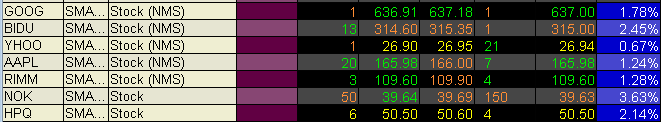

Börsipäev 20. november - HPQ hirmutab konkurente

Kommentaari jätmiseks loo konto või logi sisse

-

Hewlett-Packard (HPQ) teatas eile tugevad kvartalitulemused, öeldes et taaskord on suudetud turuosa võita (arvatavasti Delli, Lenovo ja LXK arvelt). Kuigi kahekohalist kasvu suudeti näidata igas regioonis (Revenue in the Americas grew 10% on a year-over-year basis to $11.9 billion. Revenue grew 19% in Europe, the Middle East and Africa to $11.6 billion. Revenue grew 20% in Asia Pacific to $4.8 billion), olid kasvumootoriks peamiselt arenevad turud. Jaotusvõime Hiinas ja Indias paraneb. Samuti ei mõjutanud firmat krediidiprobleemid ning tegelikult oleks tahtnud ettevõte turule veelgi rohkem müüa.

Ettevõtte käibest 67% tuleb väljastpoolt USA-d. BRIC riikides (Brazil, Russia, India ja China), mis moodustavad käibest 9%, suudeti aga käivet kasvatada lausa 37%.

USA aktsiaturgude suurimate indeksite futuurid on avanemas ca 1% kõrgemal tasemel.

-

Wachovia Starts Euroseas (ESEA) at Outperform

11-19-2007 05:45:17 PM

Wachovia initiates coverage on Euroseas (Nasdaq: ESEA) with an Outperform rating and a $22 to $24 price target.

The firm said it expects containership and dry bulk fundamentals to remain strong throughout 2008.

Euroseas, Ltd. and its subsidiaries provide ocean-going transportation services worldwide. It owns and operates drybulk carriers that transport iron ore, coal, and grains, as well as bauxite, phosphate, and fertilizers. -

Enne täna avaldatavat housing datat kardetakse, et uute ehitusete alustamine on langenud 16 aasta madalaimale tasemele, mis omakorda annaks võimaluse intresside langetamiseks. Futuurid indikeerivadki, et 11. detsembri kohtumisel alandatakse intresse 4.25%-ni. Kui veel eelmine kuu hinnati selle tõenäosuseks 72%, siis tänaseks on tõenäosus tõusnud 96%-ni.

Seetõttu on dollar kukkunud uutele põhjadele, hetkel küsitakse euro eest $1.478, ära on käidud ka $1.48 all. Ühtlasi võib turgudele närvilisust lisada ka FOMCi protokoll, mis avaldatakse meie aja järgi kell 21.

-

Google tgt raised to $900 from $800 at Credit Suisse.

Credit Suisse raises their tgt on GOOG in attempt to better account for long term opportunities in areas like display, local, and mobile. The firm believes that over time as all advertising goes digital, including television, radio, and outdoor, and Google becomes the de facto "operating system" for advertisers, providing them with the dashboard to monitor and optimizer their advertising, tremendous value will be created for Google shareholders. -

kiire reaktsioon, Madis :)

ma just tahtsin öelda, et HPQ ja GOOG võivad täna tehnoloogiaktsiad kappama panna -

Deutsche Bank on täna taas Citi hinnasihi kallal ning kärpimas seda $29 peale $34-lt. Välja tuuakse just riskijuhtimise vajakajäämised, millega on ikka kenasti puusse pandud. Eile liikusid ka jutud, et võibolla tahab ettevõtte CFO saada uueks CEOks Citis, kuid arvestades, et võetud riskide eest vastutab ikkagi ka finantsjuht, ei tundu sellistel juttudel väga tugevat vundamenti olevat.

-

Kuigi uudisnupp on eilne, siis Google'i jutu jätkuks kõlbab küll. Barronsi Tech Trader vahendab analüüsiettevõtte Hitwise'i uuringut, mille kohaselt on Google jätkuvalt turuosa võitmas. Oktoobris tehti 64.49% otsingutest läbi Google'i (septembris 63.44%). Oma turuosa on suutnud suurendada ka ASK.com (IACI), kelle vastavad näitajad on 4.76% vs 4.32% septembris.

Microsofti ponnistused ei tundu veel vilja kandvat, eelmise aasta 10.42% ja septembri 7.83% pealt on kukutud 7.42%-ni. Sama seis ka Yahooga: oktoobri turuosa 21.65% vs septembri oma 22.55%.

-

Building Permits 1178K vs 1200K consensus

Housing Starts 1229K vs 1170K consensus -

kuu aja tagused andmed revideeriti üles

Housing Starts 1191 -> 1193

Building Permits 1226 -> 1261 -

Tehnoloogiasektor on eelturul muud turgu edestamas ning kuubikud avanemas ca +0.8%ga.

-

Aasia alustas miinuses, kuid päev suudeti lõpetada valdavalt plussis. Euroopa turud jagunevad laias laastus pooleks ning USA alustab plussis.

Saksamaa DAX +0.68%

Prantsusmaa CAC 40 +0.66%

Inglismaa FTSE 100 +0.08%

Hispaania IBEX +0.55%

Venemaa MICEX -0.09%

Poola WIG -1.10%

Aasia turud:

Jaapani Nikkei 225 +1.12%

Hong Kongi Hang Seng +1.13%

Hiina Shanghai A (kodumaine) +0.45%

Hiina Shanghai B (välismaine) +1.40%

Lõuna-Korea Kosdaq -1.51%

Tai Set -0.03%

India Sensex -1.80%

-

Yesterday's Pain Brings Today's Opportunity

By Rev Shark

RealMoney.com Contributor

11/20/2007 7:18 AM EST

To improve the golden moment of opportunity, and catch the good that is within our reach, is the great art of life.

-- William James

One of the things about the market that seldom changes is that intense emotions lead to good opportunities. That is why I have been very focused on the potential for a tradable bounce recently. The mood has turned unusually negative, and when it is that bad, it will almost always will suddenly lift for a while and give us a chance for some good trades in the other direction.

This very negative mood in combination with the propensity for the market to trade in positive fashion around the Thanksgiving holiday makes the possibility for a good bounce quite high. The key to taking advantage is to be mentally and emotionally prepared to embrace a bounce.

After days like yesterday, many market players become extremely pessimistic. All they can think about is how poor the action is. They can't even consider the possibility that the mood might shift even for a little bit. That is why when we do turn the action can be quite dramatic. The folks that have turned so negative scramble to be less so, and eventually they make the same mistake the other way and become overly optimistic about the market.

At a time like this, it is particularly important to be clear as to what time frames you are using. There is little question that the intermediate trend for the market has turned down. We are taking out the lows of last week and the lows of August are not that far off. It is a very poor technical picture and we can't ignore that fact. We have to make sure we play some defense and work to protect our capital should the trend persist.

However, within that longer-term trend there will be many shorter-term ones, and if you are so inclined, they can offer great opportunity. Some of the best trading is often big bounces within a longer-term downtrend, and that is what we are setting up for right now.

One thing that has been tricky about this market over the past year has been the tendency of the market to break down and bounce straight back up. These sorts of "V"-shaped recoveries are not what the stock market technician usually expects to happen. More typically, bounces after a sharp breakdowns will fail.

We saw a good example of the more typical action this past week as we completely gave back the huge bounce that we had last Tuesday. I suspect that many market players were hoping for a "V"-shaped bounce and were not positioned well when the bounce completely failed. That probably helped to increase the intensity of yesterday's selling.

Despite the sour close last night, we are set up for a very positive open this morning. Asian markets reversed strongly after a poor open and Europe is acting much better. Positive earnings from Hewlett-Packard (HPQ) and generally better news flow is helping matters.

----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: BCSI +14.7%, JWN +10.4%, DKS +7.2%, DHI +5.8%, SKS +4.3%, MDT +3.9%, HPQ +2.7%, TGT +2.0% (also announces new $10 bln share repurchase program), HRL +1.7%, SSI +1.3% (in-line ests and announces buyback)....Other news: ACTG +24.3% (announces its subsidiary has settled litigation against Xata and Universal City Development Partners), RSTO +15.3% (Sears discloses stake in RSTO and seeking non-public info), CHA +9.5% (strength attribute to report that govt may speed up plans to grant wireless permits), CEO +8.9% (still checking), CN +6.5% (strength attribute to report that govt may speed up plans to grant wireless permits), ACH +5.3% (still checking), AUO +5.3% (DELL places 12.1-inch touch screen order with AUO says Digitimes), GMO +5.2% (announces strategic partnership with ArcelorMittal who signed agreement to acquire a 12.6% stake in GMO), ABB +3.8% (announces completion of sale of its downstream oil & gas business for $950 mln), LSCC +3.3%, NOK +3.3%, RMBS +3.1% (Amtech views tentative ruling as favorable), TSL +2.6% (hearing initiated with Overweight at tier-1 firm), RIMM +2.6% (initiated with Outperform at Thomas Weisel), MT +2.4% (announces strategic partnership with GMO) FSLR +2.0%, NICE +1.8% (announces it received a multimillion dollar order for an enterprise fraud soln), CVTX +1.7% (says FDA accepts Ranexa sNDA and NDA for filing), GOOG +1.6% (tgt raised to $900 at Credit Suisse)....Analyst upgrades: WCG +8.0% (upgraded to Sector Outperform at CIBC), FBTX +5.4% (upgraded to Market Perform at Keefe, Bruyette), STO +5.0% (upgraded to Buy at UBS), UA +4.5% (upgraded to Buy at UBS), WYNN +2.6% (upgraded to Buy at Jefferies), HES +2.2% (upgraded to Buy at UBS).

Allapoole avanevad:

In reaction to weak earnings/guidance: FRE -16.0% (FNM -12.9% in sympathy), GA -11.3%, FMCN -7.3%, HRAY -6.5%, PERY -4.0%, KONG -3.9%, GME -3.8%, TGT -3.4%, EGLT -3.3%, ODP -1.6%, CNQR -0.9%...Other news: DISH -7.3% (WallStreetJournal Deal article says DISH and T deal is not imminent), WM -2.4% (still checking), INAP -2.1% (announces Chief Financial Officer is stepping down), AMT -1.0% (hearing downgraded to Neutral at tier-1 firm). -

Capital Economics võttis tänase statistika kokku järgmiselt:

As we expected, US housing starts rebounded slightly in October. The trend is still clearly downwards, however, and these figures should not be misinterpreted as a sign that housing activity is even close to bottoming out. Starts rebounded by 3.0% to 1,229,000 annualised last month, only partly reversing the massive 11.4% decline in September. The unseasonably warm weather in the north-east probably helped as did the rebound in multi-family starts after a particualrly big drop off in September. But single-family starts fell again to 884,000, from 954,000. Most worryingly, the number of building permits issued dropped to a 14-year low of 1,178,000, suggesting that the number of starts will fall again in the coming months. Even if starts did somehow miraculously stabilise over the next few months, the overall level of housing construction would still continue to decline for at least another 6 months because of the time it takes to build a home. In short, aside from the very modest bounce in the headline figure there is nothing in this report that is at all encouraging. Housing is still in deep trouble.

-

Kogu selle positiivsuse peale on HPQ tugevus ära vajunud

-

Ericsson(ERIC) ootab, et 4. kvartali tulemused jäävad suure tõenäosusega antud 53-60 miljardilise prognoosivahemiku alumisse äärde. See lisab omakorda ebamäärasust selle kohta kuna ja mil moel jälle jalad alla saadakse ning tänases seisus ei ole see kindlasti midagi sellist, mida investorid oleks valmis kuulama. Aktsia käis ka 12 % miinuses juba, kuid on tugeva turu taustal tasapisi ülespoole tagasi tulemas (hetkel -9%).

-

Nafta hind on taas turge kollitama hakanud - 3% täna plussis ja barreli hind üle $97.

-

FRE ja FNM on täna ikka koledad

FRE market cap täna -7B kui Q3 loss oli -2B -

on kellelgi wachovias või oppenhaimeris käsi sees?

-

tahad neid õlut jooma kutsuda? ;-) ma eile tundsin ka oppaka vastu huvi...

-

nad on küll viimase märkimise käendajad, aga ma eeldan, et kodutöö on korralikult tehtud

-

Võimalik, et turg annab alla ka selle peale, et levimas on kuulukad Countrywide (CFC) pankroti kohta

-

finantssektorile see erilist tuge "pühaderalliks" ei pakuks

-

anoogen, seda küll jah. Kuid kui rumoriks asi jääb ning selle peale müüakse kõvasti, siis iseenesest tõstab puhtalt suurem negatiivsus võimaliku ralli tõenäosust.

-

ilmselt tehnoloogia eestvedajad GOOG, AAPL ja BIDU jne on vastusuunaas liikuvad, huvitav kaua? Mis arvate tanase paeva lyppuks/.

-

FEDi protokollist siis järgmised kommentaarid majandusolukorra kohta. Esmalt futuurid üles, kuid nüüdseks ollakse taaskord languses. Midagi väga üllatavat siit ei tulnud, kuid tundub, et kaitset ollakse nõus pakkuma. 2008. aasta kasvuprognoose kärbiti päris tublisti..

14:02 Fed says concerned that high overall inflation could push expectations higher

14:02 FOMC Minutes: Economic growth seen rising to near trend by 2009, downside risks somewhat smaller than at Sept FOMC

14:02 Fed saw 'moderate' spending as 'most likely scenario'

14:02 TECHX Markets see a relatively muted-to-slightly positive initial reaction to the FOMC minutes -Update- -Technical-

14:01 FOMC Minutes: Rate reduction would provide 'additional insurance' against any unexpected severe weakening

14:01 Fed sees GDP rising as much as 2.7% in 2009, 2.6% in 2010

14:01 Fed says 'nearly all' FOMC voting members supported rate cut

14:01 Fed cuts Core PCE forecast to 1.7-1.9% in 2008 from 1.75-2%

14:00 Fed officials judged Oct 31 rate cut as 'close call'

14:00 Fed says central tendency-US GDP growth: 2.4-2.5 PCT IN '07; 1.8-2.5 PCT '08; 2.3-2.7 '09; 2.5-2.6 '10

14:00 Fed cuts growth forecast for 2008 to 1.8-2.5% from 2.5-2.75%

13:59 FOMC minutes pending...to be released at 2pm EST -

renessanss, tehnoloogia tundub üleüldse praegu parem bet olevat kui SPY. Lühiajaliselt olen sektoris suhteliselt positiivselt meelestatud isegi.

-

olen sinuga nyus, aga eelmisel nadalal liikus tehnoloogia sektor vastupidi??? Praegu minu arvates turg otsib suunda kas langeda pikkas perpektiivis vyi pigem lyhidas intresside karpimisega tyusma!

-

Tänan ka kõiki seminaril osalejaid ning materjalid saavad ka varsti lehele üles.

-

renessanss, hetkel ongi määramatus päris korralik ning seda näitab ka ikkagi üle 26 punkti olev VIX... pea iga päeva liikumine sõltub juba konkreetsetest uudistest. Niipea, kui kuuleme, et valitsus või Fed on majanduslanguse vältimiseks või finantsturgude stabiliseerimiseks midagi ette võtmas, unustatakse suure tõenäosusega tänased kahtlused mõneks ajaks taas ära... nii nagu augustiski.

-

Countrywide: Bankruptcy Rumors "Absolutely False"

-

kuubikud outperformisid SPY-d kuni protokollini kuid nüüd on situatsioon vastupidine. Tehnoloogia miinus isegi suurem, mis üldiselt väga julgustav märk ei ole. Praegustelt tasemetelt aga võib indikeerida juba paanikat!? GOOG, AAPL ja RIMM on päris tublid. Üldiselt on ka turu emotsioonidest keeruline aru saada kuna tundub, et suur raha rahmeldab ka aktiivsemalt ringi - kuuldused mitmete fondide õhkulendamisest on levimas.

-

Viimaseks tunniks natuke muusikat, mis ühtib emotsioonidega turul : )

http://www.youtube.com/watch?v=ke7fqbW-5eo -

Ah et muusika ikka mängib veel!

-

finantsi vabalangus!

-

mina näen küll võimsat põrget hoopis

-

no k***t, 300 punktiseid päevaliikumised ei ole normaalsed lihtsalt! On sel topispallipõrkel ka mingi alus? Või lihtsalt - pulli pärast??

-

äkki on mõni trading programm rikki läinud :)

-

The Financial sector (-1.8%), in particular, has shaved a large portion of its losses. There is not a specific news item to account for the pop.

-

unf******believable

-

Äkki lühikeseks müüjad katavad? Hirmuralli.

-

Nonii...kuulasite ikka seda lugu? Mina kuulasin ja kuulasin ning kes veel julgeb väita, et naeratamine ei tee maailma ilusamaks? :)

-

uh mine või palderjaani järgi, ölut ju enam ei saa. QQQQ rebib vist +1%ni ära.

-

Financial crisis has officially ended.

US Government. -

10y treasury kukkus ka kolksti 0,3% ehk siis 10 minutiga ca 5 bps yieldi liikumist. Natuke imelik selle kohta, et ei ole üldse mingit uudist.

-

ja QQQQga läks nagu tavaliselt....ralli lükkus edasi!

-

Finantsasutuste downgrade'id on lahedad.

Friedman Billings has downgraded Freddie Mac (FRE 27.06, -10.44) to Underperform from Market Perform, and is reducing its price target to $20 from $55. -

To: dol. Osta õlut ikka kastiga ja harjuta ennast mõõdukalt tarbima ;-)

-

ehk teadjamad härrad oskavad seletada GMKT järelturul üle 11 % tõusu.?

-

http://www.nasdaq.com/aspxcontent/ExtendedTradingTrades.aspx?mode=frameset&kind=&symbol=GMKT&symbol=INTC&symbol=MRVL&symbol=IWM&symbol=XLE&symbol=CCJ&symbol=TTWO&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&symbol=&selected=GMKT&FormType=&mkttype=AFTER&pathname=&page=afterhours

-

jama joru sai.aga tundub et suurem kogus läks märksa madalama hinnaga kaubaks