Börsipäev 13. veebruar

Log in or create an account to leave a comment

-

13. kuupäevi on aastas 12, reedeid on iga 7 päeva tagant. Seega keskmiselt võiks olla aastas reede ja 13.-ndaid 1.7 tükki. Kuna selliste kuu- ja nädalapäevade kombinatsioonid ei ole just kuigi tihedad, siis ilmselt selle tõttu inimesed kipuvadki neil päevil tavapärasest ebausklikumad olema. 2009. aastal on ebausklikke inimesi aga õnnistatud - 13. ja reedeid on meil sel aastal lausa 3 tükki (13. veebruar, 13. märts ja 13. november), mis on ka maksimaalne võimalik selliste kuu- ja nädalapäevade kokkusattumiste arv aastas. 2009. aastale sarnaselt on kolme 13. ja reedega rikkad veel aastad 1998, 2012, 2015, 2026 ja 2037.

-

Tuletan meelde, et esmaspäeval on turud USAs Presidentide päeva tõttu suletud, seega ees ootab pikk nädalavahetus.

-

Hea koht, igaks-juhuks posse kinni panna? ;-)

-

The fear of Friday the 13th is called paraskavedekatriaphobia.

Another theory about the origin of the superstition traces the event to the arrest of the legendary Knights Templar. According to one expert:

The Knights Templar were a monastic military order founded in Jerusalem in 1118 C.E., whose mission was to protect Christian pilgrims during the Crusades. Over the next two centuries, the Knights Templar became extraordinarily powerful and wealthy. Threatened by that power and eager to acquire their wealth, King Philip secretly ordered the mass arrest of all the Knights Templar in France on Friday, October 13, 1307 - Friday the 13th. -

Saksamaa Q4 GDP kukkus 2.1% võrreldes Q3-ga, konsensus ootas langust 1.8% võrra.

-

Euroala GDP kukkus oodatust 0.2% rohkem 2008 aasta viimasel kvartalil. Konsensus ootas 1.3% langust, mis suurenes Saksamaa, Prantsusmaa, Itaalia ja Hispaania GDP oodatust järsema kukkumisel tausatal 1.5%-ni. 2008 aastal suudeti euroalas kokku näidata 0.7% GDP kasvu.

-

Hollandi tulbimaania kordus Hiinas - Pu'eri tee hinnamull.

-

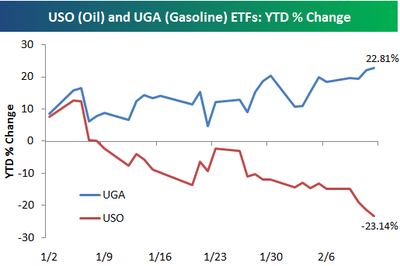

Rafineerijate halva tuju tõttu ei ole bensiini hind naftaga võrreldavas tempos langenud, vaid on beskope.com'i arvutuste kohaselt aasta algusest hoopis tõusnud 23%:

-

USA turud on päeva alustamas ettevaatlikult. Eileõhtuse miinused kustutanud tugeva ralli järel on S&P500 -0.6% @830 punkti, Nasdaq -0.6% ning nafta +1.8% @ 34.6.

Saksamaa DAX +0.54%

Prantsusmaa CAC 40 +1.45%

Inglismaa FTSE 100 +0.17%

Hispaania IBEX 35 +1.39%

Venemaa MICEX +4.77%

Poola WIG +0.51%

Aasia turud:

Jaapani Nikkei 225 +0.96%

Hong Kongi Hang Seng +2.47%

Hiina Shanghai A (kodumaine) +3.24%

Hiina Shanghai B (välismaine) +2.89%

Lõuna-Korea Kosdaq +2.53%

Tai Set 50 +1.43%

India Sensex 30 +1.78%

-

Lack of Leadership

By Rev Shark

RealMoney.com Contributor

2/13/2009 8:43 AM EST

Leadership is a matter of having people look at you and gain confidence, seeing how you react. If you're in control, they're in control.

-- Tom Landry

Despite all the government action, economic news and loud debates, the key to this market is one rather simple thing: Investors have little confidence. You can see this in the sentiment, the reaction to news and in the charts.

Considering that we hear stories every day confirming that this is the worst economic crisis since the Great Depression, it would be surprising if market players were feeling fat and happy. We are unlikely to see the sort of confidence that flourishes in a bull market for a while, but what we might see -- and what we have to watch for -- is greater hope that some of these government moves may be meaningful.

Even if you have little confidence in the bank bailouts and stimulus spending, as I do, they can still have a positive impact on the market for a period of time by affecting the mood of the market. We don't even need any real belief in the merits of these plays. We just need to have folks believe there are others who do. After the ugly downside action we have had, no one wants to be left behind when we finally do see better action, so a little spark of confidence can get things moving if the news flow improves and a small group of people start to believe that something substantive is really being done on the economic front.

As always, we need to let the market be our guide. The huge late-day reversal yesterday on news of a housing bailout plan pulled us back from some technical danger. The S&P 500 was looking set to close below a key technical line that connected the bottoms in November, January and February, but the index recovered just in the nick of time. A one-day reversal like that is a positive, but we are still just barely hanging onto these support levels. There is no good upside momentum, and charts of individual stocks are not very interesting.

I harp on this quite often because it is so important: We need leadership. Some of the big-cap technology stocks like Apple (AAPL) , Google (GOOG) and Baidu (BIDU) have been acting a bit better, but there aren't any pockets of momentum out there. It is when those pockets start to spread to other sectors of the market that we see good, solid, lasting uptrends build. So far, there is no sign of that happening, which means we have to stick to the daytrading if we want to play. If you are longer term, there still is little reason to be jumping in here.

We have a mild start this morning as investors contemplate this new mortgage plan but also struggle with more and more poor economic news and worries about banks. I'm looking for a choppy but relatively quiet day compared to yesterday.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CSTR +12.6%, VCLK +10.7%, RACK +9.5% (also announces $40 mln stock repurchase program), CTSH +8.3%, WYN +7.4% (also discloses that it will initiate $200 mln equity sales program), ANF +4.4%, MFE +2.8%, ENB +2.3%, SONO +2.0%, E +1.7%, PEP +1.5%... Other news: MELA +104.0% (announces positive top-line results form MelaFind trial), YRCW +9.1% (finalizes bank amendment), SIRF +7.3% (still checking), JASO +5.9% (announces update on strategic alliance with BP Solar), LVS +5.2% (modestly rebounding from yesterday's 15% drop)... Analyst comments: DFT +6.4% (upgraded to Buy at BofA/Merrill), SIGM +5.9% (upgraded to Outperform at Baird), STM +4.4%, WFR +2.7% and TXN +1.8% (upgraded to Neutral at UBS), PFCB +3.5% (upgraded to Outperform at William Blair), PALM +2.9% (initiated with Outperform and $11 tgt at Credit Suisse), ASML +2.8% (upgraded to Buy at Deutsche), V +2.0% and MA +1.4% (upgraded to Outperform from Underperform at Cowen), MRVL +1.5% (initiated with a Buy at ThinkEquity- tgt $10).

Allapoole avanevad:

Gapping downIn reaction to disappointing earnings/guidance: LYG -31.3% (sees adjusted pretax profit of GBP1.3 bln; sees core Tier 1 Capital ratio 6-6.5% at Dec 31 - DJ), AMKR -9.4% (light volume), CAKE -7.1% (also downgraded to Sell from Neutral at Piper Jaffray), COGO -6.0% (also downgraded to Neutral from Positive at Susquehanna Financial), COG -5.3%, PNRA -3.7%, SHO -3.1%... Select financials under pressure: RBS -12.7%, AIB -12.1%, FITB -6.8%, HBAN -5.5%, MTU -3.7%, BAC -3.6% (downgraded to Hold at Argus), JPM -3.3%, WFC -3.2% (announces 4th quarter 2008 non-cash charge for preferred securities), UBS -2.3%, HBC -2.1%, MS -1.7%, GS -1.4%... Select stem cell related names trading lower: GERN -12.5% (filed an 8-K discussing a European patent decision from November; also chatter of a spot secondary offering being priced below current levels), ASTM -5.8%, STEM -3.4%... Select metals/mining names showing weakness: GOLD -4.0%, AAUK -3.6%, AU -2.6%, AUY -2.1%, ABX -1.7%, GLD -1.2%... Other news: SVNT -28.2% (announced that the co filed amendments to strengthen and clarify the data included in the previously submitted pegloticase Biologics License Application), JAH -7.5% (still checking), ITMN -6.5% (prices common stock offering - 3.5 mln shares at $17.96), CAL -5.1% (still checking), PVX -4.9% (reduces cash distribution to $0.06 per unit from $0.09 per unit; lowers capital budget), AAV -4.9% (approves reduction in the cash distribution for the month of February 2009 to $0.04 per Unit from the current $0.08 per Unit), LPHI -4.6% (Cramer makes negative comments on MadMoney), MDT -1.8% (Judge failed to disclose son's tie to MDT - WSJ)... Analyst comments: EGLE -5.8% (downgraded to Sell at Cantor Fitzgerald), JAVA -5.6% (added to Americas Conviction Sell list at Goldman- Reuters), BWA -4.0% (downgraded to Underperform at Baird), LNCR -3.0% (downgraded to Sell at UBS), NVDA -1.3% (downgraded to Neutral from Buy at Goldman- Reuters), RIMM -1.2% (downgraded to underperform at Credit Suisse). -

February University of Michigan-prelim 56.2 vs 60.2 consensus, prior 61.2

-

Eriliseks joonetõmbajaks ennast ei pea, kuid kuna foorumlaste huvi on selle vastu olnud, siis panen siia kolme indeksi - Dow Jones, Nasdaq ja S&P500 - liikumist üha kitsenevas vahemikus hoidvad pildid ka siia.

-

Ja sellised pildikesed peaks reeglina allapoole murduma ...

-

Ütleme nii, et sellised pildid peaks reeglina murduma. Selle kohta kas alla või üles, reeglid puuduvad.

-

Uudistevoogu vaadeldes oleks nende murdumine alla justkui paremini põhjendatud. Justkui.

-

Sellised pildid liiguvad alati vasakult paremale, muu peale kindel ei oleks.

-

Reegel on just see, et murdub trendi suunas, mis on allapoole.

-

Jajah porgandil tulevad juured ikka allapoole.

-

Ma ei tea, mis need porgandid siia puutuvad, aga ülal eksponeeritud pildikeste jaoks on õpikud olemas.

-

kuskil foorumis kirjutati, et nüüd pidid ju lisaks ka sisse ja väljapoole liikuma

-

Rising wedge reeglina alla ja vastupidi. Symmetrical triangle kohta kindel suundumus puudub.

-

tauts, konkreetset statistikat on näidata selle "reeglina" kohta?

-

Tänase kauplemispäeva esimene pool on igaljuhul täielik eilse päeva kopeering - alustatakse päeva gap downiga, liigutakse väiksesse plussi ning vajutakse seejärel päeva alguse põhjade juurde tagasi... Kas pika nädalavahetuse eel on karud eileõhtuse ralli tõttu pisut hellad ning jätavad selle reede müügilaine vabaks?

-

Flags and pennants are among the most reliable of continuation patterns and only rarely produce a trend reversal.

John J. Murphy -

Merrill Lynch on täna langetanud oma S&P500 kasumiprognoosi 2009. aastaks $56 pealt $46 peale ning 2010. aastaks $63 pealt $55.5 peale. Kui see oleks reaalsus, siis P/E '09. oleks 18x ning '10. aastal 14.9x.

-

on see vähe või palju ?

-

USA mehed on ikka täielikud naljamehed :)

-

Selle allapoole murdmise koha pealt soovitan võtta S&P 500 graafiku perioodil aprill 2002-aprill 2003 ja mõelda, kuhupoole pidi turg murduma.

-

Ega seda allapoole murdumist ei pruugi juhtuda, sest tegemist ju erakorralise juhtumiga, kus riik täiega sekkumas. Ilmselt on aja küsimus, kas enne börs kukub või jõuavad abipaketid abivajajateni, mis viskab indeksid üles (ja seab dollari surve alla).

-

millised ennustused tänase päeva suhtes??? + või -

-

Ja nüüd müüma, sest ei tasu kõrgeid lootusi panna.

Kino jätkub -

kas te olete tähele pannu mida VIX täna on teinud?

esiteks esimene suurem laks üles tuli koos turu ralliga :-0?

ja pärast seda on mingi väga segane tõmblemine

kas need kiired lükked on seotud mingite suuremate optsioonide liikumistega, mis korraga tehakse ? -

Joel, ma oled veel liinil ?

mida sa arvad ML S&P prognoosidest? -

speedy

Kõigepealt see uudis:

13:45 White House says Obama to outline foreclosure plan Wednesday - DJ

Mis turud rallima pani ja see uudis:

14:05 White House warns against "unreasonable expectations" regarding housing plan - Reuters

Mis turud alla tõi

Puhas uudiste mäng -

stocker

sa ikka graafikule vaatasid? vist mitte -

Mida ma vaatama pidin?

Peaaegu eilse koopia -

House Approves Stimulus With No Republican Support

The vote was 246 to 183, reflecting the Democrats considerable majority and the Republicans deep dissatisfaction with the $787 billion package. -

US

selle põrke ootamise koha pealt soovitan vaadata DJ või S&P graafikut perioodil aprill 30 kuni aprill 32 -

stocker

ma näen midagi muud, ...aga mis seal ikka -

speedy,

Kui Merrilli 2010. aasta prognoosida uskuda, siis 14.9x minu arvates ei ole palju. Aga väga raske niivõrd segastes majandusoludes midagi uskuda... -

Ok, vaatsin graafikut.

SPY

Kuu aega on tõmmeldud 80 ja 88 vahel.

Kui murdub, siis sinnapoole visatakse ja tugevalt.

Seni- 81 ost ja 87 müük. -

Stocker,

ma rääkisin tänasest VIX päevasisestest liikumistest -

see on ikka super kuidas suckeritega mängitakse

iga päeva lõpus lastakse jaole, et saaks järgmine päev jälle kõrgemalt suruma hakata -

Speedy - VIX - järgmine nädal lõppevad optsioonid, sellest volatiilsust ning kuna pikk nädalavahetus tuleb, siis seetõttu VIX ei tõuse nii palju kui muidu sellise valdavalt punase päeva peale.

-

Vaadates 5 veebr. börsipäeva, siis karud võitsid.

-

Kas ma olen ainuke idioot, kellel PetroChina pikas perspektiivis praegusel tasemel huvitav tundub?