Börsipäev 24. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Täna kell 15.30 Eesti aja järgi teatatakse USA märtsikuu kestvuskaupade tellimuste muutus. Ootuseks -1.5%, veebruari näit oli +5.1%. Ilma autodeta oodatakse -1.3%, veebruaris oli +3.9%. Kell 17.00 teatatakse uute majade müüginumber - veebruari näit oli 337 000 ning täpselt sama oodatakse ka märtsikuult.

Enne turu avanemist tulevad tulemustega veel SLB, AEP, F, MMM ja HON. -

Tulemuste tabel uuendatud ja link siin.

-

Täna tulevad siis ka esimesed infokillud bank stress-testi kohta.

-

Tundub, et Hiina valitsus on viimastel aastatel kaasa aidanud kullahinna rallile - USA võlakirjade kõrval on kiiresti kasvatatud kullavarusid:

Reuters reports China revealed on Friday that it had quietly raised its gold reserves by three-quarters since 2003, increasing its holdings to 1,054 tons and confirming years of speculation it had been buying. Hu Xiaolian, head of the State Administration of Foreign Exchange, told Xinhua news agency in an interview that the country's reserves had risen by 454 tons from 600 tons since 2003, when China last adjusted its state gold reserves figure. The world gold market has been buzzing with talk about China buying gold for years as the country's foreign exchange reserves have rocketed, and speculation has picked up since the global economic crisis threatened to weaken the value of those reserves. Gold prices jumped on the news and were up 1% on the day at $910.80 an ounce at 0540 GMT. By a Reuters calculation, China's holding of gold would be worth $30.9 bln at current prices. -

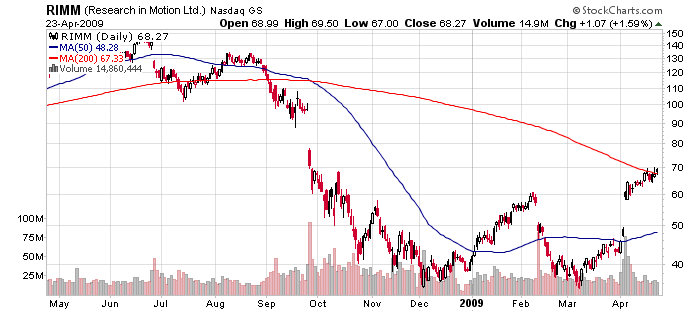

Citi tõstab täna Research in Motion'i (RIMM) reitingu "Osta" peale hinnasihiga $100. Ühtlasi lisatakse aktsia Top Picks Live nimekirja. Kuigi RIMM on teinud pärast oodatust paremaid tulemusi korraliku ralli, siis antud call'i sõnastus tundub piisavalt tugev, et ka täna aktsias ostuhuvi tekitada.

Thesis — Our Sept 2008 downgrade was based on concern over deterioratinggross margins (50% Aug '08, 46% Nov '08, 40% Feb '09). However, we now have increased confidence that GM% has stabilized in 42-44% range. Stable GM% combined w/RIMM's still stellar topline growth from strong consumer uptake should drive a positive EPS revision cycle, historically a positive catalyst for RIMM shares. $100 TP based on ~20x P/E applied to our above consensus FY11 $4.78. While we recognize RIMM shares’ outperformance since Apr 2 earnings call, we see add'l gains as RIMM offers rare growth in wireless sector.We add RIMM to CIRA's Top Picks Live for best new money ideas.

-

Ford Motor beats by $0.48, beats on revs. Reports Q1 (Mar) loss of $0.75 per share, $0.48 better than the First Call consensus of ($1.23); revenues fell 42.7% year/year to $24.8 bln vs the $22.01 bln consensus. Ford remains on track to meet or beat its financial targets based on current planning assumptions, including the target for its overall and North American Automotive pre-tax results to be breakeven or better in 2011, excluding special items. Ford finished the first quarter with $21.3 billion in Automotive gross cash and reiterated that based on current planning assumptions it does not expect to seek a bridge loan from the U.S. government. Ford reiterated that it expects operating-related cash outflows in 2009 to be significantly less than 2008. Ford also continues a collaborative effort to reduce its dealer levels, with a 14 percent reduction since 2005, consolidate and realign its suppliers, and reduce salaried and other overhead costs. With the $1.9 billion of first quarter Automotive structural cost reductions, Ford is on track to exceed its target to reduce Automotive structural costs by $4 billion in 2009.

-

Fordi kardetust paremad tulemused on positiivne märk majanduse kui terviku osas ning aktsiafutuurid kiires tõusus.

-

Durable goods orders for March fell 0.8%, which is not as severe as the 1.5% decline that was widely forecast. Still, the decline marks a reversal from the prior month's increase of 2.1%, which was downwardly revised. Excluding transportation, durable goods orders slipped 0.6%, which is not as bad as the 1.2% decrease that economists had expected. The prior reading was revised lower so that it reflects an increase of 2.0%.

-

Huvitav, et FAS liikumine peaks järgima Russell 1000 Financial indeksit, aga tegelikkuses liigub hoopis XLF järgi. Ma ainult paar päeva uurinud seda, kas kellegil on pikemaid kogemusi?

-

Eile oli XLF'ga vahe märgatav, aga üldiselt ongi mugavam XLFi järgi vaadata. Pigem asi selles, et Russel 1000 ja XLF liiguvad ise tugevas korrelatsioonis.

-

USA turud avanemas eilsete MSFT, AMZN tulemuste ja RIMMi upgrade'i valguses ülespoole. S&P500 +0.5%, Nasdaq100 +0.8%, nafta +1.9% @ $50.6 barrelist.

Saksamaa DAX +2.14%

Prantsusmaa CAC 40 +1.93%

Inglismaa FTSE 100 +2.17%

Hispaania IBEX 35 +0.349

Venemaa MICEX -0.50%

Poola WIG +0.76%

Aasia turud:

Jaapani Nikkei 225 -1.57%

Hong Kongi Hang Seng +0.29%

Hiina Shanghai A (kodumaine) -0.62%

Hiina Shanghai B (välismaine) -0.96%

Lõuna-Korea Kosdaq -1.28%

Tai Set 50 +1.80%

India Sensex 30 +1.74%

-

Signs of Opportunity

By Rev Shark

RealMoney.com Contributor

4/24/2009 8:30 AM EDT

Learn to pause ... or nothing worthwhile will catch up to you.

-- Doug King

The market has had some mixed signals lately but continues to find sufficient good news to encourage the bulls. A combination of low expectations and pretty numbers last night has all the major stocks that reported gapping up this morning. Microsoft (MSFT) , Amgen (AMGN) , American Express (AXP) and Amazon (AMZN) are all trading up in the early going, and we even have Ford (F) doing very well.

What has been most interesting about earnings season this quarter is that despite a pretty big run by many stocks into their reports, expectations never really increased that much, and the stocks keep on going even when the numbers and guidance weren't so fantastic.

I imagine that the fear that the market was, or is, near a depression helped to keep anyone from expecting that we would see any really great reports. When companies simply came close and didn't talk about how bleak the future looked, there was a collective sigh of relief.

With most of the big reports out of the way now, the question we really have to focus on is, where do we go from here? We still have quite a few small-cap reports, and that will assist us in trying to find some new winners.

Many charts have improved greatly in the last month or so, but too many went straight up and never offered a good entry for those who were waiting for pullbacks. The good news is that an uptrend is a necessary step in a better chart, and even if stocks are extended at this point, they can pull back, consolidate and offer some good entries. We need to be patient and not feel frustrated when we have a morning like this when there at a lot of gaps to the upside.

Technically, the major indices look pretty good. The momentum has slowed since the Wells Fargo (WFC) earnings preannouncement popped things on the Thursday prior to the Easter holiday, but this trading range action is very healthy and is what we need to build support for another leg higher.

The big issue this morning is whether these earnings report gaps will hold. There seem to be few folks who really though MSFT was a good report, but it has an upgrade, and obviously expectations were at a rock bottom. The immediate reaction is quite positive, but will it be sustained? My policy is to not chase opening gaps. In fact, if I have gains, I tend to sell into positive opens and then look for re-entry.

The next big market-moving news is going to be the bank stress tests. The public isn't supposed to have any information about this until May 4, but some of the methodology is being released today, and I wouldn't be surprised to see some rumors and reactions hit the financial sector as this process advances.

There seems to be a lot of confusion over the whole stress-test idea, but financial companies have been doing a great job of spinning numbers lately and making it sound like they are doing better than expected. If the stress test is to have any real teeth, there will have to be some victims, and right now there doesn't seem to be too much worry.

So earnings are good, the technical pattern developing into a trading range, and we have lots of unknowns about the stress test. Sounds like a market with opportunities we need to trade but not be too comfortable with.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: DDR +31.4%, F +23.7%, OFG +20.0%, CAKE +16.6% (also upgraded to Outperform from Mkt Perform at William Blair), CPHD +10.5%, STAR +10.1%, BUCY +9.4%, INFA +8.6% (also upgraded to Buy at Citigroup), ALGN +8.3%, DDUP +7.7%, PMCS +7.3%, JNPR +7.2%, MHK +7.1%, AXP +6.6%, SGEN +6.5% (light volume), CYH +5.2% (light volume), SLB +5.1%, WDC +4.6%, RVBD +4.5%, E +4.2%, MSFT +3.9% (also upgraded to Overweight at Morgan Stanley), OPLK +3.7%, CF +3.6%, SYNA +3.2%, DV +2.5%, AMZN +2.5% (also upgraded to Hold at Benchmark), BNI +2.1%, POWI +1.7%... Select metals/mining names showing strength: HMY +6.4%, GFI +6.2%, MT +2.9%, AUY +2.8%, GOLD +2.6%, KGC +2.0%, AAUK +1.7%... Select oil/gas related names trading higher: NOV +4.2%, TOT +3.4%, RDS.A +2.3%, HES +2.0%, COP +1.8%... Select financials showing strength in early trade: PRU +4.6% (upgraded to Buy from Sell at Goldman- Reuters), WFC +4.0%, PUK +2.8%, STI +2.1%, BAC +2.0%... Other news: ZGEN +21.9% (ZymoGenetics and Bristol-Myers Squibb present positive 4-week results of PEG-Interferon with ribavirin in hepatitis), ETFC +3.1% (still checking), CSCO +2.2% (still checking), GE +1.3% (still checking for anything specific)... Analyst comments: CBL +13.1% (raised to Conviction Buy from Neutral at Goldman- Reuters), RVBD +9.7% (upgraded to Outperform from Mkt Perform at William Blair), RIMM +2.5% (upgraded RIMM to Buy from Hold at Citigroup), ACN +1.6% (upgraded to Buy at Keybanc), CS +1.4% (upgraded to Neutral at UBS and upgraded to Neutral at BNP), T +1.0% (initiated with Buy at Piper).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: IBKR -15.6%, COLM -11.1% (downgraded to Negative from Neutral at Susquehanna Financial and downgraded to Sector Perform from Outperform at RBC Capital Mkts), SPWRA -8.8% (also downgraded to Sell at Merriman and downgraded to Underperform from Neutral at Macquarie), CYBS -8.3% (light volume), DECK -5.4%, TUNE -5.3% (light volume; also downgraded to Hold at Collins Stewart, based on disappointing quarter and outlook), NFLX -5.1%, ACI -4.8%, RMBS -3.8%, SWKS -3.2%, AMGN -2.5%... Other news: SD -6.4% (prices public offering of 15.2 mln common shares at $7.60/share), NOK -5.5% and VOD -4.2% (still checking), CPN -5.3% (agreed to sell 20 mln shares of the common stock in a registered public secondary offering), LHO -1.9% (prices offering of 10.75 mln common shares at $10.10/share), DNDN -1.6% (announces schedule for data presentations and webcast at AUA Annual Meeting)... Analyst comments: NIHD -10.4% (light volume; downgraded to Neutral from Outperform at Credit Suisse), MAR -4.5% (downgraded to Hold from Buy at Stifel Nicolaus based on valuation, downgraded to Market Perform at FBR and downgraded to Market Perform at Wachovia), NWL -2.5% (downgraded to Neutral at BofA/Merrill), SPG -1.6% (removed from Conviction Buy list at Goldman- Reuters), UPS -1.0% (downgraded to Underperform from Neutral at Credit Suisse). -

August 2007 (aktsiaturu tipp oktoober 2007) - päris huvitav on seda Crameri videot praegu 2 aastat hiljem uuesti vaadata...

-

March New Home Sales 356K vs 337K consensus, m/m -0.6%

-

Fed says most US banks currently have capital reserves "well in excess" of "well capitalized" levels

Fed officials decline to specify size of capital buffer required

Viimane on üsna veenev lause. -

Ja juba ostetakse jälle hooga üles, VIX samuti jälle punasele poolele kukkunud.