Börsipäev 7. august

Kommentaari jätmiseks loo konto või logi sisse

-

Täna teevad BoE ja ECB oma monetaarpoliitilised otsused:

Esiteks teatab Bank of England intressimäära otsuse 14:00. Ilmselt jääb intressimäär 5% juurde. UK inflatsioon on kõrge ja ootused edasiseks veel kõrgemad (eriti kasvavate gaasiarvete tõttu).

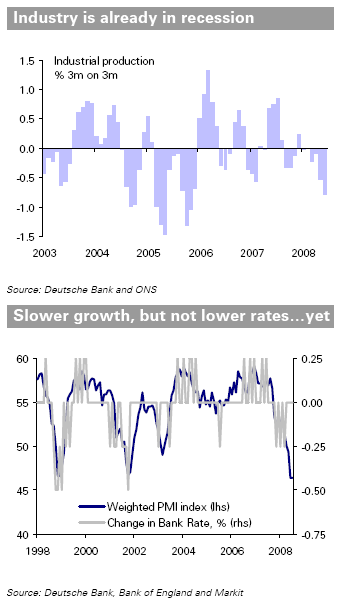

Samas ei kiputa intressimäärasid tõstma, kuna UK majanduskasv on aeglustunud ja väljavaated endiselt negatiivsed. UK tööstustoodang on juba kolmandat kvartalit languses ja selle kvartali majanduskasv võib olla nulli lähedal.

P.S varasemalt on üsna hästi BoE intressimäära otsust seletanud PMI. Kõrge inflatsiooniga pole see küll kõige paremini töötanud, kuid viitab sellegi poolest intressimäärade alanemisele tulevikus.

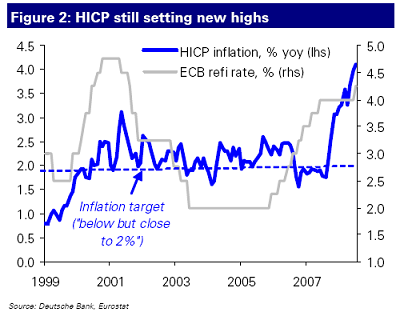

Teiseks teatab 14.45 Euroopa Keskpank oma intressimäära otsusest. Konsensus ootab samuti intressimäära püsimist 4.25 juures. Eurotsooni probleemid on analoogsed UK’le- kasvava inflatsiooni ja aeglustuva majanduskasvu riskid on enamvähem tasakaalus, mistõttu ei ole põhjust muuta ka intresse. Kuigi nafta hinnalangus vähendab inflatsiooni riski, on ECB endiselt mures teise ringi efektide pärast.

-

Üks väike nimekiri siia eile õhtustest ja öistest tulemuste teatajaist. Kuna tulemuste hooaeg on läbi saamas, siis praegused teatajad on ikkagi üldjoontes väiksemad ettevõtted. Ülekaal negatiivsetel tulemustel/prognoosidel. Väiksematel ettevõtetel on reeglina ka keerulisemates majandustingimustes oluliselt raskem tegutseda.

Opnext (OPXT) beats – upside guidance

Entravision (EVC) beats

Alnylam (ALNY) misses

Maxwell Tech (MXWL) misses

Given Imaging (GIVN) beats – upside guidance

Andersons (ANDE) beats

LMI Aerospace (LMIA) beats – upside guidance

Five Star Quality (FVE) misses

AMN Healthcare Services (AHS) misses – downside guidance

True Religion (TRLG) beats – upside guidance

Universal Technical (UTI) misses

Xenoport (XNPT) misses

Internet Brands (INET) beats – inline guidance

Amerisafe (AMSF) beats

Parexel (PRXL) beats – upside guidance

Ashford Hospitality(AHT) misses

Central Graden (CENT) misses

TXCO Resources (TXCO) misses

Veraz Networks (VRAZ) misses – downside guidance

Cbeyond Comms (CBEY) misses – inline guidance

Einstein Noah (BAGL) beats

TBS International (TBSI) beats

SoundBite Communication (SDBT) misses – downside guidance

Planar Systems (PLNR) beats – downside guidance

Plains All Amer (PAA) beats

Tenaris (TS) beats

UTStarcom (UTSI) misses

VeriSign (VRSN) beats

Paragon Shipping (PRGN) beats

Super Micro Computer (SMCI) beats

Salem Comms (SALM) beats

Service Corp (SCI) beats

LivePerson (LPSN) inline – downside guidance

Hill International (HIL) misses

Savient Pharma (SVNT) misses

TFS Financial (TFSL) misses

EDiets.com (DIET) misses

CPI International (CPII) misses

Sun Healthcare (SUNH) beats

URS (URS) beats – inline guidance

Sunoco (SUN) beats

Career Education (CECO) beats

Callon Petroleum (CPE) beats

Strategic Hotels & Resort (BEE) beats – downside guidance

Penn Virginia (PVR) misses

Nektar Therapeutics (NKTR) misses

Medcath (MDTH) misses

Yamana Gold (AUY) misses

Gladstone Investments (GAIN) misses

Medical Staffing (MRN) misses

Sina (SINA) beats – upside guidance

Orthovita (VITA) misses

China Digital TV (STV) beats – downside guidance

Amerco (UHAL) misses

Nationwide Health (NHP) beats

Hill-Rom (HRC) beats – upside guidance

American Int (AIG) misses

Dyncorp Intl (DCP) beats - downside guidance

Kohlberg Capital (KCAP) misses

Great Plains (GXP) misses

Furniture Brands (FBN) misses

Republic Airways (RJET) beats

Standard Parking (STAN) beats – inline guidance

ExlService (EXLS) beats – downside guidance

Providence Service Corp (PRSC) beats – downside guidance

American Railcar Industries (ARII) misses

Comp Vale Do Rio (RIO) beats

UniSource Energy (UNS) misses

Integrys Energy (TEG) misses – inline guidance

Alon USA Energy (ALJ) misses

Jer Investors Trust (JRT) misses

Geokinetics (GOK) beats

MCG Capital (MCGC) misses

Resource Capital (RSO) misses

Key Energy (KEG) inline – inline guidance

ATP Oil & Gas (ATPG) misses

Delek US Holdings (DK) misses

Teekay Shipping (TK) misses

Teekay Tankers (TNK) misses

Thomas Properties (TPGI) beats

-

Costco (COST) juuli võrreldavate poodide müüginumbrid on täitsa ilusad. +10% vs oodatud ca +7.5%. Rahvale meeldivad üha enam discount poed...

-

Euroopa Keskpanga intressimäära otsuse järgset pressikonverentsi on otseülekannes võimalik jälgida siit.

-

UK kinnisvarahinnad tegid juulis läbi rekordilise languse. Kinnisvaralaenude vahendaja Halifax teatel langesid majade hinnad 1.7*% M-o-M ja 8.8% Y-o-Y. Viimati tabas inglismaad nii kiire hinnalangus (8.3%) aastal 1992.

-

Joeli poolt väljatoodud nimekirjast hakkab silma (American Int (AIG) misses). Teisipäeval UBS poolt ostusoovituse saanud ning seetõttu korralikus tõusus olnud aktsia kukkus eile järelturul pärast tulemuste avaldamist ligi 10%. AIG teatas $5.6 mld kvartalikahjumist, ehk -2.06 aktsia kohta. Analüütikute konsensus oli 63 senti aktsia kohta kasumit.

-

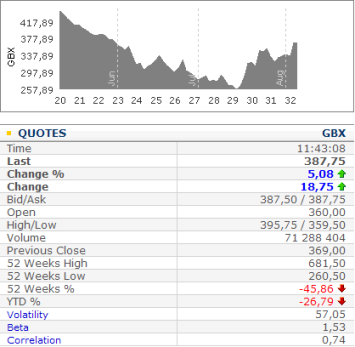

Barclays Plc (BARC) aktsiahind on kerkinud Londoni aktsiaturul 5.08%. Suurbritannia üks suurimaid panku teatas teise kvartali majandustulemustest, brutokasum langes 34% aktsiaturgudel tehtud tehingute arvu vähenemise ja mahakirjutamiste tõttu. Viimased kuus kuud on põhjustanud ettevõttele paksu pahandust, puhaskasumi languseks oli 1.72 miljardit naela ehk 26.2% aktsia kohta. Barclays teatas, et lisakapitali pole vaja tõsta pärast eelmise kuu 4.5 miljardi naela väärtuses aktsiapakkide müüki.

-

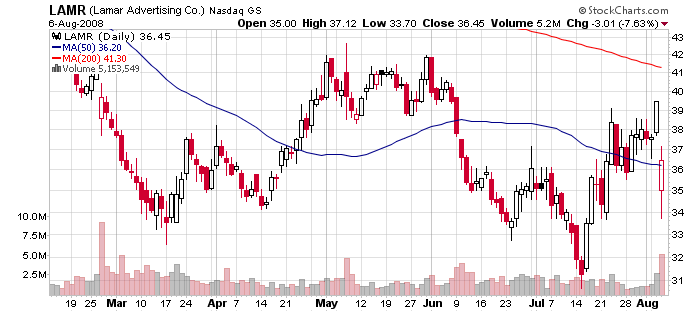

Lamar Advertising (LAMR) on üks suurimaid välireklaami pakkujaid USAs. Eile teatas ettevõtte oma Q2 tulemused, mis vastasid laias laastus turu ootustele, kuid prognoosid valmistasid pettumuse:

Lamar Advertising sees Q3 national sales flat; Q4 slightly down - Reuters (35.50 -3.96): Expects 2009 to be tough for ad spend.

Nüüd on Citigroup alustamas Lamar’i katmist soovitusega Müü ja hinnasihiga $28. Lühidalt võib Citi nägemuse kokku võtta nii:

We view the run-up from 2005-2007 as over exuberance around the digital opportunity, and believe that we are just now returning to the expected trading range for the company. However, Lamar still trades at a substantial premium to other media stocks from an EV/EBITDA perspective, despite only single digit EBITDA growth. Because we think that we are just seeing the beginnings of the slowdown in Outdoor advertising, and that this could infringe on the digital roll-out into 2009, we think that LAMR still has room to fall.

Lisaks on legendaarne karu Douglas Kass samuti LAMR’I lühikeseks müümas, panustades USA reklaamituru jahtumisele. Hoolimata eilsest 7.5%-lisest langusest usun, et näeme ka täna tugevat müügihuvi.

-

Täna enne turu avanemist avaldab oma Q2 tulemused Blockbuster (BBI), kellest on ka varem foorumites juttu olnud. Briefing vahendab Wedbush'i, kelle soovitus on Strong Buy ja hinnasiht $7, ootusi tulemuste eel:

Wedbush expects slight Q2 EBITDA upside and maintenance of 2008 guidance : Wedbush notes BBI is scheduled to report 2Q08 results on Thur, Aug 7. Firm expects Q2 rev of $1.231 bln and EPS of $(0.14), compared with consensus of $1.226 bln and EPS of $(0.20). Firm believes mgmt will increase 2008 guidance for EBITDA (currently at $290 -- 310 million) slightly, and will narrow the range of its net income guidance of $5 -- 25 million (implying EPS of $0.02 -- 0.11). Ultimately, they expect Blockbuster's stock to appreciate as continued execution on its plan relieves investor confusion about the company's direction and leadership. -

BoE jättis intressid oodatult samaks.

-

BoE'lt rohkem infot täna ei tule. Inflastiooni- ja majanduskasvu prognoosid avaldatakse järgmisel kolmapäeval.

-

Ei ole ka Euroopa Keskpanga intressiotsus üllatusena - määrad jäetakse samaks.

-

BBI kahjum sendi võrra oodatust suurem, kuid samas tõstetakse FY08 EBITDA prognoose. Aktsia on eelturul suhteliselt ebalikviidne ja vara veel öelda, kuidas tulemustele reageeritakse.

Reports Q2 (Jun) loss of $0.20 per share, $0.01 worse than the First Call consensus of ($0.19); revenues rose 3.2% year/year to $1.3 bln vs the $1.23 bln consensus. Based on positive trends in the Company's underlying business and financial results year-to-date, the co raised its previously issued guidance for the full-year 2008 from adjusted EBITDA in the range of $290-310 mln to adjusted EBITDA in the range of $300-315 mln, which corresponds to net income in the range of $21-$36 million. -

Esmaste töötu abirahade taotlejate number jätkab kasvamist.

Initial Jobless Claims 455K vs 425K consensus, prior 448K -

ECB rõhutab pressikonverentsil eelarvete kärpimise vajadust ja paneb riigijuhtide südamele, et fiskaalpoliitika eesmärke ikkagi täidetaks ja suure defitsiidiga eelarveid ei koostataks. Majanduskasvu pärast ollakse selgelt mures.

-

Inflatsioonine, aga majanduskasvu kommentaarid EURi rõhumas.

-

veidi irooniline, aga nõrk EUR paneb Euroopa turud taas kerkima, ligi 0,5% põrget

-

Panen siia ka EUR-USD graafiku, kust on näha, et täna hommikune euro tugevnemine dollari vastu on ECB ettevaatlikkusele kutsuvate sõnade järel nüüdseks kustutatud.

-

graafikult ka näha, et ECB kommentaarid tulid "just in time" ja tapsid ära USD nõrgenemise katse kehvapoolse initial claims järel

-

Killer Confidence

By Rev Shark

RealMoney.com Contributor

8/7/2008 8:13 AM EDT

What men want is not knowledge, but certainty.

--Bertrand Russell

The market has now enjoyed a couple of positive days and the technical conditions are improved, but it is important not to forget the many issues that are likely to keep this market struggling. The market is never easy, but there are times when it is more challenging than others -- now is such a time.

The constant predictions and breathless proclamations by Wall Street professions and market pundits add to the problems of navigating the market. They always sound so confident that they know how things will play out, and we can feel downright foolish when we doubt them and they turn out to be right for a few days.

This is not a market environment that warrants great confidence and certainty. Even when we rally over the course of a couple of days, it isn't nearly as easy as it looks, as the stocks that lead and lag completely reverse from one day to the next.

We have a particularly good example this morning of how confusing this market can be. Financials are weak after a good run on a poor report from AIG (AIG) , oils are rallying as crude finds support, and the dollar weakens and same-store retail sales are coming in weaker than expected. Being confident and certain when we have these sorts of shifts nearly every day is just downright foolish.

The major positive right now is that there is some better technical action taking place. The indices have been bouncing since mid-July and have been able to make some higher highs. The Nasdaq was particularly strong yesterday and seems to have sucked in some cash from the sidelines.

The big question is whether this is just another bear-market bounce or whether we have really seen a meaningful low. Being confident of anything at this point is dangerous, but it is helpful to have a working thesis in mind. I continue to stick with the contention that we are still in a bear market and are enjoying nothing more than a temporary respite.

The bull case here is that banks have priced in the worst and have seen the lows, and that the broad market has already discounted the fact that the economy is going to stumble along. The bulls have made similar arguments for over a year now and have been proved wrong each time. I see little to convince me that they will be right this time.

Throw in seasonal weakness, some market complacency and overhead resistance in the technical patterns, and I don't see a reason to jump on the bull-market train. I'll be happy to be proved wrong, but the bulls have plenty of hurdles to jump before we can be more optimistic.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance/same store sales: ENG +11.6%, NFS +10.7% (also Nationwide Mutual Insurance Co and Nationwide Financial Services reach agreement to combine in $2.4 bln transaction), CAR +9.3%, GIVN +8.6%, LMIA +8.0% (light volume), DCGN +7.7% (light volume), COGO +7.4%, AXA +6.5% (light volume), EGLE +6.1%, TMTA +5.7%, URS +5.2%, VRNM +5.1%, PRXL +5.1%, XIDE +4.8%, JCP +4.8%, AAP +4.7%, BAGL +4.3%, SUN +4.0%, HAYN +3.7%, CBEY +3.2% (also upgraded to Buy at Merriman and upgraded to Overweight at JPMorgan), BCS +2.6%, RIO +1.9%, XRM +1.9% (light volume), SINA +1.5%... Select European financials trading higher following BCS and AXA qtr results: UBS +4.2%, LYG +3.5%, DB +2.7%... Other news: SYNM +10.5% (still checking), VE +6.2% (soars on plan to cut costs, sell assets - Bloomberg.com), KBR +4.1% (announces a repurchase program of up to 5% of its outstanding common stock; declares $0.05 quarterly cash dividend), RAME +4.0% (still checking), RTP +1.6% and BP +1.3% (still checking)... Analyst comments: STO +3.2% (hearing upgraded to Overweight at HSBC), GNA +2.7% (upgraded to Buy at KeyBanc), RIG +1.6% (upgraded to Buy at Stifel Nicolaus), WATG +1.4% (upgraded to Buy at Merriman), FTI +1.0% (upgraded to Add from Neutral at Capital One Southcoast).

Allapoole avanevad:

In reaction to disappointing earnings/guidance/same store sales: MCGC -28.0%, DITC -18.9%, KG -16.7%, STV -16.3%, VRSN -14.4% (also downgraded to Perform at Oppenheimer), MEND -11.4%, BBI -9.1%, AIG -7.7% (also downgraded to Market Perform at FBR), MSSR -7.6%, CTRN -7.5% (also downgraded to Neutral at Piper), IMAX -7.3%, CECO -7.3%, AEG -7.1%, ALNY -6.2%, MLM -5.8%, SVNT -4.4%, AEO -4.0%, ALG -3.8% (light volume), HOTT -3.8% (also downgraded to Neutral at Piper), PLCE -3.8%, CAH -3.7%, DYN -3.2%, WMT -2.9%, TGT -2.1%, FRZ -2.0% (also WSJ reports Collusion inquiry targets ice companies), CPHL -2.0% (also downgraded to Neutral at Piper Jaffray), SUNH -1.3%... Select airline/cruise-related names showing weakness with crude higher: AMR -12.4%, NWA -6.8%, LCC -6.6%, CEA -5.7%, JBLU -5.5%, CAL -5.0%, UAUA -5.0%, CCL -2.1%, RCL -1.7%,... Select financial names trading modestly lower: LEH -3.2%, COF -2.9%, WB -2.9%, WM -2.6%, MER -2.5%, MS -2.3%, C -2.2%, WFC -2.0%, BAC -1.9%, JPM -1.8%, ING -1.2%, HBC -1.1% (denies new deadline for $6.3 billion KEB deal - Reuters.com)... Other news: SMI -6.5% (shares fall on concern competition may increase - Bloomberg.com), ACOR -6.4% (prices a 4 mln share common stock offering at $28.50/share), INCY -4.9% (announces the closing of its public offering of 12,075,000 shares at a price of $9.00 per share), MEE -1.4% (agrees to sell 3.8 mln shares of its common stock at a public offering price of $61.50 per share), BIDU -1.4% and GOOG -1.0% (still checking)... Analyst comments: LL -2.7% (downgraded to Neutral at BofA), EW -2.4% (downgraded to Underweight at JPMorgan), DPL -2.2% (downgraded to Underperform at Merrill), SIVB -1.6% (downgraded to Market Perform at Keefe Bruyette), PKX -1.3% (downgraded to Equal Weight at Morgan Stanley), EIX -1.1% (downgraded to Underperform at Merrill). -

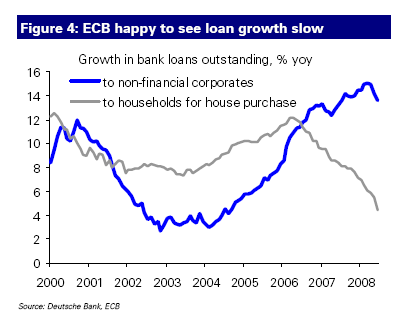

Lisaks majanduskasvu kommentaaridele, mõjutavad eurot Trichet kommentaarid rahapakkumise kohta. Tricheti esialgsel hinnangul on rahapakkumise kasv olnud jõuline. Alles praegu on esialgseid märke M1 rahapakkumise kasvu vähenemisest. Rahapakkumise kasvu näitab ka Euroopa laenumahtude suurenemise graafik:

-

Euroopa ja Aasia indeksid:

Saksamaa DAX +0.47%

Prantsusmaa CAC 40 +0.86%

Inglismaa FTSE 100 +0.25%

Hispaania IBEX 35 +0.10%

Venemaa MICEX +1.83%

Poola WIG -1.05%

Aasia turud:

Jaapani Nikkei 225 -0.98%

Hong Kongi Hang Seng +0.70

Hiina Shanghai A (kodumaine) +0.31%

Hiina Shanghai B (välismaine) -0.61%

Lõuna-Korea Kosdaq -0.93%

Tai Set 50 +5.24%

India Sensex +0.29%

-

Oodatust parem data.

June Pending Home Sales +5.3% vs -1.0% consensus, prior revised to -4.9% from -4.7%. -

Ehitajad toetavad turgu ilusa pending home sales numbri peale ning tehnoloogiasektor on jällegi näitamas tugevust. Kui raske on täna finants???

-

U.S. Chain same store sales up 2.6% on year in July vs June's revised +4.2%, according to the ICSC

-

Turg üritab ehitajate ja tehnoloogia najal ülespoole rallida, kuid finants ikka väga raske (AIG ja C). Turgu toetab toornafta futuuride nulli langemine. Nafta hetkel +0.25 $118.88 barrel tasemel.

-

Finantssektorit langetab ka Citi kohtujuhutum:

Aug. 7 (Bloomberg) -- Citigroup Inc., the largest U.S. bank by assets, agreed to buy back or help clients unload $19.5 billion in auction-rate securities and pay a $100 million fine to settle U.S. regulatory claims it improperly saddled customers with untradeable bonds.

Citi näitel võivad sama teha ka näiteks HSBC, UBS ja Merrill. -

Turgudele sai finantssektor siiski liiga raskeks ankruks ning hetkel korralik müügisurve juba kõikides sektorites.