Börsipäev 1. juuli

Kommentaari jätmiseks loo konto või logi sisse

-

Austraalia keskpank otsustas jätta intressimäärad puutumata.

Austraalia keskpank põhjendas tehtud otsust sellega, et viimase 12 aasta kõrgeimad laenukulud ja rekordilised naftahinnad aeglustavad majandust. Juhtkonna hinnangul on sel aastal oodata nõudluse kasvu. Olgugi, et inflatsiooni väljavaated on murettekitavad.

Glenn Stevens (Austraalia kuberner) jättis määrad muutmata neljandat kuud järjest, sest langevad aktsiaturud, tõusvad toornafta hinnad ja tööhõive vähenemine erodeerib tarbija usalduse. Austraalia dollar langes kahe nädala kõige madalamale tasemele pärast seda, kui keskpank teatas, et neli intressimäära kergitust ajavahemikul august kuni märts peaksid külmutama inflatsiooni.

Austraalia dollar langes 95.78 USA sendilt kuni 95.38 USA sendini kohe pärast teate avalikustamist. Keskpanga juhtkond on otsustanud, et praegune monetaarpoliitika on situatsioonile kohane. Tõusvad kütuse, toidu ja kinnisvarahinnad on kergitanud inflatsiooni Austraalias 4.4 protsendini esimeses kvartalis, mis on viimase 17 kõrgeim. Keskpanga eesmärk on hoida inflatsioon keskmiselt 2-3 protsendi juures. Austraalia valitsus avalikustab teise kvartali inflatsiooni 23. juulil.

-

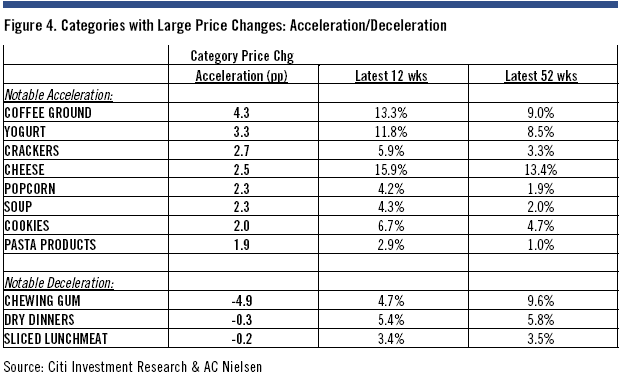

AC Nielsen’i andmetele tuginedes on toiduainete hinnad tõusnud 12 nädalasel perioodi, mis lõppes 14. juuni, kõigis 19 kategoorias – märk sellest, et toiduainetööstuse ettevõtted on sisendhindade tõusu leevendamiseks lükkamas kulusid edasi tarbijale. Märkimisväärselt kallinenud kategooriad olid juust (+15.9%), kohviuba (+13.3%), jogurt (+11.8%) ja küpsised (+6.7%). Alloleval graafikul on näha erinevate kategooriate hinnatrendid viimase 12 ja 52 nädalase perioodi jooksul:

Samas tarbimismahud on vähemalt esialgu vaid kerget vähenemist näidanud: kuigi juustu hind on viimase 52 nädala jooksul keskmiselt tõusnud 13.4% võrra, siis tarbimine on vähenenud ainult 2.6% võrra. Leidub ka kategooriaid, mis naudivad nii hinnataseme kui ka tarbimise tõusu. Näiteks on jogurti hind tõusnud viimase aasta jooksul keskmiselt 8.5% võrra ja samas ka tarbimine tõusnud 2.2% võrra.

See on heaks uudiseks näiteks General Mills’ile (GIS), kes on lisaks jogurtile näitamas head müüki ka teistes kategooriates. Viimase 12 nädalase perioodi jooksul kasvatas GIS müüki 6.1% võrra aasta baasil mõõdetuna. Samuti on tugevalt esinenud Heinz (HNZ) ja Kellogg (K), kasvatades müüki vastavalt 8.2% ja 3.8% võrra.

-

"...tõusvad toornafta hinnad ja tööhõive vähenemine erodeerib tarbija usalduse."

erodeerima <55: -.deerida, -deerin> geol, med erosiooni tekitama.

erosioon <20: -ooni, -.ooni> geol vooluveekulutus; med limaskestamarrastus;

Mis selle tarbija usaldusega siis ikkagi juhtub, kas limaskestamarrastus või vooluveekulutus? -

Kinnisvara hinnad jätkavad oma langust nii siin kui teisel pool ookeanit. Bloomberg kirjutab siin täna, et Suurbritannia majade hinnad kukkusid juunikuus üle 6%. Pärast maikuist 1%list langemist on see päris terav juukselõikus majaomanikele. Tarbijausaldus on langemas ning kardetakse, et ka Suurbritannia majanduskasv võib sarnaselt USAga langeda nulli lähedale või isegi negatiivsele territooriumile, vedades niimoodi kaasa ka ülejäänud maailma.

Ühes teises artiklis ütleb majadeehitaja KB Homesi (KBH) kunagine asutaja Eli Broad, et tema arvates on tänane olukord majanduses kõige hullem pärast Teist Maailmasõda. Päris kriitilised sõnumid siis. Negatiivsus on võimust võtmas ning just sellised lood meedias on see, mis võiks ülemüüdud aktsiaturgudele põrget ja lohutust pakkuda. Futuurid USAs juba koledas -0.7%lises languses.

-

PeaLik

Tegemist ju kõnekujundiga. Ma arvan, et lugejale on sellise võrdluse kasutamine tegelikkuses arusaadav, seega ka "erosiooni" mõiste kasutamine omal kohal. "Erosiooni" mõistet kasutatakse ka "erosioonkulumise" tähistamiseks ja "kulumise" mõiste peaks ka tarbijausalduse kontekstis olema mõistetav.

Ehk siis tarbijausaldus väheneb. -

Natuke huvitavat lugemist eelmisest nädalast kauplejatele

10 Things I Love About This Market

By Alan Farley

RealMoney.com Contributor

The major averages are in a tailspin these days, with a bull's-eye pointed directly at the March lows. The Nasdaq 100's poor performance during Friday's selloff tells us that big tech stocks won't offer safe haven in the upcoming event, even though they've been a relatively good trade for the last three months.

But this isn't a column about gloom and doom. Frankly, there are plenty of those discourses to go around, so instead I'm taking a different approach as the calendar passes from spring into summer. In fact, it's my intention to be downright positive today and list the 10 things I really like about this market.

OK, expect a little sarcasm to seep into this listing, but that's not my main objective. Rather, when it finally comes, the elusive upside will develop from small themes that are already weaving themselves in the dark strands of selling pressure that hit the tape in May. Finding these small rays of light now might give us a tradable edge in the future.1. Banking Index: The index dropped another 6% last week and is getting close to the multiyear support level I noted in a column last week. That floor should start the bottoming process and eventually yield a historic buying opportunity. But don't rush the gun, because big turns after long downtrends take time to set up.

2. The Mighty Dow: The Dow Industrials have led the market to the downside in recent weeks. But ironically, the venerable index shows a more bullish long-term chart than the S&P 500 or Nasdaq averages. Note how the March reversal started at six-year breakout support. A bounce at that level in the next month or two may trigger a massive double bottom that finally ends the bear market.

3. Daytrading: Without question, the last two years have yielded the most profitable daytrading environment since the bubble burst in 2000. The key has been the Market Volatility Index's (VIX) rise over 20, which has widened daily trading ranges and triggered the type of intraday swings that translate into fast-fingered profits.

4. Beautiful Trends, Part 1: Hey talking heads, it's only a bubble when you're not long. Crude oil and other commodities show the same bullish patterns we thought were perfectly normal when their names were Cisco Systems (CSCO) or Qualcomm (QCOM) . Let's face it. The only bad markets are those without speculators and low-hanging fruit.

5. Short-Selling: Two years ago, I'll bet you thought this esteemed practice was obsolete. Then came the perfect storm of an abolished uptick rule, inverse funds and a falling market. Here's a fact of life: The dumbest money in 2008 is coming from market players, both retail and institutional, that still refuse to sell short when the opportunity arises. CSX Corp. (CSX)

6. Beautiful Trends, Part 2: There's always a bull market somewhere, and you won't find a prettier one at the moment than with the railroad stocks. CSX Corp. (CSX) , my top sector pick, is pulling back after a magnificent run and letting more shareholders jump aboard. Keep your stop loss below 50-day moving average support at $62.50, just in case.

7. The Market Has No Memory: Gone are the logical days when you expected a strong close to yield a strong opening in the following session, and vice versa. OK, this sounds like a bad thing, but it isn't. It means you can carry some of your biggest losers overnight and get bailed out when prices take off in the other direction.

8. Utilities: Market folklore tells us that recessions don't happen while the utility stocks are moving higher. Well, guess what, the sector still shows a bull-market profile. The Utilities SPDR (XLU) ETF is trading above its 50- and 200-day moving averages after a pullback from the all-time high posted in December.

9. Lots of Lots: The timing couldn't be better. Real estate prices are plummeting just as we baby boomers send our kids off to college and get ready to look for the retirement property that carries us into the golden years. Now, if we can just hold out long enough to dump our current homes to the thirty-something slacker types now starting families.

10. Wall Street in a Noose: The egregious abuse of power and downright greed we've watched in the top investment banks during this crisis will usher in a long period of suffocating industry regulation. Market insiders will hate every minute, but we small fries will love watching their self-serving arms get chopped off and thrown to the alligators.

So, sure -- things look a bit bleak at the moment. But look hard enough, and you can find things to love, even in a market as ugly as this one. -

Nojah, labase ja maavillase "vähenemise" asemel "erodeerumisest" rääkimine demonstreerib ju rääkija asjatundlikkust ja haritust. Jään ootama kujundlikke nupukesi tarbijausalduse peatsest erekteerumisest või ejakuleerumisest. :)

-

PeaLiK : )

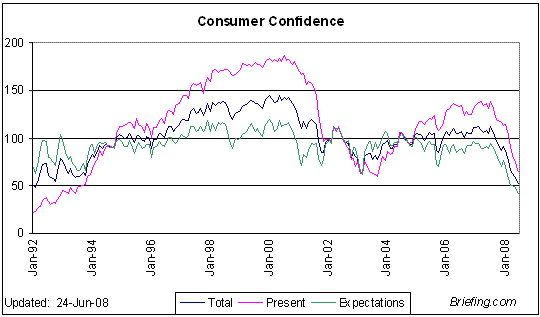

Kommentaaridega päris labasusteni ei tasuks ikka laskuda. Tegijal ikka juhtub. Ja mõte oli ju ka üheselt arusaadav. Aga kuna jutt juba tarbijausaldusele läks, siis Kristjani ja minu jutu illustreerimiseks toon välja ka vastava graafiku USA kohta, kust on näha, et tarbija tõepoolest tunneb ennast nii, et justkui tuleks varsti hakata sööma vaid makarone ja kiirnuudleid, tööl käima jalgrattaga ning riideid ostma harvemini, kui varem planeeritud.

-

PeaLiK, mis sa norid, noored poisid on pandud pikki nende jaoks segaseid tekste tõlkima pandud ja siis läheb kohati otsetõlkeks.

Ilmselt oli originaalis kasutatud sõna "erode" ja sõnaraamat andiski ilusti vasteks erodeerima. -

Misasjast erekteerumine või ejakuleerimine labasused on? See on väga viktoriaanlik mõtlemine juba. :D

-

Pentagon officials expressed concern that Israel could carry out an attack on Iran's nuclear facilities before the end of the year

-

Long natuke LEH @ $20.03. Turg näeb välja natu tahaks taastuda ja LEH tundub hea variant selle peale panustamiseks, eriti kui arvestada MS katmise alustamist. Ahneks ei lähe, ilmselt mingi paarkend senti on täitsa piisav.

Või siis tegelikult on mul ilmselt lihtsalt igav, ei ole mitte midagi huvitavat täna hommikul. -

On jah vaiksevõitu. Mul on MA radaril positiivse Coweni kommentaari peale. Cowen pole küll suurem asi, aga MA on võimeline iga asja peale liikuma. kõik sõltub pakutavast hinnast. Lisaks, kui turg peaks taastuma, liigub MA tavaliselt suhteliselt rohkem.

-

MA kommentaar on liiga hädine minu maitse jaoks, eriti sellise turuga.

-

Bank of America (BAC) on eelturul -1.76% languses $23.45 tasemel, mis võiks samuti osutuda üsnagi heaks põrkekandidaadiks. Finants hetkel üsna suure surve all, seega näpuotsaga paari päeva horisondiga võiks põrget oodata, kuid alumine stopp tasuks kindlasti paika panna.

-

Armastuse värv pidavat see punane olema... aktsiaturul kehtib see vaid short selleritele. Igaljuhul turud nii Aasias kui Euroopas väga punased.

Saksamaa DAX -2.04%Prantsusmaa CAC 40 -2.59%

Inglismaa FTSE 100 -2.54%

Hispaania IBEX -2.66%

Venemaa MICEX -2.88%

Poola WIG -2.27%

Aasia turud:

Jaapani Nikkei 225 -0.13%

Hong Kongi Hang Seng N/A (börs suletud)

Hiina Shanghai A (kodumaine) -3.10%

Hiina Shanghai B (välismaine) -1.54%

Lõuna-Korea Kosdaq -1.60%

Tai Set N/A (börs suletud)

India Sensex -3.71%

-

The Two Most Important Things to Keep in Mind

By Rev Shark

RealMoney.com Contributor

7/1/2008 9:06 AM EDT

The very greatest things -- great thoughts, discoveries, inventions -- have usually been nurtured in hardship, often pondered over in sorrow, and at length established with difficulty.

--Samuel Smiles

As we kick off the third quarter, the gloom is so thick you can cut it with a knife. There are simply no positives out there at the moment. Oil prices keep rising as tensions in the Middle East grow, the financial sector continues to struggle with its massive bad debt issues, and pessimism about the state of the worldwide economy is increasing quickly.

The good news is that the evaporation of hope and optimism leads to the sort of environment that eventually will give us a tradable bottom. When things are this negative, investors who have been uncertain about selling will be pushed to do so, and that eventually will give us the washout that leads to a low.

It's all a matter of timing, and the big problem is that although things are quite negative and gloomy, there hasn't been enough intensity to the negativity to really drive the marginal holders over the brink and induce them to sell. We haven't had any real panic selling to purge the market of some of its poison, and instead we get slow and steady selling that feeds on itself.

There are two important things to keep in mind right now. First and foremost, this market is busted and is in a downtrend. There is no way to know how much longer the pain will last and how much lower things might go. Nonetheless, traditional Wall Street is going to keep on urging us to jump in and start buying. The nature of Wall Street advice is that lower prices are always "buying opportunities."

I strongly urge you to ignore the advice to anticipate major market turns. There is no reason to believe that the market is going to get healthier soon. The key right now is to protect your precious capital and keep losses to a minimum so you'll be prepared to profit when the trend starts to turn.

The second important thing to keep in mind is that the market is probably close to some sort of oversold bounce. Although we haven't had capitulatory-type selling, the mood is bad and the seasonal conditions are ripe for at least a temporary rebound.

If you are already positioned defensively and have a short-term time frame, these counter-trend bounces can present some great opportunities. You just have to keep in mind that you are trading and not investing at this point, and that the goal is to get in and get out and not build up big long-term positions.

We have a very poor start this morning, and that is probably a good thing as far as setting us up for a potential bounce. If you have been heeding my advice and are already defensively situated this poor open is a good thing.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: VFC +4.7%, SCHN +2.1%, STZ +2.0% (light volume)... Other news: PPHM +14.3% (awarded DTRA contract worth up to $44.4 mln to develop Bavituximab for viral hemorrhagic fevers), CIT +10.1% (agrees to sell Home Lending business), MBLX +8.7% (announces that Mirel Bioplastics is chosen by Labcon for new laboratory liquid handling system), HALO +4.1% (announces that chemophase meets primary endpoint in phase I/IIa clinical trial), IDXX +3.8% (will replace Getty Images in the S&P MidCap 400), FST +3.1% (updates Haynesville/Bossier shale acreage and development plan; 5 Tcfe of additional net unrisked potential identified), CELG +2.6% (still checking), BQI +2.3% (still checking)... Analyst comments: FTE +2.5% (upgraded to Buy at Merrill and coverage resumed with Buy at Goldman - DJ), MIC +2.3% (upgraded to Outperform at Wachovia), TMRK +2.2% (initiated with Buy at Kaufman), SIRI +1.6% (upgraded to Buy at Merrill), LRCX +1.0% (upgraded to Outperform at Credit Suisse).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: QTWW -6.2% (light volume), FO -6.8% (downgraded to Market Perform at Wachovia), MTW -1.5% (Enodis plc agrees to recommend offer from The Manitowoc Co following completion of auction process)... Select metals/mining stocks showing weakness: RTP -5.4%, LMC -4.1%, BBL -3.6%, AU -3.6%, MT -3.4%, GOLD -2.6%, BHP -2.3%... Select European financial names showing weakness with WSJ reporting UBS (-5.6%) sets board overhaul and adopts new governance rules: RBS -4.4%, DB -3.4%, LYG -3.2%, BCS -3.2%, HBC -2.3%... Select solar names trading lower: CSIQ -4.3%, JASO -3.9%, SOLF -3.2%, ESLR -3.0%, STP -3.0%, FSLR -3.0%, TSL -2.9%, SPWR -2.8%, YGE -2.7%... Other news: IFX -10.3% (falls most in five months as takeover talk evaporates - Bloomberg.com), SFD -6.9% (announces the sale of 7.0 mln shares to China's largest agricultural trading and processing co), SUPG -6.3% (comments on preliminary efficacy update on EORTC Phase 3 Trial of Dacogen versus supportive care in patients with myelodysplastic syndromes; reiterates 2008 annual financial guidance), RVBD -6.3% (still checking), TKG -6.1% (trading ex-dividend), HCN -4.5% (still checking), GSK -1.6% (faces US delay on cancer vaccine - FT)... Analyst comments: TKR -3.9% (downgraded to Neutral at Merrill), ALTR -3.6% (downgraded to Underperform at Jefferies), RBN -2.5% (downgraded to Hold from Buy at BB&T), NYX -2.0% (removed from Conviction Buy List at Goldman - Bloomberg), JPM -1.8% (downgraded to In Line from Outperform at Fox Pitt), MF -1.3% (removed from Focus List at JPMorgan). -

Müün LEH alates $20.19, edasi 5 sendi kaupa järjest kõrgemal.

-

Flat LEH viimane $20.39 pealt.

-

iddeoflo, good one on MA, alahindasin seda calli.. võtsid?

-

veidi @ 264. nüüd juba out

-

BAC stopi võiks kergitada, põrkab päris ilusti.

-

June ISM Manufacturing 50.2 vs 48.5 consensus, prior 49.6

ISM number oodatust ilusam - aga täiesti võimalik, et hiljutine moonutatud nõudlus rebatitšekkide realiseerimise läbi on siin numbrit positiivselt mõjutanud. -

Kas kusagil on valuutareźiimide lühiülevaadet mingis kompaktses andmebaasis? Nt mitme riigi (ja milised) valuutad on seotud USD, EUR vm-ga?

-

Nõme turg on, kõik istuvad näpp sell nupu peal, valmis vähimagi asja peale paanikas müüma. Samas jälle pikalt short ei julgeta ka olla. Vaikne ja igav on ka.

-

Indeksid hakkavad küll juba väga huvitavatele tasemetele minu arust jõudma. Kas on oodata tõsisemat karuturu paanikat kui tõesti kõik korraga sellele nupule muljuvad, mida "jim" mainis, või võiks pigem põrget oodata?

-

Pisut subjektiivsust foorumitesse... usun siinsete hindade (SPY 126.3) ja ülemüüduse pealt pigem ostuhuvi esilekerkimist päeva edenedes. Saame näha.

-

Võtsin hästi natuke AXL @ $8.21 GM peale. Võiks veel edasi minna siit peale sellist kukkumist.

-

Krt, GM on liiga nõrk selle peale, panen $8.29 peale AXL müüki, ei tundu enam hea treid.

-

Rongi eest kopikate korjamine, flat.

-

Kui kellelgi on natuke üleliigset turutunnetust, siis paluks laenuks, mul absoluutselt puudub.. et ma ei roniks liiga kiiresti treidist välja, kui KOHE ei tööta.

-

AXL 2007. a käibest tuli 76% GM-lt, aktsia on kuu ajaga langenud $20 pealt $8-ni, float on vaid 46 mln ja sellest 27% on lühikeseks müüdud... ühesõnaga suurepärane short squeeze´i kandidaat GM´i heade müügitulemuste peale.

-

AXL @8.81 karm LEH @21.11

-

SPY 126.3 pealt siis 128.3 peale liikunud. Aga usun tegelikult, et ülespoole liikumise jätkumiseks on homme samuti head šansid..

-

Huvitav, kas APOL on siit short? Võiks arvata, et DV esmaspäevane suur blokk tekitas sektori aktsiatele mingisuguse lae, kuna see nii suure discountiga tehti..