Börsipäev 21. mai

Kommentaari jätmiseks loo konto või logi sisse

-

Eilne päevasisene kannapööre ja S&P500 indeksi 20 punktiline kukkumine päeva tippudest ning sulgumine päeva põhjadel näitavad turgude väsimust viimaste kuude rallist. Eelturul kaupleb indeks praegu -0.4% @ 896 punkti peal.

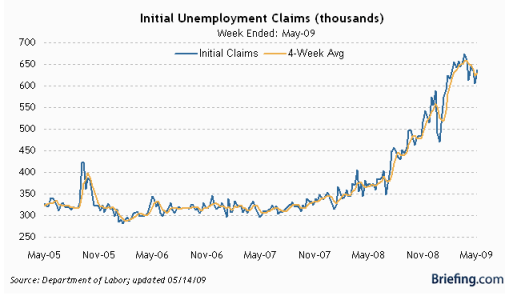

Eesti aja järgi kell 15.30 teatatakse täna esmaste töötu abiraha taotlejate arv, mis on viimastel nädalatel üldiselt vähenenud ning vähenemist oodatakse ka seekord - eelmise nädala 637 000lise näidu asemel oodatakse seekord 625 000 suurust numbrit. Poll tundi pärast turgude avanemist ehk kell 17.00 teatatake juhtivate indikaatorite aprillikuu näit - kui märtsis kukkus see 0.3%, siis nüüd oodatakse tõusu 0.8%. -

USA turgudel on täna uudisterohke päev tulemas:

- Kell 15:30 "initial claims" ehk esmakordselt töötusabirahale taotlevate inimeste koguarv. 9. mail lõppenud nädalal kerkis "initial claims" 637,000-le. 15. mail lõppenud nädala "initial claims" peaks konsensuse prognoosi kohaselt liginema juba 645,000-le.

- Kell 17:00 avaldatakse The Conference Board'i Leading Indicators indeks. Märtis langes indeks 0.3%. Konsensus prognoosib, et indeks kasvas aprillis aga 1.0%.

- Kell 17:00 avaldab Philadelphia Föderaalreserv General Business Conditions indeksi. Aprillikuus paranes indeks 10 punkti võrra ehk -24.4-le. Konsensuse prognoosi kohaselt kerkis indeks maikuus veel ligikaudu 5 punkti ehk -20.0-le.

- Kell 17:30 avalikustab The Energy Information Administration (EIA) maagaasi varusid kajastava raporti.

Esmakordselt töötusabirahale taotlevate inimeste raport (allikas: Briefing.com)

-

21. mail on suletud kõik OMX Balti ja Nordic börsid taevaeminemispüha tõttu.

-

ei olegi kaduneljapäeva tõttu börsid kinni, et investorite kaotusi vältida? :)

-

ime et Swed ja SEB täna lahti on, need ka ju peaksid tähistama taevaminemist ;)

-

S&P REVISES UNITED KINGDOM OUTLOOK TO NEGATIVE; RTGS AFFIRMED

-

Eurotsooni ostujuhtide indeksi paranemine on toetamas argumenti, et teise kvartali SKT peaks näitama väiksemat kukkumist kui esimeses kvartalis (-2.5%). PMI jõudis kaheksa kuu tippu, kerkides aprillikuu 41.1 punktilt mais 43.9 punktile ning ületas konsensuse ootust 2.2 punktiga. Euroopa börsid kauplevad pärast viiepäevast tõusu siiski ca -1.2% madalamal, juhindudes FED-i eilsest majandusprognoosi allapoole korrigeerimisest.

-

Ilusat aborigeenidepäeva teile kõigile svenssonite poolt!

-

mõtlesin,et mis toimub tln börsil mitte ühtegi tehingut!!!!kalendrisse pilku heites tuli välja et peale TAEVASSEMINEMISEpüha on täna veel ka KADUNELJAPÄEV,aga sel päeval võib teha ainult selliseid asju mis hävineksid.Näiteks täisid tõrjuda ja tolmu pühkida!irw!

-

To: aikikor , Siin lehel all on kirjas millal on mingi börs suletud. https://www.lhv.ee/markets/index.cfm?region=BALTIC . Ja palun, hüüumärkide pealt oleksid võinud kokku hoida ja tühikute peale jälle rohkem raisata.

-

Initial Claims 631K vs 625K consensus, prior revised to 643K from 637K; Continuing Claims rises to 6.65 mln

-

Küsimus, kas hr Kaar siis väitis ses osas ootuste numbrit valesti? erinevad allikad?

-

Vastuseks on erinevad allikad. Bloombergi andmetel oli konsensuse prognoos 620-675k lingi leiad siit.

Üldjuhul Briefing.com kajastab turu ootusi paremini.

-

Eelturg on Initial Claimsi numbrite peale nüüd müügihoo üles saanud ning S&P500 -1.3% @ 888 punkti.

-

Euroopast ja Aasiast vaatab vastu vaid punane pilt:

Saksamaa DAX -2.03%Prantsusmaa CAC 40 -1.98%

Inglismaa FTSE 100 -2.53%

Hispaania IBEX 35 -1.60%

Venemaa MICEX -4.12%

Poola WIG -1.31%

Aasia turud:

Jaapani Nikkei 225 -0.86%

Hong Kongi Hang Seng -1.58%

Hiina Shanghai A (kodumaine) -1.54%

Hiina Shanghai B (välismaine) -1.34%

Lõuna-Korea Kosdaq -0.61%

Tai Set 50 -2.74%

India Sensex 30 -2.31%

-

Stay Vigilant

By Rev Shark

RealMoney.com Contributor

5/21/2009 8:46 AM EDT

To fight and conquer in all your battles is not supreme excellence; supreme excellence consists in breaking the enemy's resistance without fighting.

-- Sun Tzu

About 10 weeks ago the market began a very steep climb upward. The emotions of market players have changed dramatically during that time, and many are now content to conclude that we have seen the market lows and that the worst is over for investors. It certainly is possible that we have already suffered through the worst of bear market, but does that mean we declare victory and proceed as if the battle is won and cannot be lost again?

There is never a final victory in the stock market, and those who are too confident about things inevitably end up being fodder for the next move. The bears have dominated lately, but while we still have some positives like strong speculative action in secondary stocks, cracks are also beginning to grow that we need to respect.

Last week the market had one of its sharpest dips since the rally began back in March. Many market players were surprised when we bounced back up on Monday, but the cynics pointed at the light volume and the overhead resistance that now existed. Yesterday the bears were caught by surprise once again as the market leapt euphorically on news of a successful placement of a huge secondary offering in the banking sector. That excitement wore off and we fizzled late in the day, giving us some negative-looking patterns in the major indices, but no profound damage has been done.

Let's review the positives and negatives for this market right now. The biggest positive the bulls have going for them is momentum. The market had a big move, and lots of folks were skeptical and underinvested and are anxious to buy dips so they won't be left out again. Until last week, the dips in this market have been tremendously shallow as money rushes in on any minor pullback.

Some bulls will also say that fundamentals are better now as well. We have banks raising large amounts of capital as the stress tests are completely behind us. The chance of a major bank failure does seem reduced at this point, simply because the government is throwing TARP money at anything that moves.

Earnings season overall was quite good, mainly because expectations were so low. Some will say we didn't see any real revenue growth and that many of the earnings surprises were due to cost-cutting, but there is no question that the reports weren't as grim as many thought they would be.

So overall, the bulls have momentum and are feeling good about a better fundamental picture.

The bearish case here is based mainly on the thinking that we had a whole lot of artificial government action to prop things up. That created a classic bear-market bounce that causes many to start to believe that the worst is over and sets the stage for them to be disappointed. The bears will tell us that unemployment is still ramping, that calls for a bottom in the real estate market are premature and that banks are still going to need to raise more capital down the road.

But rather than discuss the fundamental arguments, which will never lead to any great clarity, we need to stay focused on the price action. The bulls still have control of the charts, but warning signs are building; it's amazing how often the fundamental beliefs about the market follow the price action rather than the reverse.

The key technical levels for the market right now are the lows we saw last week. For the S&P 500, that's around 879; for the Nasdaq, it is 1664. If we hold those areas and if this underlying support that has served us so well for the last 10 weeks continues, further upside is promising. The market has plenty of support and the bears will have to work hard to start cracking it, but seasonality, the end of earnings season and a slowdown in governmental intervention will be factors helping the bears.

The battle is never over, and we must always stay vigilant. The bears are gaining a little foothold and it won't take much for that grow. Good luck and go get 'em.

-----------------------------

Ülespoole avanevad:

In reaction to strong earnings/guidance: COOP +38.7% (light volume), SMRT +30.1%, BONT +19.3%, BPI +10.8%, CTRN +5.8%, KIRK +5.7%, SMTC +4.6%, CSC +4.4%, INTU +3.2%, LTD +3.1%, AAP +1.0%... M&A news: DDUP +33.4% (NetApp to Acquire Data Domain for $25 per share)... Select drug and infectious disease related names trading higher: VICL + 20.5% (advances H1N1 pandemic influenza vaccine), HEB + 3.5% , BCRX + 3.3%... Other news: EMKR +26.9% (announces long term supply agreement with Space Systems/Loral), TSRA +19.2% (ITC rules Tessera patents valid and infringed), NCS +14.6% (Obtained waivers from its senior credit facility lenders; has made significant progress with a private equity co with regard to an investment in the co), PLAB +7.8% (still checking), DISK +7.5% (retains financial advisor to analyze a wide range of strategic alternatives), HGSI +4.0% (announces that it has submitted a Biologics License Application to the U.S. Food and Drug Administration for its human monoclonal antibody drug Abthrax), LINE +3.4% (Cramer makes positive comments on MadMoney), QTM +3.4% (ticking up in sympathy with DDUP), ING +2.4% (checking for anything specific), YHOO +1.2% (Yahoo, Microsoft talks continue - WSJ)... Analyst comments: CSIQ +5.4% (upgraded to Outperform at Oppenheimer and upgraded to Buy from Hold at Canaccord), THC +3.8% (upgraded to Overweight at Barclays), JNPR +2.9% (upgraded to Overweight at Barclays), LNC +2.7% (upgraded to Buy at UBS), SOLF +2.1% (upgraded to Buy from Hold at Canaccord), CME +1.9% (upgraded to Buy from Neutral at Goldman - Reuters), GSK +1.6% (upgraded to Hold at ING), WLP +1.4% (initiated with an Overweight and $55 tgt at Morgan Stanley).

Allapoole avanevad:

In reaction to disappointing earnings/guidance: GME -12.1%, HOTT -12.0% (also downgraded to Market Perform at FBR Capital), MF -11.6%, STP -7.5% (also files mixed shelf offering; files for 20 mln ADS offering under offering; downgraded to Neutral from Buy at Nomura), PETM -6.3% (also downgraded to Neutral from Buy at Goldman- Reuters), NTAP -3.7% (also announces plans to acquire Data Domain for $25 per share), SNPS -3.0%... Select financial names showing continued weakness: HBAN -11.4% (announces $675 mln in additional regulatory capital actions), RF -9.6% (announces successful $1.85 bln capital raise; co prices common and mandatory convertible preferred offerings), IRE -7.9%, LYG -7.7% (UK braced for call to shrink Lloyds - FT), CFNL -5.7% (announces offering of up to 4 mln shares of common stock), HBC -2.7%, ZION -2.3% (initiated with Underperform at Credit Suisse), FITB -2.3% (files for $750 mln common stock offering), MS -2.0%, GS -1.5%, BBT -1.4% (initiated with Underperform at Credit Suisse), JPM -1.0%... Select oil/gas names ticking lower: PBR -1.7% (Brazil ANP denies Petrobras bid to extend oil concessions - DJ), BP -1.6%, TOT -1.5%... Select metals/mining names showing weakness with Credit Suisse downgrading the sector to Market Weight from Overweight: BBL -3.8%, BHP -3.2%, VALE -2.6% (downgraded to Underweight at Morgan Stanley), RTP -2.4% (China wants 45% ore price cut from Rio; 40% from Vale, according to Xinhua - DJ), GFI -2.1%, GOLD -1.6%... Select shippers trading lower: EGLE -5.7%, PRGN -5.2%, SBLK -3.6%, DSX -2.5%, DRYS -2.2% (ests lowered at Lazard Capital Mkts on ATM transaction)... Other news: SHO -10.1% (announces public offering of 18 million common shares), BZH -9.8% (still checking), MED -6.4% (ticking lower in early trade following negative report from the Fraud Institute), ESLR -4.9% (priced a 37 mln share common stock offering at $1.80/share), CTV -3.9% (proposes offerings of convertible senior subordinated notes and common stock), CEPH -3.8% (filed for a mixed shelf offering for an indeterminate amount; then announced a $300 mln common stock offering and a $350 mln convertible notes offering), SEP -3.6% (announced that its public offering of ~9,000,000 common units was priced at $22.00 per unit to the public)... Analyst comments: MPEL -6.2% (downgraded to Hold at Deutsche), VOD -3.4% (downgraded to Reduce from Buy at Nomura), SII -2.8% (downgraded to Sell at Argus), POT -2.7% (downgraded to Hold from Buy at TD Newcrest). -

Tagantjärgi siis veel:

April Leading Indicators +1.0% vs +0.8% consensus (first positive number since June of 2008), prior revised to -0.2% from -0.3%

May Philadelphia Fed -22.6 vs -18.0 consensus, prior -24.4

Üks oodatust parem, teine oodatust kehvem - seepärast ka turg justkui jo-jo'd meenutades üles-alla ongi viimased 15 minutit kõikunud. -

Nagu hommikul kirjutasin, siis eilne päevasisene reverse ja põhjadel sulgumine indikeerisid müügihuvi ning täna on see ehedalt ka realiseerunud. Hirm on taas asendunud ahnusega - vähemasti ajutiselt.

-

Maagaasis on täna käimas tõeline paanikamüük -10%lise langusega. Hoiame silma peal, võib pakkuda huvitava võimaluse.

-

Joel, ega Sa vastupidi ei mõelnud? Ahnus tundub hakkavat vaikselt asenduma hirmuga.

-

:D Loomulikult, õhtul on keel sõlme läinud.