Börsipäev 2. september

Kommentaari jätmiseks loo konto või logi sisse

-

Korea Arengupangal on ikka tõsine huvi Lehmani vastu ning esmaspäeval kinnitati oma soovi osta LEHis osalus. Tutvused on kahtlemata kasulikud, kuna Korea Arengupanga tänane CEO oli veel juunis Lehmani Lõuna-Korea Seouli haru juht ning teab seetõttu ettevõtet läbi ja lõhki. LEHi tulemused septembri keskel paari nädala pärast ning tundub, et enne numbrite avaldamist üritatakse lisakapitalisüst ikkagi kätte saada.

Teiseks hommikuseks teemaks on nafta. Nimelt Gustav väga suuri purustusi energiaplatvormidele ja infrastruktuurile kaasa ei toonud ning nafta pumpamine saab hoogsalt jätkuda. Tulemuseks musta kulla üle 5%line langus reedese hinnaga võrreldes ning barrel maksab ca $109. -

Austraalia Keskpank langetas täna oodatult inressimäärasid 7.25% pealt 7.0% peale. Tegu esimese langetusega pärast 7 aastat ning põhjuseks jahenev majandus. Nüüd peaks küll kõigile selge olema, et globaalne majandusjahtumine mõjub kõigile ning decoupling teooria on auklik nagu Šveitsi juust.

-

Nafta on viimastel minutitel läinud vabalangusesse ning punasel taustal vilgub -7.8% ja hind $106.5. Koos selle langusega jõudsid aktsiafutuurid poole protsendisest miinuset nulli tagasi.

-

Illustreeriv pilt ka siia juurde. Võrdlus S&P500 futuuride ja nafta liikumise vahel:

-

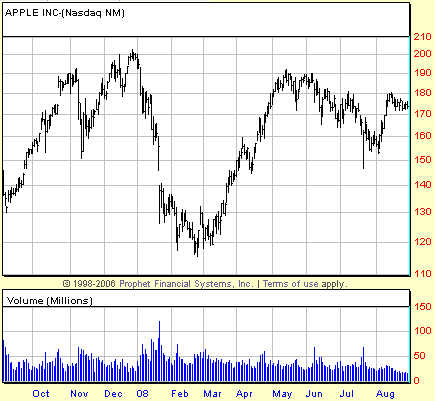

Piper Jaffrey on täna hommikul lisanud Apple'i (AAPL) Alpha Listi ehk nende ostusoovituste hulka, millesse neil on suurim kindlus ja veendumus. Kinnitatakse oma $250list hinnasihti. Huvi aktsia vastu peaks selline call aga tõepoolest genereerima.

-

Kui Katrina orkaani järel pidid kindlustusseltsid kindlustatud kahju hüvitama $41 miljardi ulatuses, millele lisandus $18 miljardit üleujutuste kindlustuste katteks valitsuse poolt (kokku $59 miljardit), siis Gustavi kahjudeks hinnatakse esialgsete andmete kohaselt $6 kuni $10 miljardit. Numbrid pole kuskilt otsast võrreldavad. Gustav jäi oodatust nõrgemaks ning ei tabanud ka New Orleansi linna - mida tihedam asutus, seda rohkem kindlustusnõudeid.

-

väike hõbeda ost 12.5ga

-

Nafta hinna langus on lisaks USA turule korralikku plussi vedanud ka terve Euroopa.

Saksamaa DAX +1.76%

Prantsusmaa CAC 40 +1.65%

Inglismaa FTSE 100 +0.42%

Hispaania IBEX 35 +1.77%

Venemaa MICEX -0.10%

Poola WIG +1.96%

Aasia turud:

Jaapani Nikkei 225 -1.75%

Hong Kongi Hang Seng +0.65%

Hiina Shanghai A (kodumaine) -0.88%

Hiina Shanghai B (välismaine) +0.31%

Lõuna-Korea Kosdaq -4.80%

Tai Set 50 -2.66%

India Sensex +3.80%

-

Looking for Consistency

By Rev Shark

RealMoney.com Contributor

9/2/2008 8:11 AM EDT

I have always been delighted at the prospect of a new day, a fresh try, one more start, with perhaps a bit of magic waiting somewhere behind the morning.

-- J.B. Priestley

It feels good to be back at my post this morning after some time away from the computer screens. I'm anxious to get back to work and seek out some good opportunities, but I need to get a feel for this market again before plunging back in. I carried very little exposure while I was on vacation, so I'm looking at things with a fresh eye and a very open mind. Clearing the decks is a great way to gain a fresh perspective.

As I reviewed the market action this weekend, the most striking thing was how choppy the action has been. There is no consistency from one day to the next. Part of that was a function of the low volume in late August, but when we have this degree of inconsistency, it is pretty clear that market players are extremely uncertain, lack conviction and are hypersensitive to news and events.

If we step back and take a look at the overall technical patterns in the major indices, there seem to be some promising developments brewing, as we have been holding above the July lows, but we don't seem to have much upside traction. We are churning quite a bit and could just as easily roll over again as deliver some more upside. It's a mixed picture with some minor positives.

When we dig a bit deeper, things are a bit more problematic. The good news is that financials have been holding up well, and the pullback in oil and commodities has boosted a few groups like airlines and truckers, but overall there is not much good upside leadership out there.

I went through hundreds of charts over the last few days looking for themes, and there just isn't a whole lot to get excited about. We have a few railroads, biotechs and a smorgasbord of other things that are acting OK, but there just aren't a lot of great charts or stocks that are showing sustained strength. There is little sector leadership, and the action in big-caps like Google (GOOG) and Research In Motion (RIMM) was very poor on Friday. Most notable, buying breakouts has not worked very well, and momentum traders have not had a lot to choose from. We just don't get much follow-through even when we do get a big day or two.

The shortage of good charts can remedy itself if the market can hold steady for a little while, but it tells us that there is no reason to be overly bullish at this point. I read a lot of comments from folks who are extremely anxious to declare the bear market over, but I see no reason other than hopefulness to believe that this market is out of the woods.

Overall, the market action has some positive aspects to it and holds some promise, but the lack of leadership and the paucity of positive chart setups mean that the market is still in "prove it" mode. I'm anxious to put some money to work, but I don't see a lot to choose from at this point. We shall see if that changes.

We have an interesting start to the week with a huge drop in oil and energy as Gustav fizzles out and does far less damage than many had anticipated. There is also some positive news in the financial sector boosting Lehman (LEH) and Merrill Lynch (MER) . So the bulls have some positives to start things off, but the one great certainly lately has been the total lack of consistency from one day to the next. Until that changes, this market is going to be extremely challenging.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: DHT +4.9%... M&A news: SCRX +58.3% (acquired by Shionogi & Co for $31/share in cash), ISH +21% (Liberty Shipping proposes to acquire International Shipholding for $25.75 per share in cash)... Select airlines showing strength with crude sharply lower: LCC +17.2%, AAI +15.4%, AMR +14.7%, UAUA +14.6%, NWA +11.1%, RYAAY +9.9%, CAL +9.8%... Select mortgage/financial names showing strength: FRE +8.0% and FNM +6.4% (following another weekend without any major negative developments on FNM & FRE; also a NY Times Dealbook story said Fannie Mae and Freddie Mac should merge), PMI +5.8%, LEH +5.5% (Korea Development Bank confirms it is in talks to invest in Lehman - WSJ), WB +4.3%, C +2.9%, DB +2.6%, MER +2.3%, GS +2.1%, JPM +2.0%... Other news: IRBT +11.4% (awarded $200 mln ceiling IDIQ U.S. Army contract for robotic systems, spare parts and accessories), GRRF +11.0% (won centralized bid to supply CDMA wireless coverage products to China Telecom)... Analyst comments: PCLN +3.8% (upgraded to Outperform from Neutral at Credit Suisse), LOW +2.5% (upgraded to Buy at Goldman -Bloomberg), AAPL +1.6% (added to Alpha List at Piper).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: XIN -15.2% (light volume)... Select oil/gas stocks showing weakness with crude sharply lower: STO -8.7%, BP -5.4% (Chesapeake Energy and BP America announce Fayetteville Shale joint venture), TOT -5.0%, RDS.A -5.0%, HK -4.7%, E -4.2%, OXY -4.2%, APC -4.0%, COP -3.4%, DVN -3.3%, APA -3.0%, CVX -2.9%, XOM -2.7%... Select metals/mining names showing weakness with lower spot prices and strength in dollar: AAUK -11.7%, GOLD -10.3%, RTP -9.9%, BHP -9.2%, AEM -7.9%, GFI -7.7%, AU -7.7%, AUY -7.6%, SSL -7.3%, MT -6.2%, ABX -4.9%, NEM -4.7%, FCX -4.3%, PAL 3.9%, GLD -3.8%... Select agriculture names showing weakness: POT -4.1%, MOS -4.0%, SYT -3.3%, CF -3.2%, AGU -2.6%, BG -1.7%... Other news: FRO -10.8% (trading ex-dividend), NOK -3.3% (still checking), SGP -2.6% (Schering-Plough, Merck's Vytorin may be linked to cancer deaths - Bloomberg.com)... Analyst comments: ESV -4.1% (downgraded to Underweight at JPMorgan), GILD -2.1% (downgraded to Neutral at BofA). -

Goldman Sachs jätkas Bank of America (BAC) katmist buy reitinguga.

-

Kes nüüd mu neljapäevase loo peale Gustaviga seotud võimalike liiga kõrgete ootustega energiasektorit lühikeseks müüs või sellest kasu saamiseks näiteks DUGi ostis, siis oli seda võimalik teha pool päeva allpool hinda $33. Nüüd oleks võimalik väljuda 15% kõrgemalt hinnaga ca $37.5ga. Muidugi võimalik, et langus sektori ettevõtetes läheb veel edasi, kuna näiteks maagaasi hind on tänaseks jõudnud tasemele, kus ei tasu enam tootmist suurendada, kuid tasemeteni, mil tootmist tuleks ettevõtetel kinni panema hakata, on veel ruumi küll. Minu jaoks tähendaks tootmise vähendamine maagaasisektoris aga ostukohta (nagu ta on ajalooliselt ka viimasel kolmel aastal kaks korda olnud). Hoiame silmad lahti.

-

Sector ETF First Hour Strength:

Homebuilders- XHB +3.4%, Cons Disct.- XLY +3.2%, VCR +2.9%, Retail- RTH +3.0%, XRT +2.9%, Commercial Banks- KBE +2.8%, Telecom- IYZ +2.5%, Financial Services- IYG +2.5%, IAI +2.2%, Regional Banks- KRE +2.5%, RKH +2.5%Sector ETF Fisrt Hour Weakness:

Coal- KOL -7.8%, Nat Gas- UNG -6.8%, Gold Miners- GDX -6.5%, WTI/Crude oil- OIL -5.9%, USO -5.3%, Silver- SLV -5.8%, Gas- UGA -5.5%, Commodities- GSG -5.3%, DBC -3.9% -

Midday Sector ETF Strength:

Homebuilders- XHB +2.9%, Retail- XRT +2.8%, RTH +2.6%, Regional Banks- KRE +2.5%, RKH +2.0%, Cons Disct- XLY +2.5%, VCR +2.2%, Commercial Banks- KBE +2.5%, Telecom -IYZ +2.0%Midday Sector ETF Weakness:

Coal- KOL -8.5%, Nat gas- UNG -8.4%, Metals/Mining- XME -7.5%, Steel- SLX -6.7%, Gold Miners- GDX -6.4%, WTI/Crude oil- OIL -5.7%, USO- 5.1%, Gas- UGA -5.4%, Solar Power- KWT -5.3%, TAN -5.3% -

Senini aktsiaturgudel väga nõrk esitlus langeva naftahinna taustal, käibed on ka üsna korralikud, kuid päev pole veel läbi.

-

U.S. offshore oil output could return to 100% in 2 weeks, U.S. Interior Secretary - Reuters

No visible signs of oil platform damage in gulf of mexico, according to U.S. Interior Secretary - Reuters

Storm Hanna stalled for now, intensity hard to predict, according to U.S. Emergency Chief - Reuters -

Lehman Brothers: Moody's takes action on certain Lehman Alt-A deals - Reuters

Moody's has downgraded the ratings of 129 tranches from 7 Alt-A transactions issued by Lehman Mortgage Trust. One tranche was placed on review for possible downgrade. Additionally, 12 tranches were confirmed at Aaa. The collateral backing these transactions consists primarily of first-lien, fixed-rate, Alt-A mortgage loans. Ratings were downgraded, in general, based on higher than anticipated rates of delinquency, foreclosure, and REO in the underlying collateral relative to credit enhancement levels. Certain tranches were confirmed due to additional enhancement provided by structural features.

Lehman hetkel tagasi nulli jõudnud, mis edasi? -

Sector ETF Strength in Late Trading:

Homebuilders- XHB +2.2%, Regional Banks- KRE +2.1%, RKH +1.7%, Commercial Banks- KBE +2.1%, Retail- RTH +1.8%, XRT +1.7%, Cons Disct- XLY +1.9%, VCR +1.4%Sector ETF Weakness in Late Trading:

Nat Gas- UNG -8.7%, Coal- KOL -8.0%, Metals/Mining- XME -7.5%, Steel- SLX -6.8%, Gold Miners- GDX -6.4%, Solar Power- TAN -6.2%, KWT -5.3%, Energy- XLE -5.1%, IYE -4.6%, WTI/Crude oil- OIL -4.7%, USO -4.1% -

Lehman Brothers (LEH) management to address investment management division, co will give status report tomorrow after the close - CNBC