Börsipäev 10. detsember

Kommentaari jätmiseks loo konto või logi sisse

-

Krediidikriisi loodud trend ... lääne pangad Lähis ja Kaug-Ida investorite kätte

Swiss bank UBS unveiled $10 billion in shock subprime writedowns on Monday and said it had obtained an emergency capital injection from a Singapore government entity and an unnamed Middle East investor.

UBS, which has been severely battered by the U.S. subprime mortgage meltdown, issued a profit warning and cancelled plans for a cash dividend in moves expected to batter the stock and the banking sector as a whole.

The $10 billion charge was one of the largest writedowns by any global bank since the subprime crisis broke and was the latest sign of the devastation that the meltdown has brought to some of the world's largest financial institutions.

The announcement sent UBS's shares tumbling as investors took fright from the anticipated dilution of their share of earnings.

"The level of dilution is very significant," said Omar Fall, an analyst at ABN AMRO in London.

The Singapore investment, which gives the Asian island-state a 9 percent stake in UBS, was the latest case of a rescue of a top western bank by a sovereign wealth fund, after the Abu Dhabi Investment Authority bought a $7.5 billion stake in Citigroup.

"It's a developing trend. Asian and Middle Eastern sovereign investors are cash rich and have a longer time horizon than the average market investor," said Fall. -

Finantsinstitutsioonides energia hindu üles bidinud commodity deskid pumpasid niimoodi lisaraha energiariikide kukrutesse ja iga tõusva naftadollariga (kombineerituna koos halbade otsustega laenudivisjonides muidugi) müüdi tükike enda ettevõttest maha. Ironic?

-

Omaan, Abu-Dhabi jt. - Suckers' rally.

-

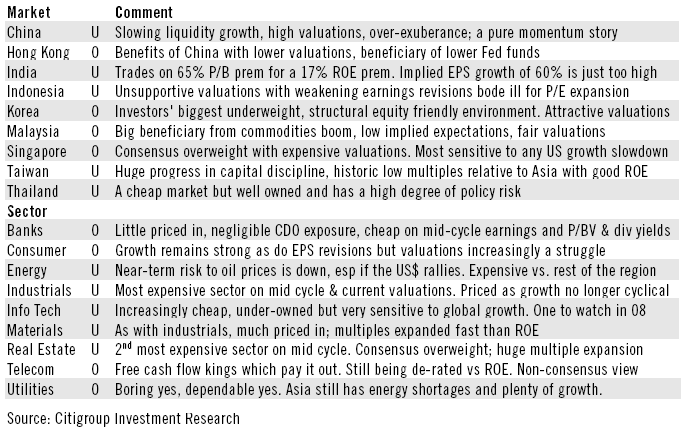

Järgmine aasta on ukse ees ja analüüsimajad avaldavad oma 2008. aasta eri regioonide strateegiaid. Ühe sellise mammutteose on valmis meisterdanud ka Citi, kus analüüsitakse Aasiat. Lühidalt iseloomustatakse regiooni kui suurepärast kasvulugu, mis praegusel hetkel on 20-25% üle hinnatud. Oodatakse MSCI Aasia (ex-Jaapan) kukkumist 480-510 punktini, kuid samas viidatakse selliste languste harvadele esinemistele. Viimase 17 aasta jooksul on nii suuri kukkumisi ette tulnud ainult kahel korral. Siiski ei viita Citi karuturule, vaid ootab ainult korrektsiooni. Kõik head uudised on hindadesse sisse arvestatud, kuid riske ignoreeritakse. Selle põhjuseks on toodud de-coupling, kuid see ei toimu ühe ega paari aastaga, vaid aastakümnetega

Kõige haavatavamate turgudena tuuakse välja Hiinat, Indiat ja Singapuri ning nõrkust oodatakse tööstus- ja kinnisvarasektoris. Eemale tuleks hoiduda momo aktsiatest ning eelistada suuri ja tugeva rahavooga ettevõtteid. Kes Aasiasse edasi soovivad investeerida, võiksid seda teha Hong Kongi, Korea, Malaisia ja Taivani turgudel, kus toetust pakuvad madalad ootused ja mõistlikud valuatsioonid. Korea ja Malaisia on konsensuse poolt hetkel vähim soositud turud, mis võiks olla tugevaks argumendiks kasvu toetuseks tulevikus.

Ära on toodud ka kokkovõttev tabel, kus riikide ja sektorite kohta lühike kommentaar. O ja U tähistavad siis vastavalt Overwighti või Underweighti.

-

Morgan Stanley arvates on muutuvate määradega laenude intresside külmutamisest vähe abi. Laenukahjud peaksid programmi tulemusena vähenema $2-9 miljardit, mis moodustab ainult 1-5% oodatavast kogukahjust. NIMi suurenemist ei oodata enne 2008. aasta teist poolt, samuti kauplevad pangad tunduvalt kõrgematel suhtarvudel võrreldes 1990. aastaga.

Seega jääb Morgan Stanley pankade suhtes pessimistlikuks ning 2008. aastast oodatakse kasumite edasist nõrkust. Ollakse ettevaatlikud suurte pankade suhtes ja soovitatakse müüa aktsiaid, mis uudise valguses viimasel ajal tõusnud on, eraldi tuuakse välja C ja NCC. Lisaks hüpoteeklaenudele satuvad surve alla krediitkaardid ja autolaenud. -

Ning et jutt lihtsalt ümmarguseks ei jää, panen siia börsil kaubeldavate fondide sümbolid regioonide kohta, mida Citigroup 2008. aastal omaks. Loomulikult on neid võimalik ka LHV vahendusel osta.

EWY - Lõuna Korea

EWS - Singapur

EWM - Malaisia

EWH - Hong Kong -

Ma ei oskagi enam öelda, kumba rohkem turul oodatakse - kas seda, et täna enne Fedi mingeid olulisi liikumisi tulemas ei ole või et pärast Fedi otsust turud üles hüppavad... Complacency

-

RTS kaupleb teist päeva uutel rekorditel, peamiseks põhjuseks "poliitiline selginemine". Tugevust eeldatakse aasta lõpuni ja loodetavasti suudab uue tipu teha ka Sberbank, millel veel 3% jagu tõusta oleks vaja.

-

Üks võimsamaid tõusjaid Venemaa - selle kohta pani ka Madis siia juba graafiku.

Saksamaa DAX +0.22%

Prantsusmaa CAC 40 +0.10%

Inglismaa FTSE 100 -0.11%

Hispaania IBEX +0.06%

Venemaa MICEX +1.78%

Poola WIG +0.52%

Aasia turud:

Jaapani Nikkei 225 -0.20%

Hong Kongi Hang Seng -1.18%

Hiina Shanghai A (kodumaine) +1.38%

Hiina Shanghai B (välismaine) +0.74%

Lõuna-Korea Kosdaq -1.13%

Tai Set N/A (börs suletud)

India Sensex -0.18%

USA on päeva alustamas plusspoolelt - ca +0.2% jagu.

-

Be Skeptical About the Long Term

By Rev Shark

RealMoney.com Contributor

12/10/2007 7:51 AM EST

The first proof of a person's incapacity to achieve, is their endeavoring to fix the stigma of failure on others.

-- B. R. Hayden

Concerns about a looming recession and continued fallout from the subprime mortgage mess are in the headlines every day lately. The popular press is downright gloomy as it discusses the problems and gives us plenty of anecdotal evidence of how bad things really are. Nonetheless, the market continues to hold up as it looks to governmental efforts to find some ways to fix the problems.

Last week, a "bailout" program from borrowers who fall within a narrow set of parameters was announced and helped to bolster the market mood. This week, the market is looking toward the Federal Open Market Committee's interest rate decision on Tuesday afternoon to further brighten the mood and give us more relief from the liquidity squeeze.

The question we need to consider is how long these government efforts to fix economic problems can continue to hold the market up. Many wonder whether any of the actions that are being taken can really fix problems that have a root cause far deeper than the level of interest rates. Freezing and/or cutting rates will only help bail out a fairly small group of troubled loans. Many loans will still need to be digested by the financial system in one way or another, and there is going to be some economic fallout regardless of what remedies are embraced.

Is the market is being overly optimistic about the impact of these governmental efforts, or have we already priced in the problems and a potential recession? Is the worst already fully discounted by the market? That seems like a very questionable proposition.

In the short term we have the Fed decision and positive seasonality into the end of the year to help us out. A lot of big money needs to hold this market up into the end of the year, and, with the help of the Fed, those players are going to do their best to keep things from falling apart. You don't have to be a believer in the health of this market to understand why we may continue to hold up as the year winds down.

The key for the individual investor is to be very hesitant about trusting in the longer-term health of the market at this point. The shorter-term positives can help us overlook some very major problems, but at some point the market is going to pay a price if an economic slowdown is coming, as looks increasingly likely.

Today and tomorrow we are going to be held hostage by the Fed interest rate decision. That is all that matters at the moment. After that, things will get very tricky once again, but seasonality may save us for a few more weeks.

We have positive early indications this morning. Asian markets were mostly lower and Europe was mixed overnight. UBS (UBS) announced a large subprime writedown, but that isn't having much of an impact in the early going.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance/same store sales: FREE +3.0%, MCD +1.4%... M&A news: ARXT +35.7% (announces Reckitt Benckiser will tender for acquisition of ARXT for $60/share in cash), MOGN +20.2% (Eisai to acquire MOGN for $41/share in an all cash transaction), PLTE +6.0% (to be acquired for $23.50 per share)... Other news: GTCB +19.6% (obtains FDA Orphan Drug Designation for Atryn), LDK +15.8% (signs a 10-year wafer supply agreement with Q-Cells), NVAX +13.9% (NVAX and GE Healthcare establish collaboration to develop and market pandemic influenza solution), OSIR +7.9% (receives FDA fast track status for Prochymal as first-line treatment for Acute GvHD), KEG +6.4% (announced that it has acquired the well service assets of Kings Oil Tools, acquired assets will contribute revenue of approximately $36 mln in 2008), SGEN +6.4% (announces positive data from a phase Ia trial of SGN-33), EPCT +4.9% (releases new data demonstrating prolonged five-year leukemia-free survival for AML patients treated with Ceplene + IL-2), PHG +4.5% (Philips shares rise as hedge funds review co - Bloomberg.com), WCI +3.7% (obtains bank covenant waiver extension), NICE +3.4% (CIBC is nudging ests and see the current weakness as a major buying opportunity), MLNM +3.3% (reported complete remission rate of 35% achieved in a Phase 3 front-line multiple myeloma trial with Velcade for injection based therapy), QCCO +2.8% (announces $2.50 special cash dividend through leveraged recapitalization), LZB +2.8% (receives $7.1 mln under U.S. dumping act), UBS +2.5% (gains two new investors, write down $10 bln), CDE +2.0% (approves merger with Bolnisi Gold and Palmarejo).

Allapoole avanevad:

In reaction to weak earnings/guidance: NAVI -4.0%, HIG -3.1%, HAYZ -3.2%... Other news: AMC -41.4% (announces adjusted funds from operations per share guidance is no longer a relevant forecast and is withdrawn; co also cancels dividend), TIN -20.8% (today is ex-dividend date for special $10.25 dividend), HEB -18.6% (intends to terminate license to Esteve for marketing of Ampigen in certain territories), SGMO -4.1% (announces presentation of positive data from its novel cell therapy), CELG -3.5% (announces Phase III Trial results of Revlimid), KOSN -2.8% (announces updated data on Tanespimycin), EXAR -2.6% (resignation of CEO a 'big blow' to turnaround efforts - CIBC), GEOY -1.5% (Harbinger Group lowers stake to 6.3% from 7.6%)... Analyst downgrades: LTRE -4.6% (downgraded to Hold at Stifel), RHT -3.0% (downgraded to Hold at Jefferies), AMGN -2.5% (downgraded to Market Perform at Bernstein, downgraded to Neutral at Merrill), STO -2.0% (downgraded to Hold at Deutsche Securities), VE -1.8% (downgraded to Hold at Brean Murray), VMC -1.1% (initiated with an Sell at UBS). -

Sulgeme VIPi idee, hinnaks $39.5, Pro all mõne minuti pärast lähemalt.

-

Oct. Pending Home Sales MoM 0.6% vs. consensus @ -1.0%

Prior revised to +1.4% vs. +0.2%

Maalib pisut ilusama pildi, kuid siit ei tasuks küll mingeid ennatlikke järeldusi teha. -

Madise kommentaarile selgituseks, et oleme jätkuvalt VIPi investeeringuna soosimas, kuid peale 30-protsendilist tõusu nii lühikese ajaga usume väikest korrektsiooni. Oleme madalamatelt tasemetelt firmat uuesti ostmas ja usume pikaajalist teesi.

-

Tehnopuliidele mõtisklemiseks - QQQQ pluss annab tugevuse osas pisut petliku pildi, arvestades, et AAPL, AMZN, BIDU, YHOO, DELL on punases....

-

Morgan Stanley revises downward U.S. growth outlook and says "mild" economic recession is likely

-

10 kauplemispäevaga SPY +8%... mind paneb küll selle lühiajalises jätkusuutlikkuses kahtlema. But that's just me :)

-

Kuuldavasti on Bofa külmutanud rahaturufondi institutsionaalsetele investoritele, aktsia on selle peale ka alla tulnud ning hea uudis see kindlasti ei ole

-

Ait, ära muretse, küll mingi lähi-ida fond kõik kinni plekib. Ben trükib kiirelt raha kah juurde, kui veel puudu jääb.

-

Küsimusele, kas homse Föderaalreservi otsuse järgsest liikumisest rääkides poleks 'sell the news' reaktsioon liialt labane, annaksin ma kõigepealt lugeda sellist kirjatükki Marcini sulest, mis natukene aega tagasi RM'i all ilmus:

If Ben had Chutzpah...

(by Robert Marcin)

...the Fed would cut 100 bps tomorrow. Part of the problem with the fixed income market seizure has been the Fed's incremental moves. But now that the economy is on the cusp, if not worse, much more aggressive measures are necessary.

If the Fed had a pair, they would cut rates much more than market participants think. Easy Al's 1% Fed funds policy forced investors out on the risk curve. Unfortunately, Uncle Ben needs to do the same. They need not worry about a leverage/stupidity bubble this time. Easing the credit crunch is the best they can do.

Ehk teiste sõnadega ma tahan näidata, et enam ei räägita isegi 25 bipslisest või 50 bipslisest, vaid kohati lausa juba 100 bipslisest langetamisest. Emotional exuberance? Et labane ootus või mitte, aga eks homne tulemus sõltu ikkagi konkreetsest numbrist ja sellega kaasaskäivatest kommentaaridest.