Börsipäev 15. aprill

Log in or create an account to leave a comment

-

Hoolimata turu eilsest nõrkusest jätkas Imax (IMAX) oma rallit, põhjuseks viimase aja positiivsed sõnavõtud aktsia suhtes ning Monsters vs Aliens avanemistulud. Eile tõusis aktsia koguni 8%, kuid nii kiire tõus ei ole tavaliselt jätkusuutlik. Meie pikaajaline siht $6.5 juures jääb siiski paika.

-

Täna kell 15.30 teatatakse märtsikuu tarbijahinnaindeksi muutus, mille põhiosalt oodatakse näitu +0.1% ning tervikosalt +0.1%. Veebruaris olid need vastavalt +0.2% ja +0.4%. 15 minutit enne börsi avanemist tuleb märtsikuu tööstustoodangu muutus. Kui veebruaris langes see -1.4%, siis märtsilt oodatakse -0.9%list langust.

-

Täna enne turgu peaks oma tulemused teatama ka kivisöesektorist Peabody Energy (BTU). Tulusid oodatakse $1.635 miljardit ning EPSi $0.97.

-

Fidži teatas täna valuuta 20%lisest devalveerimisest.

-

USAs staaritsenud finantssektoril võeti eile hoog küll maha, ehk tuleb täna lisa. Euroopas takerdus finantsi ralli UBSi kasumihoiatuse taha, pank ootab esimese kvartali kahjumiks $1.8 miljardit.

-

Huvitavad arengud:

MBA Mortgage Applications 21.2% vs 5.95% Prior -

Madis, siin on veidi teine statistika

NEW YORK, April 15 (Reuters) - Mortgage applications to finance the purchase of homes and to refinance existing loans fell last week even as U.S. home loan rates treaded water just above record lows, the Mortgage Bankers Association said on Wednesday.

Requests for new loans dropped in the Good Friday holiday week after five straight weekly increases.

"The MBA does not provide a holiday adjustment for the Easter/Passover weekend, which may have contributed to this week's decrease in application volume," the trade group said in a statement.

During the prior five-week run, average 30-year mortgage rates sank by as much as a half percentage point before starting to trend up again.

The total mortgage applications index fell 11 percent in the week ended April 10 to a seasonally adjusted 1,113.2. The purchase index fell 11.3 percent to 264.1 and the refi index dropped 10.9 percent to 6,071.7. -

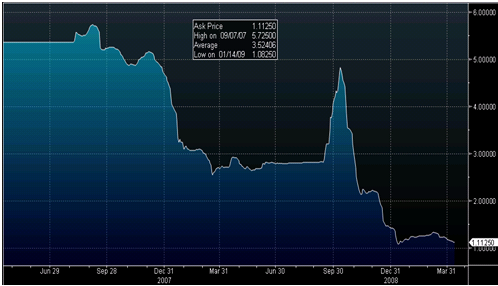

LIBORi graafikut ei olegi tükk aega siia postitanud - teeme seda nüüd:

-

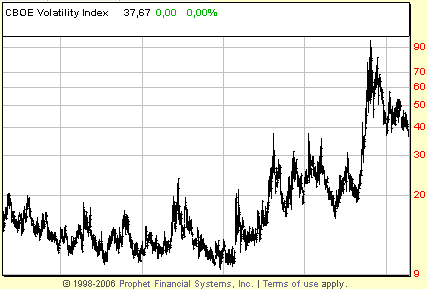

Joel, pane VIX ka. Ja siis laulame kõik koos ... "Happy days are here again...."

-

VIX on vist 37 juures. Kolm aastat tagasi oli see mega volatiilsus.

-

5 aasta VIXi graafik siia:

-

Karum6mm - iga kord, kui ma kuulen fraasi "happy times here again", mõtlen järgmise katkendi peale.: )

-

Quoting from the video “when the markets plunged in London, a well known firm issued a statement “market participants don’t know whether to buy on the rumor or sell on the news, do the opposite, do both or do neither depending on which direction the wind is blowing”” and when the markets went up an analyst from ABN amro says “We’re back to happy days again!”

http://bx.businessweek.com/bailout/how-did-the-us-get-into-this-mess--futurescafe/10401321195155002694-b81a10e005a2a6f8d0a5dd0c3ff43e62/ -

Joel, see on puhas kuld ja klassika. Aga "Happy dayd are here again" pärineb Suure Depressiooni ajast ning vist ajastus hitina kuhugi sinna "mõningane paranemine enne suuremat jama." Mitte, et ma millelele sellisele viitaks. Loomulikult mitte...

-

Rep Barney Frank says on Bloomberg TV that pretending all banks are equally strong makes no sense

Frank also says stress test results should be made public, and that "banks can fail" and "we need a system" for permitting failure of firms. -

April 15 (Reuters) - The New York Federal Reserve Bank said on Wednesday its "Empire State" manufacturing activity index rose in April to -14.65 from -38.23 in March.

-

March Industrial Production -1.5% vs -0.9% consensus, prior revised to -1.5% from -1.4%; Capacity utilization 69.3% vs 69.6% consensus

-

miks BKC nii pihta saab?

-

Põhjus oodatust madalamatel fiskaalaasta kolmanda kvartali tuludel:

Burger King sees EPS of $0.33-0.35 vs. $0.33 First Call consensus; sees Q3 (Mar) revs of $600 mln vs. $625.79 mln consensus (22.68 ) Co issues mixed guidance for Q3 (Mar), sees EPS of $0.33-0.35 vs. $0.33 First Call consensus; sees Q3 (Mar) revs of 600 mln vs. $625.79 mln consensus. Earnings per share were negatively impacted by significant traffic declines in the month of March resulting in lower than expected co restaurant margins for the quarter. The negative impact of lower than forecasted company restaurant margins on earnings was more than offset by continued rev growth, improved general and administrative (G&A) costs, lower interest expense and a lower than forecasted tax expense. Worldwide co restaurant margins were lower than expected primarily due to an unanticipated traffic slowdown in the month of March across most company-owned restaurant markets. Co reports worldwide positive comparable sales of 1.0%.

BKC Burger King reports 3Q09 revs of $600 mln vs $625.79 mln First Call consensus

BKC Burger King sees 3Q09 EPS of $0.33-0.35 vs $0.33 First Call consensus; -

Tugevatest sektoritest võiks täna esile tõsta majadeehitajaid, XHB on on üle 4% plussis. Turul nähakse ehitajate osas jätkuvat paranemist, eks järgmised makroandmed annavad täpsemalt aimu.

-

Lisan siia tagantjärgi veel energiavarude muutuse - nafta varud jõudsid viimase 19 aasta tipule.

Dept of Energy reports that crude oil inventories had a build of 5671K (consensus is a build of 1750K); gasoline inventories had a draw of 944K (consensus is a draw of 500K); distillate inventories had a draw of 1170K (consensus is a draw of 1000K). -

Jube kus riigis me ikka elame!!! Vaatasin just Pealtnägijat, Eesti selle aasta esikaunitar peab võtma pangast laenu, et sõita miss Universumi võistlustele.

-

Ja ise töötab FHMis ;) No see on küll mark FHMi poolt, ei saa siis väikest nuppu "saadame oma töötaja reisile" teha...

-

Tulemuste peale negatiivseid reaktsioone tänaseks juba omajagu - GS, BTU, INTC...

Homme enne turgu JPM ja NOK ning peale turgu GOOG tulemused. -

Eile tugeva langusega tulemustele reageerinud GS täna üllatavlt tugev, üle +3% tõusus püsides pealpool $119 taset.