Börsipäev 14. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Tund aega enne USA turgude avanemist teatatakse täna aprillikuu tootjahinnaindeksi muutus, millelt oodatakse +0.2%list tõusu, tuumikosalt +0.1%list tõusu. Samuti on tulemas esmaste töötu abiraha taotlejate number, mis on viimasel ajal hakanud tasapisi vähenema - eelmine nädal oli see 601 000, seekord oodatakse 610 000. Hetkel on eilse veresauna järel indeksid püsimas nulli lähedal, kuid siiski kerges miinuses.

-

Australia ASX 100 -89.80 -2.84% 3,069.80 5/14 3:52pm

Australia ASX All Ords -114.70 -2.99% 3,727.80 5/14 3:52pm

Australia ASX Mid-cap 50 -81.70 -2.42% 3,299.90 5/14 3:52pm

Hong Kong Hang Seng -551.54 -3.23% 16,508.08 5/14 1:52pm

Hong Kong HSCC Red Chip -91.69 -2.53% 3,528.28 5/14 1:52pm

Japan Nikkei 225 -235.05 -2.52% 9,105.44 5/14 11:00am

Loodetavasti jääb DOW 8000 peale pendeldama. -

Muideks, kes ei ole tähele pannud, siis eile tegi Baltic Dry Indeks viimase ca 7 kuu tipu:

-

Mis kasu sellest, kui dilution laastab :)

-

Siin on BDI tõusu põhjusest ka arvamus:

Cargo Ships Treading Water Off Singapore, Waiting for Work

Dilutioni all pidasin siis silmas DRYS ja värskelt ka EXM. -

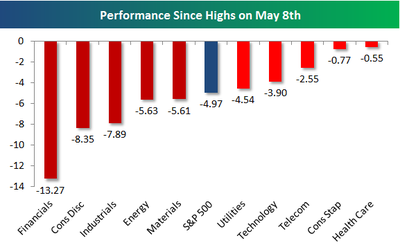

Bespoke'i vahendusel ülevaatlik pilt sellest, kui palju erinevad sektorid enne S&P 500 8. mail tehtud tippu tõusnud on ja kui palju nad hiljem langesid. Konkurentsitult juhib finantssektor nii tõusu kui ka languse edetabelit, traditsiooniliselt kaitsvad sektorid tervishoid, esmatarbekaubad ja telekomid on olnud kõige vähem volatiilsemad:

Ja langus 8. mai tippudest numbrilisel kujul:

-

Enne turu avanemist teatab täna oma tulemused Wal-Mart (WMT). EPSi oodatakse $0.77 ning müügitulu $96.4 mld.

-

Wal-Mart reports EPS in-line; guides Q2 EPS in-line. Reports Q1 (Apr) earnings of $0.77 per share, in-line with the First Call consensus of $0.77; revenues fell 0.6% year/year to $93.47 bln, in-line with company preannouncement. Co issues in-line guidance for Q2, sees EPS of $0.83-0.88 vs. $0.85 consensus.

-

Coca-Cola Ent (CCE) kinnitas täna oma 2009. fiskaalaasta kasumiprognoosi ning Goldman Sachs lisab ettevõtte oma conviction-buy listi.

-

MGM investoritele pole nende osaluse lahjendamine kuidagi meelt mööda. Esialgu plaaniti müüa 81 mln aktsiat, kui aktsia kauples turul 12.40 dollaril. Aktsia eilse 30%-lise languse tõttu tõstetakse täna pakkumist 143 miljoni aktsiani ja väärtpaberi müügihinnaks määratakse 7 dollarit ehk 25% soodustust eilse hinna suhtes. Eelturul kaupleb aktsia -12% @ 7.65 USD

-

Erko, oskad öelda mitu % on aktsionäride vara lahjendatud selle supi keermise juures:)

-

Initial Claims 637K vs 610K consensus, prior revised to 605K from 601K.

April PPI month/month +0.3% vs +0.2% consensus.

April core PPI month/month +0.1% vs +0.1% consensus. -

Yahoo finance andmetel oli viimase kvartali seisuga väljalastud aktsiate arvuks 276.5 mln ja kui nüüd plaanitakse juurde tuua 143 mln siis läheb umbes poole võrra lahjemaks

-

Kle, jah liha maitset enam üldse ei tunne selles söökla toidus...

-

USA turu indeksid on eelturul väikeses miinuses, nafta punases 1.5%, kaubeldes $57 peal.

Saksamaa DAX -0.78%

Prantsusmaa CAC 40 -0.80%

Inglismaa FTSE 100 +0.04%

Hispaania IBEX 35 -1.54%

Venemaa MICEX -2.62%

Poola WIG -1.04%

Aasia turud:

Jaapani Nikkei 225 -2.64%

Hong Kongi Hang Seng -3.04%

Hiina Shanghai A (kodumaine) -0.90%

Hiina Shanghai B (välismaine) +0.06%

Lõuna-Korea Kosdaq +0.15%

Tai Set 50 -5.15%

India Sensex 30 -1.22%

-

Ülespoole avanevad:

In reaction to strong earnings/guidance: WH +15.8%, KONG +8.7%, WFMI +7.1%, AEG +6.0%, AMSC +4.3%, DNN +3.7% (light volume), CCE +3.0% (also added to Conviction Buy list at Goldman- Reuters), KSS +2.5%, CA +1.2%, JACK +1.1%, URS +1.0%... Select European financials showing strength: IRE +13.6%, BCS +5.8%, AIB +4.9%, RBS +4.2%, UBS +3.6%, DB +1.7%, HBC +1.5%... Other news: AIG +3.7% (plans to divest Nan Shan Life in Taiwan, according to sources - WSJ), MEDX +3.7% (announces primary endpoint achieved in MDX-1100 anti-IP-10 antibody Phase 2 trial for rheumatoid arthritis), LPHI +3.3% (declares special enhanced dividend payment of $0.25), MT +2.9% (announces $2.25 bln bond issue)... Analyst comments: ALGT +1.8% (upgraded to Overweight at Morgan Stanley), CME +1.5% (upgraded to Neutral at Pali Capital and upgraded to Neutral at JPMorgan).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: CIG -19.4%, CVLT -18.1%, ANW -16.1%, WNC -14.5%, FCE.A -12.1% (also announces 40 mln shares common offering), ENS -11.0%, ELOS -8.8% (light volume), LEA -8.6%, GIL -7.8%, ASEI -7.3%, ACMR -4.2%, CGV -3.4% (light volume), SNE -2.9%... Select financial related names showing continued weakness: FIG -6.1% (announces public offering of $125 million of Class A shares), FITB -5.3%, MBI -4.4% (Banks sue MBIA over business split; lawsuit says MBI split was fraudulent -- WSJ), HBAN -3.9%, BAC -2.8%, C -2.3%, PVTB -2.3% (announces pricing of upsized public offering of common stock at $19.25/share)... Select oil/gas names trading lower: TOT -2.6%, E -1.7%, RDS.A -1.3%, BP -1.1%... Select metals/mining related names showing weakness: AAUK -2.0%, BBL -1.6%, AU -1.3%... Other news: BEXP -10.6% (announced it has commenced a 30 mln share common stock secondary offering), MGM -8.5% (completes $1 bln common stock offering), CLF -6.5% (prices 15.0 mln common share offering at $21/share), EXM -4.8% (files for 2,579,898 Class A common share offering by certain holders), GMXR -2.9% (prices its 5 mln share common stock offering at $12/share), LVS -2.2% (down in sympathy with MGM)... Analyst comments: BAS -10.8% (light volume; downgraded to Sell at UBS), LPX -8.5% (downgraded to Underperform at Credit Suisse), PTEN -4.9% (downgraded to Sell at UBS), UAUA -2.1% (downgraded to Equal Weight at Morgan Stanley), ANR -1.8% (downgraded to Market Perform from Outperform at BMO Capital Markets), AZN -1.0% (downgraded to Underperform at Jefferies). -

S&P500 indeksil tundub olevat optsioonireede valguses tugev magnetiline tõmme ümmarguse 900 punkti peale.