Börsipäev 9. jaanuar

Kommentaari jätmiseks loo konto või logi sisse

-

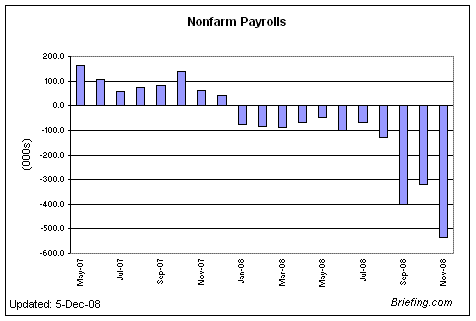

Täna kell 15.30 avaldatakse USA tööjõuraport, konsensus ootab töötusemäära tõusmist 7%-ni. Prognooside kohaselt kaob detsembris 550 000 töökohta, karusema vaatega analüütikud on pakkunud ka kuni 800 000 töökoha kadumist.

-

Lisan meeldetuletuseks graafiku ka senistes trendidest USA tööjõuturul.

-

The Real Unemployment Number 12.5% —We are 1/2 Way To A Depression

December 5, 2008

The Government just released the unemployment numbers for November 2008.

The published unemployment rate is a gloomy 6.7%.

If you feel like more than 6.7% of people are out of work, you are right. As CWN pointed out months ago (see related story below) the actual number of people out of work is much higher. If you count workers who have been out of the workforce for more than a year or who have given up hope of finding a job, the real unemployment number is a staggering 12.5%.

During the Great Depression the unemployment rate climbed to 25%. Yes, we are half way there!

http://www.consumerwarningnetwork.com/2008/08/18/why-you-can’t-believe-government-statistics-part-1-the-real-unemployment-rate/ -

December Nonfarm Payrolls -524K vs -525K consensus, prior revised to -584K from -533K

-

Ja töötusmäär tõuseb 6.7% pealt 7.2%ni.

-

Pisut põhjalikum info raporti ja 2008. aasta USA tööjõuturu muutuste kui terviku kohta on toodud minu artiklis siin.

-

USA turud alustavad päeva 0.3%lise plussiga. Nafta 2% punases $40.9 peal.

Saksamaa DAX +0.73%

Prantsusmaa CAC 40 +1.08%

Inglismaa FTSE 100 +0.36%

Hispaania IBEX 35 +0.24%

Venemaa MICEX N/A (börs suletud)

Poola WIG -1.09%

Aasia turud:

Jaapani Nikkei 225 -0.45%

Hong Kongi Hang Seng -0.27%

Hiina Shanghai A (kodumaine) +1.42%

Hiina Shanghai B (välismaine) +1.43%

Lõuna-Korea Kosdaq +0.55%

Tai Set 50 -1.60%

India Sensex 30 -1.88%

-

Waiting for the News

By Rev Shark

RealMoney.com Contributor

1/9/2009 7:54 AM EST

He who laughs has not yet heard the bad news.

-- Bertolt Brecht

The primary focus of the market today is going to be the monthly jobs report. It is expected that the number of nonfarm jobs decline by around 500,000. Some estimates are higher and some lower, but it should be pretty hefty number.

If you have been paying attention to the headlines, that isn't all that surprising. We are obviously mired in one of the worst economies since the 1930s. We already know things are bad and may indeed become worse, especially on the employment front. However that doesn't necessarily mean that the market is going to continue the ugly downtrend that we endured last year.

For market investors, the key issues boil down to expectations and psychology. A lot of folks believe that expectations for the economy and the upcoming earnings season are already quite low and that we are therefore unlikely to have any major surprises.

Even the folks who aren't so sure that we have correctly anticipated the bad news are inclined to buy when bad news hits, because it is the trade that has worked well recently. It really hasn't matter that much to the market lately that a major retailer like Wal-Mart (WMT) warns or that President-elect Obama is going to deal with a federal deficit far beyond anything we've ever seen. Traders have made money by buying the bad news so that is what they are going to do. I've already heard a number of traders say they are looking to buy any weakness created by the jobs report this morning. That has been the right move psychologically even when expectations have been too high.

One of the big things helping the bulls right now is that the technical condition of the charts is in good shape. We have a good base of support established during December, and the pullback on Wednesday wasn't bad enough to do much damage. We are now sitting at support, and we saw late yesterday afternoon that there was some desire to add long exposure, even with the important economic news coming this morning.

We would probably be better off if there weren't so many looking to shrug off the jobs report no matter what it might be, but if that sentiment continues, we have a technical pattern that will support upside.

Overseas markets were a bit weak overnight with mining shares leading to the downside, but gold is up and oil down as we await the economic news.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: APOL +11.6% (also target raised to $104 at Stifel Nicolaus), MDRX +9.4%, AMMD +6.7%, HWAY +6.3% (also upgraded to Hold at Jefferies), IHS +5.5%, SNX +5.3%, GIS +1.0%... Select drybulk shippers showing strength as Baltic Dry Index extends rally for fourth day: OCNF +6.3%, DAC +6.2%, NM +6.2%, EXM +5.7%, DRYS +5.1%, EGLE +4.7%, GNK +4.3%, DSX +3.3%, TBSI +2.3%... Other news: YRCW +15.2% (Teamsters overwhelmingly vote 'Yes' to modify current contract with YRC Worldwide), IO +9.5% (modestly rebounding from yesterday's 25%+plunge), RBS +3.9% (still checking), AZN +2.1% and GSK +1.9% (still checking for anything specific), YHOO +1.7% (Yahoo! nears end of search for a CEO - WSJ)... Analyst comments: PALM +14.6% (upgraded to Buy at Morgan Joseph), BBI +8.0% (initiated with a Buy at Roth Capital).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: GBX -41.6% (light volume) WSCI -33.6%, EBS -11.4%, HNSN -10.9%, ASIA -6.8%, CVS -6.3%, COH -5.5% (also downgraded to Neutral at boutique firm), SCSC -3.8%, IN -1.8% (light volume), ARG -1.5%... Select metals/mining names showing weakness: AAUK -5.2% (downgraded to Hold at Deutsche), MT -3.0% , RTP -2.5% (downgraded to Hold at Deutsche), GG -1.3% (downgraded to Market Perform from Outperform at BMO Capital), ABX -1.3%... Other news: OREX -34.6% (announces that the first of four Phase 3 trials of its lead investigational product Contrave met its co-primary and key secondary endpoints), BPZ -13.5% (BPZ Energy and Shell discontinue talks on farm-out agreement), ANDS -9.8% (modestly pulling back after yesterday's 200%+ surge), SI +3.9% (still checking), NVS -2.8% (still checking), XNPT -2.3% (Xenoport and GSK resubmit New Drug Application for Solzira in restless legs syndrome)... Analyst comments: ENOC -4.5% (downgraded to Underperform at Jefferies), ALU -4.2% (downgraded to Equal Weight from Overweight at Morgan Stanley), Q -3.2% (downgraded to Equal Weight from Overweight at Morgan Stanley), PCX -3.0% (initiated with Sell at Citigroup), DOV -2.9% (downgraded to Hold at Deutsche), GD -2.3% (downgraded to Neutral at Goldman - DJ), SYK -1.8% (downgraded to Underweight from Equal Weight at Morgan Stanley); Select airlines seeing weakness following BofA/Merrill downgrades: JBLU -3.0%, UAUA -2.6% and CAL -1.8% (downgraded to Neutral at BofA/Merrill) and AAI -2.7% (downgraded to Underperform at BofA/Merrill). -

EUR/GBP on langenud 850 pipsi 9 päevaga. 0.9750 pealt 0.8900 peale. Seda ei juhtu just iganädal.

Kas on oodatada põrget 0.9400 kanti tagasi lähimate nädalate jooksul või on see langus tugevam ja liigub veelgi alla ? -

Mnjah...Octopus. Olemegi turgudel, kus liikumised ei sarnane iganädalastele. Nafta üleeilne -12%line langus oli selle väga heaks tunnistajaks.

BoE on oma intressiotsuse teatavaks teinud ning kärpis määrasid 0.5% võrra. ECB samm tuleb järgmisel neljapäeval. -

Pisut subjektiivsust foorumisse. S&P500 futuurid 890 punkti peal. Minu arust risk-rewardi poolest sellelt tasemelt täna ülespoole liikumiseks šansid paremad.

-

Paulson päästab turu??!? :D

-

Rambus Inc. (RMBS) saab kõvasti müüki peale Bloombergis ilmunud artiklit, kuigi kohtusaaga peaks saama avalöögi alles 19. jaanuar. Hetkel kauplemas alla $11 usd taseme näidates juba -41% langust.

-

RMBS Rambus: Color on Stock Action (11.06 -7.44)

Rambus shares have fallen 40% intraday (on almost 7x average volume) on news of an unfavorable court ruling in its ongoing battle with chip makers. Bloomberg.com reports that a federal judge ruled Rambus can't use a dozen of its patents to demand royalties from DRAM maker Micron (MU 3.28 -0.13). The U.S. District Judge determined that the patents were unenforceable because Rambus destroyed documents in the infringement lawsuit.

Kergelt ekslik oli esialgne info. Kohus otsustas MU kasuks ning 19.jaanuaril algaval protsessil hakatakse ka ülejäänud patentide kautusõiguse üle vaidlema. -

Rambus confirms that the court declared its patents in suit unenforceable in Micron Delaware case (11.57 -6.93)

Co confirmed that the U.S. District Court of Delaware in the patent infringement matter with Micron Technology (MU) has found that Rambus cannot pursue its claims against Micron due to spoliation. The judge determined that Rambus executed its document retention policy during a time when it anticipated litigation. "We respectfully, but strongly, disagree with this opinion, and at the appropriate juncture plan to appeal," said Tom Lavelle, senior vice president and general counsel at Rambus. "This opinion is highly inconsistent with the findings of the Court in the Northern District of California which looked at the same conduct and found there was nothing improper with our document retention practices. We are confident in the strength of our position and will continue to vigorously pursue fair compensation for the use of our patented inventions." -

S&P 2009 Earnings estimate per share is 42.24

paistab, et saab juba PE 15'ga 600 kätte