Börsipäev 30. aprill

Kommentaari jätmiseks loo konto või logi sisse

-

Täna tund aega enne turu avanemist avaldatakse esmaste töötu abiraha taotlejate näit möödunud nädala jaoks. Eelmine kord oli näidu suuruseks 640 000, seekord oodatakse 645 000. Samuti tulevad märtsikuu raportid inimeste sissetulekute ja kulutuste kohta - sissetulekutelt oodatakse 0.2%list vähenemist, kulutustelt 0.1%list vähenemist.

Eelturul on futuurid taas rohelised - indeksid ca poole protsendi jagu plussis kauplemas. Nafta hind jõudnud $51.5 peale. -

Uuendasin ära ka meie tulemuste tabeli, kus aktsiate reageeringud 28. aprilli turu järel ja 29. aprilli turu eel tulemused raporteerinud ettevõtteile oli erakordselt head. Tabelis olnud ettevõtteist lausa 6 tõusid rohkem kui 10%.

Eile õhtul raporteeris oma möödunud kvartalist Green Mountain (GMCR), kelle näidud on suurelt üle ootuste ning aktsia kauples järelturul enam kui 20% plusspoolel. Ameeriklased jätkuvalt tarbimisaltid. Positiivselt suutis üllatada ka First Solar (FSLR).

-

Tulemuste poolest tuleb ka täna väga tihe päev - enne turu avanemist tulevad tulemustega teiste seas ASH, AZN, CL, EK, PG, XOM, DOW, MOT, MRO, K jt. Pärast turu sulgemist MFE ja USTR.

-

Väga hea näide sellest, kuidas H1N1 gripipuhang Mehhikos on mõjutamas ka finantsturgude tegemisi.

Mehhiko aktsiate börsil kaubeldav fond USA turul on EWW.

-

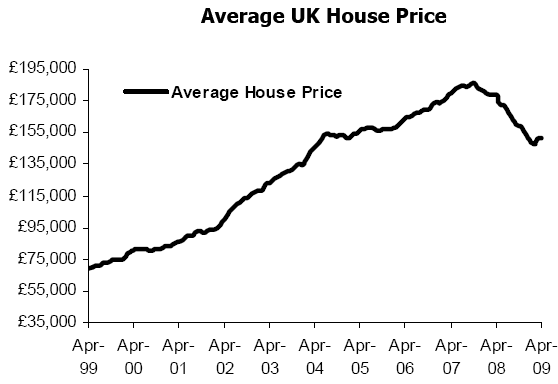

Kui märtsis kerkisid Nationwide andmetel Surbritannia majade hinnad esimest korda alates 2007. aasta oktoobrist (+0.9%) siis aprillis jäi näitaja 0.4%-ga miinuspoolele. Kuised numbrid võivad olla väga volatiilsed ega ole põhjapanevad trendide kinnitamiseks. Sellest võis aru saada juba märtsi statistika puhul, sest UK suurima kinnisvaragaendi Halifaxi sõnul hinnad mitte ei tõusnud, vaid langesid -1.9%. Tarbijad jäävad kinnisvarahindade suhtes endiselt negatiivselt meelestatuks ning suuresti usutakse, et järgmise kuue kuu jooksul kukuvad hinnad edasi. Hinnalanguses võib aga juba täheldada olulist stabiliseerumist.

“The housing market is very sensitive to income and, as a result, conditions in the labour market are crucial to its performance. The economy is now in the deepest recession since the Second World War and unemployment is continuing to increase, with the latest data showing that it breached the two million mark. Even though negative inflation will mean that real earnings will be increasing, it is likely to be some time before this feeds into a strong enough change in sentiment to encourage a full scale revival in the housing market. That said, the correction in house prices and improved affordability conditions provide a good grounding for the market once domestic and global economic conditions once again become more favourable.”

-

MGM: Dubai World ja MGM Mirage matsid kirve, Dubai World võttis hagi tagasi ning mis peamine, $1,8 B täiendav rahasüst CityCenteri ehituse lõpuleviimiseks. Eilne asi, aga kuna aktsia halditi enne ära, siis reaktsioonid täna tulemas.

-

USA aktsiaturgude eelturul on võimust võtnud ülim optimism ja ostupaanika - S&P500 enne turu avanemist juba +1.7% @ 885 punkti, Nasda100 +1.8% @ 1402 punkti ning nafta barreli eest küsitakse +1.5% @ $51.8.

-

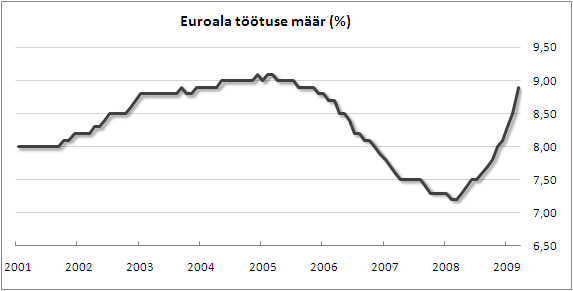

Eurotsooni töötus jõudis märtsi lõpus rohkem kui kolme aasta kõrgeimale tasemele, ulatudes 8.9%-ni ning ületades Bloombergi küsitletud analüütikute ootust 20 baaspunktiga. Tõsine murelaps on Hispaania kus töötus kasvas ühe kuuga 16.5%-lt 17.4%-le, olles aasta tagasi 9.5%. EU27 arvestuses ei sammu kaugel enam ka Läti ja Leedu, kus näitajad vastavalt 16.1% ja 15.5%. Lisaks kinnitas Euroopa Liidu statistikaamet märtsi inflatsiooniliseks näitajaks 0.6%, jäädes alla analüütikute oodatud 0.7%-st. Tegemist on madalaima tasemega alates 1996-aastast, mil andmeid hakati esimest korda kokku panema.

-

In a major shift, Apple builds its own team to design chips

AAPL has been hiring people from many different segments of the semiconductor industry, including engineers to create multifunction chips that are used in cellphones to run software and carry out other chores. -

Stocker, kas mingi viide on olemas ?

-

Muidu viskas Briefingusse selle üles, aga mingi jutu leidsin ka sealt:

http://finance.yahoo.com/news/Apple-Building-Its-Own-Chip-paidcontent-15081995.html?.v=1 -

Tagantjärgi ka makroandmed siia:

Q1 Employment Cost Index +0.3 vs +0.5% consensus, prior +0.6%

March PCE Core m/m +0.2% vs +0.1% consensus, prior +0.2%; PCE Core y/y +1.8% vs +1.8% consensus, prior +1.8%

March Personal Spending -0.2% vs -0.1% consensus; prior revised to +0.4% from +0.2%

March PCE Deflator y/y +0.6% vs +0.7% consensus, prior revised to +0.9% from +1.0%

March Personal Income -0.3% vs -0.2% consensus

Initial Claims 631K vs 640K consensus, prior revised to 645K from 640K -

Saksamaa DAX +2.36%

Prantsusmaa CAC 40 +1.80%

Inglismaa FTSE 100 +2.08%

Hispaania IBEX 35 +1.72%

Venemaa MICEX +0.77%

Poola WIG +2.37%

Aasia turud:

Jaapani Nikkei 225 +3.94%

Hong Kongi Hang Seng +3.77%

Hiina Shanghai A (kodumaine) +0.38%

Hiina Shanghai B (välismaine) +1.22%

Lõuna-Korea Kosdaq +1.32%

Tai Set 50 +1.97%

India Sensex 30 N/A (börs suletud)

-

Bullishness Reigns

By Rev Shark

RealMoney.com Contributor

4/30/2009 8:37 AM EDT

This woman did not fly to extremes, she lived there.

-- Quentin Crisp

What is always amazing about the market is how we can go from complete despair and distress and feeling like the world is going to come to an end -- as we did back in early March -- to the polar opposite where we have no fear or worry and a feeling that things will only continue to improve from here. It would be tricky enough if we just bounced back and forth from one extreme to the other, but what makes it so much more difficult is that the extremes tend to persist much longer than many of us think is reasonable.

While many market players were ready for some relief from the pessimism of six or seven weeks ago, few have easily made the transition to the complete and utter bullishness that seems to be enveloping us now. This persistence of trend and extreme emotions is what momentum investing is all about. Rather than try to argue that the market is unreasonable because it's too bullish or bearish, the momentum investor embraces the fact that market players are engaged in a form of crowd psychology that doesn't promote careful analysis and contemplation over whether things have gone too far in one direction or the other.

OK, but how do we deal with it? When we were trending down, I repeatedly maintained that we simply had to respect the trend and trade what was in front of it. There was no reasonable way to determine when things might shift. Now we are at the other end of the spectrum -- the trend is up, we have plenty of upside momentum and while it can seem quite extreme, we shouldn't be surprised by how persistent it might be.

My approach is to respect the trend but not to be too trusting. I want to continually take some partial profits into strength and build a cushion of profits so I'm not hurt too badly when the inevitable reversal comes. At some point we'll see the emotions shift and things get gloomy once again, but right now the big fear is being left behind, and that is a major driving force.

We have some economic data coming up, but there isn't too much news on the wires other than some decent earnings reports from the likes of Visa (V) , First Solar (FSLR) and a few others. We often have a tendency to reverse some of the gains we see on Fed day, so I'll be looking for some fading of the early strength, but pockets of momentum are very likely to persist. I'm focusing on some solar energy plays today that I think will move in sympathy with FSLR, and there should be some other groups of interest as well.

Strap on those trading goggles -- we're sure to see some shrapnel today. Good luck and go get 'em.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: PCX +25.5%, ICO +21.2%, OI +19.2%, GMCR +18.5% (also announces distribution partnership with Walmart), HGSI +14.4%, DSCM +13.9%, SKX +13.2%, TNDM +12.5%, BARE +12.2%, TRN +11.4%, FSLR +11.4%, DOW +11.0%, TYC +10.1%, NWL +9.6%, AMKR +8.4%, AKAM +7.7% (also upgraded to Neutral, removed from Americas Conviction Sell list at Goldman- Reuters), ASH +6.5%, ARRS +6.3% (also upgraded to Buy at Collins Stewart), CTXS +6.2%, TSM +6.2%, AGNC +6.1%, IP +5.5%, TTEK +4.5%, TER +3.7%, CELG +3.2%, WLT +2.8%, PLD +2.8%, NYX +2.7%, AZN +2.5%, MOT +2.3%, NLY +2.2%, CL +2.2%, FLS +2.1%, DRIV +2.1% (also upgraded to Hold at Collins Stewart and upgraded to Perform at Oppenheimer), ESRX +2.1%, PG +1.9%, AEM +1.7%... Select financial names showing strength: RBS +19.4%, AEG +18.5%, LYG +11.3%, AIB +10.4%, IRE +10.2%, ING +8.9%, BCS +8.1% (upgraded to Buy at RBS), HBAN +7.8%, AZ +7.1%, HBC +5.9%, UBS +5.9% (UBS axed 2,000 U.S. jobs in latest round of cuts - Reuters), FITB +5.8%, C +5.8%, BAC +5.0% (confirms all 18 directors were elected to the board; Walter Massey was elected chairman and Kenneth Lewis will be president and CEO), STI +3.9%, BAC +3.5%, JPM +2.8%, WFC +2.7%, MS +2.3%, GS +1.4%... Select solar names sharply higher following FSLR results and positive comments regarding German credit: CSUN +11.0%, SOL +9.8%, ESLR +8.7%, YGE +8.3%, CSIQ +8.2%, JASO +7.5%, SOLF +6.7%, LDK +5.5%, SPWRA +4.2%, STP +3.9%, ... Select metals/mining names showing strength: AAUK +5.2% (Anglo American 1Q iron ore up on year, considers cuts - DJ), RTP +4.0%, RIO +3.9%, BBL +2.5%... Select oil/gas names trading higher: RDS.A +3.1%, E +3.0%... Select casino names trading higher following MGM news: MGM +47.2% (MGM Mirage, Dubai World and CityCenter's Lenders reach agreement for completion of CityCenter), LVS +10.1%, BYD +4.4%... Other news: NOK +6.3% (still checking for anything specific), GM +3.9% (GM bondholders seek to control equity - WSJ), AMLN +3.2% (discloses agreement with Carl Icahn to engage in discussions with the other for the sole purpose of facilitating a settlement of the proxy contest)... Analyst comments: HST +3.4% (upgraded to Neutral at JPMorgan), MEOH +2.5% (upgraded to Strong Buy from Outperform at Raymond James), SNY +1.6% (upgraded to Overweight at JPMorgan).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: ULBI -17.0% (light volume), ITRI -10.6% (also downgraded to Market Perform at Wachovia and downgraded to Neutral at Merriman), JDSU -10.2%, CI -8.5%, CVD -8.2%, ABAX -8.0% (light volume), CAVM -7.9%, AXTI -7.0%, EK -6.9%, URI -6.5%, CMI -6.5%, ERIC -6.3%, CIR -6.2% (light volume), HAR -6.1%, FORM -6.1% (downgraded to Sell from Neutral at Piper Jaffray), NTRI -5.2%... Select gold related names showing weakness: AU -4.4%, GG -2.6%, KGC -2.6%, NEM -2.4%, GFI -2.4%, AUY -2.1%, ABX -2.1%, GLD -1.8%... Other news: SQNM -53.1% (announces delay in launch of SEQureDx Trisomy 21 test, co no longer relying on the previously announced R&D test data and results; also reported quarterly results and was downgraded by multiple analysts), EROC -23.8% (announces voluntary reduction in distribution rate), WRE -4.3% (announces public offering of 4.0 mln common shares)... Analyst comments: HTZ -3.4% (downgraded to Sell at Argus). -

Chrysler läks pankrotti.

-

Uuendused tulemuste tabelisse sisse viidud...