sequential growth as last quarter was the first time co saw a sequential drop in earnings. Revenues are expected to be $4.13 bln which would represent approx 53% y/y growth. This would be the lowest that the co has reported to date although with the size of GOOG it is difficult to complain about those numbers. Areas of interest: 1) Headcount growth- Perhaps the key issue from last quarter, analysts will be sure to pepper the co with questions regarding this matter; 2) YouTube- If someone was looking for the one major disappointment in GOOG it would be the co's lack of ability to generate revenue from areas outside of advertising. Currently advertising makes up 99% of their revenues. If the co is able to improve in this area would expect stock to get a big boost; 3) Gross Margins- Once again the downfall from last quarter, analysts are expecting the co to bounce back from this to the 60.8% area after it fell below 60% for the first time in four quarters; 4) gPhone- There has been a lot of speculation on whether or not the co is planning on releasing a gPhone. if they did would expect to see stock get a boost (and for AAPL to see some selling pressure); 5) Tax rate- Analysts continue to model for 30% tax rate even though the co has been in the 24% area the last three quarters. This usually helps provide the co with an extra few cents in EPS beat; 6) International Growth- Expected to improve and could be a big boon to the co this quarter, Currency exchange should provide help to EPS... GOOG Consensus: Reuters Q3 EPS $3.77, Revs (including TAC) $4.13 bln; Q4 EPS $4.33, Revs $4.71 bln; Y07 EPS $15.34, revs $1.63 bln; Recall the co does not provide guidance... Levels of Interest (Length of horizontal line correlates with strength of support or resistance level.) -

GOOG prelim $3.91 vs $3.77 Reuters consensus, $3.78 First Call; revs $4.23 bln vs $4.13 bln Reuters consensus.

GOOG prelim revs ex TAC $3.01 bln vs $2.94 bln First Call consensus.

Mitteametlikud ootused olid liiga kõrgele keritud, aktsia alustuseks 0.9% pealt miinusesse kukkunud.