Börsipäev 13. november

Kommentaari jätmiseks loo konto või logi sisse

-

Jätkuvalt on selleks nädalaks kõigilie huvilistele tasuta kättesaadavad Balti Pro ja LHV Pro keskkonnad. Viimasesse on paari päeva jooksul lisandunud nii mõnigi huvitav kirjutis, nt. tuuleenergia sektori ülevaade, positiivne lugu Morgan Stanleyst ja Venemaa aktsiaturu iganädalane ülevaade, lisaks on taasavatud investeerimiseks Gmarketi (GMKT) idee.

-

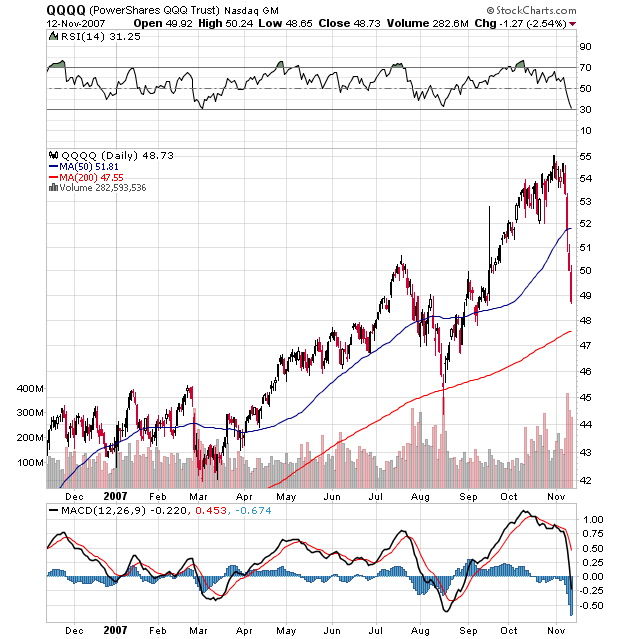

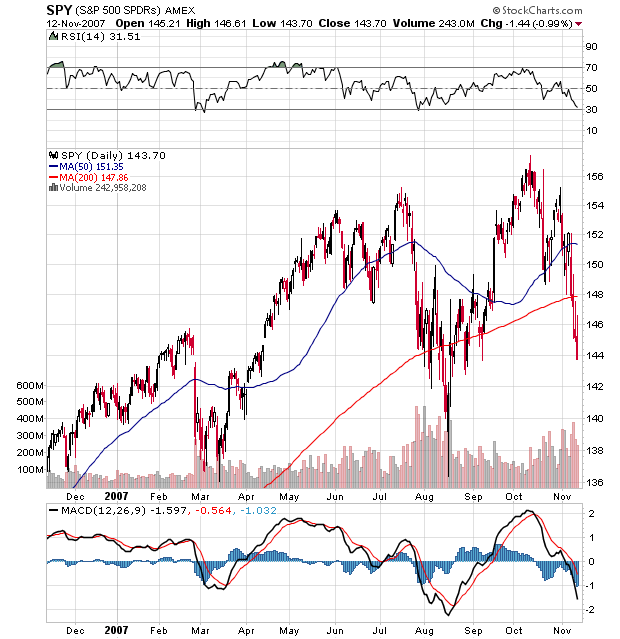

Sellist allakihutamist ei ole ammu näinud ning peale seda on USA aktsiaturgude futuurid indikeerimas hommikul ca 0.5% plusspoolel avanemist. Naftahind 0.66% miinuspoolel ning USD/EUR taaskord langemas. Tundub, et energiasektorist on võimalik veelgi auru välja lasta, kuid "kuubikud" hakkavad lühiajaliselt muutuma juba väga ülemüüduks - liiga suur langus ja liiga kiiresti. Vaatame täna ka mõningaid pilte.

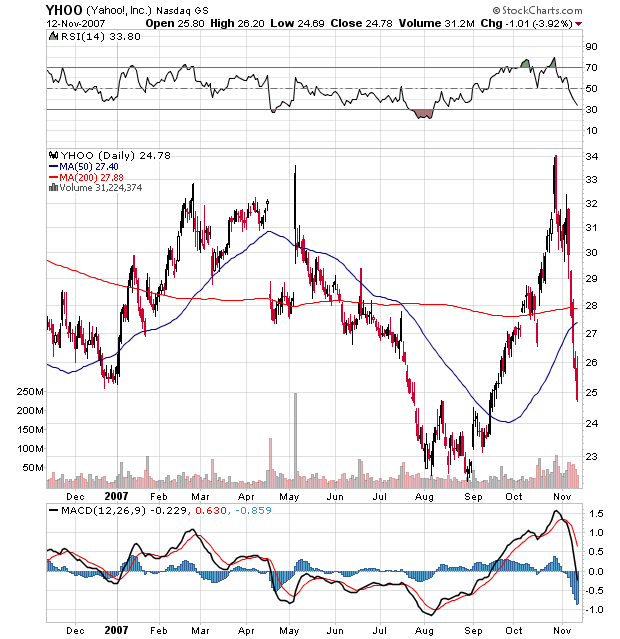

CIBC on väljas calliga YHOO osas. Kuigi teemad on vanad - varad Aasias (Alibaba, TaoBao, AliPay, Yahoo! China, Alisoft, Gmarket jne) - võib peale sellist allamüüki call huvi tekitada küll. CIBC arvates on non-performing varade väärtus $9 aktsia kohta ning ettevõtte õiglane hind $31 aktsia eest. Samuti on hea riski ja tulu suhe, mida CIBC hindab 3x.

-

Yale’i ülikooli majandusteadlane Robert Shiller, kes ühtlasi S&P/Case-Shiller majahindade indeksi üks loojatest, andis eile intervjuu Reutersile. Seal tõdes ta, et mitte ainult pole prognoosid kinnisvara madalseisu saavutamisest 2008. aastal tema meelest valed, vaid siis võidakse hoopis näha veelgi suuremat kukkumist hindades võrreldes käesoleva aastaga.

"The bottom is hard to predict. I do not see it imminent and it could be five or 10 years too. We have seen housing bubbles many times in history, but they have been much more local than this one. Based on the futures market for the S&P Case-Shiller Composite Index, we are looking at home prices down another 5% in 2008”

-

Citigroup soovitab peale 30-protsendilist langust BIDU aktsiaid osta. eCommerce on Hiinas veel varases staadiumis ning BIDU domineeriv selles äris, saades ka kasvust niimoodi kõige rohkem kasu. Tegemist on analüüsimaja Top Pickiga Hiinast 2008. aastaks. Hinnasiht $425 ning Citi kogemuse kohaselt ostetakse kõige kiiremini peale taolist langust üles firmad, mis on löönud ja samas tõstnud oma kvartaliprognoose (+tugevad fundamentaalnäitajad). Analüüsimaja arvates peaks põhi aktsias lähedal olema. Ilmselt tekitab see call päris palju huvi. Aasia turud olid ka suhteliselt muutumatud, pakkudes tuge.

While no one wants to catch a falling knife, the fundamental valuation looks highly attractive, in our view, with the company now trading at 31.6x our ‘09E and a PEG of 1.1x. Accordingly, we encourage investors to monitor Baidu closely and to be actively taking advantage of this and perhaps further near-term weakness, to build/add to positions.

-

Wal-Mart (WMT) on välja tulnud kolmanda kvartali tulemustega, lüües analüütikute kasumiootusi 2 sendiga ($0.69 vs 0.67 prognoos). Käive kasvas 8.8% $90.88 miljardini vs $90.91 konsensus.

Co issues in-line guidance for Q4, sees EPS of $0.99-1.03 vs. $1.01 consensus. Co sees Q4 same store sales between flat and +2%.

Kommentaarid järgmised:

"Our results for the third quarter reflect the improved performance of our U.S. operations. Both Wal-Mart Stores U.S. and Sam's Club increased profits faster than sales. Wal-Mart International posted a solid quarter as well," said Lee Scott, Wal-Mart Stores, Inc. president and chief executive officer. "Our focus on managing inventory this quarter was very positive.

"During the Christmas and holiday season, our price leadership position will benefit both our customers and the Company," Scott added. "We have set the stage for a successful fourth quarter."

Käibe osas jäädi tulemustele alla ning kasumi osas löödi juba langetatud prognoose. Kommentaarid üldiselt päris julgustavad suhteliselt madalaid ootuseid arvestades ning konkurentidega võrreldes ollakse madalama hinnaga praeguses keskkonnas soodsamal positsioonil.

Tulemustega tuli välja ka Home Depot (HD), jäädes sendiga alla analüütikute prognoosidele kasumi osas aktsia kohta. Käive langes 3.5% y0y $18.96 miljardile vs $19.39 konsensus.

Co expects its EPS from continuing operations, on a 52-week basis, will decline by as much as 11% from last year.

-

Eelmisel nädalal jõudis iPhone lõpuks ka Euroopasse. The Register avaldas siis loo, spekuleerides Apple’le esimesel nädalavahetusel kehvasid müüginumbreid, kuna Briti mobiiltelefonide turgu pole kerge siseneda: käsitelefonide arv ületab juba sealse rahvastiku numbri. Tegelikkus ostus siiski vastupidiseks ja iPhone näib köitvat ka Euroopa kodanikke. O2 tegevjuht Peter Erskine ütles, et tegu on kiireima läbimüügiga seadmega, mida ta eales näinud. Erskine lisas, et iPhone’i ostjatest polnud 2/3 juhtudel tegu O2 klientidega, mis tähendab uute kasutajate võitmist Vodafone’lt, Orange’lt või T-Mobile’lt. Kui USA-s müüdi esimesel nädalavahetusel kokku 270 000 iPhone’i, siis mitteametlikel andmetel ulatus see näitaja Suurbritannias 70 000-ni. Piper Jaffray analüütik on teinud veidi arvutusi ning jõudnud järeldusele, et kui USA-s müüdi 2.5 päevaga 1 telefon iga 1111 ameeriklase kohta siis Suurbritannias müüdi seda iga 860 briti kohta.

Esmaspäeva õhtul selgus, et iPhone tahab Hiinasse tuua China Mobile, kes pidamas Apple’ga läbirääkimisi. Telekomi juhi sõnul pole nõusolekuni veel jõutud, sest lahtiseks jääb müügitulude jagamine.

-

Saksamaa DAX -0.54%

Prantsusmaa CAC 40 +0.08%

Inglismaa FTSE 100 +0.12%

Hispaania IBEX -0.36%

Venemaa MICEX -1.18%

Poola WIG +0.98%

Aasia turud:

Jaapani Nikkei 225 -0.46%

Hong Kongi Hang Seng +0.50%

Hiina Shanghai A (kodumaine) -0.57%

Hiina Shanghai B (välismaine) -0.66%

Lõuna-Korea Kosdaq +0.80%

Tai Set -0.50%

India Sensex +1.59%

-

So Bad It's Good

By Rev Shark

RealMoney.com Contributor

11/13/2007 7:17 AM EST

Nothing helps a bad mood like spreading it around.

-- Bill Watterson

Over the past week, the market mood has turned pervasively negative. For a long time, market players were willing to overlook the issues that were plaguing us, choosing to pile into a small handful of big-cap technology stocks. Housing, debt write-offs, rising oil, a slowing economy and a weak dollar were in the headlines constantly but didn't have much impact on the mood.

Suddenly, for no clear reason, stocks like Baidu (BIDU), Google (GOOG) and Apple (AAPL) have lost their luster as safe havens and have plunged sharply. This action is most likely due to the nature of momentum in the stock market. It works until it doesn't, and once market players sense that momentum is waning, it tends to work in reverse. If you live by momentum you tend to die by it as well.

The real problem that is plaguing the market is that it has lost the focus on the Fed as a positive catalyst. What drove this market off the lows in August was the hope and anticipation the Fed would take steps to fix the bad-debt issue and ease the real estate problems. The Fed did indeed take some steps, but those problems persist, and many are now questioning whether the Fed really can easily solve problems by simply reducing interest rates. Without the Fed as a driver, this market is left with few positive drivers, and that is the problem

The good news in this market right now is that it is so intensely negative that we are set up for an oversold bounce. Unfortunately, rather than seeing a weak open that suddenly washes out the weak holders, we are holding up, drifting around and then closing poorly. This isn't the sort of sudden, intense pressure that coils like a spring and gives us a good snapback.

We are once again seeing a benign open this morning instead of a further washout. The news flow does seem more positive as retailers, led by Wal-Mart (WMT - commentary - Cramer's Take - Rating), are seeing some buying interest. I expect that buyers are going to be wary of a strong open and may not be willing to step up very quickly, especially given the weak closes we have suffered lately. However, we are oversold and very negative, so chances of a bounce are high, and I will be looking to position for one. It might be short-lived but we are due.

Overseas markets were mixed to lower and gold and oil continue their pullbacks.

-----------------------------

Ülespoole avanevad:

On strong earnings/guidance: OWW +10.5%, CFSG +6.2%, VOD +5.5%, WMT +4.1%... Select solar names gapping up: TSL +7.3% (announced a six-year polysilicon supply agreement with Sichuan Yongxiang Polysilicon), FSLR +6.8% (positive comments from Cramer), SPWR +6.7% & ESLR +6.1% (strength in solar names also attributed to broker chatter that renewable energy tax credits are back on track)... Other news: ETFC +10.9% (rebounding somewhat after yesterday's 60% sell-off), DRYS +5.6% (enters into 3 short term charters), VMW +5.3% (multiple analysts defending co after yesterday's ORCL announcement), PBR +5.3% (Bloomberg.com reports PBR may Start producing at Tupi in 2010 or 2011), AAPL +3.5% (China iPhone in discussions), BIDU +3.9% (Citigroup says sell-off looks overdone), YHOO +2.9% (upgraded at CIBC to Outperform).

---------------------------

Allapoole avanevad:

On weak earnings/guidance: LMC -5.7%, ADBE -1.6% (also announces new CEO), HD -1.6%... Other News: ROC -1.1% (prices a 10 mln share common stock offering at $34/share). -

Home Depot ütleb oma konverentsikõnel huvitavalt: says they started the year with a fairly pessimistic view of the housing and home improvement markets, and says they were not pessimistic enough.

-

Täna suurepärane päev jaemüüjatele. Wal-Marti enam-vähem tulemused, sektor ülemüüdud ning nafta kaupleb 2.5% mdalamal tasemel.

-

Wachovia ametnik Smith Lantey WB aktsiate ost on isegi päris korralik. 9. novembril ostis mees 100 000 aktsiat hinnaga $38.7, millega ta enam kui kahekordistas oma aktsiahuvi Wachovias. Link failingule siin.

-

Rõõmusõnum kõigile, kes soovivad lugeda WSJ-d, ent ei taha selle eest maksta: nimelt lubab News Corp tegevjuht Rubert Murdoch Dow Jonesi ülevõtmise lõpetamisel muuta populaarne lehekülg tasuta reklaamimudelil põhinevaks. Kas sama hakkab kehtima ka Barron'si kohta, seda ei täpsustatud.

-

täna on üldse 1 positiivne päev

Monthly Budget Statement -$55.6 bln vs -$59.0 bln consensus