Börsipäev 30. november

Kommentaari jätmiseks loo konto või logi sisse

-

Kuigi 11. detsembri intressimäära kärpega on juba väga tugevalt arvestatud, siis eile vihjas ka Föderaalreservi esimees, et majanduse stimuleerimiseks on vaja intressipoliitikas olla leebe, seda enam, et majanduslangusesse kukkumise tõenäosus on viimasel ajal suurenenud.

AP reports Fed Chairman Ben Bernanke on Thursday hinted that another interest rate cut may be needed to bolster the economy. The worsening credit crunch, a deepening housing slump and rising energy prices probably will create some "headwinds for the consumer in the months ahead," he said. Bernanke said he expects consumer spending will continue to grow and suggested the country can withstand the current problems without falling into a recession. But he indicated that consumers could turn more cautious as they try to cope with all the stresses. The odds have grown that the country could enter a recession. A sharp cutback in consumer spending could send the economy into a tailspin. Against this backdrop, Fed policymakers will need to be "exceptionally alert and flexible," Bernanke said. That comment probably will be viewed as a sign the Fed may lower interest rates when it meets on Dec. 11. The economic outlook has been "importantly affected over the past month by renewed turbulence in financial markets, which has partially reversed the improvement that occurred in September and October," Bernanke said. "These developments have resulted in a further tightening in financial conditions, which has the potential to impose additional restraint on activity in housing markets and in other credit-sensitive sectors," he said. In his remarks, Bernanke said rising gasoline and heating oil prices as well as higher food costs have the potential to raise inflation. He said that is something the Fed also is watching.

-

Inflatsioonist saab jagu väga lihtsalt - muuda arvutamise meetodit. Arvatavasti ongi aeg küps muutmaks metoodikat, et lisaks Greenspani asenduskaupadele kui teoreetilisele võimalusele võtta kasutusele ka näiteks asendusmediteerimine. Et stiilis, kui liha hind liiga palju rallib, siis tarbija võib seda asendada ka näiteks viineriga. Nii vist on praegu. Uus süsteem oleks, et kui viineri hinnad ka liiga palju rallivad, võib tarbija mingi guru õpetuste poole pöörduda ja üldse mitte toitu tarbida. Umbes nagu see poiss, kes 7 aastat puu all söömata elas. Peaks olema usutav ja reaalne ning inflatsiooni saaks laksust alla, kuna tarbida pole vaja.

-

Nafta hinnaliikumine on energiapulle hulluks ajamas - üle hulga aja näeme hinda allpool $90 ning turgudele see meeldib.

-

Naftas hakkab pidu läbi saama. Kui dollar ka veel pihta saaks (ralliks), siis oleks $50 tase kiiresti käes. Globaalne energiavajadus on otseses sõltuvuses majanduskasvust.

-

WSJ raporteerib, et Bushi administratsioon ja suurimad finantsinstitutsioonid on lähedal jõudmaks ühisele kokkuleppele ajutiselt külmutada intressimäärad mõningate sub-prime laenude puhul. Kindlasti on see julgustav samm koduomanikele (more than two million adjustable mortgages are scheduled to jump over the next two years), samuti majadeehitajatele ning loomulikult Bushi administratsioonile poolehoiu võitmise osas. Täpsemaid detaile alles töötatakse välja, kuid võimalik, et neist kuuleme juba järgmisel nädalal.

Pikad tekstid mulle küll ei meeldi, kuid tegemist on esimese võimaliku konkreetsema sammuga. Lugu ise järgmine:

The plan is being negotiated between regulators including the Treasury Department and a coalition of mortgage-related companies including Citigroup Inc., Wells Fargo & Co., Washington Mutual Inc. and Countrywide Financial Corp. People familiar with the talks say the individual members have agreed to follow any agreement reached by the coalition, which is called the Hope Now Alliance.

Details of the plan, which could be announced as early as next week, are still being worked out. In general, the government and the coalition have largely agreed to extend the lower introductory rate on home loans for certain borrowers who will have trouble making payments once their mortgages increase.

Many subprime loans carry a low "teaser" interest rate for the first two or three years, then reset to a higher rate for the remainder of the term, which is typically 30 years in total. In a typical case, the rate would rise to around 9.5% to 11% from 7% or 8%. That would boost an average borrower's payment by several hundred dollars a month.

Exactly which borrowers will qualify for the freeze and how long the freeze would last are yet to be determined. Under one scenario, the freeze could run as long as seven years. The parties are developing standard criteria that would determine eligibility. The criteria should be finalized by the end of year.

Mortgage servicers -- the companies that collect loan payments -- are a key part of the coalition, because they are the companies that deal directly with borrowers. Often the servicer is different from the company that originally made the loan. Citigroup and Countrywide are among the nation's biggest mortgage servicers. The mortgage servicers in the coalition represent 84% of the overall subprime market. The coalition also includes lenders, investors and mortgage counselors.

The Bush administration has been looking for ways to stem the fallout from the mortgage crisis. Treasury Secretary Henry Paulson and Housing and Urban Development Secretary Alphonso Jackson helped assemble the coalition so that government officials could have a single counterpart with which to discuss terms of a plan.

While the government can't force the industry to modify loans, Mr. Paulson and other administration officials have been using moral suasion to push for workouts, telling the companies it is in their interest to avoid foreclosure since most parties can lose money when that happens. A similar plan to freeze interest rates temporarily was recently announced by California Gov. Arnold Schwarzenegger and four major loan servicers, including Countrywide.

Among the holdouts have been investors, who typically hold securities backed by mortgages. If interest rates are frozen, they would lose the potential benefit of higher payments. But investors have cautiously moved toward cooperation, likely on the grounds that it's better to get some interest than none at all.

At a meeting at the Treasury Department yesterday, coalition members told Mr. Paulson and other regulators that they are on track to announce the new industry guidelines by year's end, according to a senior Treasury official. Among those attending were representatives of Wells Fargo, Washington Mutual, Citigroup and the American Securitization Forum, a group whose members issue, buy and rate securities backed by bundles of mortgages.

"There has been a convergence of thought on this," said William Ruberry, spokesman for the Office of Thrift Supervision, which is also involved in the discussions.

A spokeswoman for the American Securitization Forum, which earlier resisted a broad approach to changing loan terms, said: "We support loan modifications in appropriate circumstances and are working to establish systematic procedures to facilitate their delivery."

Treasury officials say financial institutions are likely to set criteria that divide subprime borrowers into three groups: those who can continue to make their payments even if rates rise, those who can't afford their mortgages even if rates stay steady, and those who could keep their homes if the maturity date of their mortgages were extended or the interest rates remained at the teaser rates. Only the third group would be eligible for help.

The creditors are likely to look at whether the borrowers have equity in their homes, despite falling house prices, and whether their incomes are holding steady.

Mr. Paulson, who is philosophically opposed to federal meddling in markets, at first rejected a sweeping approach to loan modifications when the idea was floated by Federal Deposit Insurance Corp. Chairwoman Sheila Bair. But he shifted his position recently. He told The Wall Street Journal last week that it would be impossible to "process the number of workouts and modifications that are going to be necessary doing it just sort of one-off."

As a drumbeat of bad news about housing has continued -- including news of fewer home sales, falling prices and higher foreclosures -- the Bush administration has come under pressure to be seen as actively addressing the problem.

"There seems to be a vacuum in terms of leadership," said Brian Bethune, U.S. economist at Global Insight, a research firm. Mr. Paulson and Federal Reserve Chairman Ben Bernanke need "to build up the public's confidence that they will do what is necessary to avoid recession," said Mr. Bethune.

Officials in Washington have been cautious about steps that would be seen as rescuing borrowers, lenders and investors from the consequences of their own bad decisions. That is why few are suggesting direct support for borrowers who can't afford their loans. Mr. Paulson has decided his best option is to prod the markets to sort matters out themselves, as long as companies bear in mind the public interest in keeping people in their homes. "There's not some silver-bullet piece of legislation out there," a senior Treasury official said.

Mr. Paulson, who spent 32 years at Goldman Sachs Group Inc., has been on the phone nearly every day in recent months with the heads of financial institutions such as J.P. Morgan Chase & Co., Bank of America Corp. and Lehman Brothers Holdings Inc. He has talked to chief executives to find out what they're doing to help borrowers and get their take on the extent of the losses and accompanying credit crunch roiling Wall Street.

"Where I'm spending most of my time is in the mortgage market," Mr. Paulson said in another interview this week. He convened a 7 a.m. staff meeting the Monday after Thanksgiving "to find out what are we learning."

"If I ever saw a role for government, it is...to bring the private sector together when innovation has really outrun our ability to deal with it," Mr. Paulson said. He is expected to talk about the administration's approach to the housing crisis at a conference Monday.

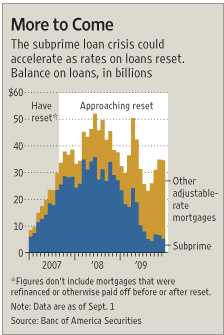

Interest rates are set to reset next year on $362 billion worth of adjustable-rate subprime mortgages, according to Banc of America Securities. An additional $85 billion in such mortgages is resetting during the current quarter. The estimates include loans packaged into securities and held in bank portfolios.

Borrowers whose loans are resetting are likely to have a tougher time sidestepping the rising payments by refinancing or selling their homes. Lending standards have tightened and many borrowers can't qualify for refinancing. And falling home prices mean that many borrowers have little or no equity in their homes. Some owe more than their homes are worth.

Top Treasury officials fear that unless creditors agree to relax the terms on many of those mortgages, borrowers will default at a higher pace. About 6.6% of subprime mortgages were in foreclosure as of August, the most recent data available, according to First American LoanPerformance. -

Näitamaks, miks on Bushi valitsusel ja Keskpangal vaja USA housingu sektori pärast põhjendatult muret tunda, panen siia ühe graafiku intressimäärade muutuste osas, mis on mulle kunagi varem ette sattunud. Kõige suuremale hulk intressimäärade muutusi saab subprime laenude osas olema 2008. aasta keskel, muude korrigeeritava intressimääraga laenude tipphetk on ühtlasemalt 2008.-2009. aasta vahel ära jagunenud.

-

Eile hilisõhtul avaldas tulemused arvutitootja Dell (DELL), kasvatades kolmandas kvartalis käivet 9% 15.64 miljardi dollarini (oodati $15.34 mld) ja kasumit 27% 766 miljoni USD-ni. Aktsiakasumiks kujunes 0.34 dollarit, jäädes analüütikute ootusest ühe sendi jagu madalamaks. Investorid tõmbasid aga Delli aktsia järelturul 10% miinusesse, reageerides kommentaaridele ebamäärasest tulevikust. Uue poliitika alusel ei väljastada tuleviku osas enam prognoose, kuid CFO sõnul mõjutavad lähiaja majandusnäitajaid aeglasem alanemine arvutikomponentide kuludes ja võimalik muutus tarbijakäitumises.

Deutsche Bank: Positiivseks peetakse müügitulude jõudsat kasvu arenevatel turgudel (BRIC +32%, milles India ja Brasiilia näitasid mõlemad 40%-list kasvu). Negatiivseks aga marginaale (GM 18.5% ja OM 5.3%), jäädes mõlemad panga ootustest. Lisaks valmistas pettumust strateegia update, mille puudumine ei võimalda hinnata Delli pingutusi firma ümberpööramises. Deutsche alandab hinnasihi 35-lt dollarilt 32 USD peale, säilitades ostusoovituse. Aktsiat peetakse odavaks võrreldes ajalooliste valuatsioonitasemetega ning usutakse paranevasse käibesse ja marginaalidesse.

Morgan Stanley: Säilitatakse equal-weight reiting, tundes muret USA segmentide aeglustuva kasvu osas, ent rõhudes ettevõtte keskendumist uutele kasvuinitsiatiividele ja aktsiate tagasiostmisele. Segaseks jääb Morgani jaoks fakt, kas praegu tehtavad investeeringud aitavad lõppkokkuvõttes genereerida tervislikumat kasvu, marginaale ja rahavoogu. Turnaroundi varajase faasi tõttu eelistatakse Delli asemel HPQ-d, tuues välja viimase hajutatud käibebaasi, tugevat tarkvara frantsiisi ja juurdepääsu kiire kasvuga PC turgudele.

Citigroup: Delli tulemused annavad alust korrata ostusoovitust Inteli aktsiatele hinnasihiga 33 dollarit. Varem on Citigroup kirjutanud, et teatud komponentide osas ei suuda Intel rahuldada nõudlust ning Dell ka seda kinnitas. Eriti kitsaks peaks minema olukord sülearvutite komponentide turul (järgnevatel aastatel ületab Delli sõnul läpakate kasv lauarvutite oma lausa 6X), mis mõjub loomulikult hästi marginaalidele. Kõrge nõudlus vähendab tõenäoliselt Inteli varusid juba kolmandat kvartalit järjest ja kui tootmismahud jäävad kõrgeks vähemalt 2008a esimese kvartalini, alandatakse sellega ühikukulusid ja kasvatatakse kasumimarginaali.

-

Huvitavad on majandusstatistikast sissetuleku ja kulutustenumbrid, mis jäid porgnoosidele alla.

PCE Deflator y/y +2.9 % vs +2.8% consensus

PCE Core m/m +0.2% vs +0.2% consensus

Personal Spending +0.2% vs +0.3% consensus

Personal Income +0.2% vs +0.4% consensus

PCE Core y/y +1.9% vs +1.8% consensus -

Majandusstatistikale on reaktsioon väike ning põhiline keskendumine on ikkagi subprime laenude määrade külmutamisele. See on kergitanud eelturu majadeehitajate aktsiaid tublisti ning usun, et kergitab veelgi. Samuti on mitmed subprime kindlustajad plussis. Futuurid indikeerivad, et indeksid alustavad kauplemist protsendi jagu plusspoolel. Samal ajal kaupleb Motorola ca 6% plusspoolele peale seda kui CNBC-s teatati, et CEO Zander astub ametist tagasi aasta lõpus.

-

Läbustan korra veel. Cramer on kirjutanud väga huvitava loo Treasury ja Fedi koostööst ning annab päris palju mõtteainet seoses tänase sub-prime freeziga. Üle pika aja hea teos:

It was always about being engaged. The Federal Reserve has not been engaged in the mortgage situation. The Treasury has not been engaged in it. They have always felt that the market is the market and the market will solve things. I am used to hearing silly things like that. It's been the litany of every single loser's strategy since the Great Depression, as if the market somehow knows everything and can solve everything. It's like they all believe in Leviathan or in the pre-Industrial Revolution England model. It's like they have never studied history. The reason why we have government besides defense is to promote the general welfare. But you can't promote the general welfare and let business run amok, which is what the mortgage business did, and think that things will work out alright.

For how many years did we hear and read those ads that anyone who had any sophistication knew had to end badly: no money down, no credit rating, no documentation. You heard that stuff, so did I. The government didn't care. Because it didn't care and because it was never engaged we were about to suffer one of the greatest declines in the economy since the great depression -- thanks John Stumpf from Wells Fargo (WFC) for elevating my views beyond gadfly status.

Now, because the cost to Wells Fargo, Countrywide (CFC) , Washington Mutual (WM) and Citigroup (C) is too great to service the bad loans -- and don't for a minute believe it is anything else -- Treasury is engaged. Because Citigroup was insolvent (and so are the mortgage insurers and Washington Mutual without help), the Fed is engaged.

Make no mistake about it, none of these guys is engaged because people were losing homes. They are engaged because, en masse, the borrowers are too big to fail and the lenders have come to the government for help. Don't feel this is wrong. We are a country with a government that does not want bread lines and disorder and massive unemployment and nasty other things you could see coming if this stuff persisted.

So now the Treasury makes it possible to value the mortgage-backed assets without additional defaults accelerating. The defaults will still happen at a more predictable pace. The Fed will now lower rates so the net interest margin will be huge and the banks can absorb the hit. The banks will not have to hire thousands of dead weight, non-revenue producing, repomen. And we will live in slower growth happily ever after, until we work off the unsold inventory as a product of country growth and household formation.

It's the beginning of the end of the crisis. There will be people who balk. There always are, out of greed. But we know from Citadel that this paper is worth 25 cents to the dollar, not more than that, and it probably rallies to 30 cents now with this plan making it possible for banks to sell some of it at hideous losses that will quickly be made up by net interest margin gains.

This is all the stuff of 1990, and it is why the financials bottomed this week except the ones that can't tap capital of which there are always some outliers. We still haven't had a single bank failure or home building failure and you know that is unrealistic. That's why it is the beginning of the end not the end.

But if you stay negative here you will miss a huge rally and you will be furious at yourself and you have made a gigantic amount of money if you are short and you are just plain piggish right now if you don't cover.

One after another I hear people on TV that it is too early to buy the financials or that they know they are going down or that the sector is just plain dangerous. Some stocks in it sure are. But, post-1990 you made out pretty well with the good ones and with the bad ones that could make it. Even post-2001 you made out with the Cornings (GLW) and the Yahoo!s (YHOO) and the Lucents and Nortels although ultimately those last two were done in by other forces.

Now, the whole time, you did better owning Medco Health (MHS) so I am not saying this is the holy grail of where you want to be. I am saying that the systematic hatred of the sector ended this week and there are bargains to pick at just like anything else now that I believe a deal has been made to cap subprime in return for a healthy net interest margin gain from lower Fed funds rates.

Of course, the whole engagement process should have been done months ago but they in government were unengaged and didn't want to listen or act.

Bernanke was more concerned with not bailing out the stock market. He didn't understand that the cost to the system of even attempting to service dead beats let alone allowing a bottom to be put in on toxic paper -- thanks Citadel -- would be prohibitive. If he were an NFL coach we would be trashing him and calling for his firing. But this is "finance" and the vast majority of the people don't even know what a losing season is, although the folks at Merrill (MER) and Bear (BSC) and Citigroup are beginning to find out.

I understand that this government would not be engaged. From the top down there is a level of cluelessness and lack of engagement and sophistication that even the most reactionary, dismantle-the-government types recognize. There has been no engagement because the marching orders up top are "don't engage because I don't even understand but that means it will work out by itself." I find it painful to even watch this administration's directives. They don't want to win because they don't even know how.

But someone from private industry explained this week that the pending insolvency would be real bad for politics and that's something they understand, so they have let Paulson engage.

It's all too little, but not too late IF the Fed cuts because a deal has been put in. With no fed cuts of magnitude, the engagement from Treasury won't work because net interest margin won't spring back and the losses will overwhelm the system.

I am betting that if, to belabor the NFL analogy, the owners went to the commissioner and said "we are all going to be bankrupt if you don't give us the concessions stands and t.v. rights and put a cap on players salaries," you will get results.

And that looks like what happened this week.

Welcome Fed and Treasury. Nice to see that you want to help instead of hinder the process with bizarre and unfathomable indifference.

-

Saksamaa DAX +1.43%

Prantsusmaa CAC 40 +1.37%

Inglismaa FTSE 100 +0.92%

Hispaania IBEX +0.61%

Venemaa MICEX +1.50%

Poola WIG +1.35%

Aasia turud:

Jaapani Nikkei 225 +1.08%

Hong Kongi Hang Seng +0.57%

Hiina Shanghai A (kodumaine) -2.66%

Hiina Shanghai B (välismaine) +3.70%

Lõuna-Korea Kosdaq +0.94%

Tai Set +0.21%

India Sensex +1.89%

Nii kuidas aktsiaturud kukkusid näiliselt pidurdamatult ankruna põhjapoole on nad sealt viimastel päevadel hooga üles tormamas. USA turud on päeva alustamas 1% - 1.2% eilsestest sulgumistasemetest kõrgemalt.

-

Don't Let Politics Interfere With Profits

By Rev Shark

RealMoney.com Contributor

11/30/2007 7:52 AM EST

The chief cause of problems is solutions.

-- Eric Sevareid

After a big jump on Wednesday due to increased confidence the Fed would cut rates and bail us out of our economic mess, we are up again this morning for the same reasons. This time the Big Kahuna himself, Ben Bernanke, has made comments that the Fed is getting ready to slash rates again by as much as 0.5%.

In addition to the very dovish Federal Reserve, the Treasury Secretary is strong arming banks into foregoing any action to deal with defaulting sub-prime mortgages. Even if you aren't appalled by this gross governmental meddling in the free enterprise system you have to wonder if we are simply delaying the Day of Reckoning and making the eventual pain even worse.

Even though there are some serious doubts about whether this government intrusion into the mortgage mess makes business sense, the market's immediate reaction is positive. With the Fed cutting rates and people being allowed to not pay their legal debts, we have an increase in liquidity and that is enough of a band-aid to hold us up and even bring in buyers who want to ride the wave of short-term optimism.

I find the whole idea of the government (and a Republican administration nonetheless!) telling banks how to deal with sub-prime loans sickening, short-sighted and a bad precedent, but our job here isn't to discuss political philosophy. Our job is to try to make some money and the market is having a positive reason to the news this morning. The question we have to ponder is whether this news is going to give us some legs into the Fed meeting that is scheduled for Dec. 11.

Back in August we ran hot and heavy into, and out of, the Fed meeting as the market seized on the belief that the Fed cut was the salve the market needed. For a while the market seemed to have lost confidence that the Fed could solve all our problems, but in the last few days belief in the Fed as our savior seems to have been restored.

Although it is very easy to question whether the Fed and meddling government can solve our problems the market seems to react very positively to the idea. Trying to fight the momentum that results is not the way to make money even if you think the market is dead wrong for reacting in that way. The market was stretched enough to the downside that a bounce can go for a while longer.

We'll likely see more downside pressure at some point in the future when it becomes clear that our problems haven't gone away, but for now the bulls are excited and the traders are anxious to chase stocks higher. Don't underestimate the power of the bounce.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: SEAC +20.9%, JCG +11.7%, OVTI +6.7%, PRLS +6.1%, TIF +3.2%, ANDE +2.8%, LTRE +1.5%, ZUMZ +1.3% (also upgraded to Positive at Susquehanna)... Financial/Mortgage sectors seeing strength after WSJ reports that banks are near agreement to temporarily freeze interest rates on certain subprime home loans: CFC +12.9%, MBI +9.0%, ABK +8.9%, FRE +6.7%, MTG +6.5%, WM +5.6%, FNM +5.3%, CIT +5.0%, WFC +3.6%, MER +3.2% (also WSJ reports CFO of NYX in advanced talks to take key position at MER), GS +3.0%, UBS +2.5%, C +2.2%... Homebuilders seeing strength on rate cut expectations/positive mortgage news: PHM +8.1%, HOV +7.3%, RYL +7.0%, SPF +5.2%, TOL +4.3%, BZH +4.1%, CTX +4.0%... Solar stocks seeing strength, House vote on energy bill is next week (12/5) which could have positive implications for group: SOLF +10.6% (continued momentum after yesterday's rally on earnings), LDK +6.5% (also announces its polysilicon plant construction on schedule and has secured additional 312 metric tons in polysilicon supplies for 2008), TSL +4.6%, SPWR +2.1%, FSLR +2.0% (also initiated with Hold at Soleil)... Other news: STEM +10.5% (announces first patient to receive transplant of HuCNS-SC cells in phase I clinical trial), JRJC +10.1% (still checking), ETFC +5.8% (trading higher despite analyst downgrade; mixed comments from other analysts), ALO +5.7% (announces positive results from phase III trial for its opioid), AU +5.3% (still checking), CRXL +5.1% (presents Indian phase I rabies antibodies cocktail study with positive results enabling progress towards phase II studies), BIDZ +4.9% (hearing ThinkEquity defending BIDZ), AAUK +4.9% (still checking), VMW +2.9% (CSCO discloses unchanged 6 mln share stake in SC 13D/A), PBY +2.4% (5 directors bought 99k shares in filings disclosed after close), GOOG +1.9% (WSJ reports GOOG plans to announce bid for wireless spectrum), HPQ +1.8% (hearing added to Conviction Buy list at tier-1 firm), ABT +1.6% (FDA advisory committee recommends approval of Xience), FCX +1.4% (Cramer makes bullish comments on MadMoney)... Analyst upgrades: LGF +8.2% (upgraded to Strong Buy at Wedbush), VSEA +3.0% (upgraded to Overweight at Thomas Weisel), FCEL +2.9% (initiated with Overweight at JPMorgan), FFIV +2.6% (upgraded to Outperform at BMO Capital), VLO +1.2% (upgraded to Buy at BofA).

Allapoole avanevad:

In reaction to weak earnings/guidance: DELL -9.4% (also tgt cut to $40 at Bear Sterns), BIG -4.8%, MENT -4.7%, ESEA -2.2%... Other news: FRPT -9.0% (Friedman Billings says reports from last night indicate U.S. Marine Corps may scale back its M.R.A.P requirements which would negativly impact FRPT), COMS -8.4% (Washington Times reports COMS merger with Chinese co may threaten national security), KMP -2.1% (files for 5.2 mln share common unit secondary offering)... Analyst downgrades: MOGN -6.0% , CMC -1.3%. -

Sulgesime just LHV Pro all Global Healthcare Sectori (IXJ) investeerimisidee $61.72 pealt. $63-lise sihini küll pisut maad veel, kuid arvestades, et siht oli seatud 12 kuud silmas pidades, on mõistlik hetkel pärast 4 kuud väljuda ja ca +8.4% kasumit võtta.

-

huvitav info, et ESEA alla avaneb. juba eelturul käis möll ja avanes korraliku gapiga üles.

-

See ESEA -2,2% oli eile ka järelturul...

-

ESEA hetkel 4.17% plussis. Konverentsikõnet vahendab briefing ja ütleb järgmist: On Q3 call, co says there is some nervousness in dry bulk mkt partly due to rates being at all time highs; however, co still sees favorable dry bulk outlook for '08.

DRYSon üle 7% plussis. -

Ehitussektori liikumist tervikuna kajastab selline sümbol nagu XHB - täna tublis plussis pärast Oliveri poolt pisut üleval pool mainitud valitsuse plaani laenajatele appi tõtata. Kõnealuse plaani detailid peaksid eelduste kohaselt välja tulema järgmise nädala jooksul. Kui kõik ka nii läheb, siis võiks selline plaan ehitussektorile jõudu veelgi juurde anda. Tasub radaril hoida.

-

Motorola suurinvestori Icahni kommentaar tänasele CEO Ed Zanderi lahkumisele:

"I believe that the replacement of Ed Zander as CEO is a positive step for Motorola, but that the action of the Board was long past due. As I said at Motorola's shareholder's meeting last year, although I like Ed Zander personally, I never thought that he was the right man for the job at Motorola. Further, I believe that the steps announced today do not even begin to address the major problems at Motorola. In my opinion, Motorola should be split into separate companies: a mobile devices company; an enterprise mobility company; a connected home company; and a company focused on mobile networks infrastructure. In particular, I believe that the best opportunity for the mobile devices' business to attract top flight management and to prosper and grow is to establish it as a stand alone business." -

härrased paluks abi. üritan traderis hetkel limiithinnaga BIDU-t maha müüa ,aga lööb ette kirja et orderit ei saa täita enne esmaspäeva kella üheksat.?milles probleem võib olla

-

lööb ette sellise kirja "your order will not be placed at the exchange until 2007-12-03 09;30;00 US/Eastern

-

ok..linnuke kauplemisaja välisel kohal kuidagi teiseks läinud.nyyd asi korras

-

Silicon Valley / San Jose Business Journal (Friday, November 30, 2007)

Most Viewed Stories, teisel kohal:

Estonian prime minister opens San Jose trade office