Börsipäev 5. detsember - avasime Pro all uue idee

Kommentaari jätmiseks loo konto või logi sisse

-

OPEC jättis tänasel kohtumisel toodangumahud suurendamata, mille peale nafta hind alguses ka ülespoole reageeris. Kuigi hinnad ehk lubaksid isegi toodanug suurendamist, kardetakse, et jahenev USA majandus võib järsult nõudlust nafta järele vähendada, mistõttu ei taheta toodangu suurendamisega kiirustada.

-

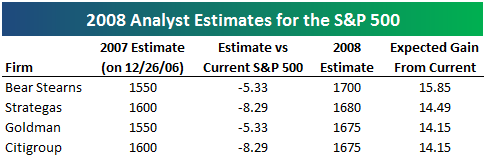

Mõnede analüüsimajade nägemused S&P 500 järgmise aasta käitumise osas + eelmise aasta prognoosid.

-

Bill Gross on ka varem 3.5-3%lisi intressimäärasid pikas perspektiivis välja pakkunud, kuid täna on ta CNBC peal rääkides 3%lisi määrasid praegu lausa 'mõistlikeks' pidamas. Rohkem vett võimsa (50bp) intressimäära kärpimise veskile 11. detsembril?

-

mis jutud IDCC kohta turul liiguvad?

-

Seoses Samsungi ja IDCC kohtuotsusega:

Broadpoint notes that late yesterday, the U.S. District Judge in New York issued his final ruling in the pending 2G/2.5G case between Samsung and IDCC. The Judge confirmed the second arbitration panel's award of $134 mlnfor 2G/2.5G units sold from 2002 to 2005, and confirmed that IDCC is entitled to receive royalty payments for 2G/2.5G handsets sold by Samsung in 2006 based on the rates set by the arbitration panel, plus annual interest of 5% on the amount due. All in, firm calculates the final amount at $185-$190 mln. Firm says with three legal losses, Samsung is running out of options and will have to pay; and firm does not rule out the possibility of Samsung entering into a comprehensive 2G/3G deal with IDCC before the I.T.C. hearings begin in April 2008. -

Aasia ja Euroopa rohetasid päris kenasti:

Saksamaa DAX +1.31%

Prantsusmaa CAC 40 +1.63%

Inglismaa FTSE 100 +1.74%

Hispaania IBEX +0.59%

Venemaa MICEX +2.65%

Poola WIG +2.68%

Aasia turud:

Jaapani Nikkei 225 +0.83%

Hong Kongi Hang Seng +1.61%

Hiina Shanghai A (kodumaine) +2.58%

Hiina Shanghai B (välismaine) +2.27%

Lõuna-Korea Kosdaq +0.32%

Tai Set +0.33%

India Sensex +1.07%

-

see on hea, arvati juba, et jääb järgmise aasta algusesse

IDCC sõjakäikude trackrecord on hea

sarnane case on sees praegu ka Nokia vastu, mõlemad juhtumid alles hiljuti ühendati,

seega peaks siit peagi lisa tulema -

Be Patient and Get Ready for Gains

By Rev Shark

RealMoney.com Contributor

12/5/2007 8:18 AM EST

I run on the road long before I dance under the lights.

-- Muhammad Ali

Success in the stock market is a product of patiently contending with the drudgery of action like we have seen the last couple days while we wait for good opportunities to arise. Too many market participants are overly anxious for great trades, and they rush for glory before the time is right.

Profits in the market tend to come in spurts as market conditions slowly align. Unfortunately, many investors look for consistent and uniform gains day after day and as a result have no patience when the market struggles. They quickly turn negative and start to feel like thing will never improve again. They give up because they are impatient.

One of the reasons that smart investors can profit from the stock market is that human traits so often mislead people and create the conditions for opportunity. When we have a few poor days, like we have had so far this week, people tend to become more negative and less inclined to look for a bounce. They want immediately results, and when they don't see them, they become discouraged and start to act as though they will never see a shift in the current trend.

The patient investor who bides his time as emotions ebb and flow can profit greatly is he does his preparation and puts in the time needed for things to set up. The glory of great trades demands patience and drudgery as well as the ability to stay calm and objective while those around you are increasingly emotional.

The market is in one of those periods now where we have to do our roadwork and get ready for the opportunities that are going to come when the Fed interest rate decision approaches. No one knows for sure how things will play out, but we do know that the likelihood is that there will be volatility and an opportunity to make money if we approach things in the right way.

Prepare yourself mentally and emotionally now, and don't let the drudgery of this poor market affect you. Better opportunities are developing -- we just need to be ready.

We have a positive start this morning as overseas markets perked up on increased hope that solutions to the subprime issue will be found. Gold and oil are up and the news flow is generally positive.

---------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PSS +14.0% (also upgraded to Above Average at Caris), VSNT +11.3%, SOHU +7.0%, GES +6.9% , CTV +4.5% (raises Q4 2007 guidance), WDC +4.5%, DSW +4.0%... Other news: ADLR +20.0% (announces exclusive contract with PFE for 2 new pain compounds), CPST +13.0% (New York city mayor announces standard for use and installation of microturbine technology), UXG +9.5% (announces Bill Pass, Vice President and CFO, is retiring), SNTA +6.3% (receives $80 mln upfront payment from GSK), IDCC +5.9% (Broadpoint thinks win at Samsung removes major overhang), KSU +2.7% (will be added to S&P MidCap 400), NSTK +2.6% (enters into feasibility study with undisclosed global leader in production of plasma products), MT +2.6% (gains 2.4% oversea trading after CEO comments on steel demand), CY +2.1% (Cramer makes positive comments on MadMoney), HOKU +2.0% (still checking), BFAM +2.0% (initiated with neutral and $40 tgt at BofA).

Allapoole avanevad:

In reaction to weak earnings/guidance: PLAB -10.2%, CMCSA -7.9% (cuts year outlook, also hearing downgraded at tier-1 firm), CHS -7.8%, WIND -3.0%, CPRT -2.8%, CPRT -2.8%, CMCSK -2.4% (cuts year outlook, also hearing downgraded at tier-1 firm), AVAV -1.0%... Other news: TOPT -21.3% (prices 21 mln share offering at $3), NOVL -5.7% (postpones earnings release), CSIQ -2.2% (prices $75 mln convertible senior notes), MDT -1.1% (discloses in 10-Q it received letter from US attorney requesting documents relating to co's relation with one of its customers)... Analyst downgrades: NTRS -2.1% (downgraded to Neutral at Merrill), AZ -1.2% (downgraded to Neutral at Merrill). -

LHV Pro all avasime uue idee, mis on küll kõrge riski, kuid loodetavasti ka kõrge tootlusega. Ettevõtte nimi on Vital Images (VTAL) ja oleme põgusalt sellest ka varem kirjutanud.

Lähemalt juba seal...

-

Bushi plaanist külmutada muutuvate määradega hüpoteeklaenude intressid, et laenuvõtjate maksed ei tõuseks ja nad selle tulemusena kodust ilma ei jääks, on varem räägitud, kuid täpsemat kinnitust pole see leidnud. Reuters teab aga rääkida, et Bush võtab homme sellel teemal sõna, avalikustades ka tegevusplaani.

-

Tehnoloogiasektori tervise, kui nii võib öelda, hindamiseks võiks jälgida Baidud (BIDU) - aktsia on teinud 8 järjestikust tõusupäeva ning eilne päeva lõpu kukkumine näitas, et üldine närvilisus on üpris suur ja paljudel näpp 'müü' orderi peal valmis.

-

MBI teeb Bloombergi pealkirjade peale seoses Moody kommentaaridega kapitali võimalikust puudujäägist läbi koleda kukkumise ning ka turg liigub allapoole.

-

Oil will hit $100 a barrel within 6 months, Boone Pickens says

-

Oskab keegi öelda,miks PBG on täna kõvasti kukkunud.

-

Goldman Sachs alandas PBG reitingut. Artikkel Y!F-i vahendusel siin.

-

Homme kuuleme siis kinnisvara mõtetest Paulsoni nägemuse läbi:

US Treasury says Paulson to hold news conf on mortgage proposal at 1:45 PM on Thursday