Börsipäev 13. august

Kommentaari jätmiseks loo konto või logi sisse

-

Täna hommikul avaldati siis Eesti II kvartali majanduskasv ja tulemuseks vähenemine -1.4%.

Link statistikaameti teatele on siin.

-

Maailmamajandusele tuli täna öösel tagasilöök Jaapanist. Teise kvartali SKP langes -2.4% YoY. Vähenesid nii eksport kui tarbimine. Jaapani enda valitsus tunnistas hiljuti, et sõjajärgne majanduskasv ei pruugigi enam Jaapanisse tagasi jõuda ja majandus seisab stagnatsiooni lävel.

-

Üks 238 Merko aktsia ost otse pakkumiselt hoiab OMXT Baltimaade börssidest ainsana rohelises praegu...

-

kas tulemas mõni rida GIGM kohta ka?

-

Reuters Eestist: Estonia hits recession in Q2 as demand dries up! - The former high flying Baltic state of Estonia has fallen into recession, with data on Wednesday showing gross domestic product contracted 1.4 percent year-on-year in the second quarter. TALLINN, Aug 13 (Reuters)

-

ktammin. Tänase päeva jooksul valmib kindlasti ka GIGMi kommentaar.

-

Schlagbaumm,

238 on Merko käive senini. Aktsiaid osteti selle eest 33 tükki. -

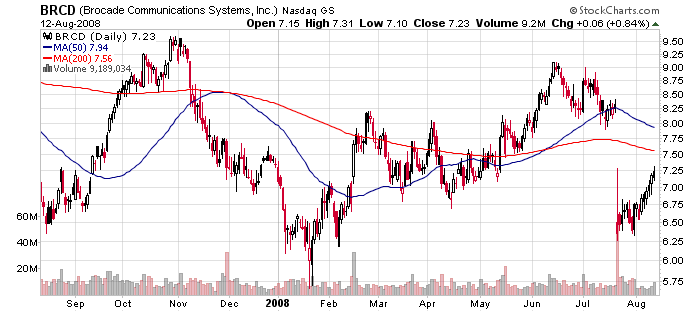

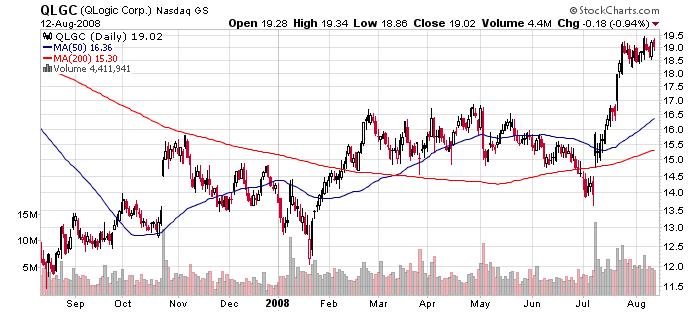

Täna enne turu avanemist avaldab oma Q3 tulemused Brocade Communications Systems (BRCD). Eile oli huvitava kommentaariga väljas Avian Securities, kelle arvates tasub aktsiad enne tulemusi osta, sest konkurent Cisco Systems (CSCO) on nende hinnangul BRCD-le märkimisväärselt turuosa kaotanud. Lisaks pakuti välja paaristreidi võimalus – shortida QLogic’ut (QLGC), kelle aktsia hind on uutele aasta tippudele tõusnud ja koos sellega ka valuatsiooni kergitanud ebasoodsatele tasemetele.

Avian is suggesting investors to buy BRCD and short QLGC ahead of BRCD's Q3 earnings. Firm anticipates that BRCD will exceed expectations as suprisingly poor results at CSCO despite a strong storage environment appear to signal a significant share gain at BRCD. Firm also believes BRCD will get a boost from old MCDTA customers who waited for the 8 gb director class upgrade. Firm notes while QLGC is setting a new 52 wk high and trading at extended multiples, BRCD just recently was battling to stay above 52 wk lows. This divergence offers an opportunity and they would look to own BRCD for near term strength and potentially pair this with a short position in QLGC due to its premium valuation as they think that stock has topped out.

Seega on kahtlemata huvitav täna jälgida, kas Aviani tees mängib välja.

-

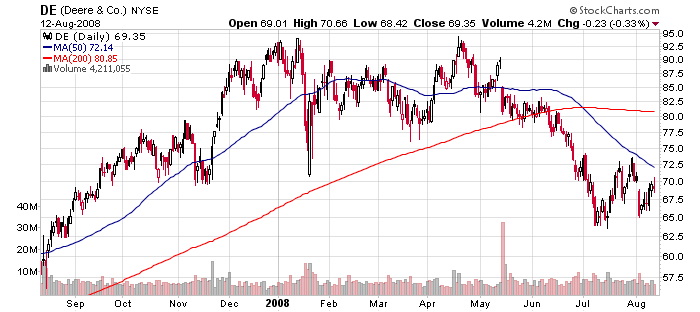

USA tulemuste teatajaist tasub täna hommikul jälgida eelkõige Deere'i (DE) ja Macy't (M). DE'lt oodatakse EPSi $1.37 ning müügitulu $7.24 miljardit ning M'lt EPSi $0.19 ning müügitulu $5.76 miljardit.

-

jajah, vaatasin vale rida. OMXT-d see kaua püsti ei hoidnud muidugi.

-

Deere (DE) jääb analüütikute konsensusele alla nii kasumi kui ka käibe osas. Aktsia on eelturul 6%-lises languses ehk $65 tasemel.

Reports Q3 (Jul) earnings of $1.62 per share, $0.04 worse than the First Call consensus of $1.36; revenues rose 18.1% year/year to $7.07 bln vs the $7.23 bln consensus. Company equipment sales are projected to increase by about 21 percent for the full year and 29 percent for the fourth quarter of 2008. Included in the forecast is about 5 percent of currency translation impact for the year and about 3 percent for the quarter. Deere's net income is forecast to be about $425 million for the fourth quarter. Escalating raw material costs are expected to have an impact on margins for the quarter.

Deere’i aktsia on viimasel ajal päris terava korrektsiooni läbi teinud, kuid nõudlus põllumajanduses kasutatavate masinate järgi ei ole seni jahtumise märke näidanud. Samuti on valuatsioon muutumas üpriski huvitavaks – aktsia kaupleb $65 hinna juures 12.8-kordsel FY08 ning 10.7-kordsel FY09 oodataval kasumil.

-

Selgub, et Briefing tegi DE tulemuste edastamisel vea ning tegelik EPS oli $1.32, jäädes $0.04 võrra alla konsensusele. Parandan ka eelmise kommentaari ära.

-

BRCD suudab konsensust ületada. Kudos goes to Avian Securities :)

Reports Q3 (Jul) earnings of $0.16 per share, excluding non-recurring items, $0.02 better than the First Call consensus of $0.14; revenues rose 11.7% year/year to $365.7 mln vs the $351.7 mln consensus. -

E*TRADE (ETFC) kohal on kaua tumedad pilved hõljunud ja kvartalitulemused jäid samuti ootustele tugevalt alla, kuid täna peaks aktsiahind toetust saama järgmisest avaldusest:

E*TRADE (ETFC) says total retail customer assets, for the July 2008, grew $153 mln

Co announces that total retail customer assets, for the July 2008, grew $153 mln from June to total $162 bln. Total Daily Average Revenue Trades increased 9.2% sequentially to 182,835. Net new retail accounts were 19,583. -

Kohe avalikustatakse USA jaemüügi numbrid. IFR prognoos:

Retail Sales (Jul) Following the 0.1% increase in June, IFR forecasts flat retail sales in July as the last of the stimulus tax rebates checks were last sent out in Mid-July and though they might slightly pull sales up, it should not be enough to offset declines in auto sales.

-

Jaemüük kukkus juulis 0.1%

-

Bloombergi andmetel - Merrill says financial sector problems are far from over; investors are underestimating scope of credit problems.

-

Tuleks korra Deere'i (DE) juurde tagasi ja paneks siia kasvud segmentide lõikes:

Põllumajandustehnika (59% müügitulust) - kasv +35% vs Q2 07

Äri- ja tavatarbe tehnika (17% müügitulust) - kasv -1% vs Q2 07

Ehitus- ja metsatehnika (15% müügitulust) - kasv -7% vs Q2 07Põllumajandustehnika müük on igaljuhul täies hoos ning tugevust on näidanud siin isegi USA ja Kanada. Juhtkonna prognoos USA ja Kanada kasvuks 2008. aastaks põllumajandustehnika osas on 20 kuni 25%. Väga agressiivset kasvu oodatakse Ida-Euroopalt, Venemaalt ja SRÜ riikidelt uue ja kaasaegse põllumajandustehnika soetamise näol. Brasiilia kasvuks oodatakse ca 40% ning positiivsed ollakse ka Austraalia osas. Põllumajandustehnika segmendis ollakse negatiivsed vaid Lääne-Euroopa osas, kus kaasaegne tehnika on põllumeestel juba varasemalt soetatud.

Uut põllumajandustehnikat on Ida-Euroopa ja SRÜ riikides juba aastaid soetatud, kuid see on väga aeglane ja kulukas protsess. Masinate eluiga on 10-20 aastat, mida osade kaupa farmerid välja hakkavad vahetama, mistõttu põllumajandustehnika osas usun Deere'ile jätkuvat agressiivset kasvu veel mitmeteks aastateks. Vähesed teavad, et korraliku uue teraviljakombaini hind, mis on elektroonikat kordi rohkem täis pakitud kui tavainimese tippmugavustega sõiduauto, jääb täna 2 ja 4 miljoni krooni vahele, mistõttu on hoolimata põllumajandussaaduste hinnatõusust põllumehed oma investeeringuid ajas hajutamas mitmete aastate järele.

Ehitustehnika segmendis mõjub 2008. aasta müügitulude kasvule negatiivselt USA kinnisvarakriis. Nõrk on ka Kanada. Mujal maailmas nenditakse veel tugevat nõudlust.

-

Euroopas ja Aasias on pilt eranditult punane:

Saksamaa DAX -1.57%

Prantsusmaa CAC 40 -1.73%

Inglismaa FTSE 100 -1.23%

Hispaania IBEX 35 -1.16%

Venemaa MICEX -1.38%

Poola WIG -0.82%

Aasia turud:

Jaapani Nikkei 225 -2.11%

Hong Kongi Hang Seng -1.61%

Hiina Shanghai A (kodumaine) -0.44%

Hiina Shanghai B (välismaine) -1.46%

Lõuna-Korea Kosdaq -0.90%

Tai Set 50 N/A (Suletud)

India Sensex -0.78%

-

Stay Focused on the Short Term

By Rev Shark

RealMoney.com Contributor

8/13/2008 9:01 AM EDT

A pleasant illusion is better than a harsh reality.

--Christian Nevell Bovee

The market has recently enjoyed a bounce and a new flurry of "the worst is over" predictions based on the hope that lower oil and commodities will boost the consumer and that banks have found a bottom. Our job as investors is to try to determine whether this is realistic or just a pleasant illusion.

This morning there are stories in the Wall Street Journal and New York Times about how, despite lower oil, the big issues out there continue to be falling home prices, a weak job market and tight credit. Many believe banks still have substantial writedowns to come, and we saw a little of that Tuesday.

It is quite easy to be bearish about the macro environment, but some better technical action in the indices has caused some hope that we are going to see more upside. Oil has made for a very convenient reason to rally, and the market is hypersensitive to the moves in crude right now. Counting on oil alone to drive this market is a dangerous hope when there are still other issues out there that impact the consumer far more, such as the value of their home.

The nature of a bear market is to have a series of hopeful rallies that suck in buyers and then disappoint them, which leads to a new cycle of selling. Eventually, this process exhausts even the optimism, and that is when we finally see a real bottom.

Unfortunately, I believe that this process is still playing out and that the recent upward move is nothing more than another bear market bounce. It may last a bit longer, but it's already showing some deterioration as concerns over banks grow and oil becomes oversold.

Overseas markets were quite weak, and oil and gold are bouncing. I'm sticking with a defensive posture and focusing on very short-term trades and shorts.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: DISK +19.7%, LFT +10.8% (light volume), CFSG +9.9%, SORL +7.8%, SBLK +6.3% (light volume), BRCD +5.1%, NVDA +4.6%, CREE +4.3%, APEI +2.5%, DPS +2.5%, AMAT +2.3%, TOL +1.3%, SQM +1.0% (light volume)... M&A news: LDG +29.9% (CVS Caremark to acquire Longs Drug Stores for $71.50 per share)... Select metals/mining stocks modestly rebounding: AAUK +2.1%, HMY +1.8%, AUY +1.7%, GG +1.2%... Other news: RAD +8.6% (trading up in sympathy with LDG), MHGC +6.4% (Zabeel and Mubadala square up for Morgans hotels - Times of London), TS +2.7% (still checking), ASML +2.0% (still checking), HRB +1.2% (Ameriprise Financial to acquire H&R Block Financial Advisors for $315 mln).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: TWB -33.6% (also downgraded to Sell at Citigroup and downgraded to Underperform at Friedman Billings), PODD -14.5%, HQS -14.3% (light volume), SATC -10.9%, WCG -9.0%, DE -8.5%, CSIQ -7.8%, LIZ -7.0%, ERII -6.2%, SRX -5.4%, M -2.9%, CRME -2.0%... M&A news: CVS -3.9% (to acquire Longs Drug Stores for $71.50 per share)... Select airline/cruise-related stocks trading modestly lower: CUK -3.7%, CCL -3.0%, UAUA -2.9%, CAL -2.1%, AMR -1.6%, DAL -1.5%, LCC -1.5%... Select European financials trading lower following weakness overseas: RBS -5.4% (CBA pulls out of talks with RBS - Financial Times), LYG -4.5%, BCS -2.9%, UBS -2.3% (UBS chiefs knew of rule breaches - FT), DB -2.3%, HBC -1.7%... Other news: CAP -4.1% (prices offering of 2.25 mln common shares at $15.50/share), CBMX -3.4% (files for $100 mln common stock offering), BTI -1.8% (still checking)... Analyst comments: MDRX -5.5% (downgraded to Market Weight at Weisel), LVLT -3.5% (downgraded to Underperform at Oppenheimer), ARAY -3.1% (downgraded to Hold at Jefferies), FOSL -2.6% (removed from Focus List at Morgan Keegan), CCOI -2.1% (downgraded to Underperform at Oppenheimer), TJX -1.4% (downgraded to Hold at Lazard Capital), HLEX -1.2% (downgraded to Market Perform at BMO Capital Markets), CNSL -1.0% (downgraded to Neutral at Credit Suisse). -

Muideks... Baltic Dry Index on täna üleval. Esimest korda peale 10. juulit... Turu jaoks positiivne.

-

Energialeide tuleb ka ikka ette. Heller on täna RealMoney all SNG maagaasi hiigelleidu vahendamas:

Shares of Canadian Superior Energy (SNG:Amex) are up sharply today on the announcement of a natural-gas discovery off the coast of Trinidad. The company has indicated that this well, discovered while the company was testing the Bounty well, may be capable of producing 200 million cubic feet per day.

-

Mnjaa... Mootorkütuse niivõrd kiire vähenemine on kindlasti energiasektorit toetavaks teguriks.

Dept of Energy reports that crude oil inventories had a draw of 316K (Bloomberg consensus is a build of 300K); gasoline inventories had a draw of 6394K (Bloomberg consensus is a draw of 2150K); distillate inventories had a draw of 1759K (Bloomberg consensus is a build of 1950K). -

Nädalase kütusevarude raporti peale on toornafta futuurid rallinud juba +2.5% $115.80 barrel tasemele ning turul finantssektor jällegi väga nõrk. Energasektor on võimsalt põrkamas, XLE +2.75% ja tehnoloogiasektor on samuti ära vajumas.

-

Tehnoloogiasektor üritab kosuda ning kisub turgu ülespoole, finants on samuti taastunud päeva põhjadest. Naftafutuurid siiski püsivad pealpool $115.50 barrel taset. Kas turg suudab kosuda? Teatavasti aegusid eile ka finantssektori shortimise lisapiirangud.

There has been continued cautious broker comments related to the sector today, with Deutsche Bank cutting estimates on Lehman, Merrill out saying financial sector problems are far from over and that investors are underestimating scope of credit problems, and just in the past half hour Merrill downgrading GS, LEH and MS. Additionally, the SEC Emergency Order against naked shorting expired last night -- some of the weakness in the sector may be attributed to the expiration of this order, as it had protected a number of key financial stocks against naked shorting and its inception back in July coincided with a big rally in the sector... Finally, CNBC just reported that a global settlement regarding auction-rate securities case is imminent... Today's performance in the group stands as follows: XLF -4.1%, BKX -5.2%, BAC -7.7%, MS -7.5%, WB -6.8%, LEH -6.3%, UBS -5.6%, WM -5.6%, C -4.8%, WFC -4.3%, GS -2.4%.

-

Crude makes new highs at $116.68 on continued strength from the inventory data; currently higher by $3.49 to $116.50

-

GMKT GMarket shares see volume surge as EBAY takes a stake in Co

GMKT GMarket: EBAY SAYS SEEKING TO BUY INTERPARK'S STAKE IN S. KOREA'S GMARKET

Aktsia +5.46% $23.39 tasemel -

Fed's Stern says more high inflation data likely over near term

Fed's Stern says US economic activity to remain subdued into 2009 -

Google CEO Schmidt says on CNBC they are not splitting the stock

GOOG Google jumps 3 points as Cramer highlights the stock on CNBC; GOOG CEO Schmidt is a guest on today's mid-day Cramer show

Googlelt väga võimas liikumine -

eBay huvi Interparki 37%lise osaluse vastu Gmarketis (GMKT) on igati tervitatav. Võimalik, et kui eBay selle kätte saab, tuntakse huvi ka kogu ettevõtte vastu. Igaljuhul on need arengud Gmarketi (GMKT) investoritele vaieldamatult positiivsed. Kohe kindlasti soovitame aktsiaid edasi hoida ja neid mitte müüa allpool meie $28list hinnasihti.

-

Kui kellegile huvi pakub, siis PDO võiks olla lühiajaline short kandidaat, kodutöö peab ise tegema.

-

Toornafta futuurid kukkunud taas alla $116 barrel taseme ja turg rallinud korralikult ülespoole ning energiasektor samuti veel korralikult üleval.

-

NY AG Cuomo office would like to make announcement today on the auction rate securities investigation, but could be delayed

Cuomo's auction rate securities investigation largely focuses on three firms: WB, MER & to some extent MS. -

Lehman Brothers (LEH) peab läbirääkimisi Blackrock-iga, kes on potensiaalne $14 miljardi kinnisvaraga seotud laenude ostja.

Aktsia jõudnud juba tõusu +1.8% $16.50 tasemel.