Börsipäev 7. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Täna kell 15:30 on oodata USA tööjõuturu raportit. Eile mõjus majadeehitajatele ja kogu turule hästi Bushi administratsiooni ja finantsinstitutsioonide koostöös valminud plaan, mida Deutsche Bank kommenteerib järgmiselt:

* Banks/brokers told us that every little bit helps, at least if this is one of several potential government steps that improves confidence. For mortgage related securities,the question is whether less interest income is offset by more confidence in getting principal (ABX was up slightly for the day). Yet, DB's Global Securitization Group (headed by Karen Weaver) believes that the impact is only marginally beneficial and that under 1/3rd of subprime borrowers will be impacted by a rate extension.

Täna on futuurid päeva alustamas kergelt negatiivsel toonil, kuid täpsema suuna annab tööjõutururaport. -

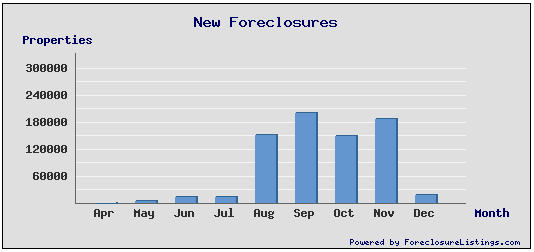

Ei mäletagi, kas enneaegselt omanikelt panga poolt ära võetud majade graafikut on siia varem pandud, aga minu teada vähemasti viimasel ajal mitte. Parandame vea - novembris suleti kokkuvõttes rohkem maju kui augustis või oktoobris ehk suure tõenäosusega ei olnud september foreclosure'ite tipp. Ja iseenesest ka ju loogiline, sest ega siis muidu Bush niisama appi ei tuleks, kui asjad juba paremuse poole läheksid.

-

Bill Gross räägib Bloombergis, et Föderaalreserv jätkab intressimäärade kiiret alandamist ning võimalik, et aja jooksul kukub see isegi alla 3%. Juttu tuleb ka diskontomäärast (intress, millega on võimalik pankadel Kommertspankadelt laenata) ning hetkel on see baasintressimäärast pool protsendipunkti kõrgemal. Gross usub, et 11. detsembri miitingul langetab Föderaalreserv seda rohkem kui baasintressimäära - loodetavasti 50 bipslit. Diskontomäära suurem alandamine aitaks kaasa LIBOR (London Inter-Bank Offer Rate)-määrade allatoomisele.

-

Average Workweek 33.8 vs 33.8 consensus

Unemployment Rate 4.7% vs 4.8% consensus

Nonfarm Payrolls 94K vs 70K consensus, prior revised to 170K from 166K

Hourly Earnings 0.5% vs. +0.3% consensus -Update-

Erasektoris vähenes oktoobriga võrreldes töökohtade juurdeloomine 130 000 pealt 64 000 peale ja teenuste sektoris 190 000 pealt 127 000le. Oluliselt halvenesid ehitussektor -5 000 pealt -24 000le ning finantssektor +2 000 pealt -20 000 peale. Halvenemise peatumist, kui nii võib öelda, näidati kestvuskaupade osas, kus eelmine kuu kaotati -12 000 töökohta, siis seekord -1 000 ning tootmises, kus eelmine kord kaotati -21 000 töökohta ning sedapuhku -11 000.

Turgudele tundub oodatust pisut parem tööjõuraport meeldivat, indeksid reageerivad üles... -

What the Jobs Report Means

By Rev Shark

RealMoney.com Contributor

12/7/2007 8:16 AM EST

"It's not a bailout."

-- Hillary Clinton

I'm not sure what you call it when government forces private business to give money to people who don't pay their bill, but the market liked the idea yesterday. Whether it continues to embrace this convenient excuse for political posturing we will have to wait and see.

The focus of the market is going to remain on government intervention in the next few days as it contemplates whether the Fed is going to cut rates again next Tuesday. A cut is a certainty with the real issue is whether it will be a quarter or a half point. The jobs report, due out at 8:30 a.m. EST this morning, is widely believed to be a key factor in determining what the Fed will do. A weak report is seen as locking in the likelihood of a half point cut.

The question for us to ponder is whether all this government help is going to keep the bounce of the last two days going. Back in September the interest rate cut boosted the market much more than many expected. Those who were looking for a "sell the news" reaction when the news hit were caught by surprised as the market continued to rally for weeks afterward.

Subsequently the market seems to have lost its confidence in the Fed's ability to fix our economic woes through rate cuts but the action of the last two days has shown renewed optimism over the ability of the government to help fix our faltering economy.

In addition to the positive feelings about governmental help, the market has end of the year seasonality helping us out. With just 16 trading days left in 2007 many investment managers are anxious to tack on some additional returns and the way to do that is to be aggressive buying stocks that move fast. As a consequence there is probably a greater tendency to chase strength as the year winds down and that can keep things going.

So the dilemma we face as we head into the big interest rate decision next Tuesday afternoon is whether a big run up into the news will give us a sell the news reaction. The jobs report this morning is seen as determining the size of the cut so it also has the potential to be a catalyst for a sell the news reaction.

My feeling is that because of seasonal pressures, there is likely to be some folks anxious to buy a dip created by this reaction. If we do pull back I am looking for the buyers to come in fairly fast and keep us running. We are a bit extended technically at this point, which may keep the upside capped for a bit but it's the underlying support that is key right now and I believe we will see some should we pull back on the news.

However this plays out we should see some good trading for those who are willing to move fast.

We have slightly negative action in the early going as we await the jobs news. Overseas markets were higher in sympathy with the strong US close yesterday. News wires are quiet. Oil is steady and gold down.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PZZA +19.8%, LQDT +9.4%, GOT +8.3%, ICOC +7.1%, ACTL +6.1%, SON +6.0%, OPTM +3.8%, SNPS +3.8% (also upgraded to Buy at Deutsche Bank), LGTY +1.6%... Other news: TIN +3.7% (declares a special cash dividend of $10.25 per common share), ALU +3.2% (still checking), SGR +2.8% (tgt raised to $90 at Stifel and Cramer makes positive comments on MadMoney), UIS +2.5% (Idaho awards Unisys seven-year medicaid contract), GEOY +2.5% (Cramer makes positive comments on MadMoney and says co gave launch date for third satellite), OCNF +2.2% (recovering from sell off after announcing yesterday CEO and CFO has left the co; hearing stock was upgraded this morning), AAUK +2.1% (Anglo, Xstrata shares surge on speculation of takeover offer - Bloomberg.com)

Allapoole avanevad:

In reaction to weak earnings/guidance: SWHC -22.4% (also multiple analyst downgrades), PALM -16.5% (also tgts lowered at Lehman and Piper Jaffray), HRLY -8.2%, GIL -7.8%, GMTN -7.1%, EXFO -5.5%, CAE -4.1%, SORC -2.4%, FIZZ -1.6%, ORCC -1.4%, NSM -1.3%, HSC -1.2%, SIRO -1.1%... Other news: GUID -4.4% (CEO John Colbert resigns and Victor Limongelli appointed CEO), ACTG -4.3% (announced that its Telematics Corporation subsidiary has settled litigation against @Road, enter license agreement with S), TVL -4.3% (concludes its review of strategic alternatives), PENX -4.3% (prices a 2 mln share offering at $25/share), TRBN -3.2% (announces upcoming presentation and TRU-016 data), SURW -3.2% (reaches definitive agreement to acquire Everest Broadband), GFI -2.7% (still checking), FRP -2.5% (reached an agreement on a variety of operational issues relating to its proposed acquisition of VZ's landline network), EXAR -2.4% (announces CEO and President resignation), BTU -2.4% (Cramer makes negative comments on MadMoney), APOL -2.2% (Ex-Apollo Finance Chief says co withheld education report in 2004- Bloomberg), TWPG -2.1% (discloses in 8-k the discontinuation of its Discovery Research coverage of U.S. equities), AMGN -2.1% (in discussions with FDA to update U.S. prescribing information for ESAs), TRGL -2.0% (provides update on Black Sea operations) -

Saksamaa DAX +0.61%

Prantsusmaa CAC 40 +1.22%

Inglismaa FTSE 100 +1.13%

Hispaania IBEX +0.88%

Venemaa MICEX +1.13%

Poola WIG +0.44%

Aasia turud:

Jaapani Nikkei 225 +0.52%

Hong Kongi Hang Seng -2.42%

Hiina Shanghai A (kodumaine) +1.12%

Hiina Shanghai B (välismaine) +1.47%

Lõuna-Korea Kosdaq -0.52%

Tai Set -0.63%

India Sensex +0.86%

Euroopa on terve päeva tugevust näidanud ning ka USA avaneb tööjõuraporti järel (taas) ülevaltpoolt. +3.7% tõusu 2 börsipäeva ja tänase eelturuga.. kas pole juba pisut palju nii lühikese aja kohta?

-

FMD:

"Due to uneconomic terms in the current capital markets, we have elected not to securitize private student loans this quarter. We are exploring non-securitization and securitization alternatives for future quarters to enhance our business model and provide long-term capacity to the private student loan market in a manner that benefits our shareholders. Our business volumes remain strong and we see many opportunities to facilitate and process private student loans," said Jack Kopnisky, Chief Executive Officer and President of The First Marblehead Corporation. "Our Board of Directors determined it was prudent to continue to return capital to our shareholders this quarter even during these challenging times."

"With regard to the current credit environment, First Marblehead continues to monitor closely the performance of the portfolio," added Kopnisky. "The credit quality of the overall portfolio remains strong with average FICO scores in excess of 700. Steps have been taken to tighten underwriting criteria related to lower credit tiers. The collection and recovery processes are being modified, including reaching out earlier to borrowers, and to co-borrowers who frequently have higher credit scores than borrowers. These new processes are being implemented and the results are not yet reflected in the performance of the portfolio. We remain focused on providing long term value to our shareholders, our clients, and students."

kelgule kelgule

ma arvan, et paljudel on täna sitt püksis -

Kas keegi oskab lihtsalt selgitada, mida FMD asi täpselt tähendab?

-

Tarantel, ma pole küll selle ettevõttega tuttav, kuid ma saan praegu aru, et ettevõte ei suuda oma laenuportfelli väärtpaberistada ning on sunnitud ka dividende üle 50% vähendama. Mitte just parimad uudised ühele ettevõttele.

-

Michigan Sentiment-prelim 74.5 vs 75.0 consensus - madalaim näitaja alates 2005. aasta oktoobrist.

-

SIX on viimastel pävadel tugevalt üles roninud. Võtab keegi kommenteerida?

-

Kui tahad investeerida finantssektorisse, siis pead uskuma imedesse!

Securitization turg on surnud, sest investorid on kaotanud usalduse skeemi vastu. Ma ei tea, kuidas on FMD vahendatud laenudega, kuid üldiselt on investoritele tagumiku kaudu kohale jõudnud, et reitinguagentuuride poolt pandud reitingutel ei ole tegelikkusega midagi pistmist. See turg ei taastu kunagi kuna see töötas püramiidskeemi põhimõttel. -

Võibla keegi tõlgiks, mis oli selle HillaryClintoni point - "It's not a bailout."

-

long FMD, näpuotsaga ja naljapärast.

Tundub mulle suht tugev ja pigem konservatiivne firma. Laene vahendatakse ikkagi ülikooli minevale seltskonnale, mitte Alabama porchmonkeydele. Pluss ise ei võta FMD eriti mingit riski ja kulusid on ilmselt võimalik ka kergemini kärpida, kui mujal finantssektoris (viimane väide vaieldav, muidugi).

Neg külg on muidugi see, et FICO skoorid ei pruugi täna enam nii usaldusväärsed näitajad olla. Aga eks neil ole ka muid indikaatoreid, mille järgi laenajaid reastada.

nagu öeldud, võtsin tõesti vaid näpuotsaga ja olen valmis allpool juurde võtma.

sB -

Ahjaa, keskmine hind on 16.08

-

Ma arvan, et tõestama pole mõtet hakata. Kui keegi näeb ühes või teises suunas võimalusi, siis tehke vaikselt ära.

-

martk

äkki viitsid lähemalt lahti kirjutada mis moodi on tegu püramiidskeemiga? -

nextphase'i kommentaarid on väga tervitatud

tahaks natuke rohkem asjalikku inputi siia FMD kohta

Joel,

FMD ei oma ise laenuportfelle vaid vahendab neid, neil on ka oma laenutoode turule toodud, kuid selle osakaal alles mingi 10-15%

kas vanad LHV arhiivid on ka kuskil veel üleval ? -

Speedy, mis arhiivid? LHV ei ole FMD katmisega kunagi tegelenud minu arust (peale paari artikli, mis kirjutanud oleme) ja selle pärast ma ei kommenteeri ka seda firmat väga. Nextphase oleks võinud ka oma "naljapärast" asja natukene lahti seletada rohkem, sest ülaltoodud lõigu oleks võinud ka kirjutada $10 taala kõrgemalt ning see oleks väga tõsiseltvõetavalt kõlanud : )

Mõninga positiivse noodi võis sellest eelpool toodud inglisekeelsest lõigust välja lugeda, kuid kui suur reageering sellele on ülemäärane? 8%, 10%, 5% ? Tegelik põhjus tradel oli ülemüüdus ning langus mõnes mõttes vanade uudiste peale?

Aga üldiselt on sellised mõtteavaldused teretulnud, Nextphase. -

Kui ühte laenu või võlga müüakse erinevate moodsate nimede all 5 korda(võib-olla ka 3x) edasi,siis see ongi püramiidskeem. -

Henno,

Ameeriklastel oli kombeks finantseerida vanu laene uute laenudega. Nii kaua, kui varade hinnad tõusid skeem töötas. -

Citygroup (C) 42,50 jan 08 optsiooni (CAV) hind inv.portfellis 10.00, mis on kindlasti vale praeguse C aktsiahinna juures (34,25).

-

Hetkel väike probleem selle konkreetse optsiooni hindade kuvamisega. Tegelik hind hetkel 0.12. Loodame lähiajal probleemi lahendada.

Vabandame ebameeldivuste pärast. -

Erinevate instrumentide ühte suurde potti kokkukogumine ja väärtpaberistamine (Securitization) on minu arvates täitsa hea idee! See võimaldab luua uusi tooteid kauplemiseks. Küll on aga hetkel veel probleemiks vastavate tooteportfellide n.ö. õiglasele väärtusele tõsiseltvõetavate hinnangute andmine.

-

kas mitte (vähemalt traderi portfelli ) optsioonidel ainult kord päevas hinda ei uuendata veebis?

Nii vähe kui vaadanud olen on tavaliselt suht mööda hind -

ma mõtlen eelmise meeskonna arhiive, minu mäletamist mööda oli küll

tahaks lihtsalt FMD ärimudeli kohta eestikeelset lahtiseletust veelkord lugeda

inglisekeelseid foorumeid ja artikleid lugemiseks on küllalt, kuid pean tunnistama, et mõningatest detailidest arusaamine käib üle jõu -

speedy conzales

Ehk leiad siit midagi: Kas Marblehead (FMD) vahetab kurssi? ja CompuCredit (CCRT) ja First Marblehead (FMD) -

need on ka ok

aga mitte väga põhjalikud -

Briefingust väike lõik FMD kohta FBRilt:

First Marblehead: Announcement to cut its dividend and delay its securitization is not entirely unexpected - FBR (16.86 -1.10)

FBR says that FMD's announcement to cut its dividend and delay its securitization is not entirely unexpected. However, even when credit spreads improve in the future, they believe FMD's economics will be significantly lower, as concerns regarding credit and trust performance will likely dictate higher collateral levels and less upfront cash fees for the company. Furthermore, they say the inability to securitize these loans brings into question the vulnerability of the co's customer base that may look to alternate providers or simply keep these loans on the balance sheet. Possible plans by FMD to put the loans on its own balance sheet will require dilutive capital and depress the economics further, in their opinion. -

SWHC tänane kukkumine 28% paneb mõtlema, kas ameeriklased enam püsse ei armastagi.

-

FBR - Snowling ?

tema viimase downgrade'i target oli $26

;)) -

FMD

Minumeelest kaeti seda firmat ühel teisel interneti aadressil, millel praegu üksainus lausejupike ripub. ;) -

stocker, nii see vist oli tõesti

my bad