Börsipäev 11. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Tänasel päeval majandusraportite avaldamisi kavas ei ole. Üksnes Bernanke räägib hilisõhtul kell 19.30 USA idaranniku aja järgi stresstesti tulemustest. Tulemuste hooaeg hakkab samuti läbi saama ning jäänud veel üksikute ettevõtete numbrid ära oodata. Täna enne turgu tuleb tulemustega Playboy (PLA) ja Clar Channel Outdoor (CCO).

-

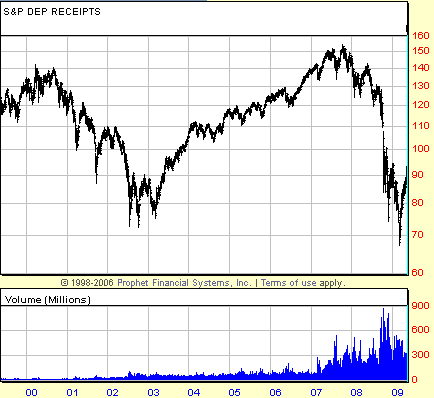

Täpselt kahe kuuga on S&P500 indeks tõusnud reede õhtuseks seisuks +38.5% ning Nasdaq100 +36.5%. Ja neist ülikiiretest liikumistest hoolimata usuvad paljud roketeeriva tõusu jätkumisse - näiteks reede õhtul avaldati RealMoney all arvamust, et Dow on varsti taas 10 000 punkti peal. Kaks kuud ja isegi ka veel kuu aega tagasi käisid karud Dowle välja sihte, mis algasid 5, 4 ja isegi 3ga... Kui vaadata toimunud liikumist 10 aastase graafiku pealt, siis enam rohkem V-kujuliseks minna ei saagi - ometi on konsensus mõistnud, et V-kujulist taastumist ei tule. Loomulikult on osa viimase aja liikumisest tulnud õigustatult Suure Depressiooni idee mahamatmisest, kuid sellegipoolest tasuks endalt küsida, kas niivõrd agressiivne liikumine saab ikka jätkuda ning milline oleks riski-tulu tase pärast 35%list rallit tänastelt tasemetelt tõusu taga ajades...

-

Great Depressioni põhjast tõusis S&P500 325%, 1932-1937. Kusjuures esimese kahe kuuga tõusis indeks 111%.

1974 aasta kriisi põhjast tõusis S&P500 indeks ühtejutti kuni 2000.a. tootluse % on liiga suur arvutamiseks :)

Seega on meil veel ruumi minna küll.

btw, ma usun, et lähiajal tuleb korrektsioon. kuid see ei tule nii suur, kui enamus arvab. -

Üheks tõusu põhjuseks kindlasti on ka see, et aktsiad olid ju ülemüüdud.

-

USA turud avanevad täna miinuspoolel. S&P 500 -1.4% @ 912 punkti, Nasdaq100 -1.2% ning nafta -1.5% @ $57.7 barrelist.

Saksamaa DAX -1.12%

Prantsusmaa CAC 40 -2.08%

Inglismaa FTSE 100 -0.87%

Hispaania IBEX 35 -1.39%

Venemaa MICEX N/A (börs suletud)

Poola WIG -0.74%

Aasia turud:

Jaapani Nikkei 225 +0.20%

Hong Kongi Hang Seng -1.74%

Hiina Shanghai A (kodumaine) -1.75%

Hiina Shanghai B (välismaine) -2.20%

Lõuna-Korea Kosdaq +1.17%

Tai Set 50 +1.56%

India Sensex 30 -1.63%

-

How to Deal

By Rev Shark

RealMoney.com Contributor

5/11/2009 8:33 AM EDT

"Confidence comes not from always being right but from not fearing to be wrong."

-- Peter T. McIntyre

Given how shallow the pullbacks have been in this market over the past couple months, it shouldn't be surprising that there is a now a very high level of confidence that the worst is over. For nearly two months, we haven't seen more than a couple negative days in a row as the aggressiveness of the dip buyers has been consistent and strong.

The idea that this rally is just a bear market bounce is steadily losing steam as there has been so little weakness for so long. The bears are being worn out and run over. The consensus now is that the stimulus plans and financial plans are working sufficiently to avert a collapse of the financial system. There is still plenty of debate over the pace at which things will improve, but the market is acting like it has completely dismissed the idea that the economy is still in free-fall.

Even the bears seem to be given up on the idea that we will revisit the market lows. They are mainly focused on the idea that the market has gone too far, too fast and is in need of a rest. Maybe when that happens, and we do rest, then their pessimism will increase, but presently they are just looking for momentum to cool.

So how do we deal with the stock market from this point? There are a huge number of stocks that have already made big moves and many are now quite extended. If you have been waiting for a pullback, you haven't seen much of one, and if you didn't jump in very fast, you have had great difficulty trying to gain long exposure. Many of the biggest moves out there have been by secondary stocks as momentum traders have hunted for action and created it on their own.

Certainly, we would be foolish to expect the recent momentum to continue unabated. Markets like this will need to rest, but market players aren't going away. Even when we do have weakness in one part of the market, they are moving to another. For example, on Friday technology was weak, but energy and commodities did well, as the hot money looked for some place else to go.

More than ever, this is a market in which you have to stick to the good charts and use good money management. That means that you make sure to take some profits into strength when you have them and keep stops tight and cut your losses should momentum fizzle.

Anticipating that this uptrend will end is a very tough game to play. For weeks now we have been talking about how we need a rest, but the buyers keep on jumping in as soon as weaken just a little. At some point, this dip buying is going to be punished badly, but it is so persistent that it's the bears that have been punished and who have grown skittish.

This morning the financials are looking a bit weak as the market digests news about how they are going to raise the capital they need. However, Morgan Stanley (MS) has an upgrade, and George Soros is sounding bullish.

There is no question we are going to rest here soon. It is just a matter of for how long and whether it starts to impact the mood when momentum finally does cool. The bulls still have the benefit of the doubt, but the hurdles are getting higher.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: CNO +37.2%, VM +12.8% (light volume), PMI +11.8%, GSI +9.0%, HOGS +7.9% (light volume), FEED +6.3%, DISH +5.8%, CRZO +3.7% (light volume)... M&A news: CF +5.0% (Agrium Increases Offer for CF Industries to $40.00 in Cash Plus One Agrium Share Per CF Share)... A few financials showing strength: HBAN +7.7%, FITB +5.4%, RF +2.9%... Other news: TCM +49.5% (still checking), PBCT +7.5% (Cramer makes positive comments on MadMoney), AZN +6.8% (AstraZeneca's Brilinta drug beats Plavix in clinical trial - DJ), STAR +3.0% (Cramer makes positive comments on MadMoney)... Analyst comments: ANDS +17.0% (upgraded to Buy at ThinkEquity), AEO +7.4% (upgraded to Buy at Lazard Capital Mkts and upgraded to Buy at Citigroup), IPSU +6.3% (upgraded to Buy at BWS Financial), HMA +4.2% (upgraded to Buy at Citigroup), LNC +3.2% (seeing early strength; hearing added to Buy List at tier 1 firm), HOT +2.3% (upgraded to Overweight at JPMorgan), IP +1.3% (upgraded to Buy from Neutral at Goldman- Reuters).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CPSL -21.4%, ALD -13.0%, AOB -12.3%, BPZ -10.7%, CPBY -10.3%, SLW -4.6%, HBC -3.8%, ENER -2.9%... M&A news: AGU -2.1% (Agrium increases offer for CF Industries to $40.00 in cash plus one Agrium share per CF Share)... Select financials pulling back: COF -8.1% (announces public offering of 56 mln shares of common stock), IRE -7.9%, BCS -6.4%, RBS -6.0%, AIG -4.5%, LYG -3.9%, KEY -3.9% (confirms capital raise of $750 million), BAC -3.5% (Bank of America selling CCB stake - WSJ), C -3.2% (MUFG may cancel purchase of Citi unit, according to report - WSJ), AZ -3.2%, MTU -2.5% (Mitsubishi UFJ Financial Group has decided to purchase shares of common stock of Morgan Stanley in the public offering), JPM -2.3%, CS -2.1%, WFC -1.9% (confirms common stock offering, raises $8.6 bln)... Select oil/gas related names trading lower: SNP -6.7%, E -3.3%, BP -3.3%, RDS.A -2.6%, TOT -2.4%... Select metals/mining names showing weakness: GOLD -4.0%, RTP -3.7%, BBL -3.6%, BHP -3.3%... Select shipping names trading lower premarket: DRYS -6.3%, EXM -5.8%, FRO -3.6%... Other news: AFL -3.6% (files for a senior debt/subordinated debt securities shelf offering for an indeterminate amount), STP -3.3% (Suntech Power to manufacture solar products in the U.S.)... Analyst comments: CBG -7.6% (trading lower in early trade; hearing downgraded to Sell at tier 1 firm), MU -4.5% (downgraded to Neutral at UBS), CTV -4.0% (downgraded to Neutral at UBS), LOW -2.7% (downgraded to Market Perform at Bernstein), NOK -2.6% (downgraded to Neutral at GC Research), VLO -2.6% (ticking lower in early trade; hearing downgraded to Sell at tier 1 firm), HD -2.2% (downgraded to Market Perform at Bernstein), COST -2.0% (downgraded to Neutral from Buy at Goldman- Reuters), CLX -1.3% (downgraded to Underperform at Bernstein). -

Rev Sharki kommentaarist ... George Soros is sounding bullish

-

General Motors Bondholder Committee says company offer of 10 pct equity must be "materially improved", according to source - Reuters

Otseselt 'ei' ju võlausaldajad ei öelnud, kuid kui juhtkond midagi palju paremat välja pakkuda ei oska, on Chapter 11 pankrotimenetlus ka GMi jaoks üks võimalik stsenaarium. -

Finantssektori liikumist kajastav XLF teeb uusi päeva põhju...

-

IYF testib samuti päeva alguses tehtud madalaimaid tasemeid:) Finantsis võetakse kasumeid, kuid tehnoloogia oluliselt paremini käitunud.

-

Tasuliste haridusasutuste aktsiad soosingust väljas?

Briefing: Career Education downgraded to Sell at Argus (21.16 +0.99). Argus downgrades CECO to Sell from Hold, and reduces their '09 EPS estimate to $0.96 from $1.02 (consensus $1.10). Firm says in contrast to peers, CECO saw its revenue shrink during the first quarter, and its results were weak given the generally favorable environment for for-profit education companies. Firm believse that education companies are nearing the peak of enrollment growth, and that CECO's declining revenue in this environment does not bode well for its future prospects. Firm would consider raising their rating at prices below the year-to-date low of $17. At that level, firm believes that CECO's underperformance relative to peers would be appropriately factored into the shares. -

Meredith Whitney on CNBC says on a core basis she absolutely would not own financial stocks; says underlying core earnings power of banks is negligible. Discussing the recent rally in financials, she notes shorts covered and long-only investors had to re-weight as rally proceeded... Says credit contraction is happening at an accelerating rate, and consumer spending will come in lower than what people will expect. Believes shorting the retailers is something one can do following their rally.

-

Lisaks siia juurde veel, et USA jaemüügiettevõtete liikumist kajastav börsilkaubeldav fond on RTH, mida võib siis lühikeseksmüümisel instrumendina kasutada.

-

Meredithi jaoks on vist deja vu all over again, samamoodi nagu selle imepisikese kriisihakatise alguses on ta üks ja ainus karu, kes probleeme näeb.

-

Päris julge ütlemine enne kolmapäevast jaemüügi näitajate avalikustamist.

-

Tänasel kukkumisel käive viimaste päevade väikseim. See võiks indikeerida pigem ostjate tavapärase õhtuse ostulaine puudumist, mitte rallieelsetele päevadele tavaks saanud õhtust kõva müügisurvet.

-

Muidugi see võib vabalt tähendada ka seda:

http://www.youtube.com/watch?v=4ADh8Fs3YdU -

Täiesti korralik nali Credit Suisse'lt:

"Contactless payment by mobile phone - technically possible, work continues on requirements for commercial use"

http://www.credit-suisse.com/news/en/media_release.jsp?ns=41155