Börsipäev 27. november

Kommentaari jätmiseks loo konto või logi sisse

-

Alustuseks LHV Traderist üks varahommikune futuurigraafik S&P500-st, mis on eilse veresauna järel üle 1% plussis - ajal, mil ameeriklased magavad sügavat und ja mõtlevad, et kas tõesti on võimalik, et turud sirgjooneliselt alla lähevad:

-

Abu Dhabi $7.5 miljardilisest investeeringust Citigroupi (C) on investeerimismaailm omajagu vaimustuses. Ühtteist sellest on ka napisõnaliselt siinses intervjuus räägitud, kuid üldiselt on tore lihtsalt fakt, et raha on nii-öelda USA finantsettevõtetesse tulemas täiesti süsteemiväliselt – mitte et mõni pank oleks lihtsalt teisest huvitatud (nagu BACi investeering CFC-sse), vaid tundub, et ka sügavate taskutega välisinvestoritel on USA finantssektorisse tänaste tasemete pealt pikaajalist usku, mis niivõrd nadides turu tingimustes mõjub toetavalt. Londonist on toetavaid teateid likviidsuse olemasolu ja kasumiprognooside kohta tulnud ka Barclay'lt.

-

Kas Abu Dhabi on sovereign wealth fund nimeline asjandus?

-

Mida lähemale kauplemise algusele - seda madalamale futuurid langevad !

-

hirmupäeva pole veel turul olnud, et langus lühiajaliselt lõppeda võiks, aga kes teab, jõulud ja fedja tulemas!

-

momentum, sovereign fund'iga tegu jah.

-

Mida lähemale kauplemise algusele, seda rohkem ameeriklasi ärkab üles ja saavad asuma müüma seda, mis eile müümata jäi :). Aga hirmupäeva olemasolu või mitteolemasolu kohta on raske midagi kommenteerida. Ausalt öeldes usun, et eilset -2.3%list langust ei vaadanud pärast korralikku (õhukesel käibel küll) reedet mitte üksnes mina halva maitsega suus, vaid ka Bushi valitsus (kellele võidakse varsti küsimusi minna esitama, et mis sest housingust siis ikkagi saab), finantsmaailm ja paljud teised.

-

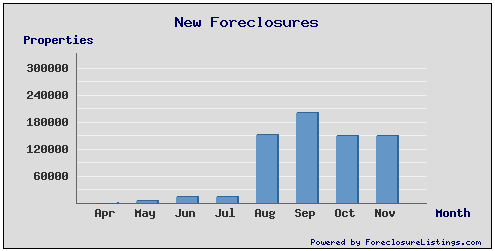

Wall Street Journalis mustades toonides artikkel taaskord. Lisan inimestelt äravõetud ja uuesti müüki paisatud majade kohta ka ühe graafiku.

WSJ reports the property value of U.S. homes will fall by $1.2 trillion, and "at least" 1.4 mln homeowners will lose their properties to foreclosure in 2008, according to a study released Tuesday by the U.S. Conference of Mayors and the Council for the New American City. The study, prepared by Global Insight, predicts a widespread and deep economic impact from ongoing housing mkt problems, which many expect to stretch through next year. Global Insight predicted that the economy would grow at a 1.9% rate in 2008, "a full percentage point lower than would have been the case without the mortgage crisis." It also said U.S. GDP growth would be $166 bln lower next year because of mortgage mkt problems, and that consumer spending would fall to 2% growth. The study also found that home price declines would average 7% in 2008.

-

Saksamaa DAX -1.26%

Prantsusmaa CAC 40 -0.67%

Inglismaa FTSE 100 -1.27%

Hispaania IBEX -0.71%

Venemaa MICEX -1.11%

Poola WIG -1.29%

Aasia turud:

Jaapani Nikkei 225 +0.58%

Hong Kongi Hang Seng -1.51%

Hiina Shanghai A (kodumaine) -1.97%

Hiina Shanghai B (välismaine) -2.32%

Lõuna-Korea Kosdaq +0.57%

Tai Set -1.18%

India Sensex -0.62%

-

Stay Nimble in a Swoon

By Rev Shark

RealMoney.com Contributor

11/27/2007 7:49 AM EST

The greater the difficulty the more glory in surmounting it. Skillful pilots gain their reputation from storms and tempests.

-- Epictetus (55-135), Greek philosopher

The market mood has become tremendously negative, as market participants see no end to the worries that are plaguing us. It is painfully ironic that the problems that were blithely ignored by the market for so long this past year are now weighing on us so heavily. The crumbling real estate market, slowing economy and persistent credit woes are now being viewed as bottomless pits when they were mere irrelevancies for so long.

Our job at this point isn't to argue with the logic of the market but to navigate these stormy seas. Above all else, that means protecting our precious capital and being in position to profit when conditions become more favorable. There is nothing that will benefit your portfolio more than avoiding losses when the market is acting poorly. If you can keep from incurring losses in your portfolio as the market falls, you avoid the very unproductive task of recouping losses once the market is more favorable.

The biggest danger in a market like this is comes from constantly trying to catch a market turn. There is nothing wrong with trying to play the bounces and spikes that are sure to occur within an emerging downtrend, but it is extremely important that you stay disciplined and not let failed trades turn into investments.

We saw a particularly good example yesterday of how signs of an early bounce can draw in investors and then turn into a rout when momentum suddenly turns down. All the bounce-buyers found themselves trapped, and when they bailed out, it caused an ugly meltdown into the close.

Unfortunately, the message of traditional Wall Street in a difficult market like this is to hold on, don't sell and stay the course. We are assured the market is going to bounce back at any time -- we just need to stay patient.

Most investors are far better off if they take their losses and then look to make them up once the market starts to act better. More often than not, the stocks that act best when the market improves aren't the ones we were nursing as it downtrends.

Don't be afraid to sell, even in a market like this that has already fallen significantly. Maybe your sales will be poorly timed, but you will find that having cash on hand is very empowering. More likely than not, you will be able to find even better opportunities than those you had stuck with too long.

We have strong early indications due primary to an investment in Citigroup (C) of $7.5 billion by the Sovereign Wealth Fund of Abu Dhabi. The market is obviously thinking that this is bargain-hunting behavior and may indicate that we are oversold.

Given how incapable this market has been to generate a sustained upside move, we can't be too trusting of early strength. There are plenty of folks who still want out of this market, and they have been inclined to sell into strength aggressively. Until the bulls can put together a couple of days of strength and discourage the increasingly confident bears, we have to be leery about trusting early bounces.

Overseas markets are mostly lower in sympathy with our poor close yesterday. Oil and gold are trading down.

------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: SPLS +8.8%, ATVI +8.3%, KOPN +4.9%, CTRN +3.5%, DCI +3.1%, CMRG +2.9%, TECD +2.5%, ESRX +2.0%, TECD +1.5%, AEO +1.3%... Financials showing strength following Abu Dhabi investment in Citi, positive BCS guidance: UBS +4.5%, C +4.0% (announces plans to sell $7.5 bln of equity units to Abu Dhabi investment authority for $7.5 bln), BCS +4.0% (gives guidance and seeks to reassure investors on earnings), LEH +2.6%, WFC +2.0%, GS +1.5%, MER +1.4%, JPM +1.2%, BAC +1.2%, WB +1.1%... Other news: BBND +11.9% (announces that five additional Chinese operators are deploying its Broadband Multimedia-Service router to process and deliver digital television services), KMP +5.6% (expects to declare cash distributions of $4.02 per unit for 2008), PHM +4.9% (reaffirms Q4 guidance), RIG +3.6% (UK regulators clear way for merger with GSF), BPHX +3.4% (positive comments from Roth), ACN. +3.3% (still checking), DKS +3.3% (agrees to acquire Chick's Sporting Goods; will be marginally accretive in FY08), AIV +2.8% (still checking), BRCD +1.9% (Cramer makes bullish comments on MadMoney), CFC +1.9% (Fox Pitt believes its unlikely that FHLB/Atlanta will stop lending to CFC), THQI +1.8% (announces resignation of Chief Financial Officer), KBH +1.8% (up in sympathy with PHM and initiated with Hold at Soleil), GSK +1.6% (obtains exclusive US OTC marketing rights to Mevacor from MRK), MON +1.6% (still checking), NOC +1.6% (received follow-up contract from US Army valued at $20 mln), CI +1.5% (announces it signed agreement to acquire Great-West Healthcare for $1.5 bln; accretive FY08), BMY +1.4% (still checking), CPT +1.4% (replacing APPB in S&P MidCap 400), IDT +1.4% (announces its subsidiary Net2Phone wins arbitration against Altice), YGE +1.4% (signs $56 mln silicon furnace contract with GTSolar)... Analyst upgrades: MRO +2.4% (upgraded to Peer Perform at Bear Sterns), MYL +2.0% (hearing upgraded to Buy at tier-1 firm), PBI +1.4% (initiated with Buy at BofA), AXA +1.4% (upgraded to Outperform at Credit Suisse), EFII +1.2% (initiated with Buy at BofA), BP +1.2% (upgraded to Outperform at Bear Sterns).

Allapoole avanevad:

In reaction to weak earnings/guidance: DBRN -1.4%, ACM -1.0%... Other news: ARB -12.1% (lowers FY07 guidance and announces co will delay commercialization of the Portable People Meter radio ratings service), IRIS -8.4% (files $125 mln mixed securities shelf), GCO -3.5% (reports subpena from US Attny relating to co's negotiations and merger agreement with FINL), GA -3.4% (announces it has been named in securities class action suit), TSO -3.2% (Tracinda withdraws tender offer for 16% of TSO shares), TOPT -1.3% (announces public offering of 21 mln shares of common stock and cessation of offers under July prospectus supplement), HBC -1.2% (continued pressure following yesterday's Goldman downgrade and co's plan to bail out two of its funds), BIDZ -1.0% (issues Thanksgiving weekend sales report; reaffirms guidance)... Analyst downgrades: NG -1.4% (downgraded to Peer Perform at Bear Sterns). -

Turud teevad hommikul võimsa alguse ning indeksid üle 1% plussis. Tõusu abistab hetkel kindlasti ka langev nafta hind - tasub silm peal hoida sel. Hetkel nafta -2.7% ja maksab $95.00.

-

Consumer Confidence 87.3 vs 91.0, prior revised to from 95.6

-

Päeva esimese 3 tunni kauplemisaktiivsust vaadates tõotab täna tulla päris suure käibega päev turgude jaoks. Ka eile löödi küll viimase 3 kuu keskmist, kuid viimase kuu aja mahte vaadates oli eilne käive ikka nii suure languse kohta tilluke. Kui ainult päevalõpu müük sedapuhku ära jääks, saaksid turud ehk kas või mõneks ajakski langusest puhkust.

Saudi Araabia lubaduse peale tootmismahte kergitada on nafta tänaseks kukkunud juba -3.3% ja maksab barreli kohta $94.5. -

Fed's Plosser says inflation data encouraging, but still a risk

Fed's Plosser says would need to adjust rates if economic outlook revised upward

Fed'S Plosser says unemployment may rise to about 5 percent next year

Fed's Plosser says expects decline in housing activity to bottom out by end of Q2 2008

Fed's Plosser says financial problems could lead to more significant spillover

Fed's Plosser says rise in oil, commodities prices suggest significant inflation pressures exist

Fed's Plosser says rate cuts run risk of higher inflation and inflation expectations -

Päris huvitav kommentaar herr Cramerilt täna Citi investeeringu kohta ning väidetavalt on tal infot, et see oli alles esimene investeering kolmest Dow aktsiatesse Abu Dhabi poolt. See viimane väide tundub mulle ausalt öeldes natuke kahtlane arvestades, millise ahastuse äärel mees eile oli, aga võimatu pole miski:

If you stay as negative post the Abu Dhabi cash infusion to Citi (C) , you are going to get hit by more than one investment. Monday my friend Erin Burnett, who just returned from Abu Dhabi, was told very specifically that there are going to be three investments in Dow Jones Industrial Average stocks -- three! If you stay negative, are you going to be ready to handle those investments?

I have to tell you that when I look at this market, which is still oversold, and when I hear about this Citi investment, I start thinking, "This is an important moment."

All of the other rallies we have had in this period have been ephemeral because nothing has really changed. -

Peale eilset nõrkust kaupleb täna ligi 3%-lises plussis Altria (MO), põhjuseks Goldman Sachsi soovitus aktsiat osta. Teesides midagi uut ei ole, peamiselt tõstetakse esile rahvusvahelist haaret, soodsat majanduslikku positsiooni, üldist tubakatööstuse aktsiate kallinemist ning suutlikkust tõsta hindu vastukaaluks kahanevatele mahtudele. Hinnasihti kergitatakse $79 pealt $85-ni.

Teistest suurematest aktsiat katvatest analüüsimajadest on varem oma hinnasihid avaldanud Morgan Stanley, Citigroup, Deutsche Bank ja A.G. Edwards, õiglaseks väärtuseks on hinnatud vastavalt $87, $84, $80 ja $77.

-

No nii Wells Fargo pani ka saba. Pankade elu pole lombi taga kerge:

http://biz.yahoo.com/ap/071128/wells_fargo_charge.html