Börsipäev 15. november

Log in or create an account to leave a comment

-

Forbesis ilmus eile üks positiivne lugu Vimpelcomist (VIP). Midagi uut seal ei ole, aga asjast huvitatutel soovitaksin lugeda.

Samuti tulid eile kaks Citigroupi analüütikut välja ennustusega, et Altria (MO) võiks tulevikus osta sigarite- ja snusi-valmistaja Swedish Matchi. Kusjuures viimane läheks eeldatavasti Philip Morris USA koosseisu, mis püüab asendada langevaid sigarettide müügimahte ning ei soovi täielikult ilma jääda rahvusvahelisest haardest. Kuigi selline kooslus oleks iseenesest huvitav, siis ülemäära tõsiselt ei maksaks ennustusse suhtuda, kuna erinevaid võimalusi pakutakse turgudel välja pidevalt.

-

Tegelikult eilse suhteliselt närvilise kauplemise ja eriti viimase pooltunni võtab väga hea kommentaariga kokku Jim Cramer:

All just a very confusing day and a win, once again, for all who want to say to heck with this market. -

Täna hommikust päeva alguse kauplemist saab mõjutama tund enne turu avanemist teatatav oktoobrikuu tarbijahinnaindeks (konsensus +0.3%, core CPI ootus +0.2%) – kui number on oodatust suurem, võib rääkida inflatsioonihirmudest(mis teadupärast pole turgudele just kõige meelepärasem), kui oodatust väiksem, siis on jälle Föderaalreservil intresside osas pisut vabamad käed (mis turgudele meeldiks).

-

Ei häbene rumal välja näha kui tuleb välja et loll küsimus, äkki oskab/viitsib keegi spetsialist vastata:

Kuidas mõjutab langev $ USA pankasid? Kas pos. või neg. see nende jaoks? Või siis teise nurga alt - kas langev $ on kasulikum USA suurpankadele (C, MS) või n. Deutshe Bank´le? -

White Nigga, langev $ mõjutab näiteks rahapoliitikat või siis rahapoliitika mõjutab langevat dollarit : -) See omakorda mängib intressimääradega ning see kajastub omakorda NIMis (net interest margin - ehk siis praktiliselt lühikese raha sisse laenamise ja pika välja laenamise vahe) ja pankade kasumis.

-

Aga kas siis n. C-le ja DB-le mõjub ühtemoodi või on see DB-le kasulikum?

-

White Nigga, üldiselt on see mudel ka nii suur, et keeruline on kõiki mõjusid hinnata. Suured pangad on nii rahvusvahelised ning diversifitseeritud.

USA aktsiaturgude futuurid on indikeerimas täna madalamal tasemel avanemist. Hetkel Nasdaqi futuur -0.7% ja SP500 futuur -0.3%. -

Pöhiline suund võetakse vast peale 15:30.

-

stocker, ilmselt jah. Kõik, mis inflatsioonistatistikat puudutab, paistab praegu ülitundlik teema olevat ja annab alust spekulatsiooniks Fedi tegutsemise oasas.

-

WSJ kirjutab jätkuvalt sub-prime laenude mahakirjutamisest. Lähemalt kommenteeritakse UBSi ja Citigroupi. Viimane on võrreldes MERi ja MSiga mahakirjutamiste protsent väiksem.

The Wall Street Journal reports expectations are growing that UBS (UBS) may face Q4 write-downs of as much as 8 bkn Swiss francs, or $7.11 bln.

Investors and analysts believe that Citigroup (C) may face more pain after announcing last week that it expected to take write-downs of $8 bln to $11 bln in Q4. Citigroup, which packaged subprime-backed bonds into CDOs, may face the toughest questions. Citigroup appears to have written down its CDO holdings by about 20%, compared to write-downs of 30% by Merrill Lynch (MER) and Morgan Stanley (MS), Sanford C. Bernstein analyst Howard Mason says.

If Citigroup is forced to take further hits because of deterioration in the market for even the most senior and safe portions of CDOs, that could force it to bring its level of write-downs at least in line with those taken by Merrill and Morgan. In that case, the bank could see additional CDO write-downs of $2 bln to $4 bln, Mr. Mason said on a conference call Tuesday.

Citigroup ended up with more than half of its $43 billion in CDO exposure because it had agreed to provide emergency financing to managers of subprime-backed CDOs it had sponsored. The bank isn't believed to have any more such commitments.

-

Suntech Power lõi päris korralikult ootusi ja kõrgete kordajatega hinnatud tööstusharu on näitamas kiiret kasvu. Prognoosid 2008. aastaks vastavad aga ootustele. Päris huvitav silm peal hoida, kuidas sellistele ilusatele numbritele reageeritakse.

STP Q3 earnings of $0.36 per share, $0.08 better than the Reuters Estimates consensus of $0.28; revenues rose 137.3% year/year to $386.7 mln vs the $357.1 mln consensus. Co issues in-line guidance for FY08, sees FY08 revs of $1.9-2.1 bln vs. $1.94 bln consensus. -

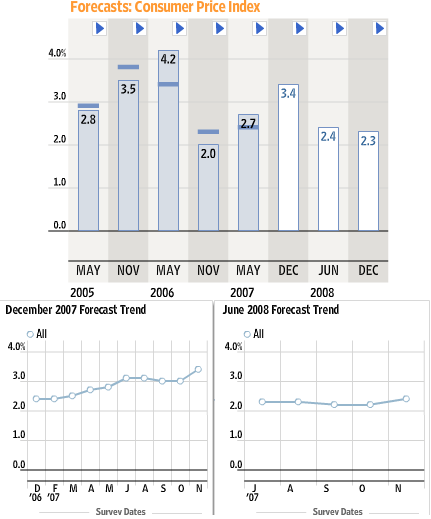

WSJ on toonud välja CPI ja vastavalt siis ka prognoosid. Nagu näha, on 2007. aasta detsembri prognoos (kütusehindade, commodity tõttu) üles kerkinud, kuid 2008. aasta juuni trend on veel suhteliselt sile. Kui kõrged kütusehinnad on here-to-stay ning hinnasurve ei lakka, korrigeeritakse ilmselt sealgi prognoose üles. See kindlasti ei meeldi ei Fedile ega ka Euroopa keskpankadele.

-

Lisaks Suntechile plaanis täna enne turgude avanemist oma majandustulemused avaldada ka Solafun (SOLF), kuid mingil põhjusel on need nädala jagu edasi lükatud. Kuid veel enne, täpsemalt kolmapäeval, teeb seda Trina Solar (TSL) ja täna peale turgu LDK Solar (LDK).

-

8. novembril kiitis FMD aktsionäride üldkoosolek heaks täiendavvate aktsiate emiteerimise 250m aktsiani

st. tänaste hindade juures vähemalt 4.8B USD, lisaks on ettevõttel raha 380m jagu

mida kavatseb või saaks FMD osta 5-6B eest ? tegemist on suurema ampsuga kui FMD ise

kui vaadata ringi sektoris, kus ta ise tegutseb, siis market cap'i poolest sobiks STU või NNI

loogilisem valik oleks minu arust STU, seda on ka lihtsam üle osta - 80% on Citi käes.

praegu tundub ka õige aeg (turu mõttes) see asi ära teha

mis mõtted liiguvad, juhuks kui FMD ostaks lähema kvartali jooksul STU ?

ma mõtlen siis pigem FMD vaatevinklist -

Madis, kas on ka kusagil link LDK pressiteatega? Pole kuulnudki, et nad lõpuks selgusele jõudnud.

-

fredo, tegu on tõesti kinnitamata andmetega.

-

Tänased numbrid vastavalt ootustele - esmane reaktsioon on indeksites pisut ülespoole, kuid jätkuvalt ebakindel liikumine.

Initial Claims 339K vs 320K consensus, prior revised to 319K from 317K

NY Empire State Index 27.4 vs 19.0 consensus

CPI y/y +3.5% vs +3.5% consensus

Core CPI y/y +2.2% vs +2.2% consensus

Core CPI m/m +0.2% vs +0.2% consensus

CPI m/m +0.3% vs +0.3% consensus -

Need numbrid peaks nüüd küll turgu juba olema sisse arvestatud ning mingit olulist mõju ei ootaks.

-

Saksamaa DAX -1.67%

Prantsusmaa CAC 40 -1.30%

Inglismaa FTSE 100 -1.24%

Hispaania IBEX -0.30%

Venemaa MICEX -0.96%

Poola WIG -3.31%

Aasia turud:

Jaapani Nikkei 225 -0.67%

Hong Kongi Hang Seng -1.42%

Hiina Shanghai A (kodumaine) -0.87%

Hiina Shanghai B (välismaine) -1.18%

Lõuna-Korea Kosdaq -1.69%

Tai Set -0.87%

India Sensex -0.72%

-

The Negatives Have Started to Matter

By Rev Shark

RealMoney.com Contributor

11/15/2007 7:53 AM EST

Somehow our devils are never quite what we expect when we meet them face to face.

-- Nelson DeMille

For many months, the major indices have moved steadily higher as they ignored a slew of negatives. The bears were greatly frustrated as the market simply shrugged off bad-debt issues, a slowing economy, lousy real estate and high oil. Even after we suffered a sharp selloff in August on bad-debt issues, the market came roaring back as investors counted on the Fed to ease the pain.

Nothing much has changed recently as far as the many negatives we face, but the mood of market players has soured considerably. That stubborn optimism that has served the market so well has eroded, and the confidence that it is safe to pile into a few big-cap technology stocks has abruptly come to an end.

Such shifts in mood without a major change in the news is simply the nature of the market. Market players tend to focus on the reasons for market movement only after such moves occur. With the market off its highs, it is now easy and convenient to focus on all those negatives that have always been there.

The good news for this market is that there is no secret as to the devils that are plaguing us. Right now, the continued bad-debt write-offs in the financial sector are the prime focus. There is no surprise negative news hitting us. We just don't know the extent of the issues that we are worrying about. The market does not like uncertainty because it can't price it in, and that is the big problem right now.

Another problem for the market right now is that another potential rate cut by the Fed is failing to reassure investors. In August and September, the Fed anticipation was the primary reason the market bounced so strongly. The Fed is very likely to cut again in the near future, but the market is not taking any great comfort in that fact. We have the CPI report this morning, which, if benign, may help to bolster some optimism about the Fed making another cut. That could get something going, but the market is no longer perceiving a cut as the magic bullet to cure all ills.

Many market players were hopeful that we might see another "V"-shaped market recovery after the huge bounce on Tuesday. The dreary close yesterday called that into question, but it doesn't mean the market is doomed at this point. Action like yesterday is far more typical after a big bounce than a straight-up recovery. Markets tend to be healthier and bottom out better when we have a series of failed spikes and bounces that shakes out weak hands and short terms. This action will actually serve us well for a rally as we enter the seasonally positive time of the year.

We have a soft open this morning as more bad-debt write-offs hit, but the focus is on CPI. Overseas markets were mostly negative. Oil and gold are trading down.

----------------------------

Ülespoole avanevad:

On strong earnings/guidance: ADLS + 31.6%, TSTC +22.0%, CHIC +18.8% , KLIC +13.6% , STP +11.0% , DIET +10.7% , FUQI +10.2% , WGOV +10.0% , BID +9.2% , PETM +6.4% , GSI +5.5% , FCSX +4.4% , INOD +3.6%, HP + 3.3%, FSYS + 3.1%, ANST +2.4% , TTEK +2.4% , PBI +2.1% (increase share repurchase), NUAN +1.7% , NTAP +1.5% , PODD +1.3% , PII+ 1.2%; Other news: LOCM +20.6% (begins liscencing local search technology), CMZ +9.2% (Icahn Mgmt reports new Compton Pete stake -- DJ), KMX +6.0% (Buffett reports holding 14 mln Carmax shares at Sept 30 -- DJ), NDN +5.7%, PLCE +4.4% (Icahn reports new Children's Place retail stores stake -- DJ), AMLN +3.9% (announces Pramlintide and Leptin weight loss results), BMY +3.0% (IMCL and BMY drug results in improved survival of colorectal cancer), OZM +2.9% (went public in IPO yesterday), IMCL +2.8% (IMCL and BMY drug results in improved survival of colorectal cancer), IACI +2.7% , MOGN +2.7% (Icahn Mgmt reports new MGI Pharma stake -- DJ), GENZ +2.5% (Icahn Mgmt reports new Genzyme stake -- DJ), TTWO +2.1% (Icahn Mgmt Reports New Take-Two Interactive Stake -- DJ), WBC +1.9% (Buffett reports holding 2.7 mln Wabco shares at Sept 30 -- DJ), GME +1.7% (Cramer gives positive comments on Mad Money), HD +1.7%, IGTE +1.6% (announces shareholder approval of delisting transaction), MER +1.2% (confirms John Thain named Chairman and Chief Executive Officer), BMY +0.5% (New England Journal of Medicine study shows ERBITUX improves survival in Advanced Colorectal Cancer) Solar stocks showing strength: TSL +4.5%, JASO +1.8%; Uprades: TMX +4.5% (upgraded to Buy at Citigroup), VCLK +3.5% (upgraded to buy at Citigroup), AVCT +1.9% (upgraded to Buy at ThonkEquity), AMZN +1.7% (upgraded to Buy at Stifel), MER +1.2% (upgraded to Neutral at Creit Suisse).

Allapoole avanevad:

On weak earnings/guidance: NFI -39.0%, SINA -9.1% (earnings and downgraded to Hold at Citigroup), DEEP -7.6% (earnings and new Chairman of Board), JCP -5.2% , AMAT -4.3%, AFCE -1.6%, WSM -0.9%; Other news: HSOA -9.1% (to delay Q3 Form 10-Q and conference call), BHP -3.7%, BEAS -3.7%(ORCL CEO made comments suggesting if another offer was made, the price would be lower, saying the $17 price seems too high now), GOLD -3.7%, THQI -3.3% (officer sells shares), SWN -2.8% (to expand customer base and pipeline system by more than 55% with purchase of Arkansas Natural Gas Utility), MTSN -2.6% (announces upcoming retirement of President and COO Robert MacKnight), GFI -1.6% (downgraded to Market Perform at BMOCapital), UBS -1.5% (WSJ reports expectations are growing of UBS Q4 write-downs of $7.1 bln), C -1.4% (WSJ reports expectations are growing of C Q4 write-downs of $8-11 bln). -

Oktoobri keskel korraks üle saja dollari jõudnud Amazon kaupleb nüüd ca 20% madalamal ning analüüsimaja Stifel Nicolaus tõstab oma soovitust “osta” peale, uskudes et spekulatiivsete investorite osakaal on kahanenud. Varasemaks reitinguks oli “müü”.

"Our rationale for the downgrade of Amazon.com shares to Sell was driven by our belief that a new, more short-term-oriented group of investors had begun moving Amazon shares to unsustainable short-term levels."

-

speedy, täna ringlevad hoopis kuulukad, et mingi Itaalia firma tahab FMD-d üle võtta ; )

-

Oliver, no räägi lähemalt

ma pigem arvan, et see jääbki kuulukaks

mis sinu mõtted - mida C arvaks, kui keegi tahaks talt STU praegu ära osta? -

Ma arvan ka, et tegu on kuulukaga. Ma tegelikult sellest sektorist midagi ei tea ning kas nad on välja öelnud, et tahavad kapitali selleks kaasata, et kedagi ära osta? Üldiselt nagu ma aru saan, siis tegelevad nad peamiselt vahendamisega, mistõttu mingid originatorite probleemid neid kummitada ei tohiks ja selleks vast kapitali ei kaasata. Kuid STU, NNI ja FMD klientuuristruktuuri ma ka ei tunne, et mingeid huvisid siin kommenteerida oskaks ..

-

Six Flags CEO bought 48K shares at $2.08-2.11 on 11/14. Selline uudis siis. Suhteliselt kommiraha peaks olema selle mehe jaoks, nii et siit midagi suurt välja ei loe. Samas on mees konverentsikõnel oma pea pakule pannud ning nüüd ostab veel stocki juurde..huvitav.

-

Realmoney all paar head graafikut - 1 Yahoost ja teine LDK-st. Pisut tehnilist lähenemist:

Yahoo! is at a "do nothing" level -- way too late to sell, but too much like a falling knife to buy.

If you own LDK Solar, you're in pain. This is a stock that should have been sold long ago, but certainly on the recent break below $35. It's not too late to sell ... and it's too early to buy. -

no ma leidsin selle su "vihje" yahoo foorumist

ma seal tavaliselt ei käi infot ammutamas, sorry

neil probleeme pole, kassas 380m cashi ja rahamasin töötab

milleks veel oleks vaja kaasata 5B kapitali?

eks ma kaevan veel -

kunagi oli teil meeskonnas keegi, kes FMD'd hästi tundis

kas pole kedagi neist enam alles ? -

Ei ole jah alles enam ja kui ei jälgi ka firmat pidevalt, siis kipuvad ununema ka vaikselt. Kõigega ei jõua kursis olla : )

-

sa STU'd ei tunne aga sa Citi't ju tunned?

kas näiteks viimase aja cashburn võiks kuidagi soodustada positsioonide realiseerimist? -

speedy, STU turukapitalisatsioon jääb alla $3 miljardi - võrreldes $10+ miljardiliste subprime varade mahakirjutamisega, pole see nüüd teab mis hiigelsumma. Pealegi on STU ikkagi likviidne vara. Ma ei usu, et nüüd niisama müüma tormatakse - ikka vaid siis, kui väga head hinda pakutakse.

-

See, et kulla impordid Indiasse on eelmise aasta oktoobriga võrreldes 50% langenud, pole sealse piirkonna kohta küll hea märk. Huvitav, kui suur roll sellel on energia kallinemisel - tegu ikkagi riigiga, kus kütuseliiter maksis aasta tagasi ca 15-18 eesti krooni liiter ja keskmine palk võrreldes kas või Eestiga on mitmetes kordades väiksem.

It is also interesting to note that the Bombay Bullion Association said yesterday that gold imports into India, the world's largest consumer of the metal, plunged 50% in October from a year earlier. The October-December period is historically the busiest season in India for jewelry sales.

-

Päris tore intervjuu Gary Schilling'iga - link siin. Gary räägib, miks Citigroupis on asjad sellised nagu nad nüüd on ning ka turgudest ja majandusest tervikuna.

-

USA 10-aastase võlakirja tulusus on kukkunud 4.17% peale (eile veel 4.27%) - kui tulusus kukub, prognoosivad võlakirjade ostjad, et majanduse rõhutus USAs saab olema keerulisem/pikem, kui varem arvatud.

-

FEDi Hoenig räägib turgu alla :)

-

Alan Farley RM'ist huvitavate mõtetega:

Interesting To Note...The February selloff bottomed out during March expiration, while the summer selloff bottomed out during August expiration. The smell of a tradable low is definitely in the air.

-

Tundub, et kolm on kohtu seadus, kuid samas võib öelda, et turgudel päevad ei ole vennad.