Börsipäev 18. august

Kommentaari jätmiseks loo konto või logi sisse

-

Osta aktsiat, mida tahad omada

Tõnis Oja, Äripäev

18.08.2008 07:05

"See on aktsia, mida ma tahaksin omada," ütles uudisteagentuurile Bloomberg üks Berkshire Hathaway aktsionär, ehkki legendaarse Warren Buffetti juhitava ettevõtte aktsia hind oli selle aasta esimese poolega kaotanud viiendiku oma väärtusest. Tegemist oli aktsia kehvima poolaastaga alates 1990. aastast.

Long EEH here. -

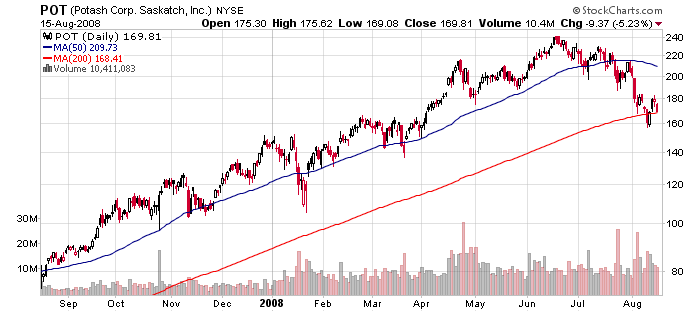

Citi on täna lisamas maailma suurima väetisetootja Potash Corp of Saskatchewan’i (POT) oma Top Picks Live nimekirja. POT’i aktsia on viimasel ajal pihta saanud koos materjalide/energiasektoriga, sest investorid kardavad globaalset nõudluse vähenemist. Samas on Citi analüütiku Brian Yu hinnangul olnud ajalooliselt nõudlus teraviljade suhtes madala korrelatsiooniga üldise majanduse olukorraga. Tsüklilisust on näidanud pakkumine, mitte nõudlus.

Citi on olnud tegelikult juba veebruari algusest ostusoovitusega väljas, kuid miks just nüüd lisada POT parimate ideede nimekirja? Reedel avaldatud statistika kohaselt langesid Põhja-Ameerika potasetootjate varud juulis 10% võrra kuu baasil mõõdetuna ja viimased fosfaatide hinnad kinnitavad tugevat nõudlust. Lisaks nähakse katalüsaatoritena:

1) Near-term earnings leverage to climbing ammonia/nitrogen prices (19% of profits).

2) A favorable potash contract settlement with China in late-08/early-09, lifting delivered pricescloser to spot values of $1,000/tonne vs ~$650/tonne.

3) The lagging Street earnings estimate of $21.28 in ’09 vs our estimate of $22.25.

Seetõttu kinnitatakse ostusoovitust hinnasihiga $264: We believe the sell-off is overdone and at 7x core ’09 earnings, POT is discounting a far worse earnings scenario than fundamentals indicate.

-

Barron’s on väljas negatiivse artikliga Fannie Mae (FNM) ja Freddie Mac’i (FRE) suhtes. Ajakirja andmetele tuginedes on vägagi võimalik valitsuse sekkumine täiendava kapitali kaasamiseks, mis aga jätaks praegused aktsionärid püksata:

Barron's reports it is growing increasingly likely that the Treasury will recapitalize Fannie Mae (FNM) and Freddie Mac (FRE) in the months ahead at taxpayer's expense, availing itself of powers granted it under the new housing bill signed into law last month. Such a move almost certainly would wipe out existing holders of the agencies' common stock, with preferred shareholders and even holders of the two entities' $19 bln of subordinated debt also suffering losses. An insider in the Bush administration tells Barron's Fannie and Freddie are being informally persuaded by the Treasury and their new regulator, the Federal Housing Finance Agency, to raise more equity. But government officials don't expect the agencies to succeed.

-

Toorainesektoris on tekkinud ostuhuvi. Maailma suurima kaevandustööstuse BHP Billitoni fiskaalaasta kasum kasvas 15%. Ettevõte tõstis ka oma dividendimäära. Esimese poolaasta kasum tõusis 30%, suuresti tänu kasvavale nõudlusele Hiinast.

-

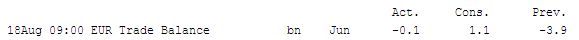

Eurotsooni kaubandusbilans oli juunis erinevalt konsensuse ootustest defitsiidis.

Eelmise aasta juunis oli euroala kaubandusbilansi ülejääk €7.5 mld eurot. Defitsiit on tekkinud peamiselt kolmel põhjusel:

a) kallimad kütusehinnad suurendavad energiadefitsiiti

b) euro on peamiste kaubanduspartnerite (USA ja UK) valuutade suhtes kallinenud

b) nõudlus ekporditurgudel on vähenenud

-

Nafta hinda on täna mõjutamas Kuuba lähistel moodustunud troopiline torm Fay, mis ähvardab kasvada orkaaniks ja vähendada tootmisvõimsust Mehhiko lahes (link). Toornafta hind on hetkel kerkinud 0.5% võrra $114.4 tasemele, üritades murda langustrendi. Lisan ka viimase nädala graafiku LHV Traderi vahendusel:

-

Notable Calls on samuti eelpool kajastatud Citi kommentaari üles korjanud: I think POT will get a boost on this call. One to watch today.

-

Times teatab:

Bradford & Bingley (B&B), the troubled buy-to-let mortgage bank, today said shareholders subscribed to 27.8 per cent of its £400 million rights issue, leaving almost 73 per cent with underwriters, Citigroup and UBS.

Aktsionäridest nõustusid ostma kõigest 27.8% B&B emissioonist (55p'ga). Hetkel kõigub aktsia ka ca 55 p juures.

-

Paar mõtet veel POT'i kohta.... ma arvan, et eelturul $173-ni ehk +2% kerinud hind ei ole enam atraktiivne. Ilmselt tasub oodata avanemisel väikest jõnksu alla, mis muudaks riski/tulu suhte paremaks.

-

Citi on ka päris huvitava kommentaariga SanDisk'i (SNDK) osas väljas:

Citigroup discusses SNDK, saying fresh pricing and product cycle data points jeopardize Street C09 ests, and contrast to a recent stock pop. The firm says contract pricing is tracking to a 22% drop in 3Q08, 2x worse than their SNDK royalty model (-10%). The firm's ests are unchanged though they see ~$0.30 of new risk and regard Street C09 estimates as very optimistic (Citi's 09 EPS est is -$0.30 vs consensus of $0.30). For sensitivity, they say every $0.05 in C09 EPS is worth $1.20 for the stock. They also do not buy the STX take-out chatter.

Tänu eelturu positiivsusele on ka SNDK hetkel +1% ja jõudnud $18 vastupanutaseme alla.... ma olen shortinud natukene @17.84, stop umbes 20c kaugusel. -

Bad Timing for the Bulls

By Rev Shark

RealMoney.com Contributor

8/18/2008 9:23 AM EDT

The bigger the summer vacation, the harder the fall.

-- Unknown

While there has been a surge in bullish rhetoric as commodity prices fall and the dollar strengthens, the overall market action has been mixed. The Nasdaq and the small-cap indices have shown some relative strength as technology and financial stocks attract buyers, but the DJIA and S&P 500 have lagged as oil and nature resources weigh more heavily on the senior indices.

Although the indices have been slowly inching up and may even be said to be climbing the proverbial Wall of Worry, the move has been on lower volume and is running into increased overhead resistance. This low-volume rise is characterized by some technicians as a "bearish wedge." There are few signs of major institutional accumulation, and these sorts of low-volume rallies are often susceptible to breaking down suddenly, because there is little underlying support.

The technical picture isn't that bad -- we could easily pull back a bit, find some support and build a base -- but it is not particularly supportive of much more upside in the near term. Some churning action would actually be quite positive as long as there is not too much of a pullback, but some of the bullish rhetoric lately has been over the top and that is always a negative.

The biggest challenge right now is that we are entering the slowest time of the year as traders take vacations in the waning days of summer. The last two weeks of August typically produce some of the slowest trading of the year, and with the mixed economic situation, that's a recipe for choppiness.

What has been most challenging about this market recently is that despite this great celebration over lower commodity prices and a strong dollar, the trading in many stocks has been extremely choppy. I don't think I have ever heard more complaints from traders in a market where the broad indices were acting pretty well. There have been few pockets of strong action and plenty of quick reversals and failed breakouts.

Many traders are feeling gun-shy, and in a lower-volume environment, that'll add to the choppy trading. The way to survive lately has been to be a short-term flipper, and that only intensifies the conditions that lead to this sort of trading.

So we enter the week with some better sentiment but mixed technical conditions and a difficult trading environment. That means we need to stay selective, trade smaller and watch for leadership to emerge.

We have a positive start shaping up as oil reverses its early gains and overseas markets perk up.

---------------------------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: FMCN +11.4%, SDTH +8.2%, TSL +2.7%, BHP +1.3%... M&A news: UB +11.5% (Mitsubishi UFJ Financial Group and UnionBanCal sign definitive merger agreement)... Select oil/gas stocks showing strength with higher crude: STO +2.9%, TOT +2.7%, RDS.A +2.0%, BP +1.5%... Select metals/mining names showing strength with higher spot prices and weaker dollar: GFI +5.1%, SLV +2.4%, MT +2.2%, AUY +1.4%, RTP +1.0%... Select solar names trading higher boosted by TSL results: SOLF +7.1%, SOL +4.0%, ESLR +1.7%, JASO +1.5%... Other news: DYAX +24.7% (announces DX-88 for hereditary angioedema meets primary and secondary endpoints in Phase 3 trial), RHD +14.4% (mentioned positively in Barron's), UBS +2.1% (UBS chairman is certain co will be independent in 2 years, according to report - Reuters.com)... Analyst comments: CDNS +4.7% (upgraded to Buy at Citigroup), POT +1.9% (added to Top Picks Live List at Citigroup).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: HSY-8.2% (downgraded to Hold at Citigroup and resumed with a Sell at Stifel Nicolaus)... M&A news: TTWO -7.4% (Electronic Arts issues update on offer for Take-Two; will allow tender offer to expire)... Other news: PMFG -41.8% (trading post split), FRE -8.9% and FNM -8.8% (Fannie Mae and Freddie Mac mentioned negatively in Barron's)... Analyst comments: BEAT -9.6% (downgraded to Hold at Citigroup and downgraded to Market Weight at Weisel), HBAN -3.4% (downgraded to Sell from Neutral at FTN Midwest). -

SNDK-st väljas @17.52.... +32c.

-

Euroopa ja Aasia põhiindeksid:

Saksamaa DAX +0.51%

Prantsusmaa CAC 40 +1.01%

Inglismaa FTSE 100 +0.69%

Hispaania IBEX 35 +0.66%

Venemaa MICEX -0.69%

Poola WIG +0.09%

Aasia turud:

Jaapani Nikkei 225 +1.12%

Hong Kongi Hang Seng -1.09%

Hiina Shanghai A (kodumaine) -5.33%

Hiina Shanghai B (välismaine) -7.53%

Lõuna-Korea Kosdaq -1.10%

Tai Set 50 -1.56%

India Sensex -0.53

-

Lehman Brothers (-4.58) langeb tugevalt. WSJ on Lehmani kriitika alla võtnud. FT sõnu käivad Lehman Brothersil siiski läbirääkimised $40 mld dollari suuruse hüpoteeklaenudega seotud portfelli müümiseks.

-

FMD tänane liikumine on muljetavaldav. Hmm, kas usk ärimudeli toimimisse hakkab taastuma. Tänaste uudiste järgi paistab Goldman Sachs FMD-s potentsiaali nägevat.

-

Sector ETF First Hour Leaders:

Gold Miners- GDX +3.0%, Ags.- DBA +2.8%, Silver- SLV +2.3%, Metals/Mining- XME +2.0%, Ag/Chem- MOO +1.8%, Commodities- GSG +1.3%, DBC +0.80%, Coal- KOL +1.2%Sector ETF First Hour Laggards:

Commercial banks- KBE -2.3%, Homebuilders- XHB -2.3%, Regional Banks- KRE -2.0%, RKH -1.9%, Finance- XLF -1.9%, IYF -1.4%, Nat. Gas- UNG -2.0%, Financial Services- IYG -1.9%, IAI -1.5%, Heating Oil- UHN -1.5% -

Sector ETF Midday Leaders:

Ags.- DBA +4.5%, Gold Miners- GDX +3.6%, Silver- SLV +3.0%, Ag/Chem- MOO +1.9%, Gold- GLD +1.7%, Metals/Mining- XME +1.4%Sector ETF Midday Laggards:

Regional Banks- KRE -3.6%, RKH -3.1%, Commercial Banks- KBE -3.4%, Homebuilders- XHB -3.4%, Finance- IYF -2.6%, XLF -3.2%, Financial Services- IYG -3.2%, IAI -3.0%, Semis- IGW -1.8%, SMH -1.9% -

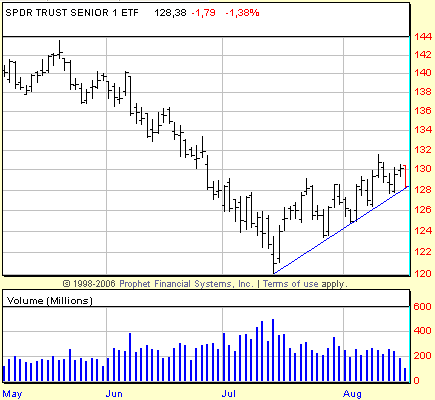

Et pildimaterjali väheks ei jääks, panen siia S&P500 liikumist kajastava SPY viimaste kuude graafiku. Tänane langus on viinud indeksi tagasi viimase kuu trendijoonele. Kui siit läbi kukutakse, on tõusu jätkumine keerulisem. Samas, tasub meeles pidada, et augusti paaril viimasel nädalal on palju turuosalisi puhkustel ning seetõttu võib kauplemine olla tavapärasest õhem ning ka trendijoontele tuleks seetõttu pisut vähem tähelepanu osutada.

-

Late Day Sector ETF Leaders:

Ags.- DBA +4.6%, Silver- SLV +2.4%, Gold Miners- GDX +2.2%, Gold- GLD +1.6%, Ag/Chem- MOO +1.1%, Commodities- DBC +0.60%, GSG +0.30%Late Day Sector ETF Laggards:

Homebuilders- XHB -4.1%, Regional Banks- KRE -3.6%, RKH -3.0%, Commercial banks- KBE -3.5%, Financial Services- IAI -3.3%, IYG -3.2%, Finance- IYF -2.8%, XLF -3.3%, Nat. Gas0 UNG -2.8%, Biotech- XBI -2.6%